This repo is designed for beginners in the deep learning community -- especially those trying to implement reinforcement learning to predict stocks/crypto/forex (or basically any time-distributed data). However, the original repository seems to not receive any updates anymore; while the packages in its requirements.txt are getting obsolete.

In this manner, this repo is a humble attempt to revive the usability of the original author's work. Note that this repo is also designed and tested within a Google Colab environment so that anyone can just:

!git clone https://github.com/notpestilence/deep_rl_trader

And start plugging their own data. Good luck on your project ❤

This repo, forked from the original author, contains:

- Trading environment (OpenAI Gym) for trading cryptocurrency

- Duel Deep Q Network

Agent is implemented usingkeras-rl(https://github.com/keras-rl/keras-rl)

For a complete list of rework, check the next segment: Changes from master.

Agent is expected to learn useful action sequences to maximize profit in a given environment.

Environment limits agent to either buy, sell, hold stock(coin) at each step.

If an agent decides to take a

- LONG position it will initiate sequence of action such as

buy - hold - hold- sell - for a SHORT position vice versa (e.g.)

sell - hold - hold -buy.

Only a single position can be opened per trade.

- Thus invalid action sequence like

buy - buywill be consideredbuy- hold. - Default transaction fee is : 0.0005

Reward is given

- When the position is closed, or

- An episode is finished.

This type of sparse reward granting scheme takes longer to train but is most successful at learning long term dependencies.

Agent decides optimal action by observing its environment.

- Trading environment will emit features derived from ohlcv-candles(the window size can be configured).

- Thus, input given to the agent is of the shape

(window_size, n_features).

With some modification it can easily be applied to stocks, futures or foregin exchange as well.

NOTE: The following 3 files have been changed its behaviour to facilitate running in a Google Colab environment. More on that within the next sub-segment.

Visualization / Main / Environment

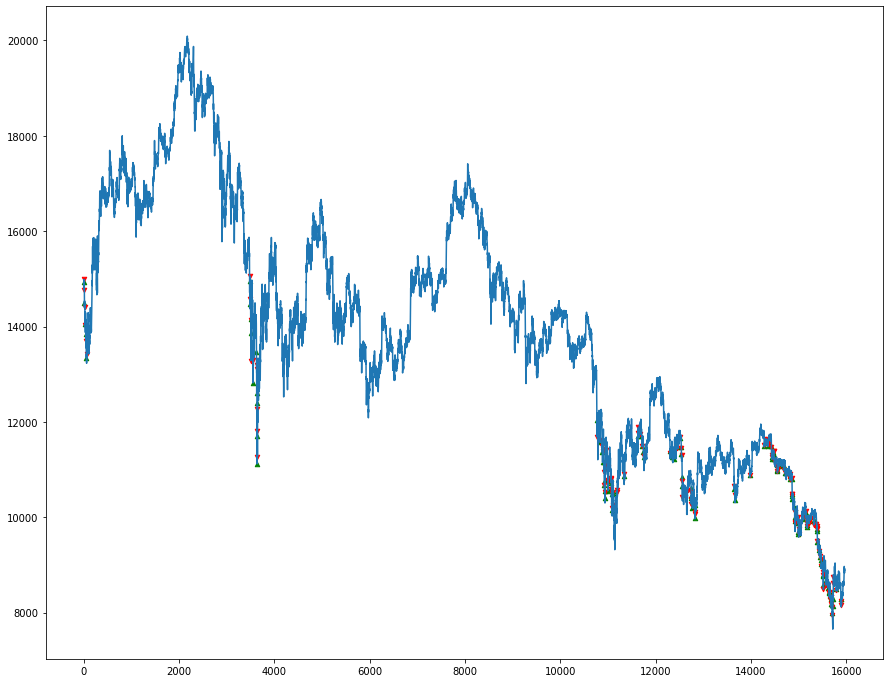

Sample data provided is 5min ohlcv candle fetched from bitmex.

- train :

'./data/train/70000 - test :

'./data/train/16000

Data shapes should follow the sample data used to ensure workability and potentially narrow down the problem to the processing part -- not the modelling part. For a preview of what the data should look like (or similar to), check the segment Data Preview.

Assuming that this is being run on a Google Colab environment (as per 1 December 2021)... Issues and changes to the original implementation:

- A lot of inconsistencies in the

requirements.txtfile in which some modules cannot be imported. For instance,anaconda_client==1.6.0is not available anymore. Therefore, installing requirements viapip install -r requirements.txtis strongly advised against since it'll crash at the first occurrence of unfounded package within PyPI. Instead, call:

!cat deep_rl_trader/requirements.txt | xargs -n 1 pip install

This will skip errors and unsupported obsolete packages and continue to install.

- The package

talibdoes not provide easy installation viapip. This will return:

Failed building wheel for TA-Lib #4245

So that we need to first download the .tar.bz2 file in the environment -- and configure numpy to take at least version 1.20.00. Otherwise, talib will return:

ValueError: numpy.ndarray size changed, may indicate binary incompatibility. Expected 88 from C header, got 80 from PyObject

This is yet another reason not to install directly from requirements.txt as some of the packages are either obsolete, deprecated of their functionality, or both 🥵

To quickly install talib within any Notebook environment:

url = 'https://anaconda.org/conda-forge/libta-lib/0.4.0/download/linux-64/libta-lib-0.4.0-h516909a_0.tar.bz2'

!curl -L $url | tar xj -C /usr/lib/x86_64-linux-gnu/ lib --strip-components=1

url = 'https://anaconda.org/conda-forge/ta-lib/0.4.19/download/linux-64/ta-lib-0.4.19-py37ha21ca33_2.tar.bz2'

!curl -L $url | tar xj -C /usr/local/lib/python3.7/dist-packages/ lib/python3.7/site-packages/talib --strip-components=3

import talib

This will GET the required TA-Lib from conda-forge and unpack the .tar.bz2 to the existing working directory. Neat!🥰

- Install

Keras, notkeras, with:

!pip install Keras==2.1.2

!pip install keras-rl==0.4.2

The version used in this model is way different than the one integrated with Google Colab. After installing, don't forget to modify the core.py file as stated within point no.8.

-

pandas.statsin the fileta.pywas deprecated, so in return, we change all occurences ofmomentswithpdand delete the line where we importpandas.stats. Functionality remains the same 🙌 -

data/trainanddata/testonmain()was changed to read as a subfolder ofdeep_rl_trader. As well as theinfoandmodelsubfolders. -

Again, I think that the version used is obsolete and doesn't support old methods. Running the script provides:

AttributeError: module 'tensorflow' has no attribute 'get_default_graph'A bit of Googling and it turns out that we should import the model from tensorflow and not keras. We have to have a perfect environment for the whole thing to work -- that means downgrading the existing tensorflow integration:

%tensorflow_version 1.14.0

Or install the required version:

!pip install tensorflow==1.14.0

NOTE: For some reason, trying to install Tensorflow beyond 1.13 is unavailable within my machine. I'm rocking 2.5 now.

- The original

create_model()function does not return themodelobject -- so when initializing it, the script returns:

AttributeError: 'NoneType' object has no attribute 'summary'

One way to fix this was to return model at the end of the function. GG.

- Updating the

core.pyfile in:

/usr/local/lib/python3.7/dist-packages/rl/

To the one within:

/content/main/deep_rl_trader/modified_keras_rl_core/

Seems to fix this issue.

- Again, compatibility issue. Using

CuDNNLSTMreturns a vague error:

Errors may have originated from an input operation. Input Source operations connected to node cu_dnnlstm_1/CudnnRNN

This is maybe because TensorFlow automatically configures standard off-the-shelf LSTM to be CuDNNLSTM unless specified otherwise. So, the main functional layer(s) should be only keras.layers.LSTM instead of keras.layers.CuDNNLSTM.

-

Final changes made to take in

hdf5format on theTraderEnv.pyfile within class methodOhlcvEnv.load_from_csv()to maximize Vaex performance. Whilst the method still saysload_from_csv(), the workings inside are loadinghdf5. Why didn't I change the method name altogether? I'm afraid it'll mess with themain()method and some other method I don't know about. -

Specified

nb_steps=10000andnb_max_episode_steps=10000when fitting the model inddqn_rl_trader.pyto facilitate 10000 epochs. -

Visualization now renders a figure of size

(12, 15)and takes the most recent output of the weights inside theinfofolder. More versatility = less hard-coding the weight names. Check the functionget_file(dir)on line 33 ofvisualize_trade.py -

Integrated to run with

vaex-- a novel out-of-core DataFrame for Python -- instead of the usualpandas. Read more about them here.

Vaex is not automatically included with Google Colab. However, when I first installed it by !pip install vaex and imported it, I got the error:

ContextualVersionConflict: (PyYAML 3.13 (/usr/local/lib/python3.7/dist-packages)

Requirement.parse('PyYAML>=5.1; extra == "standard"'), {'uvicorn'}) Turns out Google Colab is running a rather old version of IPython, therefore an upgrade is needed:

!pip install --upgrade ipython

!pip install vaex

Restart the kernel after upgrading ipython. Now the error is gone. Huzzah! 🤩

Note that we're adding %%timeit preceding every cell to underline how quick vaex is.

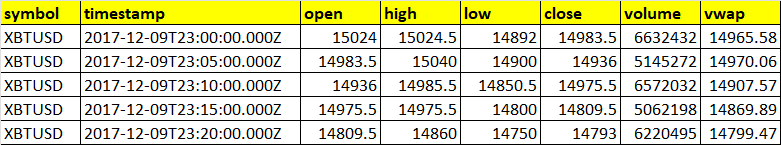

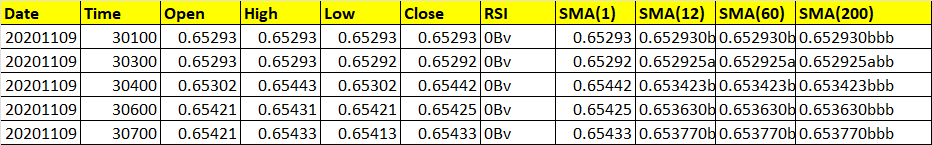

The data should take in the shape like this; what's important is the column name and the datatype of each column. Make sure to convert what's considered a date/time to datetime type.

Sample data for model only:

Sample data for entire notebook:

For symbol, it can take any transaction representation you want. USDTALICE, IDRUSD, etc.

To run the model only (without data processing):

numpy==1.20.00

tensorflow==1.14.0

Keras==2.1.2

keras-rl==0.4.2

libta-lib==0.4.0

ta-lib==0.4.19

To run the whole notebook in vaex_ml_forex.ipynb:

vaex==4.6.0

- Download the notebook

vaex_ml_forex.ipynb; - Upload the notebook as a Google Colab runtime;

- Upload your data of choice onto that kernel;

- Run the first cell of the notebook to install

vaexand upgradeipythonaltogether; - Restart runtime;

- Clone this repo:

!git clone https://github.com/notpestilence/deep_rl_trader/

This is on the 3rd cell.

-

Read your data onto the

vaexenvironment withvaex.from_csv() -

Export either to

.hdf5or.csvon section 3.3. -

Run the cell with the comment: "# Run this entire cell to import packages without setup". No need to restart the runtime again despite prompted.

-

Important! Navigate through the file browser on the left. Change the

core.pyfile within:

/usr/local/lib/python3.7/dist-packages/rl/

With the one in:

/content/main/deep_rl_trader/modified_keras_rl_core/

Just copy-and-paste the modified core.py to the original in ~./rl/ folder. I don't think there's a way to automatically do this -- we'll have to make do manually.

- Run the cell with:

import tensorflow.compat.v1 as tf

!python deep_rl_trader/main/ddqn_rl_trader.py-

Wait a few seconds...

-

Profit 🥵

# create environment

# OPTIONS

ENV_NAME = 'OHLCV-v0'

TIME_STEP = 30

PATH_TRAIN = "./data/train/" # Change as needed

PATH_TEST = "./data/test/" # Change as needed

env = OhlcvEnv(TIME_STEP, path=PATH_TRAIN)

env_test = OhlcvEnv(TIME_STEP, path=PATH_TEST)

# random seed

np.random.seed(123)

env.seed(123)

# create_model

nb_actions = env.action_space.n

model = create_model(shape=env.shape, nb_actions=nb_actions)

print(model.summary())

# create memory

memory = SequentialMemory(limit=50000, window_length=TIME_STEP)

# create policy

policy = EpsGreedyQPolicy()# policy = BoltzmannQPolicy()

# create agent

# you can specify the dueling_type to one of {'avg','max','naive'}

dqn = DQNAgent(model=model, nb_actions=nb_actions, memory=memory, nb_steps_warmup=200,

enable_dueling_network=True, dueling_type='avg', target_model_update=1e-2, policy=policy,

processor=NormalizerProcessor())

dqn.compile(Adam(lr=1e-3), metrics=['mae'])# now train and test agent

while True:

# train

dqn.fit(env, nb_steps=10000, nb_max_episode_steps=10000, visualize=False, verbose=2)

try:

# validate

info = dqn.test(env_test, nb_episodes=1, visualize=False)

n_long, n_short, total_reward, portfolio = info['n_trades']['long'], info['n_trades']['short'], info[

'total_reward'], int(info['portfolio'])

np.array([info]).dump(

'./info/duel_dqn_{0}_weights_{1}LS_{2}_{3}_{4}.info'.format(ENV_NAME, portfolio, n_long, n_short,

total_reward))

dqn.save_weights(

'./model/duel_dqn_{0}_weights_{1}LS_{2}_{3}_{4}.h5f'.format(ENV_NAME, portfolio, n_long, n_short,

total_reward),

overwrite=True)

except KeyboardInterrupt:

continue## simply plug in any keras model :)

def create_model(shape, nb_actions):

model = Sequential()

model.add(LSTM(64, input_shape=shape, return_sequences=True))

model.add(LSTM(64))

model.add(Dense(32))

model.add(Activation('relu'))

model.add(Dense(nb_actions, activation='linear'))[Verbose] While training or testing,

- environment will print out (current_tick , # Long, # Short, Portfolio)

[Portfolio]

- initial portfolio starts with 100 * 10000 (KRW - Korean won). This is roughly equivalent to 847.57 USD.

- reflects change in portfolio value if the agent had invested 100% of its balance every time it opened a position.

[Reward]

- Simply pct earning per trade.

In the initial trial, I ran for 2 episodes with 10000 epochs each. The results:

First episode:

- Runtime: 33.026 seconds

- Entry: 1,000,000 KRW (838.69 USD)

- Exit: 2,642,730 KRW (2,223.37 USD)

- Percentage profit: 264.273% (2.64 fold)

- Net profit: 1,642,730 KRW (1,382.05 USD)

Second episode:

- Runtime: 28.662 seconds

- Entry: 1,000,000 KRW (838.69 USD)

- Exit: 8,265,654.74 KRW (6,932.36 USD)

- Percentage profit: 826.56% (8.2656 fold)

- Net profit: 7,265,654.74 KRW (6,109.96 USD)

- Lee Hankyol - Initial work - deep_rl_trader

This project is licensed under the MIT License - see the LICENSE.md file for details