A trading system for automated algorithmic trading on Binance Futures and BitMEX.

The author is not responsible for any damage caused by this software. Be careful and test your strategy using very small sizes for some time to make sure it does what you expect it to do.

- API and Websocket implementation for both Binance Futures and BitMEX

- Supports all pairs

- Event-driven

- all types of orders supported including majority of parameters/combinations - if you miss any, you can request

- Supports custom strategies

- Backtesting

- Testnet for BitMEX and Binance Futures

- Stub trading (paper trading)

- TA-lib indicators, you can request an indicator if its missing

- Very easy strategy implementation, should be easy enough to migrate most pine script(tradingview) strategies - see Sample strategy

- Channel Breakout

- Cross SMA

- RCI

- Open Close Cross Strategy

- Trading View Strategy (implemented but not supported in the current implementation via gmail) - maybe in the future todo tradingview webhooks implementation, until then this project is recommended for tradingview webhooks trading: https://github.com/CryptoMF/frostybot

It is not recommended to use these strategies for live trading, as they are here mostly just for reference.

- Python: 3.6.5

$ brew install ta-lib

$ git clone https://github.com/TheFourGreatErrors/alpha-rptr.git

$ cd alpha-rptr/

$ pip install -r requirements.txt$ wget http://prdownloads.sourceforge.net/ta-lib/ta-lib-0.4.0-src.tar.gz

$ tar xvzf ta-lib-0.4.0-src.tar.gz

$ cd ta-lib/

$ ./configure --prefix=/usr

$ make

$ sudo make install

$ git clone https://github.com/TheFourGreatErrors/alpha-rptr.git

$ cd alpha-rptr/

$ pip install -r requirements.txtSet your API keys in src / config.py file.

config = {

"binance_keys": {

"binanceaccount1": {"API_KEY": "", "SECRET_KEY": ""},

"binanceaccount2": {"API_KEY": "", "SECRET_KEY": ""}

},

"binance_test_keys": {

"binancetest1": {"API_KEY": "", "SECRET_KEY": ""},

"binancetest2": {"API_KEY": "", "SECRET_KEY": ""}

},

"bitmex_keys": {

"bitmexaccount1": {"API_KEY": "", "SECRET_KEY": ""},

"bitmexaccount2": {"API_KEY": "", "SECRET_KEY": ""}

},

"bitmex_test_keys": {

"bitmextest1": {"API_KEY": "", "SECRET_KEY": ""},

"bitmextest2": {"API_KEY": "", "SECRET_KEY": ""}

},

"line_apikey": {"API_KEY": ""},

"healthchecks.io": {

"binanceaccount1": {

"websocket_heartbeat": "",

"listenkey_heartbeat": ""

}

}

}If you want to send notifications to LINE, set LINE's API key as well. #todo discord and telegram notifications implementation as well.

$ python main.py --account binanceaccount1 --exchange binance --pair BTCUSDT --strategy SampleBy changing the values of ACCOUNT EXCHANGE PAIR STRATEGY you can switch accounts, exchanges, piars, strategies.

$ python main.py --account bitmexaccount1 --exchange bitmex --pair XBTUSD --strategy Doten$ python main.py --account binanceaccount1 --exchange binance --pair BTCUSDT --strategy SampleIt is possible to trade on BitMEX testnet and Binance Futures testnet

$ python main.py --demo --account bitmexaccount1 --exchange bitmex --pair XBTUSD --strategy Sample$ python main.py --test --account binanceaccount1 --exchange binance --pair BTCUSDT --strategy Sample$ python main.py --hyperopt --account binanceaccount1 --exchange binance --pair BTCUSDT --strategy Sample$ python main.py --stub --account binanceaccount1 --exchange binance --pair BTCUSDT --strategy SampleYou can add a strategy by creating a new class in src / strategy.py.

Follow this example, which hopefully explains a lot of questions.

# sample strategy

class Sample(Bot):

def __init__(self):

# set time frame here

Bot.__init__(self, ['15m'])

# initiate variables

self.isLongEntry = []

self.isShortEntry = []

def options(self):

return {}

def strategy(self, action, open, close, high, low, volume):

# this is your strategy function

# use action argument for mutli timeframe implementation, since a timeframe string will be passed as `action`

# get lot or set your own value which will be used to size orders

# don't forget to round properly

# careful default lot is about 20x your account size !!! (binance futures)

lot = round(self.exchange.get_lot() / 20, 3)

# Example of a callback function, which we can utilize for order execution etc.

def entry_callback(avg_price=close[-1]):

long = True if self.exchange.get_position_size() > 0 else False

logger.info(f"{'Long' if long else 'Short'} Entry Order Successful")

# if you are using minute granularity or multiple timeframes its important to use `action` as its going pass a timeframe string

# this way you can separate functionality and use proper ohlcv timeframe data that get passed each time

if action == '1m':

#if you use minute_granularity you can make use of 1m timeframe for various operations

pass

if action == '15m':

# indicator lengths

fast_len = self.input('fast_len', int, 6)

slow_len = self.input('slow_len', int, 18)

# setting indicators, they usually take source and length as arguments

sma1 = sma(close, fast_len)

sma2 = sma(close, slow_len)

# entry conditions

long_entry_condition = crossover(sma1, sma2)

short_entry_condition = crossunder(sma1, sma2)

# setting a simple stop loss and profit target in % using built-in simple profit take and stop loss implementation

# which is placing the sl and tp automatically after entering a position

self.exchange.sltp(profit_long=1.25, profit_short=1.25, stop_long=1, stop_short=1.1, round_decimals=0)

# example of calculation of stop loss price 0.8% round on 2 decimals hardcoded inside this class

# sl_long = round(close[-1] - close[-1]*0.8/100, 2)

# sl_short = round(close[-1] - close[-1]*0.8/100, 2)

# order execution logic

if long_entry_condition:

# entry - True means long for every other order other than entry use self.exchange.order() function

self.exchange.entry("Long", True, lot, callback=entry_callback)

# stop loss hardcoded inside this class

#self.exchange.order("SLLong", False, lot, stop=sl_long, reduce_only=True, when=False)

if short_entry_condition:

# entry - False means short for every other order other than entry use self.exchange.order() function

self.exchange.entry("Short", False, lot, callback=entry_callback)

# stop loss hardcoded inside this class

# self.exchange.order("SLShort", True, lot, stop=sl_short, reduce_only=True, when=False)

# storing history for entry signals, you can store any variable this way to keep historical values

self.isLongEntry.append(long_entry_condition)

self.isShortEntry.append(short_entry_condition)

# OHLCV and indicator data, you can access history using list index

# log indicator values

logger.info(f"sma1: {sma1[-1]}")

logger.info(f"second last sma2: {sma2[-2]}")

# log last candle OHLCV values

logger.info(f"open: {open[-1]}")

logger.info(f"high: {high[-1]}")

logger.info(f"low: {low[-1]}")

logger.info(f"close: {close[-1]}")

logger.info(f"volume: {volume[-1]}")

# log history entry signals

#logger.info(f"long entry signal history list: {self.isLongEntry}")

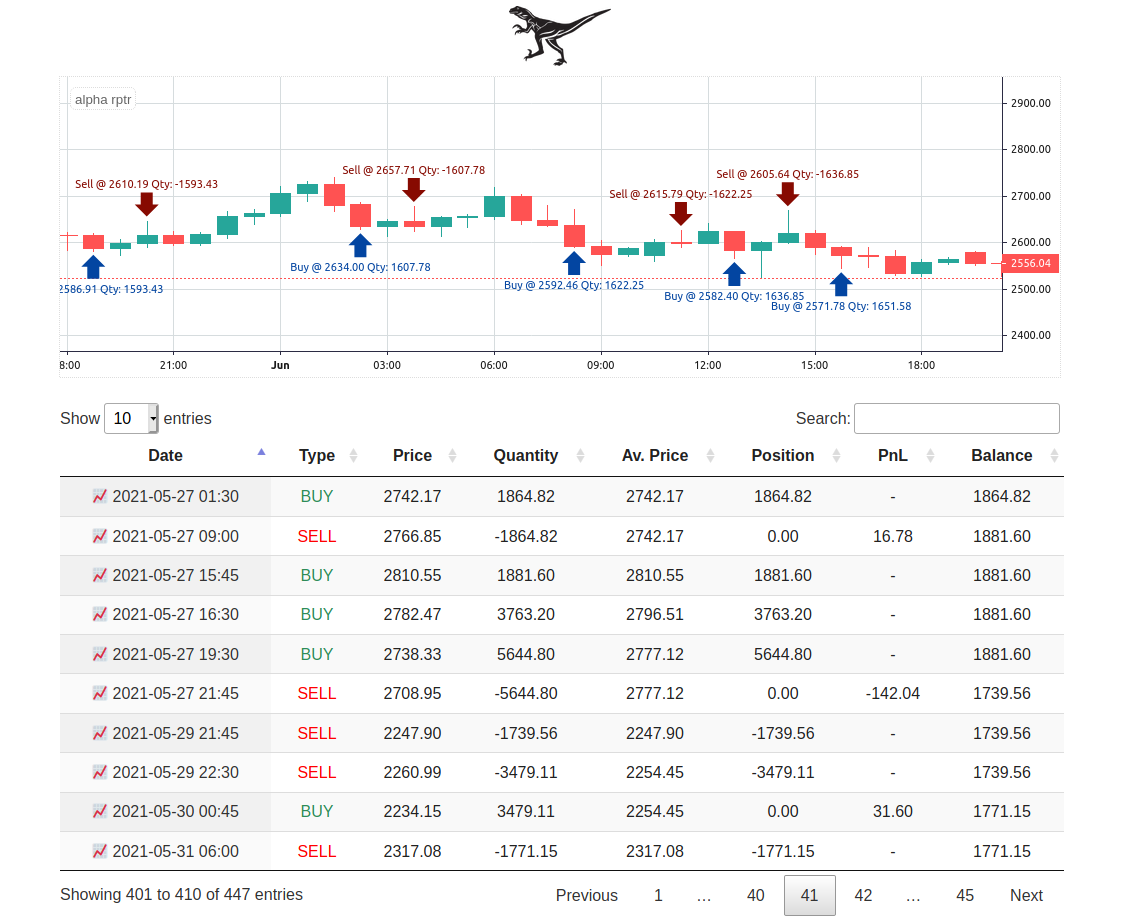

#logger.info(f"short entry signal history list: {self.isShortEntry}") A basic HTML5 TradingView Lite (Open Source Version) widget based order visualization on top of Candle Stick data is available. It also displays a table with orders that can be sorted in many ways and clicking on any order date will auto-scroll that period into view.

A file called orders.csv file is generated after every backtest in the project root folder. And then at the end of each backtest data.csv from data folder and orders.csv from project root are symlinked into the new html/data diretory

We can then use this browser interface by executing python3 -m http.server 8000 in the html folder and browse to https://127.0.0.1:8000/ to view backtest results.

Do not forget to refresh the page after each backtest for evaluating the results.

This server is dedicated for bug reporting, feature requests and support. https://discord.gg/ah3MGeN

if you find this software useful and want to support the development, please feel free to donate.

BTC address: 3MJsicsG6C4L7iZyVhEpVsBeEMUxLF3Qq2

ETH address: 0x24291B6F1e3e42D73280Dac54d7251482f5d4D99

DOGE adderess: DLWdyMihy6WTvUkdhiQm7HPCTais5QFRJQ

BNB address: bnb1kfmd03rzr7xekrrdmca92qyasv3kx2vfn7tzk6

Tether(BSC): 0x24291B6F1e3e42D73280Dac54d7251482f5d4D99

USDC(BSC): 0x24291B6F1e3e42D73280Dac54d7251482f5d4D99

SOL address: HARKcAFct9tc3L4E7vt2sDb2jkqBfZz1aaaPFBck5s6T

LTC address: LZo5Q7pabhYt5Zhpt9HC3eHDG3W5nZqGhU

XRP address: rLMGyMAhrDDAh3de2yhzDFwidbPPE7ifkt

MATIC address: 0x24291B6F1e3e42D73280Dac54d7251482f5d4D99