In probability theory and intertemporal portfolio choice, the Kelly criterion (or Kelly strategy or Kelly bet), also known as the scientific gambling method, is a formula for bet sizing that leads almost surely (under the assumption of known expected returns) to higher wealth compared to any other strategy in the long run

...

For an even money bet, the Kelly criterion computes the wager size percentage by multiplying the percent chance to win by two, then subtracting one-hundred percent. So, for a bet with a 70% chance to win the optimal wager size is 40% of available funds.

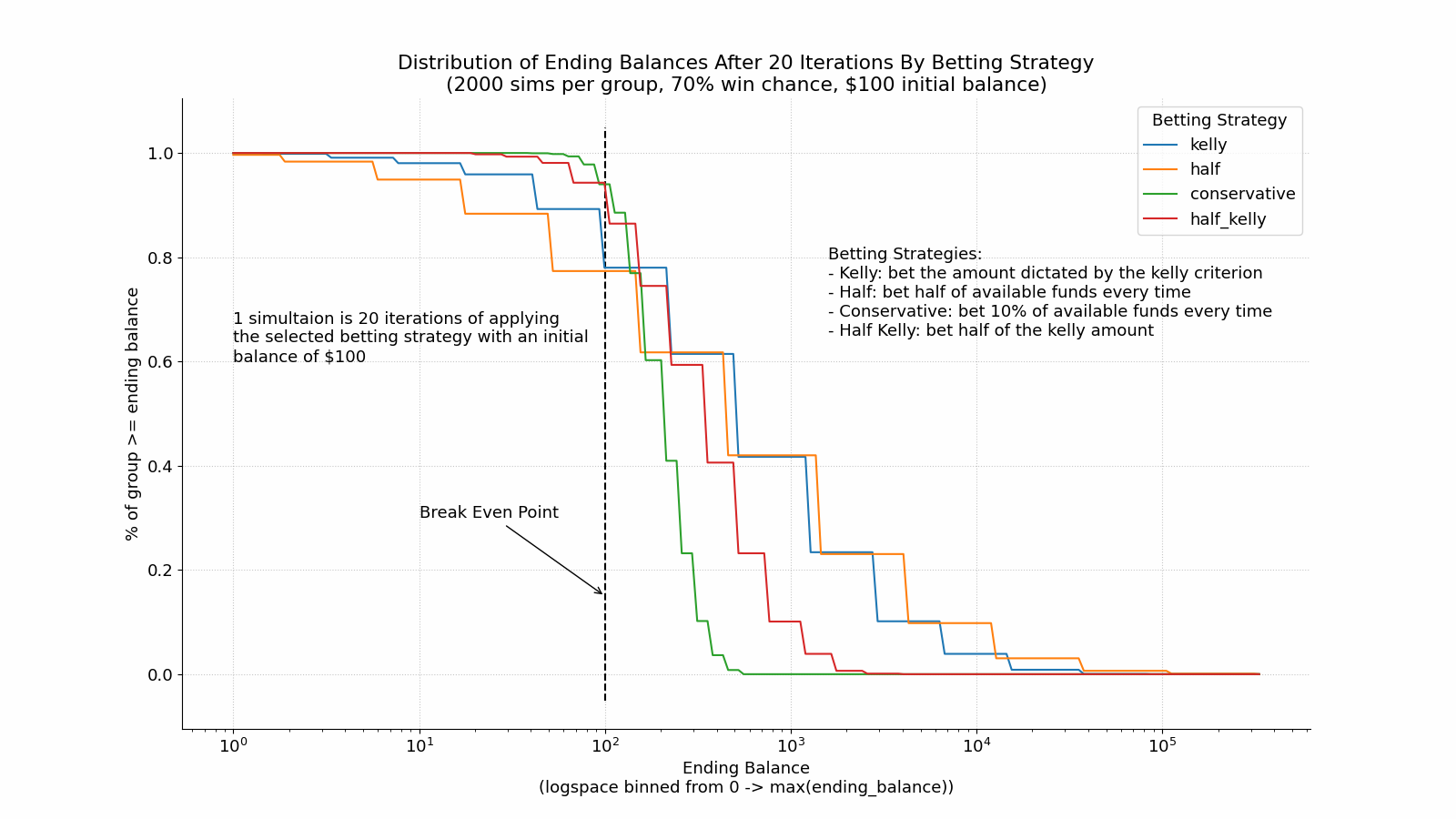

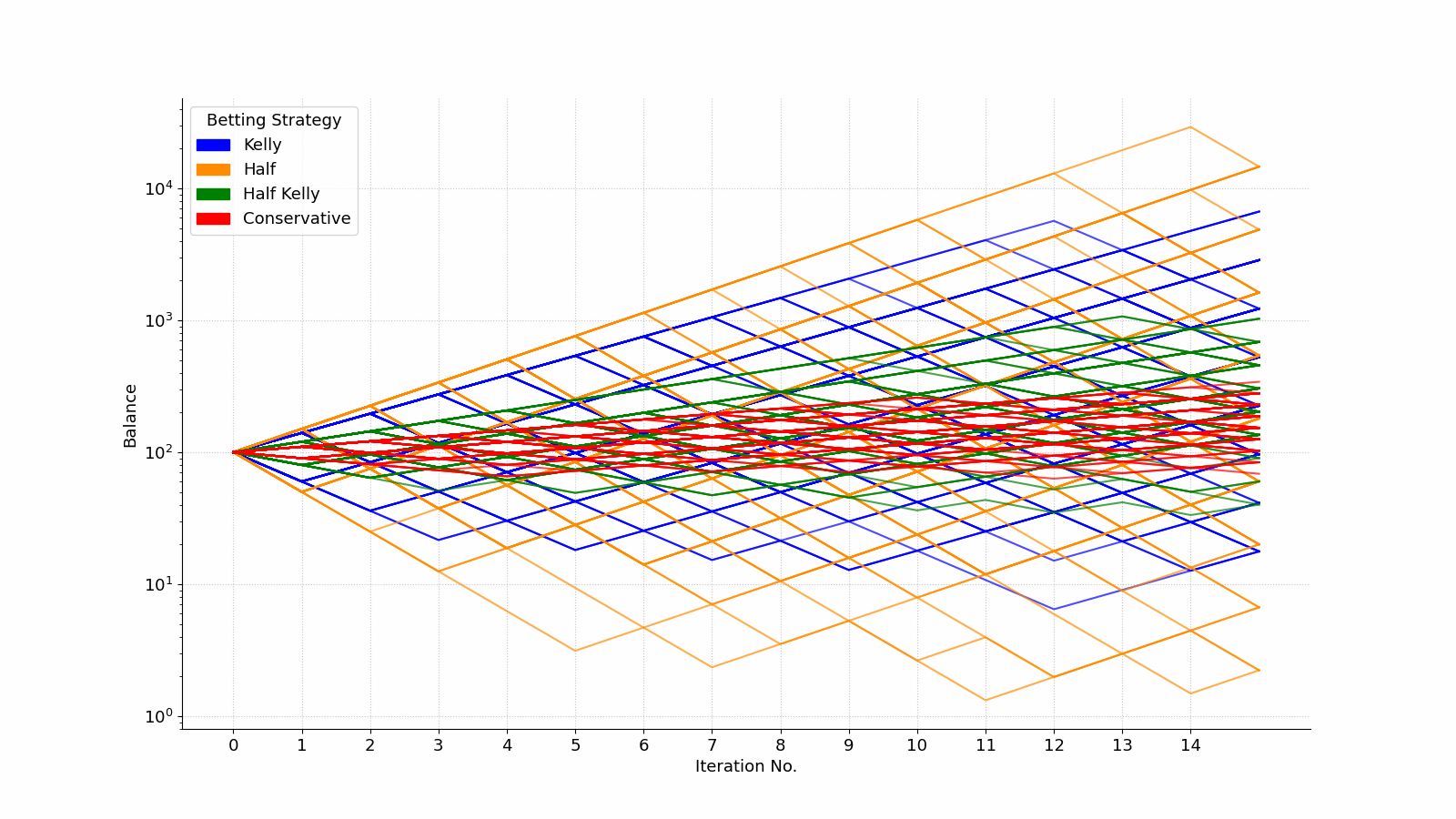

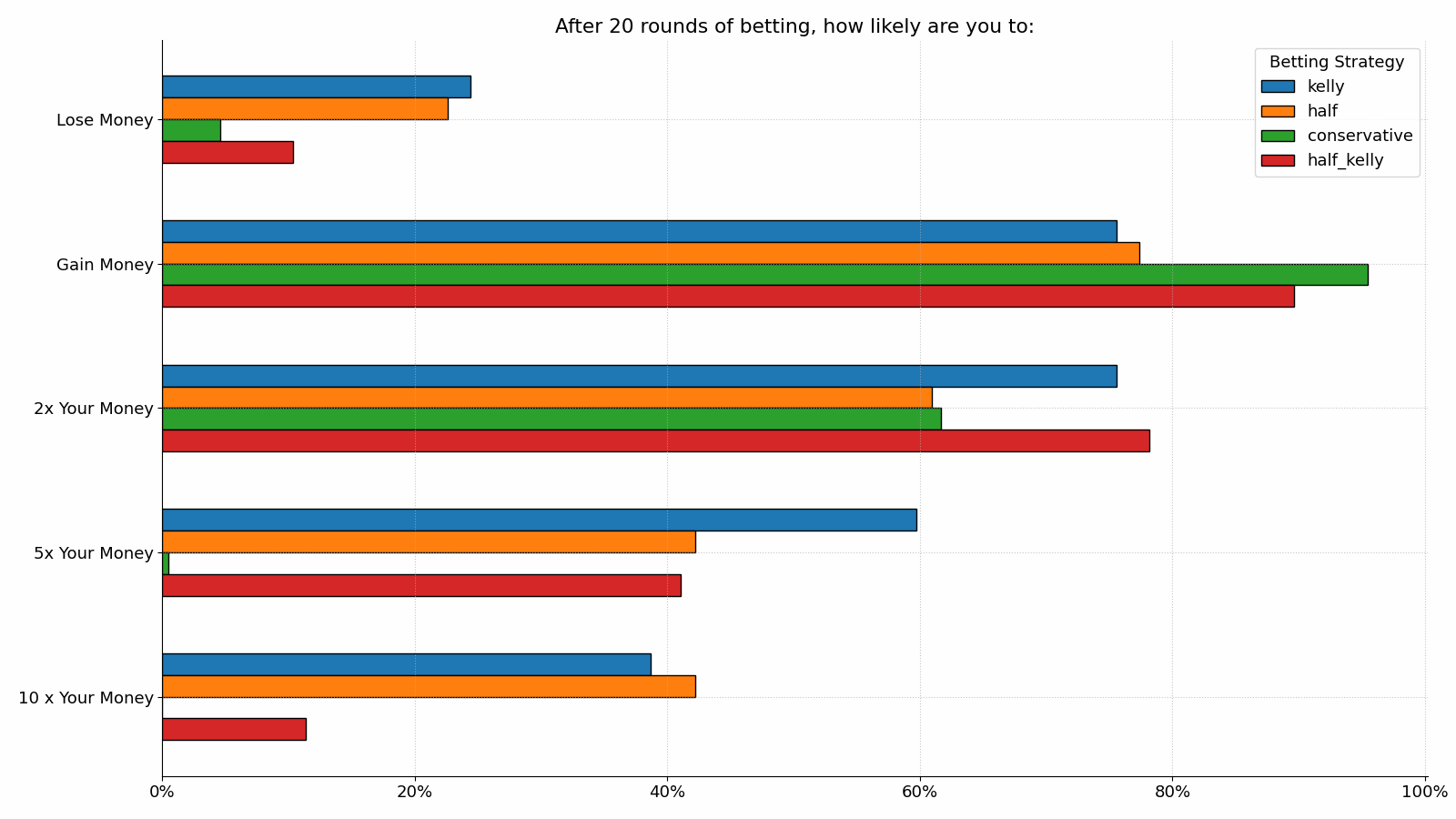

This repo contains my work implementing the kelly criterion, specifically the case outlined in the second paragraph above, and other betting strategies and then doing a bunch of simulations with them.

The work in this repo is done with the hy programming language, a lisp that maps pretty closely to python.

kelly.hycontains functions for implementing different betting strategies and functions for creating simulations with different those betting strategies.explore-kelly.hycontains code for exploring and visualizing betting simulations. This file is a bit messy 😅