This application demonstrates how to use the Wirecard Payment Page in PHP code.

- PHP

- curl extension

First install composer from getcomposer.org. Have a look and see how composer works.

Next download or clone the wpp-integration demo to any directory you like. If you have downloaded the zip file, extract it.

Rename the extracted directory to wpp-integration-demo-php if it is not already set.

Open a command shell and navigate to the root path where you can find the composer.json and composer.lock files and run

composer install

Composer will fetch all dependencies and install them in your root directory. If you run into issues please check the notice below.

Notice:

If you are working on Windows check if the extension php_intl.dll is in your php.ini file.

If you get into troubles on Linux this solution could help you:

- Open file

/etc/php/7.2/cli/php.iniand uncommentextension=intl - Open file

/etc/php/7.2/apache2/php.iniand uncommentextension=intl - Run command

sudo apt-get install php7.2-intl - Run

composer install

Copy this directory into a location where your webserver can serve it.

In the example we assume that

- your web server runs at port 80,

- the application is in the directory

wpp-integration-demo-phpin the document root of your web server.

However, you are free to choose any port and any name for your project you are comfortable with.

- install squizlabs/PHP_CodeSniffer via composer:

composer global require "squizlabs/php_codesniffer=*" - From the root directory you can execute

./vendor/bin/phpcbf name_of_file

https://github.com/squizlabs/PHP_CodeSniffer

This application provides examples for several payment method.

Click on this link to see a list of all supported payment method.

For testing purposes you can use the data below.

For further test data consult our documentation.

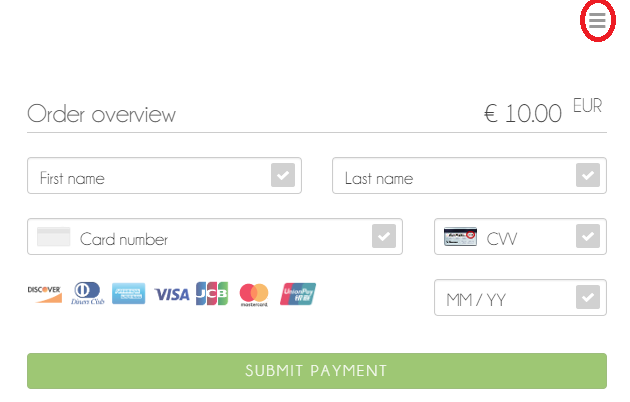

In order to execute a successful credit card payment you can use the following 3D test card:

First & last name: arbitrary

Credit card number (PAN): 4012000300001003

CVV: 003

Expiry date: arbitrary month / year in the future

You can enter the following IBAN in the input mask.

Optionally you can provide the IBAN in the request body, so that the payment will be executed without consumer interaction (so-called "silent pay").

"bank-account": {

"iban": "DE42512308000000060004"

}

Country: whatever you like

Bank Name: Demo Bank

Reference Number: any alphanumeric combination with more than 3 characters

Password: any alphanumeric combination with more than 3 characters

Tan Code: 12345

Email: paypal.buyer2@wirecard.com

Password: Wirecardbuyer

No further test data needed.

Test Voucher Code: 3105 6626 4830 5874

No further test data needed.

Choose the Apotheker Bank and enter arbitrary account data.

Account name: alipaytest20091@gmail.com

Password: 111111

Captcha Code: 8888

Payment Password: 111111

In order to execute a failing payment you can use the following SSL test card:

First & last name: arbitrary

Credit card number (PAN): 4200000000000018

CVV: 018

Expiry date: arbitrary month / year in the future

Submit the payment without filling the field "Last name".

After the payment form has been displayed

- open the menu in the top right corner of the form

- click on Cancel in the menu on the right side of the screen

You can choose between 3 types of integration:

- standalone (a.k.a. hosted): Your consumer gets redirected to a standalone payment page hosted independently of your checkout page.

- embedded: A payment form rendered over your checkout page as a modal window.

- seamless: A card form seamlessly integrated into your checkout page. This type of integration is relevant only for credit card, not for the other payment methods.

You can find more details about the integration types in our documentation.

This application provides an example for all 3 types of integration.

- Gathering the request data which is necessary for starting a payment request

- Registering the payment -> You get a redirect URL.

- Displaying the payment form to your consumer: Redirecting to the redirect URL or calling the appropriate function of WPP.

- Your consumer enters the payment data (e.g. credit card number).

At this point the process gets different for the seamless integration and for the 2 other types of integration (standalone, embedded).

- When your consumer submits the payment data, the payment form sends it to WPP.

- After the payment has been processed, your consumer gets redirected to one of the pages: success, fail or cancel.

- Displaying a feedback to the consumer about the payment status.

- The consumer submits the payment data via a button on your checkout page. Thus you have to implement the code which sends the payment data to WPP.

- After the payment has been processed, you get a response from WPP.

- Displaying a feedback to the consumer about the payment status. (On the checkout page directly or on another page.)

You can see examples for request data (standalone, embedded and seamless integration) in the folders example-requests-standalone and

example-requests-embedded. Have a look at the json requests examples to get a better idea of how request data must be structured to be accepted by our servers.

In the folder src/register/base.php a UUID is generated and added to the chosen request data.

- merchant-account-id

- success-redirect-url

- fail-redirect-url

- cancel-redirect-url

- frame-ancestor

- request-id

- transaction-type

- requested-amount

- payment-method(s)

- transaction-type

This must be a unique identifier.

If you use the uniqid function, it is recommended to set the $more_entropy parameter to true to increase the likelihood of uniqueness. (See the PHP Manual)

You can also use an arbitrary prefix e.g. an abbreviation for a department or your internal order number.

The whole request ID must not be longer than 64 characters.

This field is optional.

If you omit it:

A payment method select page will be displayed to your customer with all the payment methods which are configured for you.

If you provide a payment method:

Your consumer can use only this payment method,

e.g. the credit card data entry form is displayed to them immediately.

"payment-methods": {

"payment-method": [{

"name": "creditcard"

}]

},

This option is useful if you want to decide about the payment method on a per request basis. E.g. for purchases above EUR 100 you want to accept only credit card. For purchases from a specific country you want to allow only Paypal etc.

For the standalone integration you are ready to go.

For the embedded and seamless integrations you need further request parameter(s).

See also the examples in src/register/embedded.php and src/register/seamless.php

In case of the embedded and seamless integration the payment form will be displayed as an iframe on your page.

For this reason you have to provide the option frame-ancestor in your request with your root URL as value.

This option is necessary only for the seamless integration and must have the value seamless.

After you have gathered all the data necessary for the payment request, you have to send a POST request to the endpoint https://wpp-test.wirecard.com/api/payment/register (see the function postRegisterRequest in src/register/base.php)

If your request was not successful, the response will contain an errors array with codes and descriptions.

{

"errors" : [

{

"code" : "E7001",

"description" : "Violation of field payment.requestedAmount.currency: size must be between 3 and 3"

},

{

"code" : "E7001",

"description" : "Requested payment method is not supported."

}

]

}

If your request was successful, the response contains a payment-redirect-url.

{

"payment-redirect-url" : "https://wpp-test.wirecard.com/?wPaymentToken=eQloDaTU-QvoBx6msZ-fYLiKMn6JzCME0v7_TT0vdUM"

}

This is the URL for the payment form of this specific payment. For this reason we store this payment-redirect-url in the session, and we will use it in the next step.

This step is different depending on the type of your integration.

Your consumer will enter their payment data on a standalone payment page hosted independently of your checkout page. You have to redirect your consumer to this payment page, to the payment-redirect-url.

- reference the WPP JavaScript:

https://wpp-test.wirecard.com/loader/paymentPage.js - call the function

WPP.embeddedPayUrlwith your payment-redirect-url as a parameter

For an example see src/payment/embedded.php

- reference the WPP JavaScript:

https://wpp-test.wirecard.com/loader/paymentPage.js - call the function

WPP.seamlessRenderwith the following parameters- wrappingDivId: the ID of the div where the iframe with the payment form should be displayed

- url: your payment-redirect-url

- onSuccess: a function which will be executed, if the payment form has been rendered successfully. (Most of the times a logging is sufficient.)

- onError: a function which will be executed, if the payment form has NOT been rendered. (You'll probably want to show a meaningful error message to your consumer.)

For an example see src/payment/seamless.php

Basically a payment can have 3 status:

- success

- failed

- cancelled

The payment is posted and processed by WPP.

After WPP has determined the payment status,

it redirects your consumer to the respective URL.

(success-redirect-url, fail-redirect-url and cancel-redirect-url have been provided in the register request.)

You can display a message to your consumer on these pages.

The payment is posted by the JavaScript code on your side (the WPP.seamlessSubmit function), thus you also get the response from WPP.

In the WPP.seamlessSubmit function you can also provide the onSuccess and onError functions as parameters.

You can display a message to your consumer on the checkout page or you can redirect them to another URL.

You will be informed about the outcome of a settlement. A notification response is sent to a customized URL address. Here you can see an example how a notify respond could look like. Please consider that the response could contain more fields like shipping or pos-transaction related information and depends on the payment method.

{

"payment": {

"statuses": {

"status": [

{

"code": "201.0000",

"description": "paypal:The resource was successfully created.",

"severity": "information",

"provider-transaction-id": "5D350213JP141252A"

}

]

},

"merchant-account-id": {

"value": "2a0e9351-24ed-4110-9a1b-fd0fee6bec26"

},

"transaction-id": "978cc9d8-0530-4b9e-9cfc-9af5691f1328",

"request-id": "payment_request_5b7fc2a1a90836.41860468",

"transaction-type": "debit",

"transaction-state": "success",

"completion-time-stamp": 1535099576000,

"requested-amount": {

"value": 1.010000,

"currency": "EUR"

},

"parent-transaction-id": "48b0ad1a-e35a-4354-87a3-d20de19c8fce",

"account-holder": {

"email": "paypal.buyer2@wirecard.com",

"first-name": "Wirecardbuyer",

"last-name": "Spintzyk"

},

"custom-fields": {

"custom-field": []

},

"payment-methods": {

"payment-method": [

{

"name": "paypal"

}

]

},

"cancel-redirect-url": "wpp-integration-demo-php/src/result/cancel.php",

"fail-redirect-url": "wpp-integration-demo-php/src/result/fail.php",

"success-redirect-url": "wpp-integration-demo-php/src/result/success.php",

"provider-account-id": "00000031718207D5"

}

}

To get informed you have to define the notification URL where the response should be sent. You can also specify the format of the response.

"notifications": {

"format": "application/xml",

"notification": [

{

"url": "wpp-integration-demo-php/src/result/notify.php"

}

]

}

The following payment methods are currently supported:

- Credit Card

- PayPal

- SEPA Direct Debit

- iDEAL

- Sofort. (Klarna Group)

- Paysafecard

- Przelewy24

- EPS

- Alipay Cross-border

You will find examples for each payment method in this demo project.

You can register SEPA Direct Debit payments via the Austrian acquirer Hobex.

If you use Hobex you have to choose hobex-vt as payment method instead of sepadirectdebit.

Additional fields order-number, creditor-id and country are required.

| Field | Description |

|---|---|

| order-number | Merchant-side order number. Allowed characters: a-z, A-Z, 0-9. |

| creditor-id | The hobex AG creditor ID (always "AT94ZZZ00000001251"). |

| country | A 2-letter code, representing the first two characters of the consumer's IBAN. |

- AT (Austria)

- CZ (Czech Republic)

- DE (Germany)

- IT (Italy)

- NL (Netherlands)

- SI (Slovenia)

Please note that the only available payment currency for consumers is EUR (€).

The test merchant used in these examples has only some very popular credit card brands configured. For a list of all supported credit card brands see our documentation.

For queries and further operations we recommend to use the Payment SDK for PHP library.

For the most common use cases we provide examples in this project. You can find further examples in the wiki of the Payment SDK for PHP

- by transaction ID

- by request ID

- by transaction ID

- reserve

- payment / capture based on a reservation

- create a recurring payment based on an existing payment

- cancelling a payment

- cancelling a payment

- credit: transfer funds to a PayPal account

- credit: refund a payment via SEPA credit transfer

- credit: refund a payment via SEPA credit transfer

- Capture the reserved amount

- Cancel the reserved amount

- Cancel a payment

- Cancel a payment