Learn how to borrow any available amount of assets without putting up any collateral and build a simple arbitrage bot that would trade between Uniswap and Sushiswap pools.

Table of Contents

DeFi is hot now. One of the reasons is an existence of features such as Flash Loans.

It is an uncollateralized debt. There is no equivalent in the real world. With Aave Protocol’s smart contracts, you can borrow any amount of Ethereum or ERC20 within your smart contract, if you pay it back by the end of the transaction, plus a small fee.

To do a Flash Loan, we will build a contract that requests a Flash Loan. The contract will then need to execute the instructed steps and pay back the loan + interest and fees all within the same transaction.

After requesting a flash loan, we will do some arbitrage trading by buying/selling two different ERC20 tokens with two different prices in two different exchanges.

Please have a look at official docs by Aave. You can read them here and here.

Also, Infura has a great blog post about building arbitrage bots.

Let's start our environment for tinkering and exploring how flash loans work.

- Clone the repo first

git clone -b flash-loans-intro https://github.com/austintgriffith/scaffold-eth.git flash-loans-intro

cd flash-loans-intro- Install dependencies

yarn install- Start your React frontend

yarn start- Fork mainnet and start your local blockhain using Hardhat

yarn forkThis step is very important. We will talk to real addresses of existing contracts on mainnet. Running local blockhain with yarn chain will not work!

Watch this video to learn more about mainnet forking.

- Deploy your smart contracts to a local blockchain

yarn deployPro Tip: Use tmux to easily start all commands in a single terminal window!

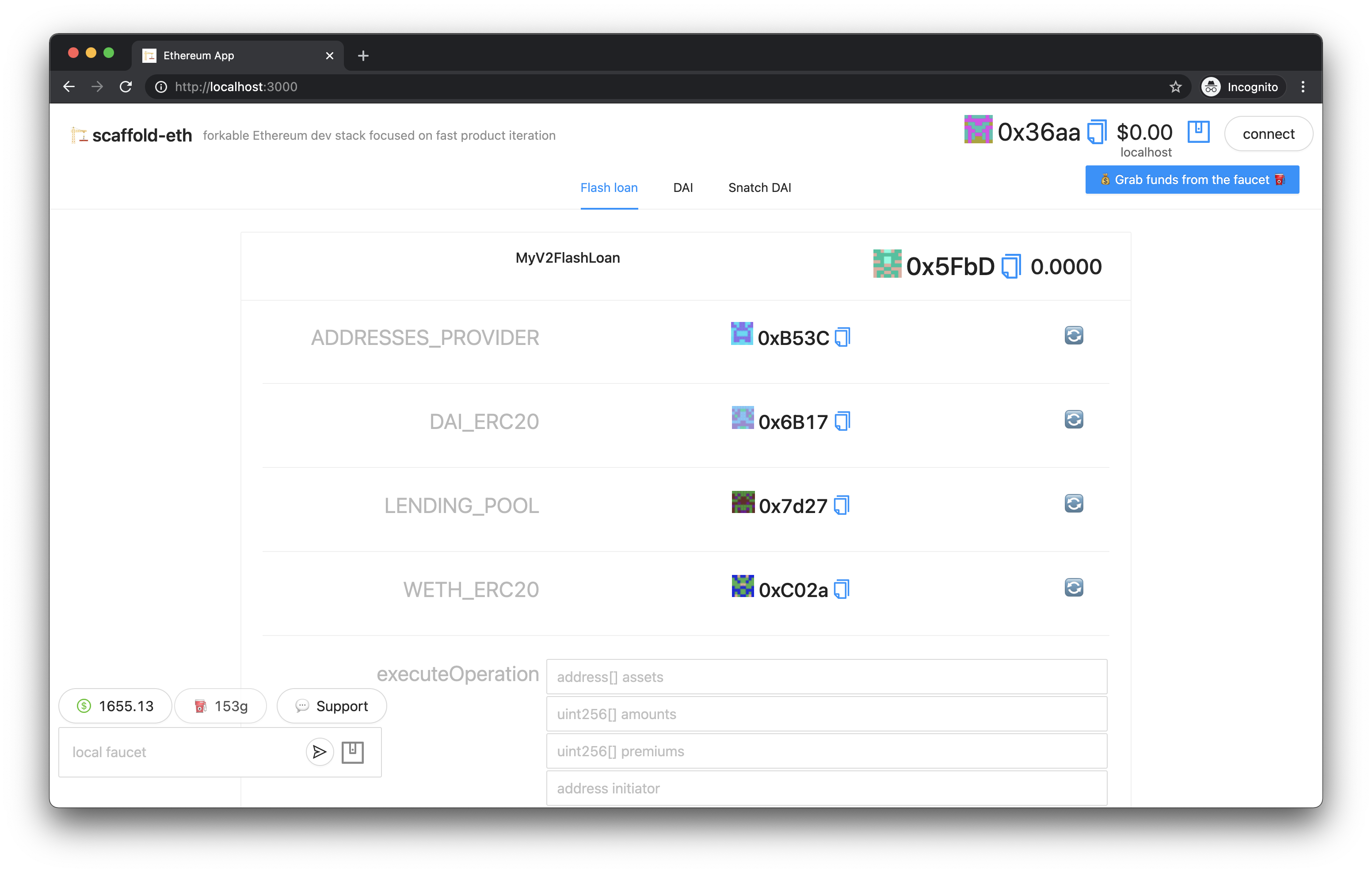

If everything worked fine, you have to have something like this opened in your browser:

Let's navigate to packages/hardhat/contracts folder and check out what contracts we have there.

We are only interested in 2 smart contracts: MyV2FlashLoan.sol and DAI.sol. All other contracts contain interfaces and constants for smooth development.

The boilerplate for this contract is taken directly from Aave docs.

The most important thing is that we must conform to the IFlashLoanReceiver interface by implementing the relevant executeOperation() function.

That's why we inherit from FlashLoanReceiverBase, which conforms to the IFlashLoanReceiver.

contract MyV2FlashLoan is FlashLoanReceiverBaseFor our arbitrage bot, we will use two different ERC20 tokens: DAI and WETH. Also, we will trade using two different exhanges: Uniswap and Sushiswap. Sushiswap is just a fork of Uniswap. That's why they have absolutely identical Router interfaces.

In order to let us trade easily, let's instantiate routers for our exchanges in the contract and create IERC20 interfaces for our tokens.

sushiswapRouter = IUniswapV2Router02(Constants.SUSHISWAP_ROUTER_ADDRESS);

uniswapRouter = IUniswapV2Router02(Constants.UNISWAP_ROUTER_ADDRESS);

DAI_ERC20 = IERC20(Constants.DAI_ADDRESS);

WETH_ERC20 = IERC20(Constants.WETH_ADDRESS);If you are not familiar with Uniswap routers then you have to read this before continuing.

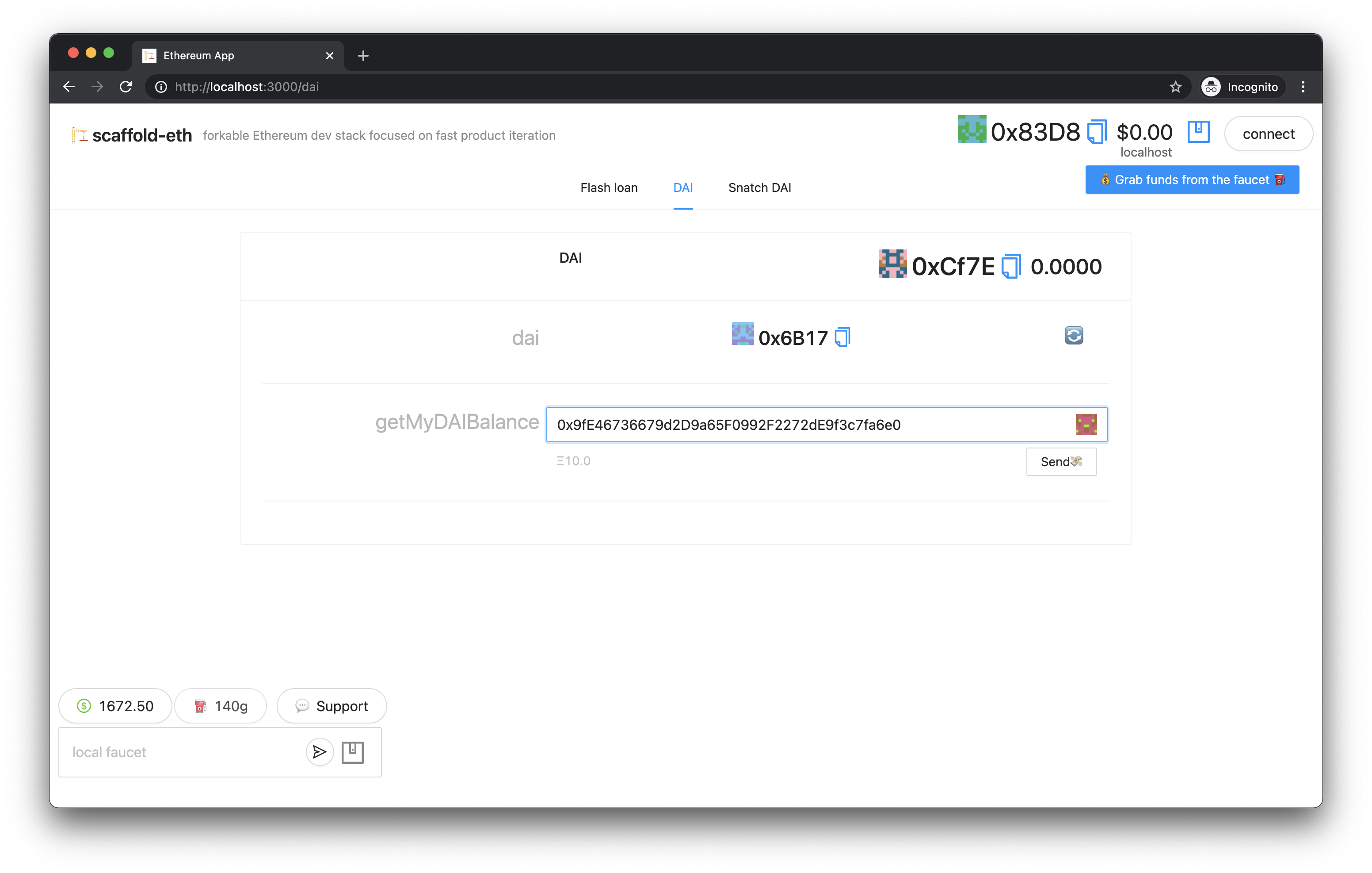

This contract is pretty simple and plays a helper role for us. All it does is checking how many DAI tokens some address has on its balance.

We will use it to check balance of our deployed contract to make sure we have some DAI beforehand to pay fees to Aave.

Firstly, let's define how much and what asset we will borrow from Aave. In our example, we will borrow 500 DAI. However, you can choose any token and borrow any amount. Check out loanSize constant in our contract.

Core logic for arbitraging is located inside executeOperation function in MyV2FlashLoan.sol contract. This function will be executed right after we receive our requested assets - 500 DAI.

Our first trade will swap all our requested DAI for WETH using Uniswap.

DAI_ERC20.approve(Constants.UNISWAP_ROUTER_ADDRESS, loanSize);

uniswapRouter.swapExactTokensForTokens(loanSize, 0, path, address(this), block.timestamp + 5);Our second trade will swap all our received WETH back to DAI using Sushiswap.

WETH_ERC20.approve(Constants.SUSHISWAP_ROUTER_ADDRESS, WETHBalance);

sushiswapRouter.swapExactTokensForTokens(WETHBalance, 0, revPath, address(this), block.timestamp + 5);In theory, if we make right calculations beforehand, we should benefit by doing these two trades.

At the end of the contract, we should make sure we approve tokens we requested from Aave and also additional fee.

uint256 amountOwing = amounts[i].add(premiums[i]);

IERC20(assets[i]).approve(address(LENDING_POOL), amountOwing);Important: In this contract we did not add any check whether we benefited from the trade or not. In real scenario, you must do this if you do not want to lose your money.

If we do not benefit from our trade, our transaction will be reverted and we will be safe.

However, let's make our transaction happen even if do not benefit from our trade (just for fun and testing). In order to make this happen, we have to make sure our contract has some DAI beforehand. This DAI will be used to cover all our expenses including fee for Aave.

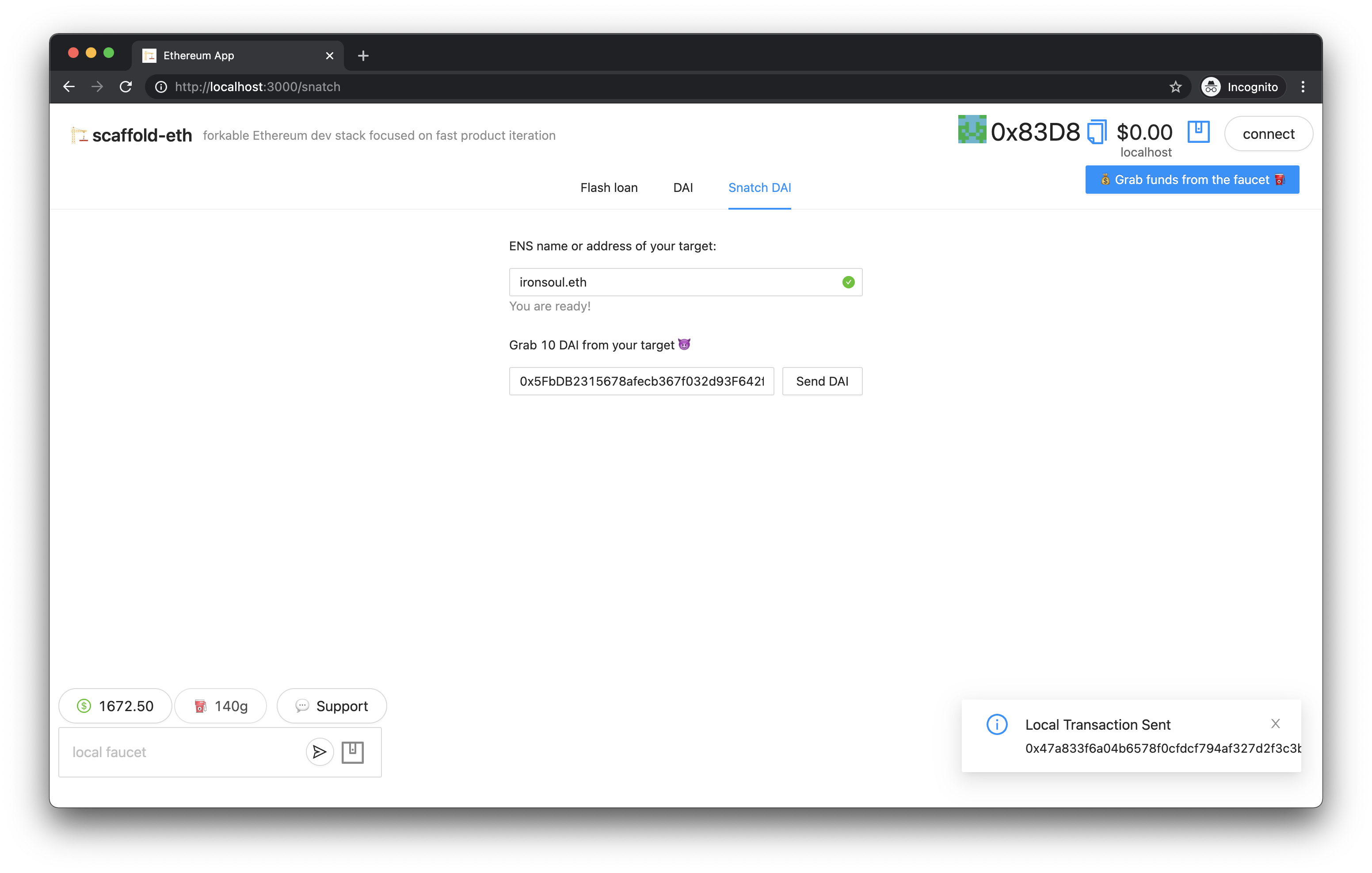

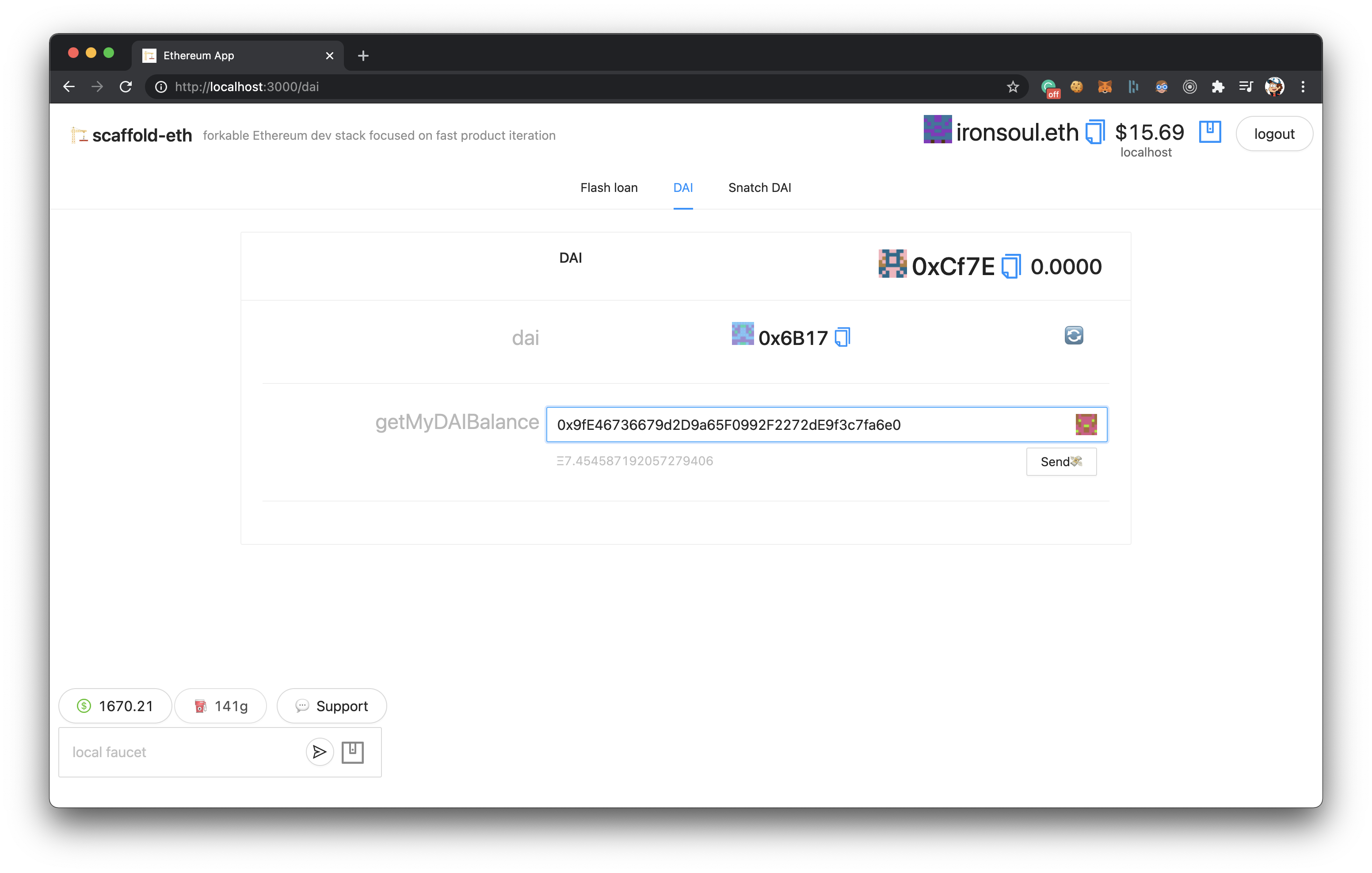

Firstly, copy address of your deployed smart contract MyV2FlashLoan and send it 10 DAI using Snatch tab on your website.

Now if you check your contract's DAI balance using DAI tab, it should have 10 DAI available for you.

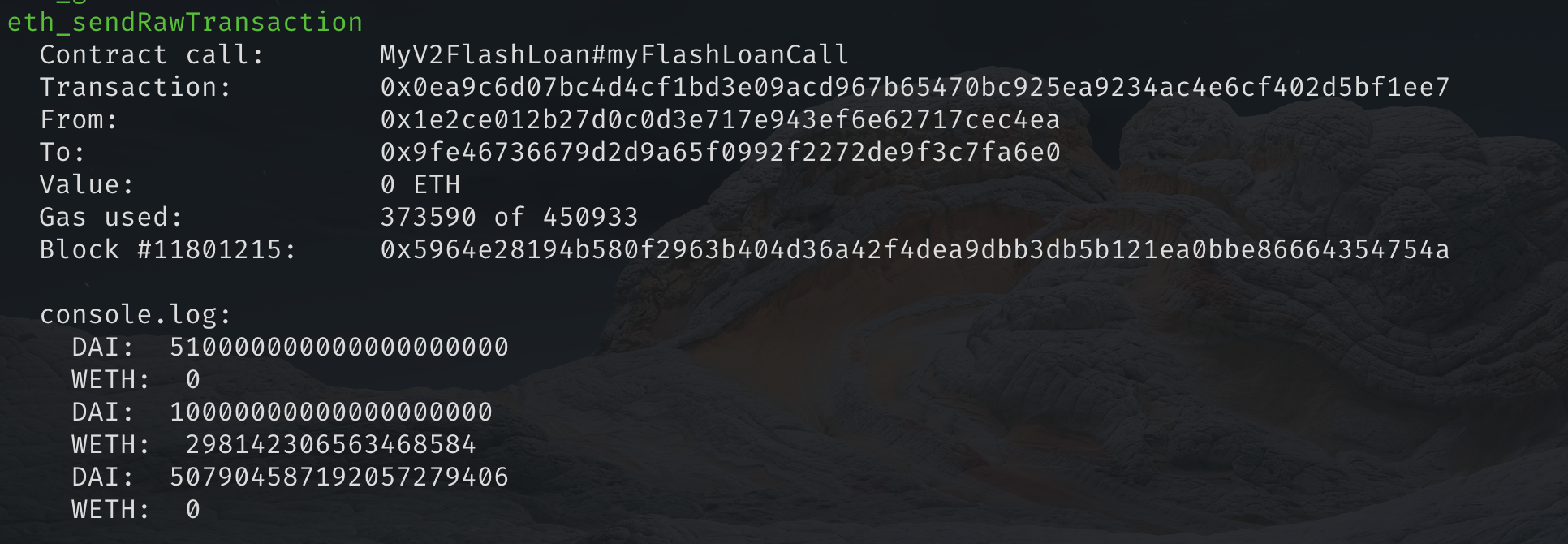

Excellent! Now let's try to run our myFlashLoanCall and watch what happens. After our transaction ends, let's check our DAI balance again.

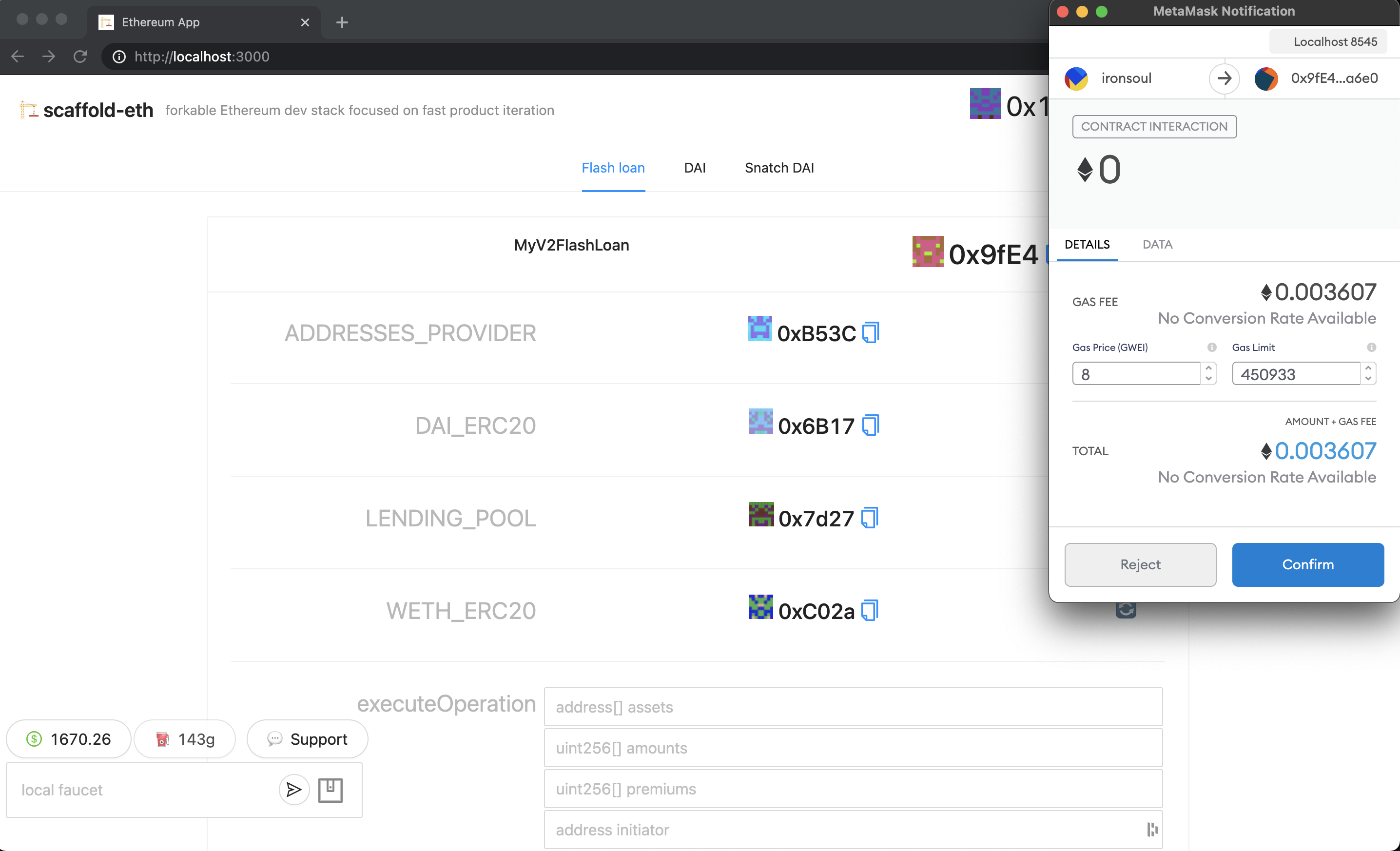

Once you press the button, it will take about 2-3 minutes for gas estimation. Just wait patiently.

Our metamask window then appears and we are ready to send our transaction!

You can also note some additional logging in our console that indicates how much WETH and DAI we have at some moment.

Not let's go back to our DAI tab and check how much DAI we have now.

In my case, my balance went down by 2.6 DAI :(

This trade was not optimal and ideally we had to revert it. Obviously, you should do some research before arbitraging some tokens. For the sake of simplicity, we did not do these just to show how arbitraging works.

- Finematics explains Flash Loans - Nice theory explanation

- Furucombo App - Flash loans using drag and drop without coding (!)

Join the telegram support chat 💬 to ask questions and find others building with 🏗 scaffold-eth!