This archive contains a sample implementation of of the Deep Hedging (http://deep-hedging.com) framework. The notebook directory has a number of examples on how to use it. The framework relies on the pip package cdxbasics.

The Deep Hedging problem for a horizon

$ \max_{a}: U[ \ Z_T + \sum_{t=0}^{T-1} a(f_t) \cdot DH_t - | a(f_t)\gamma_t| \ \right] $

where

To test the code run notebooks/trainer.ipynb.

In order to run the Deep Hedging, we require:

- Market data: this is referred to as a world. Among other members, world has a td_data member which represents the feature sets across training samples, and tf_sample_weights which is the probability distribution across samples. The code provides a simplistic default implementation, but for any real application it is recommend to rely on fully machine learned market simulators such as https://arxiv.org/abs/2112.06823.

- Gym: the main Keras custom model. It is a Monte Carlo loop arund the actual underlying agent.py networks.

Given a world we can compute the loss given the prevailing action network as gym(world.tf_data). - Train: some cosmetics around keras.fit() with some nice live visualization using matplotlib if you are in jupyter. See animation below.

To provide your own world with real or simulator data, see world.py. Here are world.tf_data entries used by gym.call():

-

data['market']['payoff'] (:,)

The payoff$Z_T$ at maturity. Since this is at or part the expiry of the product, this can be computed off the path until$T$ .

-

data['martket']['hedges'] (:,M,N)

Returns of the hedges, i.e. the vector$DH_t:=H_T - H_t$ . That means$H_t$ is the model price at time$t$ , and$H_T$ is the price at time$T$ . In most applications$T$ is chosen such that$H_T$ is the actual payoff.

For example, if$S_t$ is spot,$w_t$ is the implied volatility at$t$ ,$T$ is time-to-maturity, and$k$ a relative strike, then$H_t = \mathrm{BSCall}( S_t, w_t; T, kS_t )$ and$H_T = ( S_{t+T} / S_t - k )^+$ .

-

data['martket']['cost'] (:,M,N)

Cost$\gamma_t$ of trading the hedges in$t$ for proportional cost$c_t(a) = \gamma_t\cdot |a|$ . More advanced implementations allow to pass the cost function itself as a tensorflow model.

In the simple setting an example for the cost of trading a vanilla call could be$\gamma_t = \gamma^D\, BSDelta(t,\cdots)+ \gamma^V\,BSVega(t,\cdots)$ .

-

data['martket']['unbd_a'], data['martket']['lnbd_a'] (:,M,N)

Min/max allowed action per time step:$a^\min_t \leq a \leq a^\max_t$ , componenwise.

-

data['features']['per_step'] (:,M,N)

Featues for feeding the action network per time step such as current spot, current implied volatilities, time of the day, etx

-

data['features']['per_sample'] (:,M)

Featues for feeding the action network which are constant along the path such as features of the payoff, risk aversion,

The code examples provided are fairly general and allow for a wide range of applications. An example world generator for simplistic model dynamics is provided, but in practise it is recommend to rely on fully machine learned market simulators such as https://arxiv.org/abs/2112.06823

- Use Python 3.7

- Pip (or conda) install cdxbasics version 0.1.42 or higher

- Install TensorFlow 2.7 or higher

- Install tensorflow_probability 0.15 or higher

- Download this git directory in your Python path such that import deephedging.world works.

- Open notebooks/trainer.ipynb and run it.

We attempted to provide a base for industrial code development.

-

Notebook-free: all code can, and is meant to run

outside a jupyter notebook. Notebooks are good for playing around but should not feature in any production environment.

Notebooks are used for demonstration only.

-

Defensive programming: validate as many inputs to functions as reasonable with clear, actionable, context-dependent

error messages. We use the cdxbasics.logger framework with a similar usage paradigm as C++ ASSSET/VERIFY.

-

Robust configs: all configurations of all objects are driven by dictionaries.

However, the use of simple dictionaries leads to a number of inefficiencies which can slow down development.

We therefore use cdxbasics.config.Config which provides:

- Catch Spelling Errors: ensures that any config parameter is understood by the receving code. That means if the code expects config['nSamples'] but we passed config['samples'] an error is thrown.

- Self-documentation: once parsed by receving code, the config is self-documenting and is able to print out any values used, including those which were not set by the users when calling the receiving code.

- Object notation: we prefer using config.nSamples = 2 instead of the standard dictionary notation.

-

Config-driven built:

avoids differences between training and inference code. In both cases, the respective model hierarchy is built

driven by the structure of the config file. There is no need to know for inference which sub-models where used during training within the overall model hierarchy.

-

world.SimpleWorld_Spot_ATM class

Simple World with one asset and one floating ATM option. The asset has stochastic volatility, and a mean-reverting drift. The implied volatility of the asset is not the realized volatility, allowing to re-create some results from https://arxiv.org/abs/2103.11948

Set the black_scholes boolean config flag to True to turn the world into a simple black & scholes world, with no traded option. Otherwise, use no_stoch_vol to turn off stochastic vol, and no_stoch_drift to turn off the stochastic mean reverting drift of the asset. If both are True, then the market is Black & Scholes, but the option can still be traded for hedging.

See notebooks/simpleWorld_Spot_ATM.ipynb

-

gym.VanillaDeepHedgingGym class

Main Deep Hedging training gym (the Monte Carlo). It will create internally the agent network and the monetary utility$U$ .

To run the models for all samples of a given world use r = gym(world.tf_data).

The returned dictionary contains the following members- utiliy: (:,) primary objective to maximize

- utiliy0: (:,) objective without hedging

- loss: (:,) -utility-utility0

- payoff: (:,) terminal payoff

- pnl: (:,) mid-price pnl of trading (e.g. ex cost)

- cost: (:,) cost of trading

- gains: (:,) total gains: payoff + pnl - cost

- actions: (:,M,N) actions, per step, per path

- deltas: (:,M,N) deltas, per step, per path

-

trainer.train function

Main Deep Hedging training engine (stochastic gradient descent).

Trains the model using Keras. Any optimizer supported by Keras might be used. When run in a Jupyer notebook the model will dynamically plot progress in a number of live updating graphs. When training outside jupyer, set config.visual.monitor_type = "none" (or write your own).

See notebooks/trainer.ipynb.

The train() function is barely 50 lines. It is recommended to read it before using the framework.

The core engine in call() is not only about 200 lines of code. It is recommended to read it before using the framework.

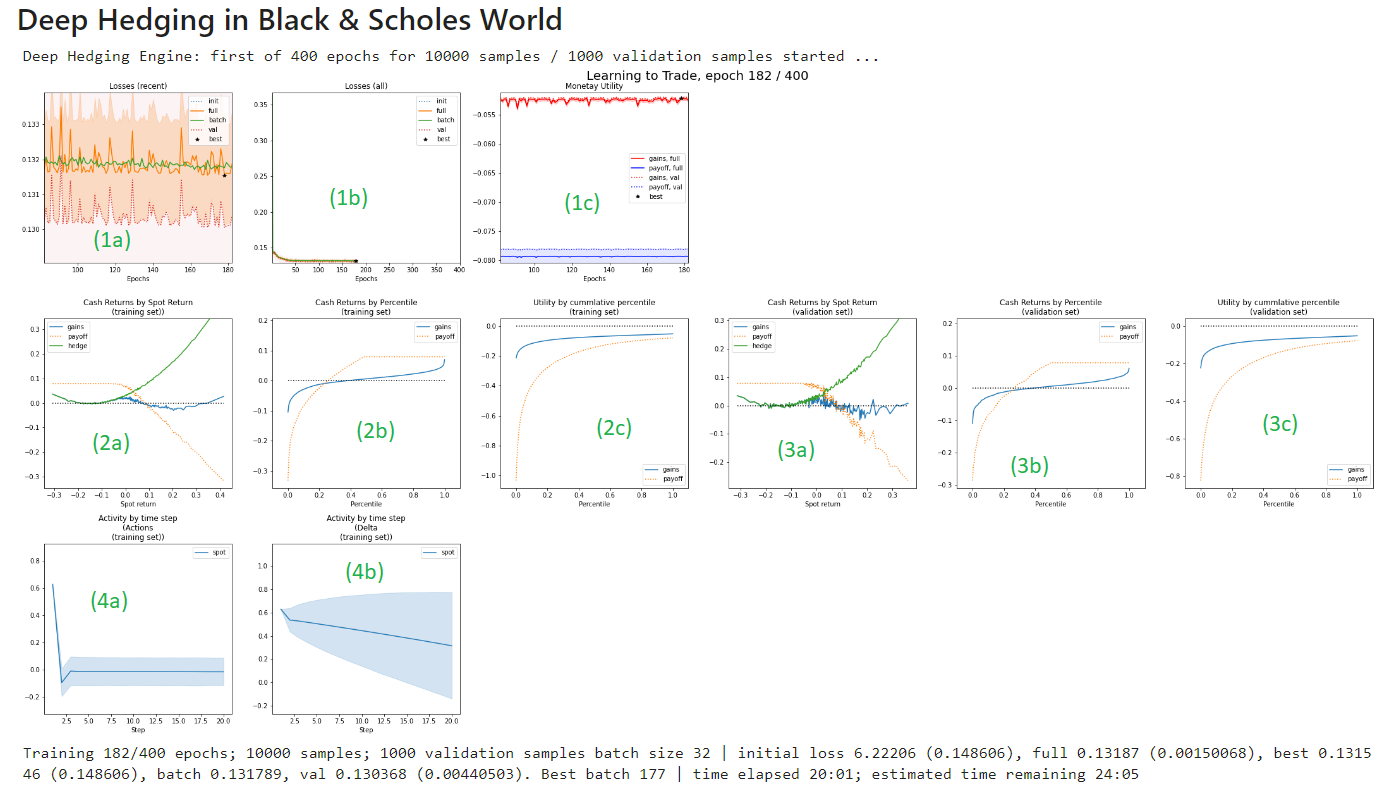

Here is an example of progress information printed by NotebookMonitor:

The graphs show:

- (1): visualizing convergence

- (1a): last 100 epochs loss view on convergence: initial loss, full training set loss with std error, batch loss, validation loss, and the running best fit.

- (1b): loss across all epochs, same metrics as above.

- (2c): last 100 epochs Monetary utility (value) of the payoff alone, and of the hedged gains (on full training set and on validation set).

- (2) visualizing the result on the training set:

- (2a) shows the payoff as function of terminal spot. That graph makes sense for terminal payoffs, but less so for full path dependent structures. Blue is the hedged position, orange the orignal position, and green the hedge.

- (2b) shows the cash (gains) by percentile. In the example we see that the original payoff has a better payoff profile for much of the x-axis, but a sharply larger loss otherwise.

- (2c) shows the utility by percentile. The farthest right is what is optimized for.

- (3) same as (2), but for the validation set.

- (4) visualizes actions:

- (4a) shows actions per time step

- (4b) shows the aggregated action as deltas accross time steps. Note that the concept of "delta" only makes sense if the instrument is actually the same per time step, e.g. spot of an stock price. For floating options this is not a particularly meaningful concept.

- gym.py contains the gym for Deep Hedging, VanillaDeepHedgingGym. It is a small script and it is recommended that every user reads it.

- train.py simplistic wrapper around keras fit() to train the gym. It is a small script and it is recommended that every user reads it.

-

base.py contains a number of useful tensorflow utilities such as

- tfCast, npCast: casting from and to tensorflow

- tf_back_flatten: flattens a tenosr while keeping the first 'dim'-1 axis the same.

- tf_make_dim: ensures a tensor has a given dimension, by either flattening it at the end, or adding tf.newaxis.

- mean, var, std, err: standard statistics, weighted by a density.

- mean_bins: binning by taking the average.

- mean_cum_bins: cummulative binning by taking the average.

- perct_exp: CVaR, i.e. the expecation over a percentile.

- fmt_seconds: format for seconds.

- world.py contains a world generator SimpleWorld_Spot_ATM.

- agents.py contains an AgentFactory which is creates agents on the fly from a config. Only implementation provided is a simple FeedForwardAgent. Typically driven by top level config.gym.agent. Is also used by objectives.py.

- objectives.py contains an MonetaryUtility which implements a range reasonable objectives. Typically driven by top level config.gym.objective.

- plot_training.py contains code to provide live plots during training when running in a notebook.

Copied from notebooks/trainer.ipynb:

from cdxbasics.config import Config

from deephedging.trainer import train

from deephedging.gym import VanillaDeepHedgingGym

from deephedging.world import SimpleWorld_Spot_ATM

# see print of the config below for numerous options

config = Config()

# world

config.world.samples = 10000

config.world.steps = 20

config.world.black_scholes = True

# gym

config.gym.objective.utility = "exp2"

config.gym.objective.lmbda = 10.

config.gym.agent.network.depth = 3

config.gym.agent.network.activation = "softplus"

# trainer

config.trainer.train.batch_size = None

config.trainer.train.epochs = 400

config.trainer.train.run_eagerly = False

config.trainer.visual.epoch_refresh = 1

config.trainer.visual.time_refresh = 10

config.trainer.visual.pcnt_lo = 0.25

config.trainer.visual.pcnt_hi = 0.75

# create world

world = SimpleWorld_Spot_ATM( config.world )

val_world = world.clone(samples=1000)

# create training environment

gym = VanillaDeepHedgingGym( config.gym )

# create training environment

train( gym=gym, world=world, val_world=val_world, config=config.trainer )

# print information on all available parameters and their usage

print("=========================================")

print("Config usage report")

print("=========================================")

print( config.usage_report() )

config.done()

This is the output of the print( config.usage_report() ) call above. It provides a summary of all config values available, their defaults, and what values where used.

Here is an example. Please run the actual code for updated parameter descriptions

config.gym.agent.network['activation'] = softplus # Network activation function; default: relu

config.gym.agent.network['depth'] = 3 # Network depth; default: 3

config.gym.agent.network['width'] = 20 # Network width; default: 20

config.gym.agent['agent_type'] = feed_forward # Default: feed_forward

config.gym.agent['features'] = ['price', 'delta', 'time_left'] # Named features the agent uses from the environment; default: ['price', 'delta', 'time_left']

config.gym.environment['softclip_hinge_softness'] = 1.0 # Specifies softness of bounding actions between lbnd_a and ubnd_a; default: 1.0

config.gym.objective['lmbda'] = 10.0 # Risk aversion; default: 1.0

config.gym.objective['utility'] = exp2 # Type of monetary utility: mean, exp, exp2, vicky, cvar, quad; default: entropy

config.trainer.train['batch_size'] = None # Batch size; default: None

config.trainer.train['epochs'] = 10 # Epochs; default: 100

config.trainer.train['optimizer'] = adam # Optimizer; default: adam

config.trainer.train['run_eagerly'] = False # Keras model run_eagerly; default: False

config.trainer.train['time_out'] = None # Timeout in seconds. None for no timeout; default: None

config.trainer.visual.fig['col_nums'] = 6 # Number of columbs; default: 6

config.trainer.visual.fig['col_size'] = 5 # Plot size of a column; default: 5

config.trainer.visual.fig['row_size'] = 5 # Plot size of a row; default: 5

config.trainer.visual['bins'] = 200 # How many x to plot; default: 200

config.trainer.visual['epoch_refresh'] = 1 # Epoch fefresh frequency for visualizations; default: 10

config.trainer.visual['err_dev'] = 1.0 # How many standard errors to add to loss to assess best performance; default: 1.0

config.trainer.visual['lookback_window'] = 30 # Lookback window for determining y min/max; default: 30

config.trainer.visual['confidence_pcnt_hi'] = 0.75 # Upper percentile for confidence intervals; default: 0.5

config.trainer.visual['confidence_pcnt_lo'] = 0.25 # Lower percentile for confidence intervals; default: 0.5

config.trainer.visual['show_epochs'] = 100 # Maximum epochs displayed; default: 100

config.trainer.visual['time_refresh'] = 10 # Time refresh interval for visualizations; default: 20

config.world['black_scholes'] = True # Hard overwrite to use a black & scholes model with vol 'rvol' and drift 'drift; default: False

config.world['corr_ms'] = 0.5 # Correlation between the asset and its mean; default: 0.5

config.world['corr_vi'] = 0.8 # Correlation between the implied vol and the asset volatility; default: 0.8

config.world['corr_vs'] = -0.7 # Correlation between the asset and its volatility; default: -0.7

config.world['cost_p'] = 0.0005 # Trading cost for the option on top of delta and vega cost; default: 0.0005

config.world['cost_s'] = 0.0002 # Trading cost spot; default: 0.0002

config.world['cost_v'] = 0.02 # Trading cost vega; default: 0.02

config.world['drift'] = 0.1 # Mean drift of the asset; default: 0.1

config.world['drift_vol'] = 0.1 # Vol of the drift; default: 0.1

config.world['dt'] = 0.02 # Time per timestep; default: One week (1/50)

config.world['invar_steps'] = 5 # Number of steps ahead to sample from invariant distribution; default: 5

config.world['ivol'] = 0.2 # Initial implied volatility; default: Same as realized vol

config.world['lbnd_as'] = -5.0 # Lower bound for the number of shares traded at each time step; default: -5.0

config.world['lbnd_av'] = -5.0 # Lower bound for the number of options traded at each time step; default: -5.0

config.world['meanrev_drift'] = 1.0 # Mean reversion of the drift of the asset; default: 1.0

config.world['meanrev_ivol'] = 0.1 # Mean reversion for implied vol vol vs initial level; default: 0.1

config.world['meanrev_rvol'] = 2.0 # Mean reversion for realized vol vs implied vol; default: 2.0

config.world['payoff'] = \<function SimpleWorld_Spot_ATM.__init__.\<locals\>.\<lambda\> at 0x0000022125590708\> # Payoff function. Parameters is spots[samples,steps+1]; default: Short ATM call function

config.world['rcorr_vs'] = -0.5 # Residual correlation between the asset and its implied volatility; default: -0.5

config.world['rvol'] = 0.2 # Initial realized volatility; default: 0.2

config.world['samples'] = 10000 # Number of samples; default: 1000

config.world['seed'] = 2312414312 # Random seed; default: 2312414312

config.world['steps'] = 20 # Number of time steps; default: 10

config.world['strike'] = 1.0 # Relative strike. Set to zero to turn off option; default: 1.0

config.world['ttm_steps'] = 4 # Time to maturity of the option; in steps; default: 4

config.world['ubnd_as'] = 5.0 # Upper bound for the number of shares traded at each time step; default: 5.0

config.world['ubnd_av'] = 5.0 # Upper bound for the number of options traded at each time step; default: 5.0

config.world['volvol_ivol'] = 0.5 # Vol of Vol for implied vol; default: 0.5

config.world['volvol_rvol'] = 0.5 # Vol of Vol for realized vol; default: 0.5

Deep Hedging was developed using Tensorflow 2.7 on Python 37. The latest version seems to run with TF 2.6 on Python 3.6 as well. Check version compatibility between TensorFlow and Python here. The main difference is that TF before 2.7 expects tensors of dimension (nBatch) to be passed as (nBatch,1).

Deep Hedging uses tensorflow-probability which does not provide a robust dependency to the installed tensorflow version. If you receive an error you will need to make sure manually that it matches to your tensorflow version here.

In your local environment:

pip install cdxbasics "tensorflow>=2.7" "tensorflow-gpu>=2.7" tensorflow_probability==0.14

Here is a stub which you may want to put ahead of any notebook you use (*)

import tensorflow as tf

import tensorflow_probability as tfp # ensure this does not fail

print("TF version %s. Num GPUs Available: %ld" % (tf.__version__, len(tf.config.list_physical_devices('GPU')) ))

In order to run on GPU you must have installed the correct CUDA and cuDNN drivers, see here. Once you have identified the correct drivers, use

conda install -c conda-forge cudatoolkit=11.2 cudnn=8.1

Run the code above (*) to check whether it picked up your GPU. Make sure you have one on the instance you are working on. Note that Deep Hedging does not benefit much from GPU use.

At the time of writing AWS SageMaker does not support TF 2.7. Moreover, it does not support GPUs for TF above 2.3. For using 2.6 without GPUs which is faster than 2.3 with GPUs, create a new instance and select the conda_tensorflow2_p36 enviroment.

In a terminal type

bash

conda activate tensorflow2_p36

pip install cdxbasics "tensorflow>=2.6" "tensorflow-gpu>=2.6" tensorflow_probability==0.14

If you have cloned the Deep Hedging git directory via SageMaker, then the deephedging directory is not in your include path, even if the directory shows up in your jupyter hub file list. You will need to add the path of your cloned git directory to python import.

A simple method is to add the following in a cell ahead of the remaining code, e.g. at the beginning of notebooks/trainer.ipynb

import os

p = os.getcwd()

end = "/deephedging/notebooks"

assert p[-len(end):] == end, "*** Error: expected current working directory to end with %s but it is %s" % (end,p)

p = p[:-len(end)]

import sys

sys.path.append(p)

print("Added python path %s" % p)