Classification & Logistic Regression Modeling - Risky Business

Background

Auto loans, mortgages, student loans, debt consolidation ... these are just a few examples of credit and loans that people are seeking online. Peer-to-peer lending services such as LendingClub or Prosper allow investors to loan other people money without the use of a bank. However, investors always want to mitigate risk, so you have been asked by a client to help them use machine learning techniques to predict credit risk.

Here we will build and evaluate various machine-learning models to predict credit risk using LendingClub data. Also, credit risk is an inherently imbalanced classification problem (the number of good loans is much higher than the number of at-risk loans). We will employ different imbalanced-learn and Scikit libraries for training and evaluating models with imbalanced class using the following 2 techniques:

Files

Resampling

Use of the imbalanced learn library to resample the LendingClub data and build and evaluate logistic regression classifiers using the resampled data.

Imbalanced classification algorithms

-

Oversampling of the data using the

Naive Random OversamplerandSMOTEalgorithms- Naive Random OverSampler:

# Resample the training data with the RandomOversampler from imblearn.over_sampling import RandomOverSampler ros = RandomOverSampler(random_state=1) X_resampled, y_resampled = ros.fit_resample(X_train, y_train)- SMOTE OverSampler:

from imblearn.over_sampling import SMOTE X_resampled, y_resampled = SMOTE(random_state=1, sampling_strategy=1.0).fit_resample(X_train, y_train) -

Undersampling of the data using the

Cluster Centroidsalgorithmfrom imblearn.under_sampling import ClusterCentroids undersample = ClusterCentroids(random_state=1, n_jobs=1) X_resampled, y_resampled = undersample.fit_resample(X_train, y_train) -

Over- and under-sampling using a combination

SMOTEENNalgorithmfrom imblearn.combine import SMOTEENN sm = SMOTEENN(random_state=1) X_resampled, y_resampled = sm.fit_resample(X_train, y_train)

Metrics Calculation

Following steps were performed for each of the algorithm:

-

Train a

logistic regression classifierfromsklearn.linear_modelusing the resampled data.from sklearn.linear_model import LogisticRegression model_ros = LogisticRegression(solver='liblinear', random_state=1) model_ros.fit(X_resampled, y_resampled) -

Calculate the

balanced accuracy scorefromsklearn.metrics -

Calculate the

confusin matrixfromsklearn.metrics -

Print the

imbalanced classification reportfromimblearn.metrics

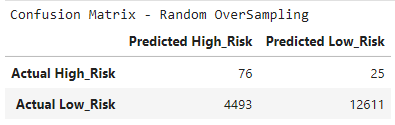

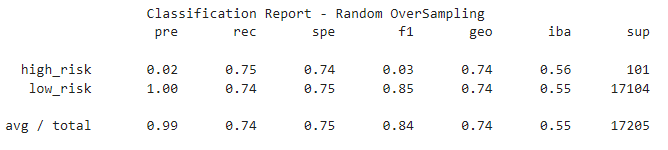

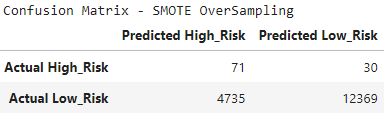

| Models | Accuracy Score | Confusion Matrix | Classification Report |

|---|---|---|---|

| Random OverSampling | 0.7448 |  |

|

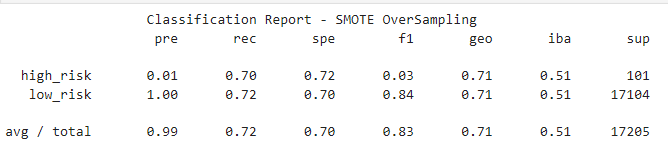

| SMOTE OverSampling | 0.7130 |  |

|

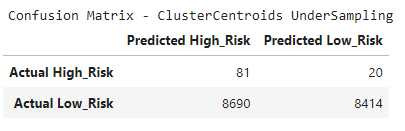

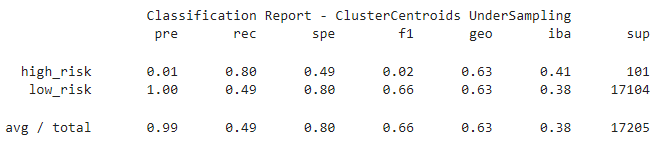

| ClusterCentroids UnderSampling | 0.6469 |  |

|

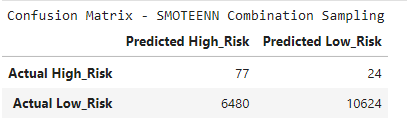

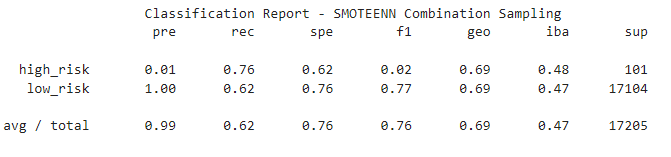

| SMOTEENN Combination Sampling | 0.6917 |  |

|

Performance Summary

Use the above to answer the following:

Which model had the best balanced accuracy score?

Naive Random OverSampler

Which model had the best recall score?

Naive Random OverSampler

Which model had the best geometric mean score?

Naive Random OverSampler

Ensemble Learning

Use of the balanced random forest classifier and the easy ensemble AdaBoost classifier to predict loan risk and evaluate each model.

Ensemble classification algorithms

-

Balanced Random Forest Classifier

# Resample the training data with the BalancedRandomForestClassifier from imblearn.ensemble import BalancedRandomForestClassifier brf = BalancedRandomForestClassifier(n_estimators=100, random_state=1, n_jobs=1) brf_model = brf.fit(X_train, y_train) -

Easy Ensemble AdaBoost Classifier

## Resample the training data with the Easy Ensemble AdaBoost Classifier from imblearn.ensemble import EasyEnsembleClassifier eec = EasyEnsembleClassifier(random_state=1, n_jobs=1, n_estimators=100) eec_model = eec.fit(X_train, y_train)

Metrics Calculations

Following Steps were performed:

-

Train the model using the quarterly data from LendingClub provided in the

Resourcefolder.from sklearn.model_selection import train_test_split X_train, X_test, y_train, y_test = train_test_split(X, y, random_state=1) -

Calculate the balanced accuracy score from

sklearn.metrics. -

Print the confusion matrix from

sklearn.metrics. -

Generate a classification report using the

imbalanced_classification_reportfrom imbalanced learn.

| Models | Accuracy Score | Confusion Matrix | Classification Report |

|---|---|---|---|

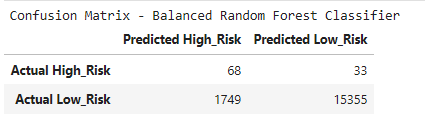

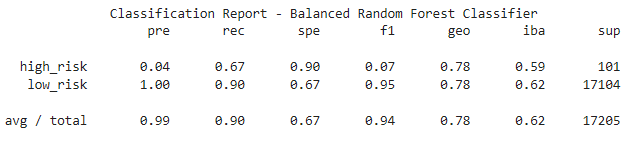

| Balanced Random Forest Classifier | 0.7855 |  |

|

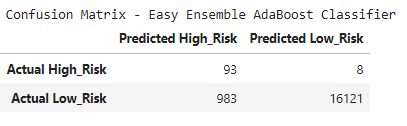

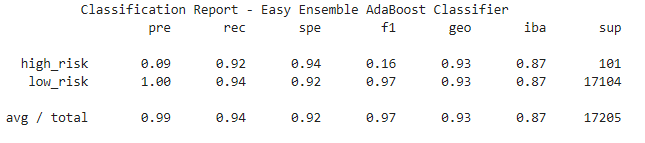

| Easy Ensemble AdaBoost Classifier | 0.9316 |  |

|

-

For the balanced random forest classifier only, print the feature importance sorted in descending order (most important feature to least important) along with the feature score.

Features [(0.09175752102205247, 'total_rec_prncp'), (0.06410003199501778, 'total_pymnt_inv'), (0.05764917485461809, 'total_pymnt'), (0.05729679526683975, 'total_rec_int'), (0.05174788106507317, 'last_pymnt_amnt'), (0.031955619175665397, 'int_rate'), (0.02353678623968216, 'issue_d_Jan-2019'), (0.017078915518993903, 'installment'), (0.017014861224701222, 'mths_since_recent_inq'), (0.016537957646730293, 'out_prncp_inv'), (0.016169718411077325, 'max_bal_bc'), (0.01607049983545137, 'dti'), (0.01599866290723441, 'revol_bal'), (0.015775537221600675, 'annual_inc'), (0.01535560674178928, 'tot_hi_cred_lim'), (0.015029265003541079, 'mo_sin_old_rev_tl_op'), (0.014828006488636946, 'out_prncp'), (0.01464881608833323, 'total_bc_limit'), (0.014402430445752665, 'total_bal_il'), (0.014318832248876989, 'mths_since_rcnt_il'), (0.013519867193755364, 'issue_d_Mar-2019'), (0.013151520216882331, 'il_util'), (0.013101578263049833, 'total_il_high_credit_limit'), (0.012784600558682344, 'bc_util'), (0.012636608914961465, 'total_bal_ex_mort'), (0.012633464965390648, 'avg_cur_bal'), (0.012406321468566728, 'total_rev_hi_lim'), (0.011687404692448701, 'mo_sin_old_il_acct'), (0.01156494245653799, 'all_util'), (0.011455878011762288, 'num_rev_accts'), (0.011409157520644688, 'bc_open_to_buy'), (0.01073641504525053, 'tot_cur_bal'), (0.010380085181706624, 'acc_open_past_24mths'), (0.010097528131347774, 'mths_since_recent_bc'), (0.00995373830638152, 'loan_amnt'), (0.00991410213601043, 'pct_tl_nvr_dlq'), (0.009821715826953788, 'num_il_tl'), (0.009603648248133598, 'inq_last_12m'), (0.009537423049553, 'num_actv_rev_tl'), (0.008976776055926955, 'total_acc'), (0.008870623013604539, 'num_bc_tl'), (0.008745106187024114, 'num_op_rev_tl'), (0.008045578273709669, 'mo_sin_rcnt_tl'), (0.007906251501807723, 'next_pymnt_d_Apr-2019'), (0.00782073260901301, 'open_acc'), (0.007798696767389274, 'num_sats'), (0.007608045628523077, 'inq_fi'), (0.0075861537897335815, 'num_bc_sats'), (0.007554511001273182, 'num_tl_op_past_12m'), (0.007471884930172615, 'open_acc_6m'), (0.007273779915807858, 'num_rev_tl_bal_gt_0'), (0.006874845464745796, 'mort_acc'), (0.006862142977394886, 'total_cu_tl'), (0.006838718858820505, 'percent_bc_gt_75'), (0.006413554699909871, 'open_il_24m'), (0.006319439816216779, 'mo_sin_rcnt_rev_tl_op'), (0.006160469432535709, 'num_actv_bc_tl'), (0.006066257227997291, 'open_rv_12m'), (0.005981472544437747, 'total_rec_late_fee'), (0.0055301594524349495, 'open_act_il'), (0.004961823663836347, 'issue_d_Feb-2019'), (0.004685198497435334, 'next_pymnt_d_May-2019'), (0.0045872929977180356, 'open_rv_24m'), (0.0041651633321967895, 'inq_last_6mths'), (0.004016461341161775, 'open_il_12m'), (0.0032750717701661657, 'delinq_2yrs'), (0.0027565184136781346, 'verification_status_Not Verified'), (0.0026174030074401656, 'num_accts_ever_120_pd'), (0.002279671873697176, 'home_ownership_MORTGAGE'), (0.0021899772867773103, 'tot_coll_amt'), (0.0020851101815353096, 'home_ownership_RENT'), (0.0018404849590376573, 'home_ownership_OWN'), (0.001736019018028134, 'verification_status_Verified'), (0.0015472230884974506, 'verification_status_Source Verified'), (0.0012263315437383057, 'application_type_Joint App'), (0.0012213148580230454, 'application_type_Individual'), (0.0012151288883862276, 'pub_rec_bankruptcies'), (0.0008976722260399365, 'pub_rec'), (0.0008125182396705508, 'initial_list_status_w'), (0.000573414997420326, 'num_tl_90g_dpd_24m'), (0.0005168345750594915, 'collections_12_mths_ex_med'), (0.0004192455022893127, 'initial_list_status_f'), (0.0, 'tax_liens'), (0.0, 'recoveries'), (0.0, 'pymnt_plan_n'), (0.0, 'policy_code'), (0.0, 'num_tl_30dpd'), (0.0, 'num_tl_120dpd_2m'), (0.0, 'home_ownership_ANY'), (0.0, 'hardship_flag_N'), (0.0, 'delinq_amnt'), (0.0, 'debt_settlement_flag_N'), (0.0, 'collection_recovery_fee'), (0.0, 'chargeoff_within_12_mths'), (0.0, 'acc_now_delinq')]

Performance Summary

Use the above to answer the following:

Which model had the best balanced accuracy score?

Easy Ensemble AdaBoost Classifier

Which model had the best recall score?

Easy Ensemble AdaBoost Classifier

Which model had the best geometric mean score?

Easy Ensemble AdaBoost Classifier

What are the top three features?

* 0.09175752102205247: total_rec_prncp

* 0.06410003199501778: total_pymnt_inv

* 0.05764917485461809: total_pymnt