USER GUIDE

actuarialmath -- Life Contingent Risks with Python

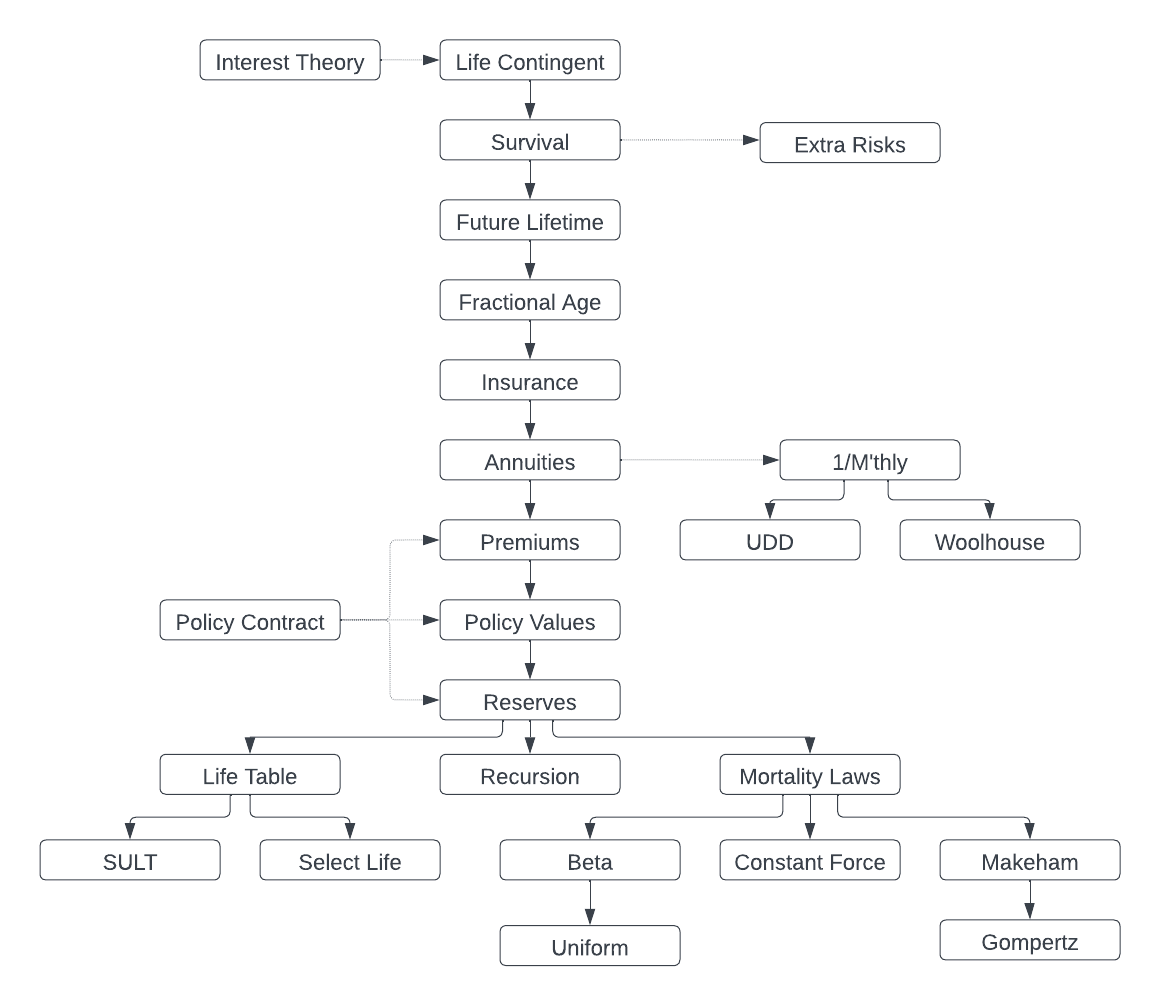

This Python package implements fundamental methods for modeling life contingent risks, and closely follows the coverage of traditional topics in actuarial exams and standard texts such as the "Fundamentals of Actuarial Math - Long-term" exam syllabus by the Society of Actuaries, and "Actuarial Mathematics for Life Contingent Risks" by Dickson, Hardy and Waters. The actuarial concepts, and corresponding Python classes, are introduced and modeled hierarchically.

Quick Start

-

pip install actuarialmath- also requires

numpy,scipy,matplotlibandpandas.

- also requires

-

Start Python (version >= 3.10) or Jupyter-notebook

-

Select a suitable subclass to initialize with your actuarial assumptions, such as

MortalityLaws(or a special law likeConstantForce),LifeTable,SULT,SelectLifeorRecursion. -

Call appropriate methods to compute intermediate or final results, or to

solveparameter values implicitly. -

Adjust answers with

ExtraRiskorMthly(or itsUDDorWoolhouse) classes

-

Examples

SOA FAM-L sample question 5.7:

Given

from actuarialmath import Recursion, Woolhouse

# initialize Recursion class with actuarial inputs

life = Recursion().set_interest(i=0.04)\

.set_A(0.188, x=35)\

.set_A(0.498, x=65)\

.set_p(0.883, x=35, t=30)

# modfy the standard results with Woolhouse mthly approximation

mthly = Woolhouse(m=2, life=life, three_term=False)

# compute the desired temporary annuity value

print(1000 * mthly.temporary_annuity(35, t=30)) # solution = 17376.7

SOA FAM-L sample question 7.20:

For a fully discrete whole life insurance of 1000 on (35), you are given

- First year expenses are 30% of the gross premium plus 300

- Renewal expenses are 4% of the gross premium plus 30

- All expenses are incurred at the beginning of the policy year

- Gross premiums are calculated using the equivalence principle

- The gross premium policy value at the end of the first policy year is R

- Using the Full Preliminary Term Method, the modified reserve at the end of the first policy year is S

- Mortality follows the Standard Ultimate Life Table

- i = 0.05

Calculate R − S

from actuarialmath import SULT, Contract

life = SULT()

# compute the required FPT policy value

S = life.FPT_policy_value(35, t=1, b=1000) # is always 0 in year 1!

# input the given policy contract terms

contract = Contract(benefit=1000,

initial_premium=.3,

initial_policy=300,

renewal_premium=.04,

renewal_policy=30)

# compute gross premium using the equivalence principle

G = life.gross_premium(A=life.whole_life_insurance(35), **contract.premium_terms)

# compute the required policy value

R = life.gross_policy_value(35, t=1, contract=contract.set_contract(premium=G))

print(R-S) # solution = -277.19

Resources

-

Colab or Jupyter notebook, to solve all sample SOA FAM-L exam questions

-

Github repo and issues

Sources

-

SOA FAM-L Sample Questions: copy retrieved Aug 2022

-

SOA FAM-L Sample Solutions: copy retrieved Aug 2022

-

Actuarial Mathematics for Life Contingent Risks, by David Dickson, Mary Hardy and Howard Waters, published by Cambridge University Press.

Contact

Github: https://terence-lim.github.io