This repository is a Liquidity Module for the XRPL DEX.

Liquidity Modules allow relayers to instantly fill their orderbooks and bootstrap liquidity with minimal effort. This particular module uses a Constant Product Market Making Model, discussed in greater detail below.

This repository is designed to start a market making bot to provide liquidity on XRPL DEX.

Automated Market Making (AMM) bots provide liquidity to a marketplace through use of algorithmic market making.

This repository is setup to run naturally on the XRPL DEX. For use on other marketplaces, you could modify the code.

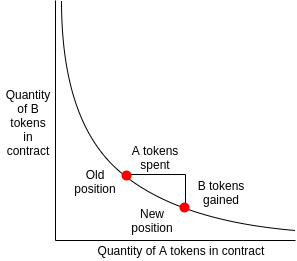

This bot runs a "constant product market maker model" (popularized in the DeFi community by Uniswap). In short, this model generates a full orderbook based on an initial price for the market. Every transaction that occurs on this market will adjust the prices of the market accordingly. It's a basic supply and demand automated market making system.

- Buying large amounts of the base token will increase the price

- Selling large amounts of the base token will decrease the price

A typical Constant Market Making model has a continuous price curve. This bot discretizes the continuous price curve and creates a number of limit orders to simulate the curve. The order price is limited between maxPrice and minPrice. The price difference between adjacent orders is priceGap.

Constant product algorithms have a disadvantage of low inventory utilization. For example, by default it only uses 5% of your inventory when the price increases 10%. expandInventory can help you add depth near the current price.

maxPriceMax order priceminPriceMin order pricepriceGapPrice difference rate between adjacent orders. For example, ask price increases by 2% and bid price decreases by 2% ifpriceGap=0.02.expandInventoryMultiply your order sizes linearly. For example, all order sizes will be tripled ifexpandInventory=3.

Constant Product AMM requires a single source of funds for both the base and quote token. As such, the general flow of setting up the AMM bot from scratch is:

- Prepare an address that holds both the BASE and QUOTE token of the trading pair you want to provide liquidity for

- Set the initial parameters for the bot

- This determines the initial price, spread, sensitivity, etc.

- Run the bot

Upon running the bot, it will generate an orderbook for your marketplace. The orderbook will appear to be static, but every trade will shift the market accordingly.

For more information on these models, Scalar Capital provided a detailed analysis of constant market making.

This project is licensed under the Apache 2.0 License - see the LICENSE file for details