Project Stable is a decentralized, on-chain, price-history and inflation dashboard. It tracks price change of various daily-use products and commodities and allow users to see true inflation rates.

It also allow users to mint an anti-inflationary asset called STABLE token.

Demo: https://inflation.netlify.app/

Subgraph: https://thegraph.com/hosted-service/subgraph/saleel/stable-price-history

Status: Testing/POC phase

Prices of daily-use products and services has been increasing drastically in the last couple of months. Many claims that govt. reported inflation numbers are not accurate. The starting idea for this was inspired by this tweet.

- Track prices of daily-use products and services, in multiple countries, on the chain.

- Prices collected from users.

- Tracks Price Index (weighted average of all prices) - measure of true inflation.

- Products to track and weightage chosen by DAO.

- Project token Stabilizer

$SZR- used for governance and rewards. - Allow users to mint an anti inflationary crypto-currency

$STABLE, that is pegged to the Global Price Index, and is "stable" in terms of purchasing power.

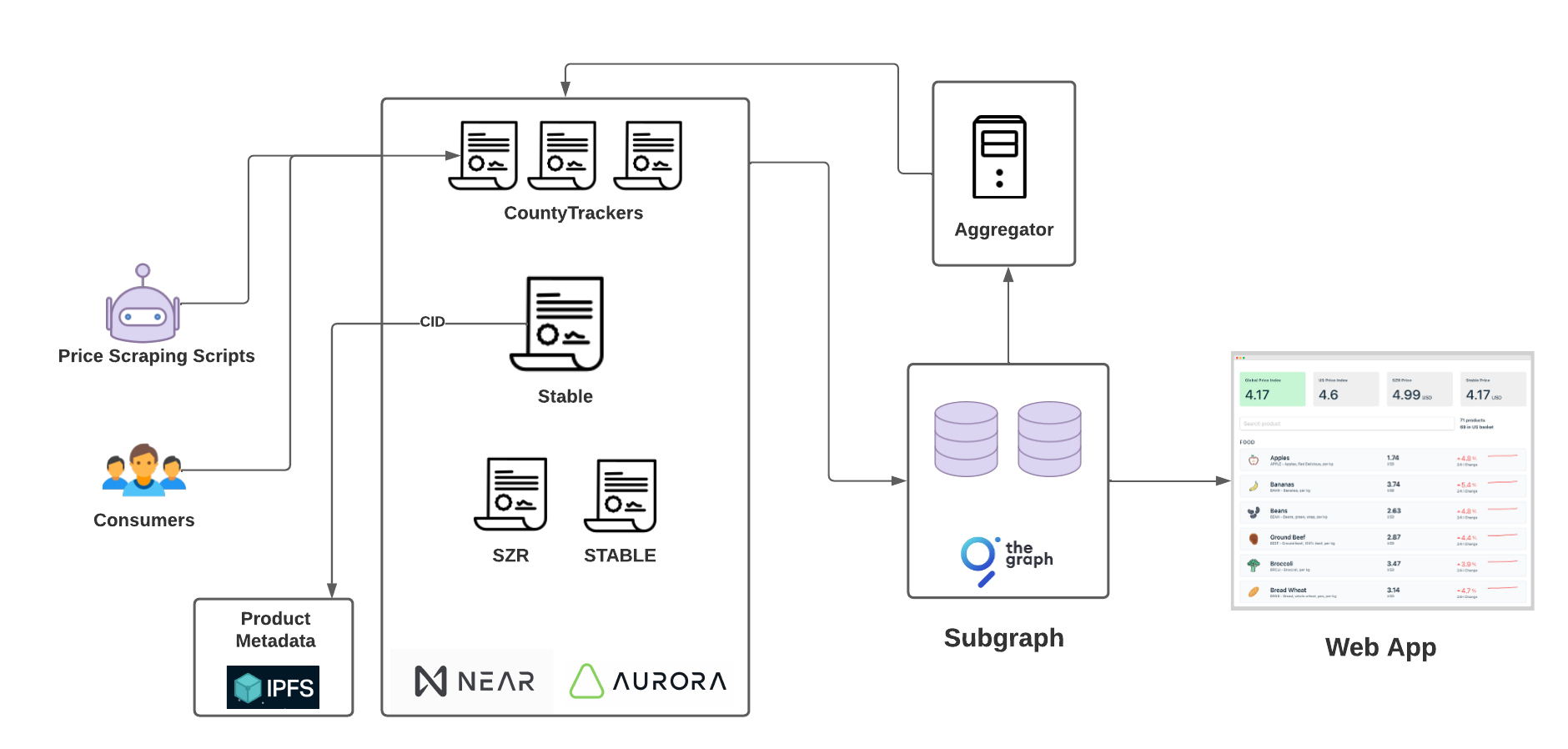

Stableis the main smart contract deployed on Aurora blockchain. A gas efficient chain like Aurora is optimal for a public facing application like this.- The product details are stored on IPFS and the hash/CID is stored in the contract.

Stablecontract create child contracts calledCountryTrackerto track prices within a country.- Users submit prices to the

CountryTrackercontract (which only emits an event). - Aggregators watch for price submission event and aggregate all submissions made in a day, calculate aggregated price for each product and the Price Index, and submit them back to the contract. The rule (logic name) to be used for aggregation is set in the contract.

- Aggregators need to lockup

SZRto get claims for aggregation rounds - the more they lock, more rounds they can get. DAO can slash their locked SZR if they don't do aggregations properly. - The price submission events are indexed by a subgraph in the

TheGraphprotocol, which aggregators can use to query submission data. CountryTrackercontract stores the latest prices of all products and the price index.- The subgraph also index price and price index history - which powers the web app.

- Aggregators receive rewards in

SZR(amount set by DAO) for completing each agg. round. Users with winning submissions are also rewarded at the same time. Rules to chose winners is also decided by the DAO. - There is also a Global Price Index in

Stablewhich is the weighted average of Price Index of each participating country. The weightage for each country is stored inStablecontract and is again, set by the DAO.

- StableToken (

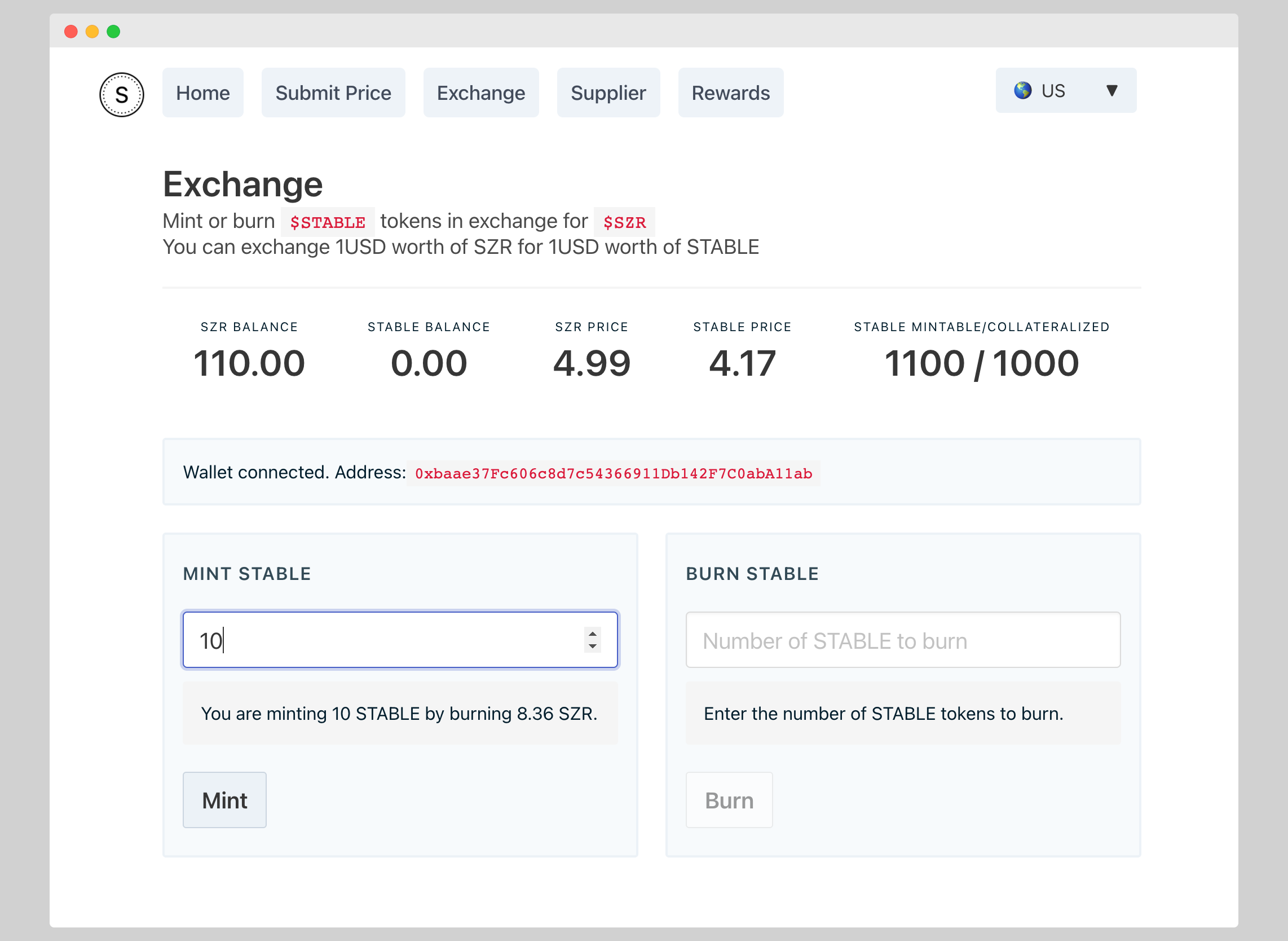

STABLE) is a token pegged to the Global Price Index. - The peg is maintained using the

SZRtoken. Users can exchange 1 USD worth ofSZRfor 1 USD worth ofSTABLE. This is similar to how Terra/Luna works. - If a user mint 1000USD worth

STABLEby exchanging 1000USD worth ofSZR, and if the inflation increase by 10%, then they can burn theirSTABLEtokens and get 1100USD (10% extra) worth ofSZR.

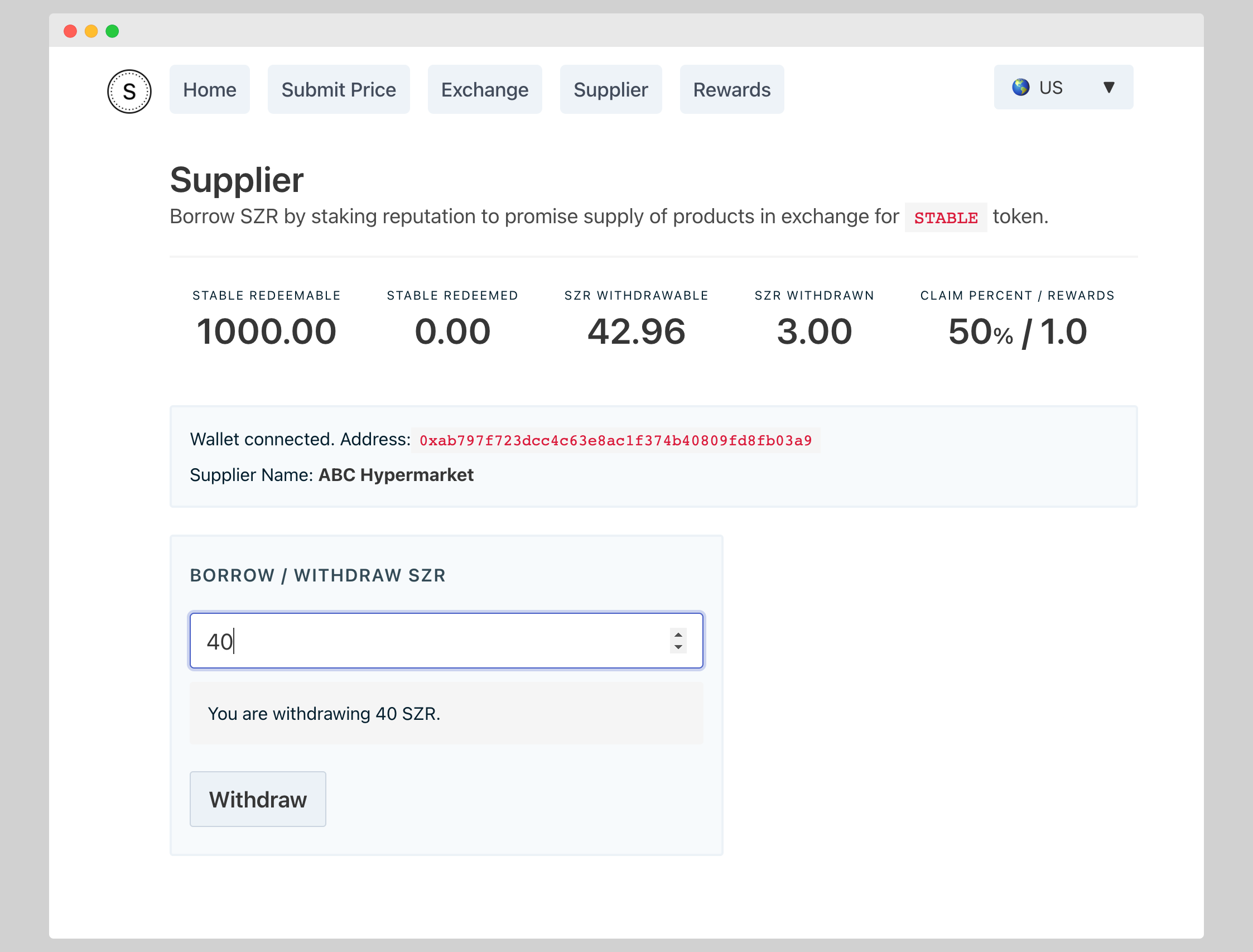

- StableToken is backed by another entity in the ecosystem called by Suppliers

- Suppliers (super-market chains for example) stake their reputation, and promise to redeem $STABLE in exchange of the goods in the product basket - and borrow equivalent $SZR.

- Instead of paying an interest, they would pay/redeem the product basket even if the price increase in the future.

- Suppliers are approved and added to the contract by DAO. DAO also set a limit on the percentage of

SZRthey can withdraw with respect to theSTABLEthey promise to redeem. DAO can slow increase these limited based on the behavior of the supplier. - Suppliers are added to the contract by DAO after verification. Suppliers will have to show their identity publicly in the proposal they create for adding them. If they don't redeem the

STABLESthey promised, it can lead to bad reputation on the brand. - The incentive for the Supplier is they can borrow money without any interest, which they can use to run their business. Even when a user redeem their Stable token with the supplier, they make profits on the sales. In addition to that they get rewards in

SZRfor each redemption they do.

- Users can only exchange

SZRforSTABLEif there are suppliers backing theSTABLE. However, there is aover-collateralization ratioin the contract which can be set by the DAO to allow mining of moreSTABLEthan that are in the contract. - As the ecosystem grows, more

STABLEthan that are backed can be minted because all users wont redeem them at once. - Also, users can always choose to burn

STABLEto mintSZRinstead of redeeming with a supplier. This would increase the supply ofSZRand reduces its value. - When users exchange

SZRforSTABLE,SZRequivalent to over collateralization is burned, as this amount is seignorage. This will also makeSZRa deflationary asset as the ecosystem grows.

- Contract deployed on Aurora -

0xaFB36003d119b3976D915D74887F9568ca635854(deployed to mainnet as TheGraph has trouble indexing testnet). - TheGraph for indexing - to track price submission, price and price index history, etc.

- IPFS for storing product meta - CID stored in contract.

- React for the UI.

Entire code for this project is in this repo

/core: Contains code for smart-contract, hardhat setup, and some scripts for transferring SZR, creating suppliers, generating sample data, etc./subgraph: Contains the subgraph definition and mappers that index price submissions, price and price index, etc./aggregator: Contains script for becoming an aggregator - lockup SZR and run aggregations./ui: React project web-app that renders the UI by connecting to subgraph and the contract.

- Suppliers backing STABLE token is only one model. DAO can have a smart contract where users can lock BTC, ETH as collateral and borrow STABLE (i.e equivalent SZR).

- Instead of paying interest, they would be paying the inflation rate as excess when they return.

- The contract can also act as an Oracle feed for the Defi apps. And also can bridge the tokens to other chains.

- Allow users to view inflation based on their choice of products and weightage.

- Improve overall quality - fix bugs, test for security/errors.

- Implement the DAO functionality - proposal and voting features. Currently the

ownerof the contract is one address, but the ownership can be transferred to the DAO. - The contract to derive the price of SZR from an oracle. It is currently simulated (based on supply) in the contract as the token is not traded on any exchange.

subgraphto also index the price submissions made through IPFS.- Implement a better logic to select one/few winners from price submissions. Currently all submissions which equal aggregated price is decided as winner.

- A lot of these would depend on the direction of this project.

Please contact me if you would like to test the app. I can transfer SZR tokens and also add you as a supplier if you would like to.

Deployed to Aurora mainnet during POC/testing phase, as TheGraph has trouble indexing testnet

Contract on Aurora: 0xaFB36003d119b3976D915D74887F9568ca635854

SZR Token: 0x2f6ee7ee17647ed9cd0e449d893b5f2a285ef316

STABLE Token: 0x264cA4C59e24Dc7424CDf75f57ac14B2cc2eF3F3

Icons and logo from icons8