AmericanBinary computes the value of American binary (a.k.a. digital) calls and puts.

AmericanBinary is written by Parsiad Azimzadeh and released under a BSD 2-clause license.

We assume that the asset follows a geometric Brownian motion:

dS = (Rate - Yield) dt + Volatility dW

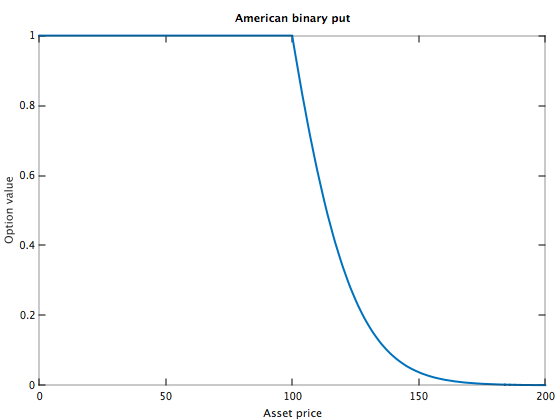

An American binary call is an option which can be exercised at any time, having an exercise value 1 if S > Strike and exercise value 0 otherwise. An American binary put is defined similarly.

The derivation of the closed-form expression for the value of the American binary call and put are here.

[Call, Put] = AmericanBinary(Price, Strike, Rate, Time, Volatility, Yield)Price: The initial value of the asset SStrike: The strike priceRate: The risk-free interest rateTime: The expiry time (useInffor a perpetual option)Volatility: The volatility of the asset SYield: The dividend rate of the asset SCall: The value of the callPut: The value of the put

The function, similar to blsprice, accepts vector/matrix arguments.

Strike = 100.;

Price = 0 : 1 : Strike * 2;

Rate = 0.04;

Time = 1.;

Volatility = 0.2;

Yield = 0.01;

[Call, Put] = AmericanBinary(Price, Strike, Rate, Time, Volatility, Yield);

plot(Price, Put, 'linewidth', 2);

xlabel('Asset price');

ylabel('Option value');

title('American binary put');