This is to help people get forward signal of their inverse volatility allocation strategy. https://www.portfoliovisualizer.com/ used to provide this for free, but now it requires a subscription.

If you are interested why this may help build your portfolio, see https://quantdare.com/risk-parity-versus-inverse-volatility/ and https://www.physixfan.com/risk-parity-touziceluegaijinbandongtaidiaozhenguprohetmfdebili/ (in Chinese)

pip3 install numpy

pip3 install requests

./inverse_volatility.py

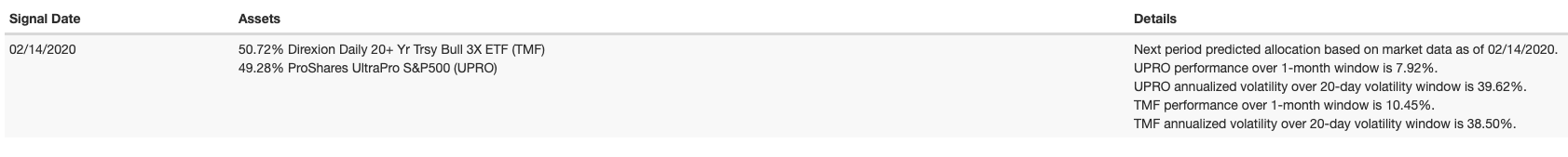

Portfolio: ['UPRO', 'TMF'], as of 2020-02-15 (window size is 20 days)

UPRO allocation ratio: 49.09% (anualized volatility: 39.87%, performance: 5.36%)

TMF allocation ratio: 50.91% (anualized volatility: 38.45%, performance: 11.64%)

Checking against Portfolio Visualizer:

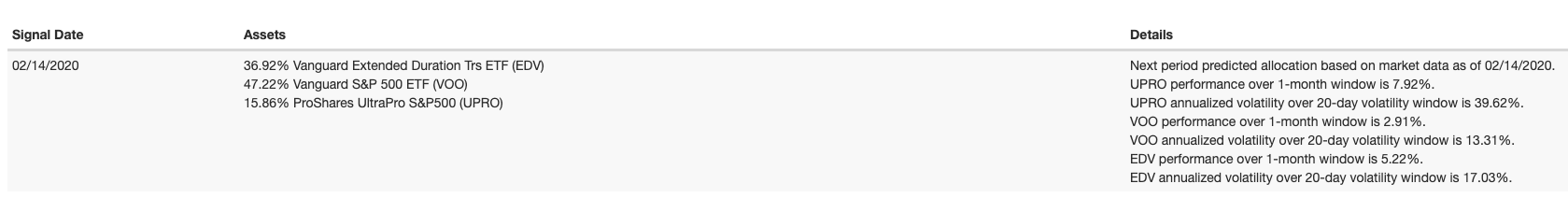

./inverse_volatility.py upro,voo,edv # comma separated symbols

Portfolio: ['UPRO', 'VOO', 'EDV'], as of 2020-02-15 (window size is 20 days)

UPRO allocation ratio: 15.79% (anualized volatility: 39.87%, performance: 5.36%)

VOO allocation ratio: 47.22% (anualized volatility: 13.33%, performance: 2.06%)

EDV allocation ratio: 36.98% (anualized volatility: 17.03%, performance: 5.63%)

Checking against Portfolio Visualizer:

For those who must manually rebalance to the nearest whole shares due to limitations on their brokerage account, continue the script with entering your current holdings. It will calculate how many shares you will need to buy/sell for each symbol.

Data source: https://finance.yahoo.com/quote/VOO/history?p=VOO -> Historical Data -> Download Data

Note that the cookie in the code may expire that you need to update the crumb parameter in the url along with your cookie from browser accordingly.