Path-dependent barrier option pricing application, scaled down to work on Heroku free tier. Try it out here

Barrier options are derivatives of an asset where payment depends on the price of the asset breaching a certain barrier price.

This particular tool focuses on pricing an exotic barrier option where we cannot feasibly utilise analytical methods such as partial differential equations as the price conditions are too complicated.

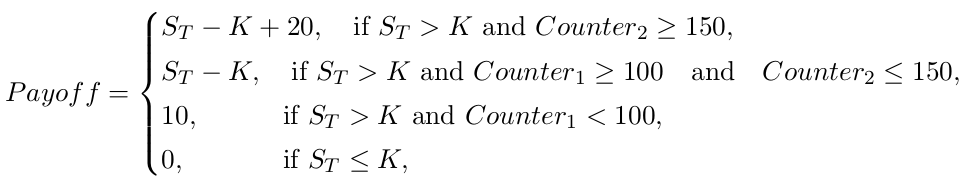

- The exotic barrier option is path-dependent such that payoff depends on the number of days where the price of the option exceeds the barrier. There are two such barriers,

First Barrier LevelandSecond Barrier Level, with day countsCounter1andCounter2respectively. - Payoff resembles a Call Option, however it is more complex. Let

S<sub>t</sub>be the share price at timetandKbe the strike price. - The cut-off points

100and150days used for payoff can both be configured in the app withCounter 1 LevelandCounter 2 Level(it was not necessary for these to be variables in the project description)

Creating a new virtual environement is recommended.

conda create -n new_env python=3.7

conda activate new_env

Git clone the repo and change directory into it. Then pip install the packages in requirement.txt.

cd directory/you/want/to/clone/into

git clone https://github.com/mdunlop2/barrier-option-pricer.git

cd barrier-option-pricer

pip install -r requirement.txt

Now test the application:

python app.py

Open a web browser and enter: 0.0.0.0:8050/

There are two pricing methods implemented in the application, stored in pricing_functions.py :

Crude Monte Carlo is the simplest implementation, simply creating a matrix of random normal variables called

rand to represent the share price change over each time step. This way, the price of the share at each time step is

stored in S_val and the number of times it crosses each barrier can be recorded, counter1 and counter2.

The payoff for the option is then calculated using the number of times the share passed each barrier and the share

payoff at maturity, using master_pricing_function.py . This is discounted to present value at risk

free rate r and the estimated price is the mean of this array’s first column. Standard deviation of the price

and counters are also returned to the user.

AVT differs from Crude Monte Carlo in that for each random normal variate in the matrix, its negative counterpart is also included, halving standard deviation of generated prices and compute time. This gives a more realistic approximation of the riskiness of the asset.

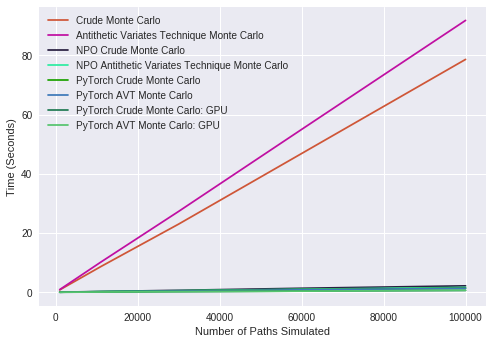

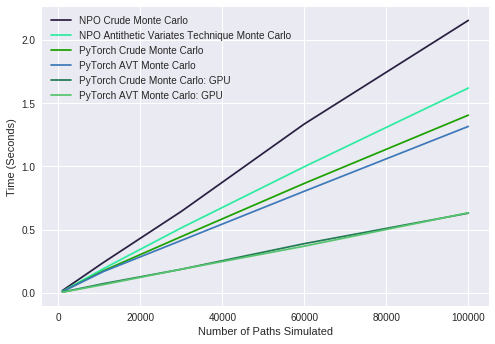

Try out our notebook CUDA_pricer_demo.ipynb to utilise PyTorch and Nvidia CUDA for over 126x speed improvement. The notebook is designed to be run in Google Collab, which offers a GPU for free (for 12 hours).

Monte-Carlo simulation is square root convergent. Therefore a 100x increase in speed (ie. simulations per second) will result in an answer which is 10x more accurate. We saw a massive increase in computational speed using GPU and optimised Matrix Multiplication Libraries (NumPy Optimized) which translates to more accurate prices for the same amount of time.

GPU Used: Nvidia K80

CPU Used: Intel Xeon 2.3 Ghz (2 threads)

We see some improvement by using the GPU however we should also note that PyTorch can be used for matrix multiplication on multiple threads of a CPU and hence we should also test a multicore CPU similar in price to an Nvidia K80 for a fair comaprison as the Google Collab Machine was supplied with 1 core (two threads).

What is interesting is the performance of the GPU is not perfectly linear, as the matrix sizes increase, the time taken per simulation actually drops (as opposed to increasing linearly with other methods). This result shows that GPU is more efficient with larger matrices.

There is plenty of room for optimisation here, especially since the final, discounted prices are always computed using CPU due to the complex payoff function.