Ultra-fast market exchange core matching engine based on LMAX Disruptor and Eclipse Collections (ex. Goldman Sachs GS Collections).

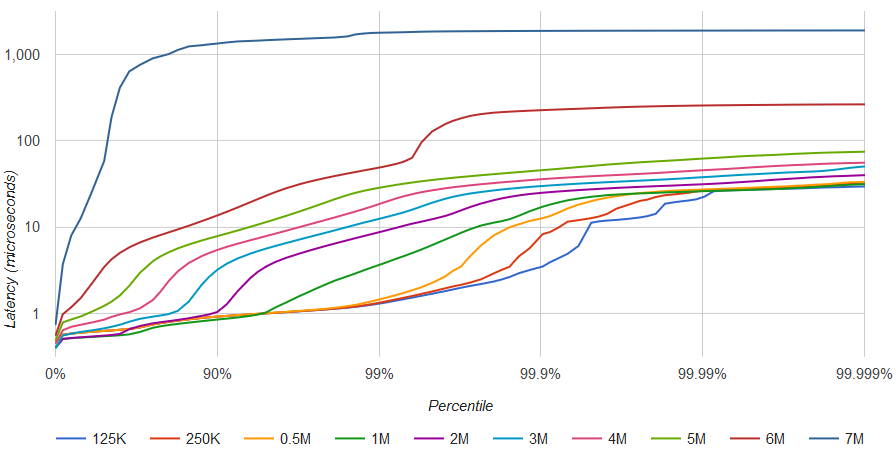

Capable to process 5M order book operations per second on 7-years old hardware (Intel® Xeon® X5690) with moderate latency degradation:

| rate | 50.0% | 90.0% | 95.0% | 99.0% | 99.9% | 99.99% | worst |

|---|---|---|---|---|---|---|---|

| 125K | 0.6µs | 0.9µs | 1.0µs | 1.4µs | 4µs | 24µs | 41µs |

| 250K | 0.6µs | 0.9µs | 1.0µs | 1.4µs | 9µs | 27µs | 41µs |

| 500K | 0.6µs | 0.9µs | 1.0µs | 1.6µs | 14µs | 29µs | 42µs |

| 1M | 0.5µs | 0.9µs | 1.2µs | 4µs | 22µs | 31µs | 45µs |

| 2M | 0.5µs | 1.2µs | 3.9µs | 10µs | 30µs | 39µs | 60µs |

| 3M | 0.7µs | 3.6µs | 6.2µs | 15µs | 36µs | 45µs | 60µs |

| 4M | 1.0µs | 6.0µs | 9µs | 25µs | 45µs | 55µs | 70µs |

| 5M | 1.5µs | 9.5µs | 16µs | 42µs | 150µs | 170µs | 190µs |

| 6M | 5µs | 30µs | 45µs | 300µs | 500µs | 520µs | 540µs |

| 7M | 60µs | 1.3ms | 1.5ms | 1.8ms | 1.9ms | 1.9ms | 1.9ms |

Benchmark configuration:

- Single order book.

- 3,000,000 inbound messages are distributed as follows: 9% limit + 3% market new orders, 6% cancel operations, 82% move operations. About 6% commands are causing trades.

- 1,000 active user accounts.

- In average ~1,000 limit orders in the order book, placed in ~750 different price slots.

- Latency results are only for risk processing and matcing engine. Network interface latency, IPC, journslling are not included.

- Test data is not bursty, meaning constant interval between commands (0.2~8µs depending on target throughput).

- BBO prices are not changing significantly thoghout the test, no avalanche orders.

- No coordinated omission effect. Processing delay is always affecting latency measurements for following messages.

- GC is triggered prior running every benchmark cycle (of 3,000,000 messages).

- RHEL 7.5, network-latency tuned profile, dual X5690, one socket isolated and tickless, no spectre/meltdown protection.

- HFT optimized. Priority is a limit-order-move operation mean latency (currently ~0.5µs). Cancel operation takes ~0.7µs, placing new order ~1.0µs;

- In-memory working state.

- Lock-free and contention-free orders matching and risk control algorithms.

- Matching engine and risk control operations are atomic and deterministic.

- Pipelined processing (based on LMAX Disruptor): each CPU core is responsible for different processing stage, user accounts shard, or symbol order books set.

- Low GC pressure, objects pooling.

- Supports crossing Ask-Bid orders for market makers.

- Two implementations of matching engine: simple and optimized.

- Testing - unit-tests, integration tests, stress tests, integrity tests.

- Automatic threads affinity (requires JNA).

- Journaling support, event-sourcing - snapshot and replay operations support.

- Market data feeds (full order log, L2 market data, BBO, trades).

- Clearing and settlement.

- FIX and REST API gateways.

- More tests and benchmarks.

- NUMA-aware.

- Latency test: mvn -Dtest=ExchangeCorePerformance#latencyTest test

- Throughput test: mvn -Dtest=ExchangeCorePerformance#throughputTest test

- Hiccups test: mvn -Dtest=ExchangeCorePerformance#hiccupsTest test