Required:

Local Setup Steps:

- git clone https://github.com/OlympusDAO/olympus-contracts.git

- Install dependencies:

npm install- Installs Hardhat & OpenZepplin dependencies

- Compile Solidity:

npm run compile - TODO: How to do local deployments of the contracts.

| Contract | Addresss | Notes |

|---|---|---|

| OHM | 0x383518188c0c6d7730d91b2c03a03c837814a899 | Main Token Contract |

| sOHM | 0x31932e6e45012476ba3a3a4953cba62aee77fbbe | Staked Ohm |

| Treasury | 0x31F8Cc382c9898b273eff4e0b7626a6987C846E8 | Olympus Treasury holds all the assets |

| OlympusStaking | 0xfd31c7d00ca47653c6ce64af53c1571f9c36566a | Main Staking contract responsible for calling rebases every 2200 blocks |

| StakingHelper | 0xc8c436271f9a6f10a5b80c8b8ed7d0e8f37a612d | Helper Contract to Stake with 0 warmup |

| Aave Allocator | 0x0e1177e47151Be72e5992E0975000E73Ab5fd9D4 | Sends DAI from the treasury to Aave (via deposit) in exchange for aDAI and holds it. See Allocator Guide |

| Convex Allocator | 0x3dF5A355457dB3A4B5C744B8623A7721BF56dF78 | Sends FRAX from the treasury to Convex and accumulates trading fees, CRV and CVX. See Allocator Guide |

| Onsen Allocator | 0x0316508a1b5abf1CAe42912Dc2C8B9774b682fFC | Sends OHM-DAI SLP from the treasury to the Sushi Onsen pool, accumulating SUSHI and xSUSHI. See Allocator Guide |

| DAO | 0x245cc372C84B3645Bf0Ffe6538620B04a217988B | Storage Wallet for DAO under MS |

| Staking Warm Up | 0x2882A5CD82AC49e06620382660f5ed932607c5f1 | Instructs the Staking contract when a user can claim sOHM |

Bonds

- TODO: What are the requirements for creating a Bond Contract? All LP bonds use the Bonding Calculator contract which is used to compute RFV.

| Contract | Addresss | Notes |

|---|---|---|

| Bond Calculator | 0xcaaA6a2d4B26067a391E7B7D65C16bb2d5FA571A | |

| DAI bond | 0x575409F8d77c12B05feD8B455815f0e54797381c | Main bond managing serve mechanics for OHM/DAI |

| DAI/OHM SLP Bond | 0x956c43998316b6a2F21f89a1539f73fB5B78c151 | Manages mechhanism for thhe protocol to buy baack its own liquidity from the pair. |

| FRAX Bond | 0x8510c8c2B6891E04864fa196693D44E6B6ec2514 | Similar to DAI bond but using FRAX |

| FRAX/OHM SLP Bond | 0xc20CffF07076858a7e642E396180EC390E5A02f7 | Similar to DAI/OHM but using FRAX |

OLD Contracts:

- sOHM: 0x31932e6e45012476ba3a3a4953cba62aee77fbbe

- Vault: 0x886ce997aa9ee4f8c2282e182ab72a705762399d

- Staking (v1): 0x0822f3c03dcc24d200aff33493dc08d0e1f274a2

Network: Rinkeby (4)

- OHM:

0xC0b491daBf3709Ee5Eb79E603D73289Ca6060932 - DAI:

0xB2180448f8945C8Cc8AE9809E67D6bd27d8B2f2C - Frax:

0x2F7249cb599139e560f0c81c269Ab9b04799E453 - Treasury:

0x0d722D813601E48b7DAcb2DF9bae282cFd98c6E7 - OHM/DAI Pair:

0x8D5a22Fb6A1840da602E56D1a260E56770e0bCE2 - OHM/Frax Pair:

0x11BE404d7853BDE29A3e73237c952EcDCbBA031E - Calc:

0xaDBE4FA3c2fcf36412D618AfCfC519C869400CEB - Staking:

0xC5d3318C0d74a72cD7C55bdf844e24516796BaB2 - sOHM:

0x1Fecda1dE7b6951B248C0B62CaeBD5BAbedc2084 - Distributor

0x0626D5aD2a230E05Fb94DF035Abbd97F2f839C3a - Staking Warmup

0x43B18Ad2624DBEf474aA8E0c8d8404a0A42b7aC4 - Staking Helper

0xf73f23Bb0edCf4719b12ccEa8638355BF33604A1

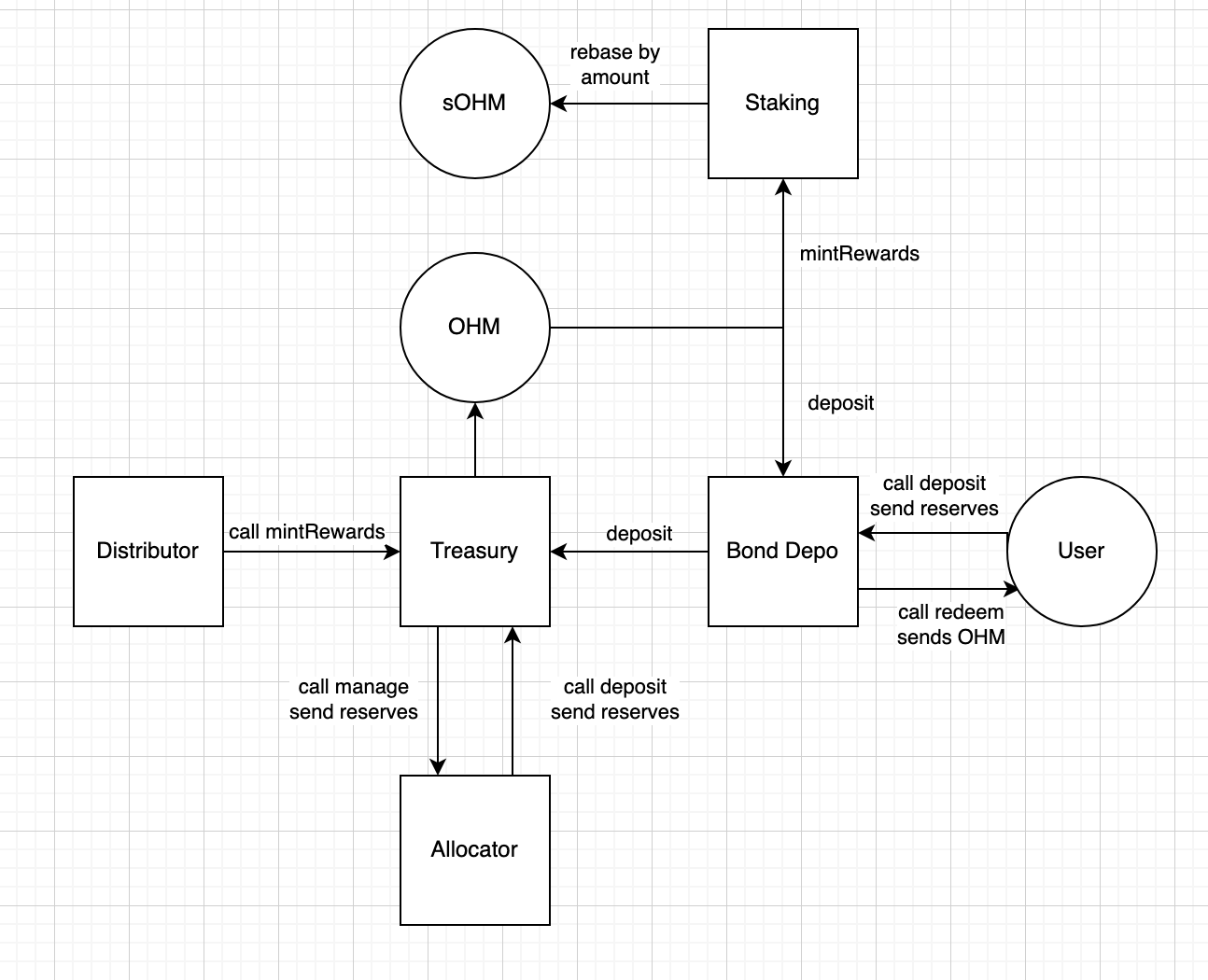

The following is a guide for interacting with the treasury as a reserve allocator.

A reserve allocator is a contract that deploys funds into external strategies, such as Aave, Curve, etc.

Treasury Address: 0x31F8Cc382c9898b273eff4e0b7626a6987C846E8

Managing: The first step is withdraw funds from the treasury via the "manage" function. "Manage" allows an approved address to withdraw excess reserves from the treasury.

Note: This contract must have the "reserve manager" permission, and that withdrawn reserves decrease the treasury's ability to mint new OHM (since backing has been removed).

Pass in the token address and the amount to manage. The token will be sent to the contract calling the function.

function manage( address _token, uint _amount ) external;

Managing treasury assets should look something like this:

treasury.manage( DAI, amountToManage );

Returning:

The second step is to return funds after the strategy has been closed.

We utilize the deposit function to do this. Deposit allows an approved contract to deposit reserve assets into the treasury, and mint OHM against them. In this case however, we will NOT mint any OHM. This will be explained shortly.

Note The contract must have the "reserve depositor" permission, and that deposited reserves increase the treasury's ability to mint new OHM (since backing has been added).

Pass in the address sending the funds (most likely the allocator contract), the amount to deposit, and the address of the token. The final parameter, profit, dictates how much OHM to send. send_, the amount of OHM to send, equals the value of amount minus profit.

function deposit( address _from, uint _amount, address _token, uint _profit ) external returns ( uint send_ );

To ensure no OHM is minted, we first get the value of the asset, and pass that in as profit. Pass in the token address and amount to get the treasury value.

function valueOf( address _token, uint _amount ) public view returns ( uint value_ );

All together, returning funds should look something like this:

treasury.deposit( address(this), amountToReturn, DAI, treasury.valueOf( DAI, amountToReturn ) );