A work in progress Cryptocurrency for common exchanges like Bitfinex, Bitmex and Binance. As most trading bots just provide basic buy and sell signals they provide many stuff to get profitable eg exchange orders like stop-losses or stop-limits are not supported by main bots. Also the limitation of fixed timeframe and technical indicators must be broken

Not production ready only basic functionality

- Fully use Websocket for exchange communication to react as fast as possible on market

- Multi pair support in one instance

- sqlite3 storage for candles, tickers, ...

- Webserver UI

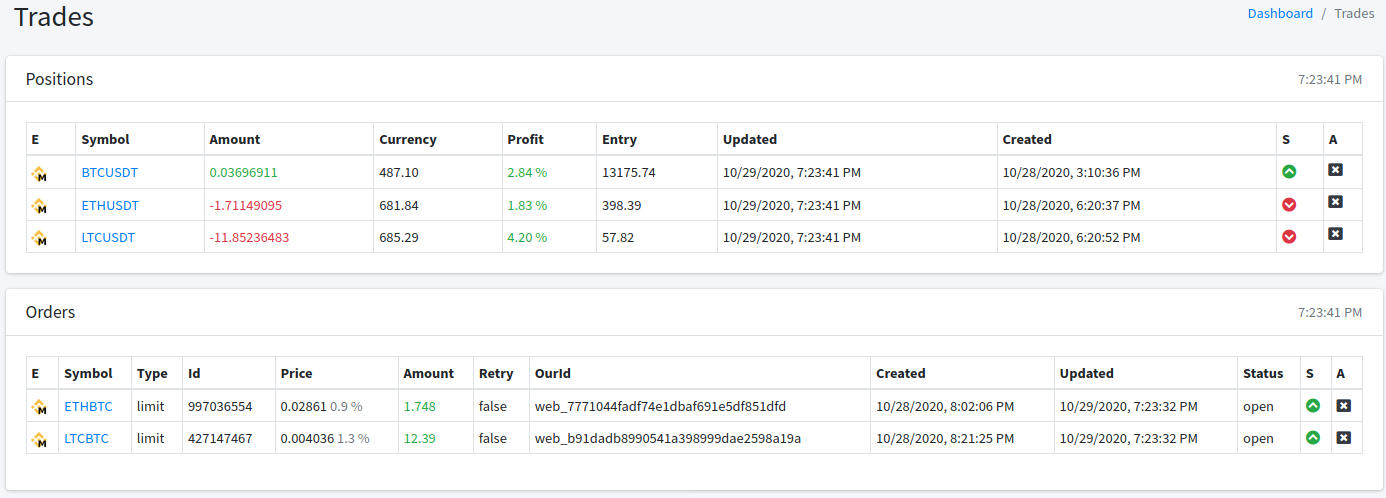

- Support for going "Short" and "Long"

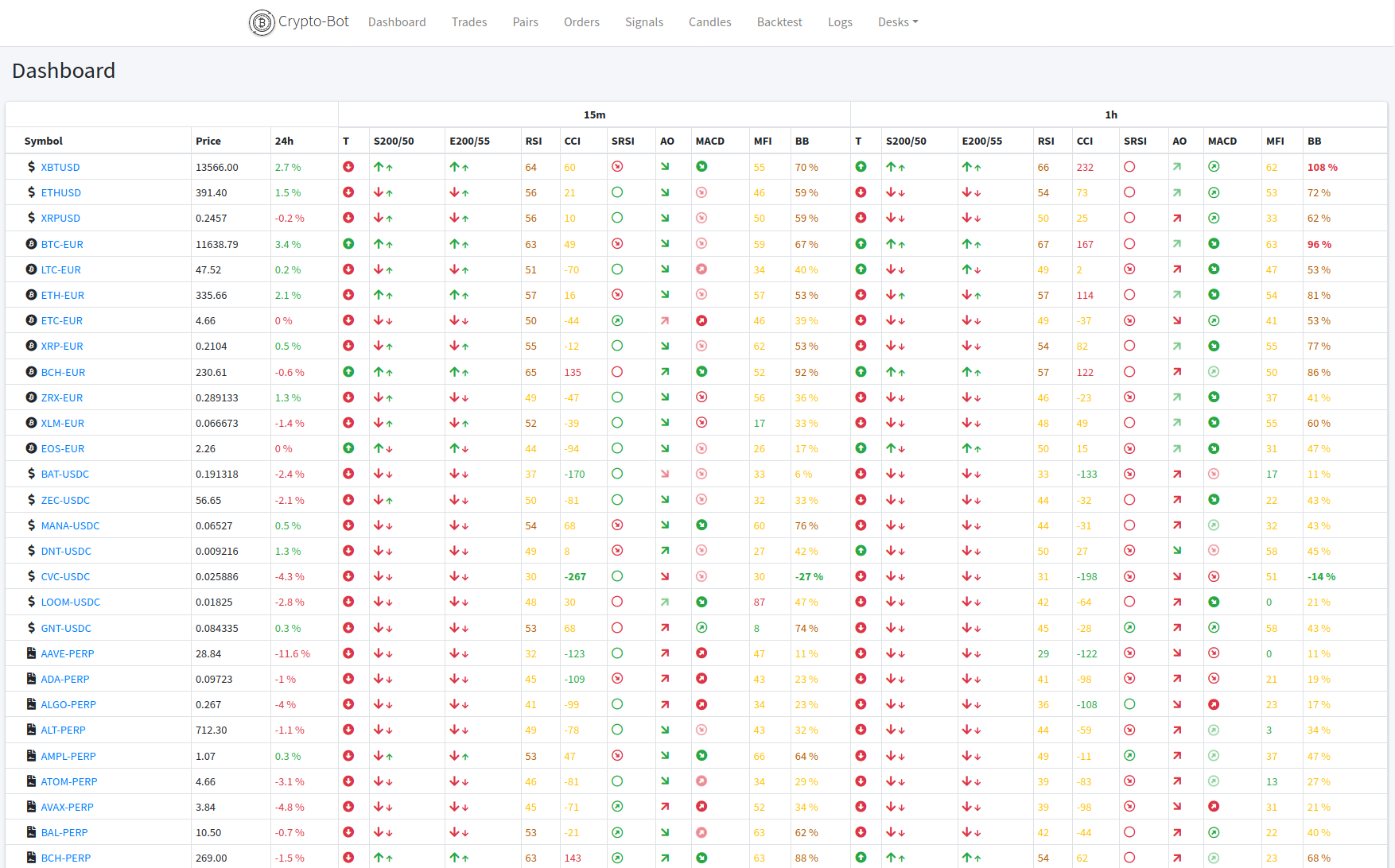

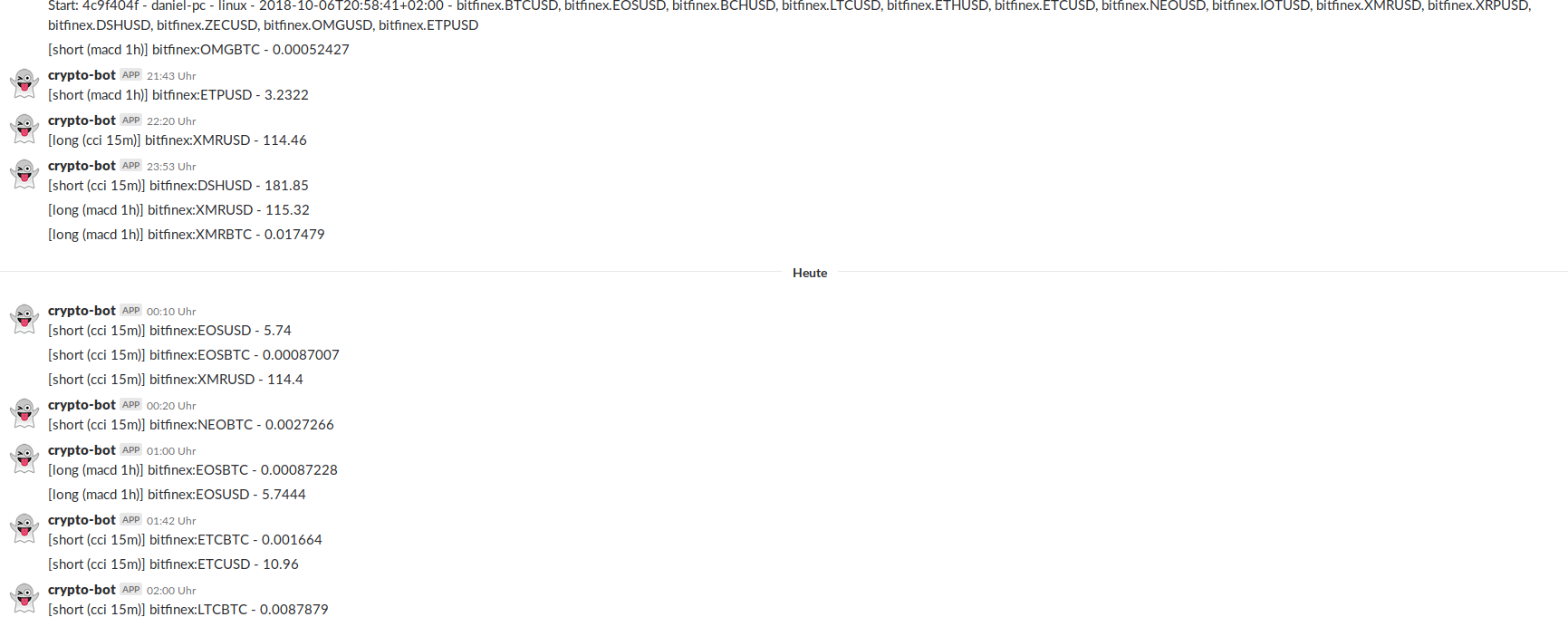

- Signal browser dashboard for pairs

- Slack and email notification

- Join foreign exchange candles (eg. Trade on Bitmex with the faster moving Binance trades / candles)

- TODO: Show possible arbitrage trades

- Bitmex with leverage configuration

- Bitmex Testnet

- Binance

- Binance Margin

- Binance Futures

- Coinbase Pro

- Bitfinex (margin wallet)

- Bybit with leverage configuration

- FTX (Perpetual Futures only)

TODOS:

- Huobi Global (margin)

- node.js

- sqlite3

- technicalindicators

- tulipindicators - tulind

- TA-Lib

- twig

- express

- Bootstrap v4

- Tradingview widgets

The tulip library is used for indicators; which sometimes is having some issues on npm install because of code compiling:

Install build tools

sudo apt-get install build-essential

The nodejs wrapper for tulipindicators is called Tulip Node (tuind), check out installation instructions there.

Also the build from source is not supporting all nodejs version. It looks like versions <= 10 are working. You can use nodejs 12 if you compiled it once via older version.

➜ npm install --production

➜ npm run postinstall

Create instance file for pairs and changes

cp instance.js.dist instance.js

Provide a configuration with your exchange credentials

cp conf.json.dist conf.json

Create a new sqlite database use bot.sql scheme to create the tables

sqlite3 bot.db < bot.sql

Lets start it

npm start

For initialize the configuration once

➜ cp instance.js.dist instance.js && cp conf.json.dist conf.json && sqlite3 bot.db < bot.sql

➜ docker-compose build

➜ docker-compose up -d

After this you can use docker-compose which will give you a running bot via http://127.0.0.1:8080

First, you'll need to create a bot for Telegram. Just talk to BotFather and follow simple steps until it gives you a token for it. You'll also need to create a Telegram group, the place where you and crypto-trading-bot will communicate. After creating it, add the bot as administrator (make sure to uncheck "All Members Are Admins").

Invite @RawDataBot to your group and get your group id in sended chat id field

Message

├ message_id: 338

├ from

┊ ├ id: *****

┊ ├ is_bot: false

┊ ├ first_name: 사이드

┊ ├ username: ******

┊ └ language_code: en

├ chat

┊ ├ id: -1001118554477

┊ ├ title: Test Group

┊ └ type: supergroup

├ date: 1544948900

└ text: A

Look for id: -1001118554477 is your chat id (with the negative sign).

For example setup, check conf.json.dist file, log.telegram section , set chatId, token, level (default is info). Check more options https://github.com/ivanmarban/winston-telegram#readme

Some browser links

- UI: http://127.0.0.1:8080

- Signals: http://127.0.0.1:8080/signals

- Tradingview: http://127.0.0.1:8080/tradingview/BTCUSD

- Backtesting: http://127.0.0.1:8080/backtest

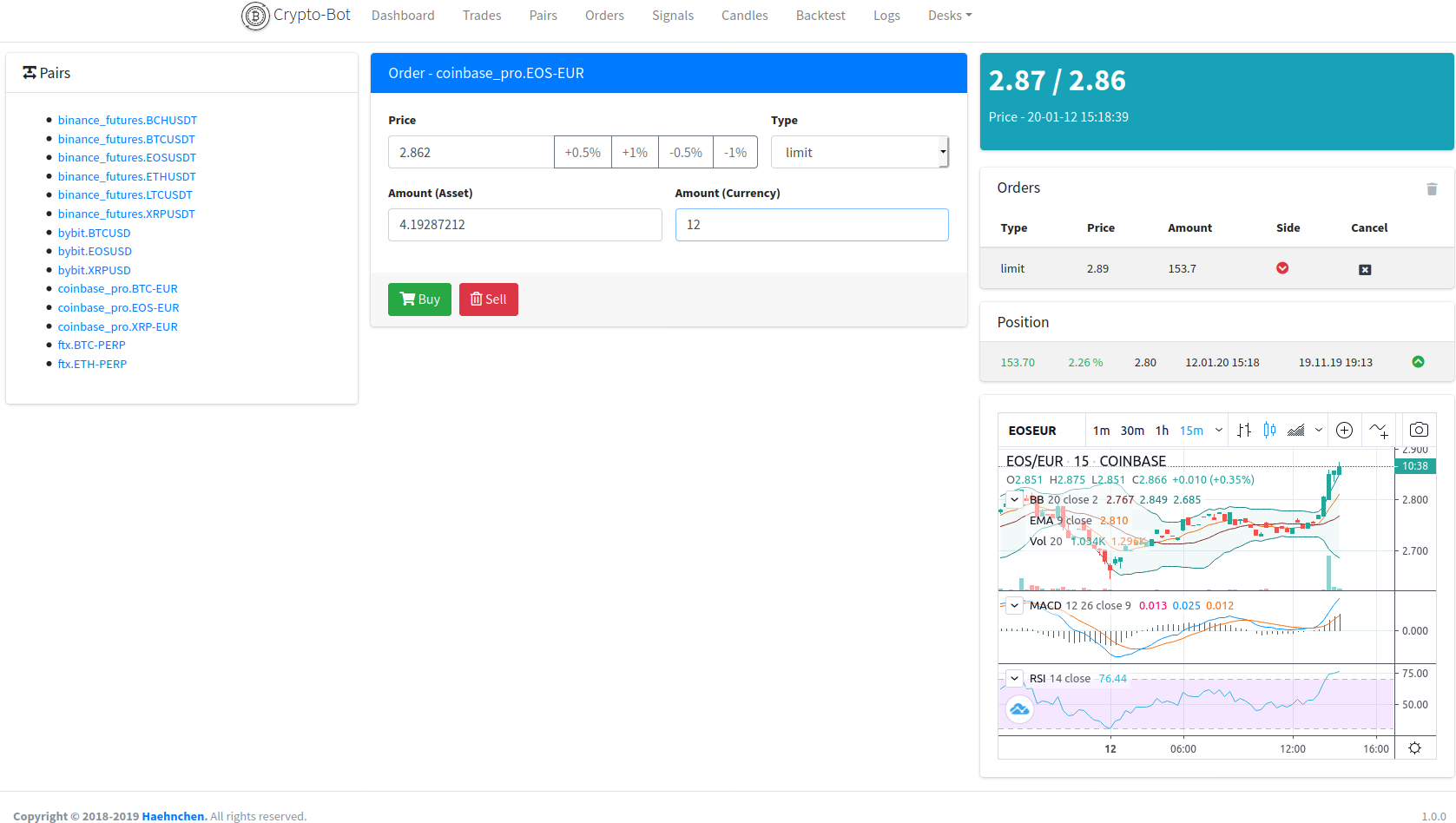

- Order & Pair Management: http://127.0.0.1:8080/pairs

As the webserver provides just basic auth for access you should combine some with eh a https for public server. Here s simple proxy_pass for nginx.

# /etc/nginx/sites-available/YOURHOST

server {

server_name YOURHOST;

location / {

proxy_pass http://127.0.0.1:8080;

}

listen 443 ssl; # managed by Certbot

ssl_certificate /etc/letsencrypt/live/YOURHOST/fullchain.pem; # managed by Certbot

ssl_certificate_key /etc/letsencrypt/live/YOURHOST/privkey.pem; # managed by Certbot

include /etc/letsencrypt/options-ssl-nginx.conf; # managed by Certbot

ssl_dhparam /etc/letsencrypt/ssl-dhparams.pem; # managed by Certbot

}

You should also set the listen ip to a local one

# config.json

webserver.ip: 127.0.0.1

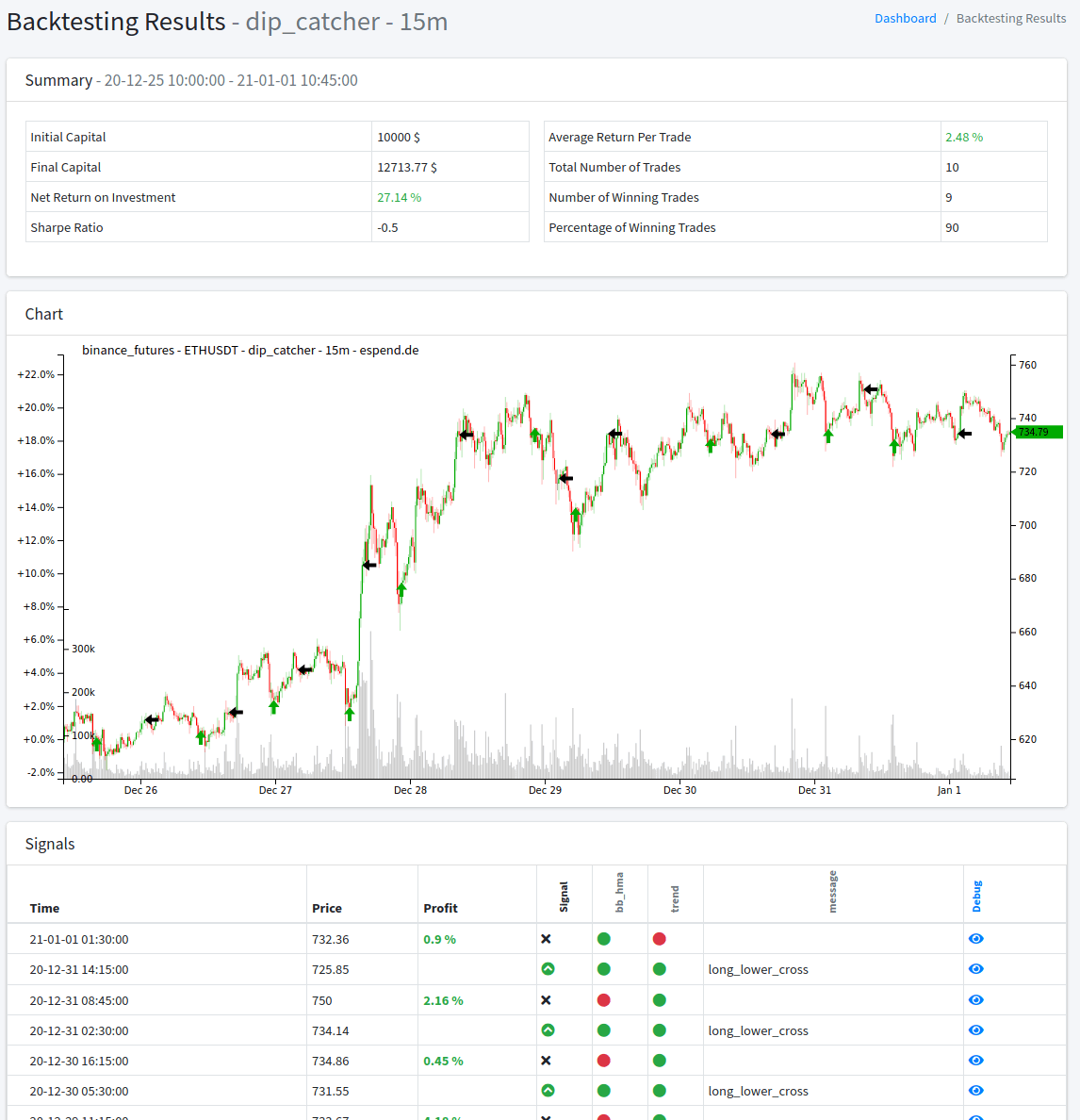

Currently there is a the UI for backtesting

Common strategy with indicators are inside, which most of the time are not profitable. See some more advanced strategy in the list below

- dip_catcher

- dca_dipper - Long term invest Dollar-Cost Averaging (DCA) Dip Investor Strategy

Find some example strategies inside src/modules/strategy/strategies

For custom strategies use var/strategies folder.

# simple file structure

var/strategies/your_strategy.js

# or wrap strategy into any sub folder depth

var/strategies/my_strategy/my_strategy.js

var/strategies/subfolder1/our_strategy/our_strategy.js

order_adjustKeep open orders in bid / ask of the orderbook in first position

stoplossprovide general stoploss order in percent of entry price (Exchange Order)risk_reward_ratioCreates Risk Reward order for take profit and stoploss (Exchange Order Limit+Stop)stoploss_watchClose open position if ticker price falls below the percent lose; use this for exchange that dont support stop_loss order liek Binancetrailing_stopUse native exchange trailing stop; if supported by exchange egBitfinex

'watchdogs': [

{

'name': 'stoploss',

'percent': 3,

},

{

'name': 'risk_reward_ratio',

'target_percent': 6,

'stop_percent': 3,

},

{

'name': 'stoploss_watch',

'stop': 1.2,

},

{

'name': 'trailing_stop',

'target_percent': 1.2,

'stop_percent': 0.5

}

],

Per default every strategy is "ticked" every full minute with a ~10sec time window. If you want to tick every 15 minutes or less see possible examples below.

Supported units are "m" (minute) and "s" (seconds)

{

"strategies": [

{

"strategy": "cci",

"interval": "15m"

},

{

"strategy": "cci2",

"interval": "30s"

},

{

"strategy": "cci3",

"interval": "60m"

}

]

}To allow the bot to trade you need to give some "playing capital". You can allow to by via asset or currency amount, see examples below. You should only provide one of them, first wins.

c.symbols.push({

'symbol': 'BTC-EUR',

'exchange': 'coinbase_pro',

'trade': {

'capital': 0.015, // this will buy 0.015 BTC

'currency_capital': 50, // this will use 50 EUR and buys the equal amount of BTC (example: BTC price 3000 use 50 EUR. will result in 0.016 BTC)

'balance_percent': 75, // this will use 75 % of your exchange margin tradable balance. Currently implemented only on Bitfinex exchange.

},

})

Every strategy stat should be live must be places inside trade.

{

"trade": {

"strategies": [

{

"strategy": "dip_catcher",

"interval": "15m",

"options": {

"period": "15m"

}

}

]

}

}Inside logs, visible via browser ui, you can double check the strategies init process after the application started.

[info] Starting strategy intervals

[info] "binance_futures" - "ETHUSDT" - "trade" - init strategy "dip_catcher" (15m) in 11.628 minutes

[info] "binance_futures" - "BTCUSDT" - "trade" first strategy run "dip_catcher" now every 15.00 minutes

An example instance.js which trades can be found inside instance.js.dist_trade. Rename it or move the content to you file.

const c = (module.exports = {});

c.symbols = [

{

symbol: 'ETHUSDT',

exchange: 'binance_futures',

periods: ['1m', '15m', '1h'],

trade: {

currency_capital: 10,

strategies: [

{

strategy: 'dip_catcher',

interval: '15m',

options: {

period: '15m'

}

}

]

},

watchdogs: [

{

name: 'risk_reward_ratio',

target_percent: 3.1,

stop_percent: 2.1

}

]

}

];Per pair you can set used margin before orders are created; depending on exchange

c.symbols.push({

'symbol': 'BTCUSD',

'exchange': 'bitmex',

'extra': {

'bitmex_leverage': 5,

},

})

c.symbols.push({

'symbol': 'EOSUSD',

'exchange': 'bybit',

'extra': {

'bybit_leverage': 5,

},

})

outdated, but there as an automatic filling on startup ~1000 candles from the past (depending on exchange) and continuously fetched when running

node index.js backfill -e bitmex -p 1m -s XRPZ18

npm test

Other bots with possible design pattern

- https://github.com/DeviaVir/zenbot

- https://github.com/magic8bot/magic8bot

- https://github.com/askmike/gekko

- https://github.com/freqtrade/freqtrade

- https://github.com/Ekliptor/WolfBot

- https://github.com/andresilvasantos/bitprophet

- https://github.com/kavehs87/PHPTradingBot

- https://github.com/Superalgos/Superalgos

Some strategies based on technical indicators for collection some ideas

- https://github.com/freqtrade/freqtrade-strategies

- https://github.com/freqtrade/freqtrade-strategies/tree/master/user_data/strategies/berlinguyinca

- https://github.com/xFFFFF/Gekko-Strategies

- https://github.com/sthewissen/Mynt/tree/master/src/Mynt.Core/Strategies

- https://github.com/Ekliptor/WolfBot/tree/master/src/Strategies

- https://github.com/Superalgos/Strategy-BTC-WeakHandsBuster

- https://github.com/Superalgos/Strategy-BTC-BB-Top-Bounce