This project develops and tests trading alphas for the Indian and US equity markets, focusing on medium to high-frequency trading strategies. The objective is to create, backtest, and optimize these alphas to enhance trading performance.

- Develop trading strategies based on given alphas

- Backtest strategies using historical market data

- Optimize trading thresholds to maximize profit and loss (PnL)

- Visualize the performance of the trading strategies

- Python 3.x

- Pandas

- Numpy

- Matplotlib

-

Clone the repository:

git clone https://github.com/saurabh4269/alpha.git cd alpha -

Install the required packages:

pip install pandas numpy matplotlib

-

Download the dataset from the provided link and place it in the project directory:

- Dataset

- Rename the downloaded file to

asset_1.csvand place it in the project directory.

-

Run the script:

python backtest.py

-

The script will:

- Load the dataset

- Optimize the trading thresholds

- Apply the optimal strategy

- Backtest the strategy

- Save the results to

backtest_results.csv - Visualize the performance

- Initialization: Accepts build and liquidate thresholds.

- Method:

apply_strategy(data)applies the trading strategy to the dataset.

- Initialization: Accepts a strategy and dataset.

- Method:

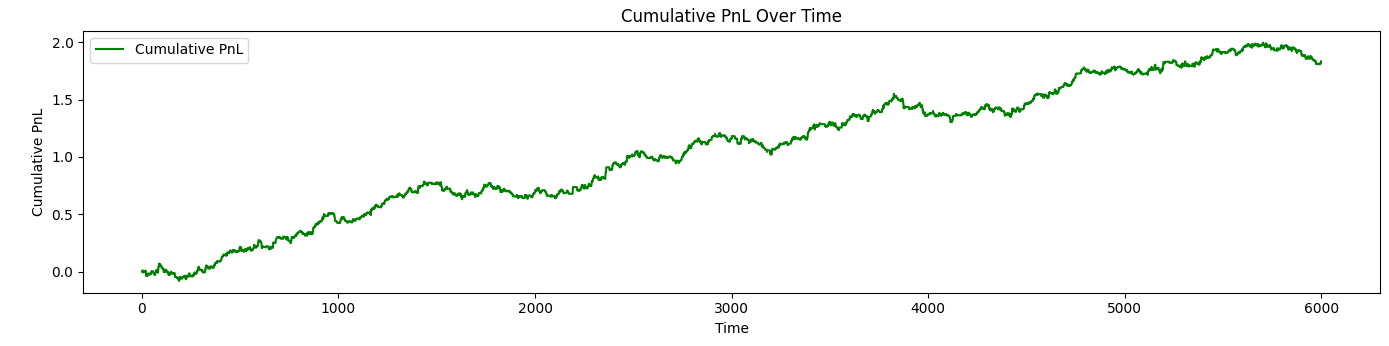

run_backtest()applies the strategy, calculates returns and PnL, and generates a cumulative PnL.

- Optimizes the build and liquidate thresholds to maximize PnL.

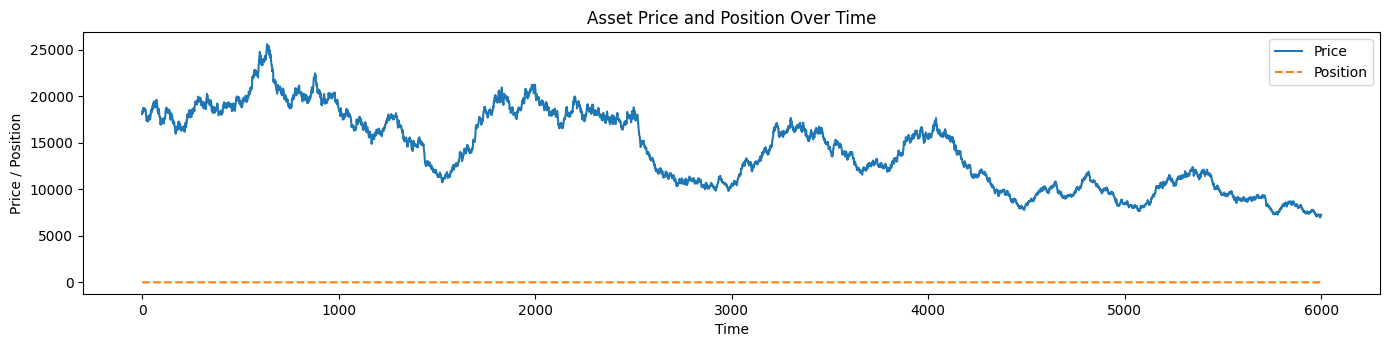

- Visualizes the asset price, position over time, and cumulative PnL.

- The script first optimizes the thresholds.

- It then applies the optimal strategy and runs the backtest.

- Finally, it visualizes the results and saves them to a CSV file.

Below are example plots generated by the script: