Options delta neutrality as a crypto native uncorrelated asset class and the best option trading experience

To get a local copy up and running follow these simple steps.

At Rysk, we use Yarn for package management with Yarn workspaces. To get started with Yarn if you haven't installed it yet, you can run:

npm install --global yarnWe use jq for formatting JSON files from the command line. To install it, you might have to run:

For linux:

$ sudo apt-get install jqFor macOS:

$ brew install jq-

Clone the repo

git clone

-

Install packages

yarn

-

Add environment variables

You will need to create free API keys for Alchemy and Infura. You can then:

- Create

/packages/contracts/.env - Add

ALCHEMY=<your-alchemy-key> - Create

/packages/front-end/.env - Add

REACT_APP_INFURA_KEY=<your-infura-key>

- Create

-

Compile contracts

yarn workspace contracts compile

-

Deploy contracts and update ABIs + address

yarn workspace contracts deploy:localhost

-

Start the front end

yarn workspace front-end start

It will become accessible on http://localhost:3000

Complete steps 1 to 3 from the installation section and then:

-

Compile all files

yarn workspace contracts compile

-

Run all tests

yarn workspace contracts testTo run a specific test suite, e.g.

LiquidityPool.tsyarn workspace contracts test test/LiquidityPool.tsRun test coverage

yarn workspace contracts test-coverage

Run foundry fuzzing

- Follow instructions on template

- In the pipenv environment run forge test --ffi --vvv

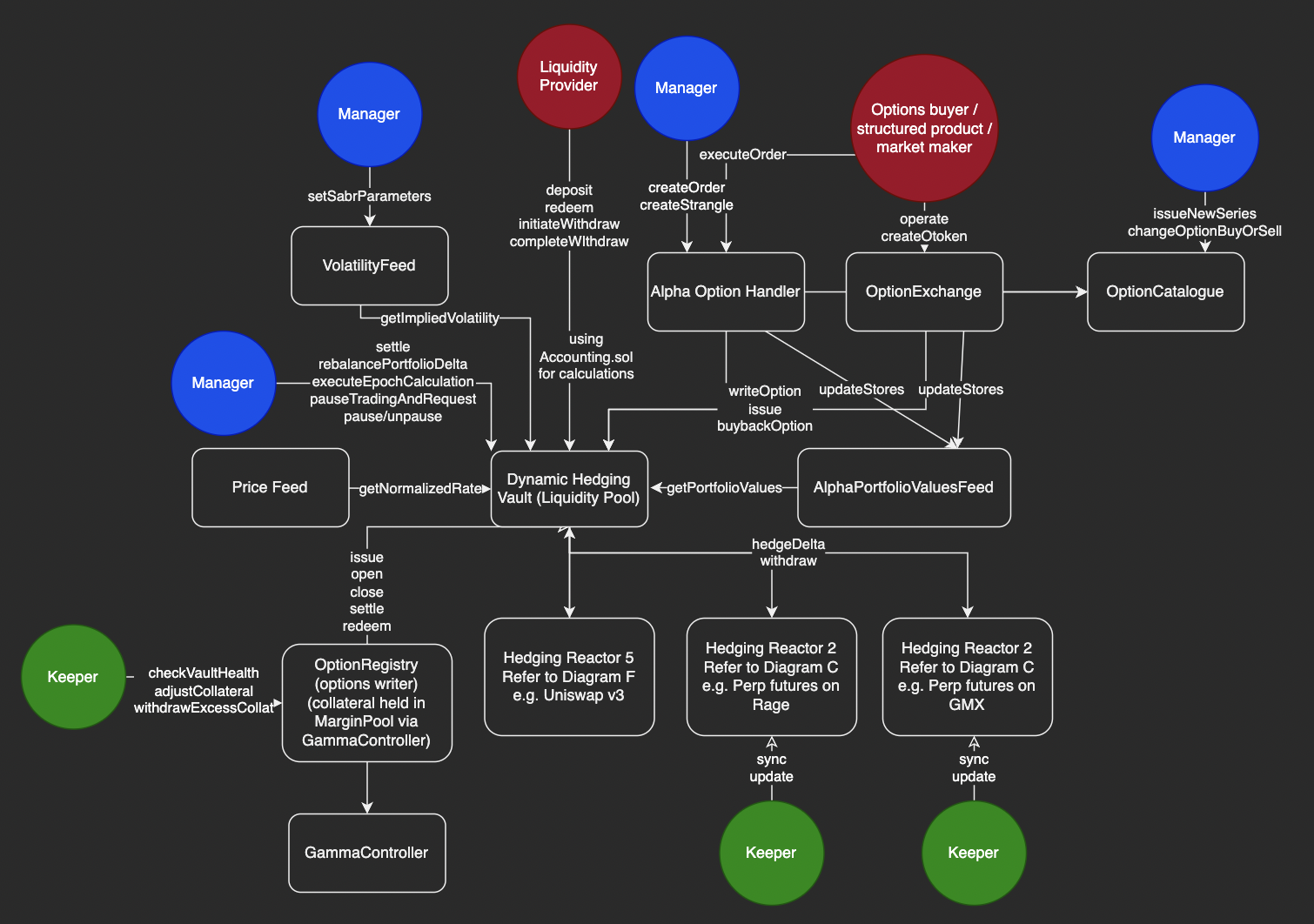

contracts

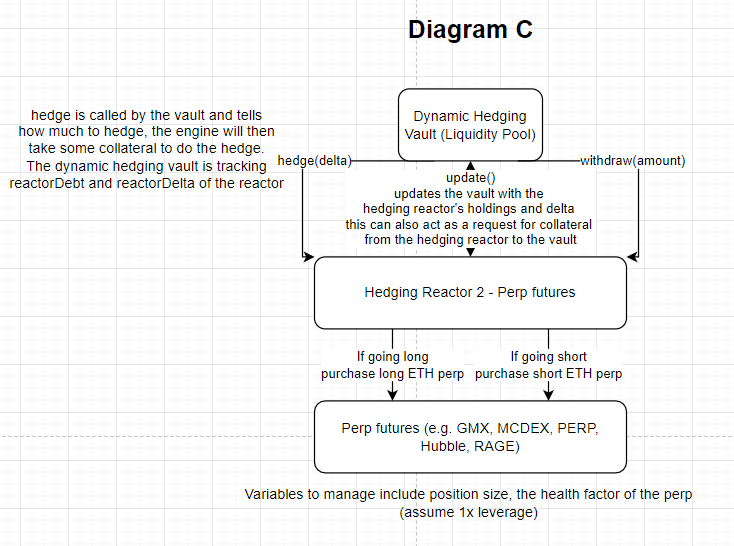

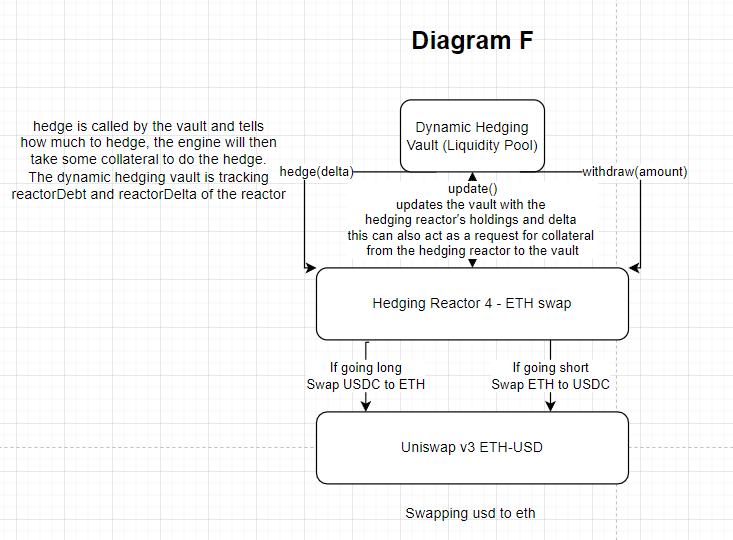

├── hedging

│ ├── GMXHedgingReactor.sol

│ ├── PerpHedgingReactor.sol

│ └── UniswapV3HedgingReactor.sol

├── interfaces

│ ├── AddressBookInterface.sol

│ ├── IAuthority.sol

│ ├── AggregatorV3Interface.sol

│ ├── GammaInterface.sol

│ ├── IERC20.sol

│ ├── IOptionRegistry.sol

│ ├── ILiquidityPool.sol

│ ├── IHedgingReactor.sol

│ ├── IMarginCalculator.sol

│ └── IOracle.sol

├── libraries

│ ├── BlackScholes.sol

│ ├── CustomErrors.sol

│ ├── NormalDist.sol

│ ├── OptionsCompute.sol

│ ├── OpynInteractions.sol

│ ├── AccessControl.sol

│ ├── RyskActions.sol

│ ├── CombinedActions.sol

│ ├── EnumerableSet.sol

│ ├── SABR.sol

│ ├── SafeTransferLib.sol

│ └── Types.sol

├── tokens

│ └── ERC20.sol

├── Accounting.sol

├── AlphaOptionHandler.sol

├── Authority.sol

├── BeyondPricer.sol

├── LiquidityPool.sol

├── OptionRegistry.sol

├── OptionExchange.sol

├── OptionCatalogue.sol

├── Protocol.sol

├── PortfolioValuesFeed.sol

├── VolatilityFeed.sol

└── PriceFeed.sol