Econometric package for Time Series and Panel Data Methods covering unit root, co-integration & causality tests. Extensive coverage of testing in the presence of structural breaks.

The tspdlib library is written for GAUSS by Saban Nazlioglu, Department of International Trade & Finance, Pamukkale University-Türkiye.

If using this code please include the following citation: Nazlioglu, S (2021) TSPDLIB: GAUSS Time Series and Panel Data Methods (Version 2.0). Source Code. https://github.com/aptech/tspdlib

The program files require a working copy of GAUSS 21+. Many tests can be run on earlier versions with some small revisions and users should contact erica@aptech.com for a modified library for earlier GAUSS versions.

The GAUSS Time Series and Panel data tests library can be installed and updated directly in GAUSS using the GAUSS package manager.

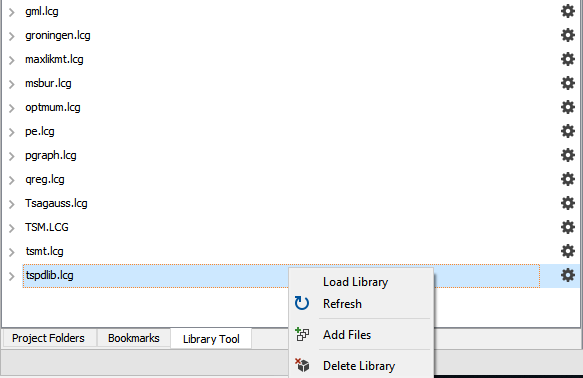

Before using the functions created by tspdlib you will need to load the newly created tspdlib library. This can be done in a number of ways:

- Navigate to the library tool view window and click the small wrench located next to the

tspdliblibrary. SelectLoad Library.

- Enter

library tspdlibin the program input/output window. - Put the line

library tspdlib;at the beginning of your program files.

Note: I have provided the individual files found in

tspdlib_2.0.zipfor examination and review. However, installation should always be done using the GAUSS Package Manager.

After installing the library, examples for all available procedures can be found in your GAUSS home directory in the directory pkgs > tspdlib >examples. The example uses GAUSS and .csv datasets which are included in the pkgs > tspdlib >examples directory.

The documentation for the tspdlib procedures can be found on our Aptech TSPDLIB Documentation page.

The author makes no performance guarantees. The tspdlib is available for public non-commercial use only.

For any bugs, please send e-mail to Saban Nazlioglu or Erica Clower.

| src file | Reference | Description |

|---|---|---|

adf |

Dickey, D.A., Fuller, W.A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Society75, 427–431. | ADF unit root test. |

adf_1br |

Zivot, E. & Andrews, W.K. (1992). Further evidence on the great crash, the oil-price shock, and the unit root hypothesis. Journal of Business and Economic Statistics 10(3), 251-270. | ADF unit root test with a single break. |

adf_2br |

Narayan, P.K. & Popp, S. (2010). A new unit root test with two structural breaks in level and slope at unknown time. Journal of Applied Statistics, 37:9, 1425-1438. | Unit root test with two unknown breaks. |

lm |

Schmidt, P., & Phillips, P. C. (1992). LM tests for a unit root in the presence of deterministic trends. Oxford Bulletin of Economics and Statistics, 54(3), 257-287. | LM test for a unit root. |

lm_1br |

Lee, J. & Strazicich, Mark C. (2013). Minimum LM unit root test with one structural break. Economics Bulletin 33(4), 2483-2492. | LM unit root test with one structural break. |

lm_2br |

Lee, J. & Strazicich, M.C. (2003). Minimum Lagrange Multiplier unit toot test with two structural breaks. Review of Economics and Statistics 85(4), 1082-1089. | LM unit root test with two structural breaks. |

kpss |

Kwiatkowski, D., Phillips, P. C., Schmidt, P., & Shin, Y (1992). Testing the null hypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root?. Journal of Econometrics, 4(1-3), 159-178. | KPSS test for the null of stationarity. |

kpss_1br |

Kurozumi, E. (2002). Testing for stationarity with a break. Journal of Econometrics, 108(1), 63-99. | KPSS test for the null of stationarity with one structural break. |

kpss_2br |

Carrion-i-Silvestre, J. Ll. & Sansó, A. (2007). The KPSS test with two structural breaks. Spanish Economic Review, 9, 2, 105-127. | KPSS test for stationarity with two structural breaks. |

fourier_adf |

Enders, W. & Lee, J. (2012). The flexible Fourier form and Dickey-Fuller type unit root tests. Economics Letters, 117, 196-199. | Dickey-Fuller unit root test with Flexible Fourier form structural breaks. |

fourier_lm |

Enders, W., and Lee, J. (2012). A Unit Root Test Using a Fourier Series to Approximate Smooth Breaks. Oxford Bulletin of Economics and Statistics,74,4(2012),574-599. | LM unit root test with Flexible Fourier form structural breaks. |

fourier_kpss |

Becker, R., Enders, W., Lee, J. (2006). A stationarity test in the presence of an unknown number of smooth breaks. Journal of Time Series Analysis, 27(3), 381-409. | KPSS stationarity test with Flexible Fourier form structural breaks. |

fourier_gls |

Rodrigues, P. & Taylor, A.M.R. (2012). The flexible Fourier form and local GLS de-trending unit root tests. Oxford Bulletin of Economics and Statistics, 74(5), 736-759. | GLS detrended unit root test with Flexible Fourier form structural breaks. |

gls |

Elliott, G., Rothenberg, T.J., Stock, J.H. (1996). Efficient tests for an autoregressive unit root. Econometrica 64,813–836. | GLS-ADF unit root test. |

gls |

Ng, S., Perron, P. (2001). Lag length selection and the construction of unit root tests with good size and power. Econometrica 69,1519–1554. | Lag selection in unit root tests. |

rals_adf |

Im, K. S., Lee, J., & Tieslau, M. A. (2014). More powerful unit root tests with non-normal errors. In Festschrift in Honor of Peter Schmidt (pp. 315-342). Springer New York. | RALS-ADF unit root test for non-normal errors. |

rals_lm |

Meng, M., Im, K. S., Lee, J., & Tieslau, M. A. (2014). More powerful LM unit root tests with non-normal errors. In Festschrift in Honor of Peter Schmidt (pp. 343-357). Springer New York. | RALS-LM unit root test for non-normal errors. |

qradf |

Koenker, R. & Xiao, Z. (2004). Unit root quantile autoregression inference, Journal of the American Statistical Association, 99(467), 775-787. | Quantile ADF unit root test. |

| src file | Reference | Description |

|---|---|---|

pd_cips |

Pesaran, M.H. (2007). A simple unit root test in the presence of cross-section dependence. Journal of Applied Econometrics, 22 (2), 265-312. | Pesaran panel data unit root test with cross-section dependence. |

pd_cips |

Westerlund, J., & Hosseinkouchack, M. (2016). CADF and CIPS Panel Unit Root Statistics with Standard Chi‐squared and Normal Limiting Distributions. Oxford Bulletin of Economics and Statistics, 78(3), 347-364. | Modified Pesaran CIP and CADF with standard limiting distributions. |

pd_panic |

Bai, J. & Ng, S. (2004). A PANIC attack on unit roots and cointegration. Econometrica, 72, 1127–78. | Panel analysis of idiosyncratic and common components (PANIC) to test whether non-stationarity in a series is pervasive, variable-specific or both. |

pd_panic |

Westerlund, J., & Larsson, R. (2009). A note on the pooling of individual PANIC unit root tests. Econometric Theory, 25(6), 1851-1868. | Panel analysis of idiosyncratic and common components (PANIC) to test whether non-stationarity in a series is pervasive, variable-specific or both. |

pd_panic |

Bai, J., & Ng, S. (2010). Panel unit root tests with cross-section dependence: a further investigation. Econometric Theory, 26(4), 1088-1114. | Panel analysis of idiosyncratic and common components (PANIC) to test whether non-stationarity in a series is pervasive, variable-specific or both. |

pd_panic |

Reese, S., & Westerlund, J. (2016). PANICCA: PANIC on Cross‐Section Averages. Journal of Applied Econometrics, 31(6), 961-981. | Panel analysis of idiosyncratic and common components (PANIC) to test whether non-stationarity in a series is pervasive, variable-specific or both. |

pd_panic |

Bai, J., & Ng, S. (2002). Determining the number of factors in approximate factor models. Econometrica, 70(1), 191-221. | Panel analysis of idiosyncratic and common components (PANIC) to test whether non-stationarity in a series is pervasive, variable-specific or both. |

pd_iltlevel |

Im, K., Lee, J., Tieslau, M. (2005). Panel LM Unit-root Tests with Level Shifts, Oxford Bulletin of Economics and Statistics 67, 393–419. | Panel data LM unit root test with structural breaks in the level. |

pd_lttrend |

Lee, J., & Tieslau, M. (2017). Panel LM unit root tests with level and trend shifts. Economic Modelling. | Panel data LM unit root test with structural breaks in the level and trend. |

pd_nkarul |

Nazlioglu, S., & Karul, C. (2017). A panel stationarity test with gradual structural shifts: Re-investigate the international commodity price shocks. Economic Modelling, 61, 181-192. | Panel stationarity test with gradual structural breaks. |

| src file | Reference | Description |

|---|---|---|

GC_tests |

Granger, C.W.J. (1969). Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37, 424–438. | Granger causality tests. |

GC_tests |

Toda, H.Y. & Yamamoto, T. (1995). Statistical inference in vector autoregression with possibly integrated processes. Journal of Econometrics 66,225–250. | Tests on the general restrictions on the VAR parameter matrices even if the processes may be integrated or cointegrated of an arbitrary order. |

GC_tests |

Enders, W., & P. Jones. (2016). Grain prices, oil prices, and multiple smooth breaks in a var. Studies in Nonlinear Dynamics & Econometrics 20 (4):399-419. | Flexible Fourier form testing for smooth structural change in a VAR. |

GC_tests |

Nazlioglu, S., Gormus, A. & Soytas, U. (2016). Oil prices and real estate investment trusts (REITs): gradual-shift causality and volatility transmission analysis”. Energy Economics 60(1): 168-175. | New causality approach augmenting the Toda–Yamamoto method with a Fourier approximation. |

GC_tests |

Gormus, A., Nazlioglu, S. & Soytas, U. (2018). High-yield bond and energy markets. Energy Economics 69: 101-110. | New causality approach augmenting the Toda–Yamamoto method with a Fourier approximation. |

GC_tests |

Nazlioglu, S., Soytas, U. & Gormus, A. (2019). Oil prices and monetary policy in emerging markets: structural shifts in causal linkages”. Emerging Markets Finance and Trade. 55:1, 105-117. | Causality test with smooth structural breaks. |

PDcaus_Fisher |

Emirmahmutoglu, F., Kose, N. (2011). Testing for Granger causality in heterogeneous mixed panels, Economic Modelling 28 (2011) 870–876. | A simple Granger causality procedure based on Meta analysis in heterogeneous mixed panels. |

PDcaus_Zhnc |

Dumitrescu, E., Hurlin, C. (2012). Testing for Granger non-causality in heterogeneous panels, Economic Modelling 29 (2012) 1450–1460. | A simple test of Granger (1969) non-causality for heterogeneous panel data models based on the averaged individual Wald statistics of Granger non causality. |

PDcaus_SURwald |

Kónya, L. (2006). Exports and growth: Granger causality analysis on OECD countries with a panel data approach, Economic Modelling, 23 (6), pp. 978-992. | Panel data Granger causality approach based on SUR systems and Wald tests with country specific bootstrap critical values. |

| src file | Reference | Description |

|---|---|---|

coint_egranger |

Engle, R. F., and Granger, C. W. J. (1987). Co-Integration and error correction: Representation, estimation and testing. Econometrica,55, 251-276. | Engle-Granger cointegration test. |

coint_cissano |

Carrion-i-Silvestre, J.L., Sanso, A. (2006). Tests the null of cointegration with structural breaks. Oxford Bulletin Economics and Statistics, 68(5), 623-646. | Lagrange Multiplier‐type statistic to test the null hypothesis of cointegration allowing for the possibility of a structural break. |

coint_ghansen |

Gregory, A.W., Hansen, B. (1996a). Residual-based tests for cointegration in models with regime shifts. Journal of Econometrics, 70, 99-126. | Tests for the null of no cointegration against the alternative of cointegration with a structural break in the mean. |

coint_ghansen |

Gregory, A.W., Hansen, B. (1996b). Tests for cointegration in models with regime and trend shifts. Oxford Bulletin Economics and Statistics, 58(3), 555-560. | Tests for the null of no cointegration against the alternative of cointegration with a structural break in the mean and trend. |

coint_hatemij |

Hatemi-J (2008). Tests for cointegration with two unknown regime shifts with an application to financial market integration. Empirical Economics, 35, 497-505. | Tests for cointegration with two regime shifts. |

coint_pouliaris |

Phillips, P. C. B. , and Ouliaris, S. (1990) Asymptotic properties of residual-based tests for cointegration. Econometrica, 58 (1), pp. 165-193. | Asymptotic critical values for residual based tests for cointegration. |

coint_shin |

Shin, Y. (1994). A residual-based test of the null of cointegration against the alternative of no cointegration. Econometric Theory, 10(1), 91-115. | A residual-based test for the null of cointegration using a structural single equation model. |

coint_tsongetal |

Tsong, C.C., Lee, C.F., Tsai, L.J., & Hu, T.C. (2016). The Fourier approximation and testing for the null of cointegration. Empirical Economics, 51(3), 1085-1113. | Test of the null of cointegration allowing for structural breaks of unknown form in deterministic trend by using the Fourier form. |

coint_maki |

Maki, D. (2012). Tests for cointegration allowing for an unknown number of breaks. Economic Modelling, 29(5), 2011-2015. | Tests for cointegration with an unknown number of breaks. |