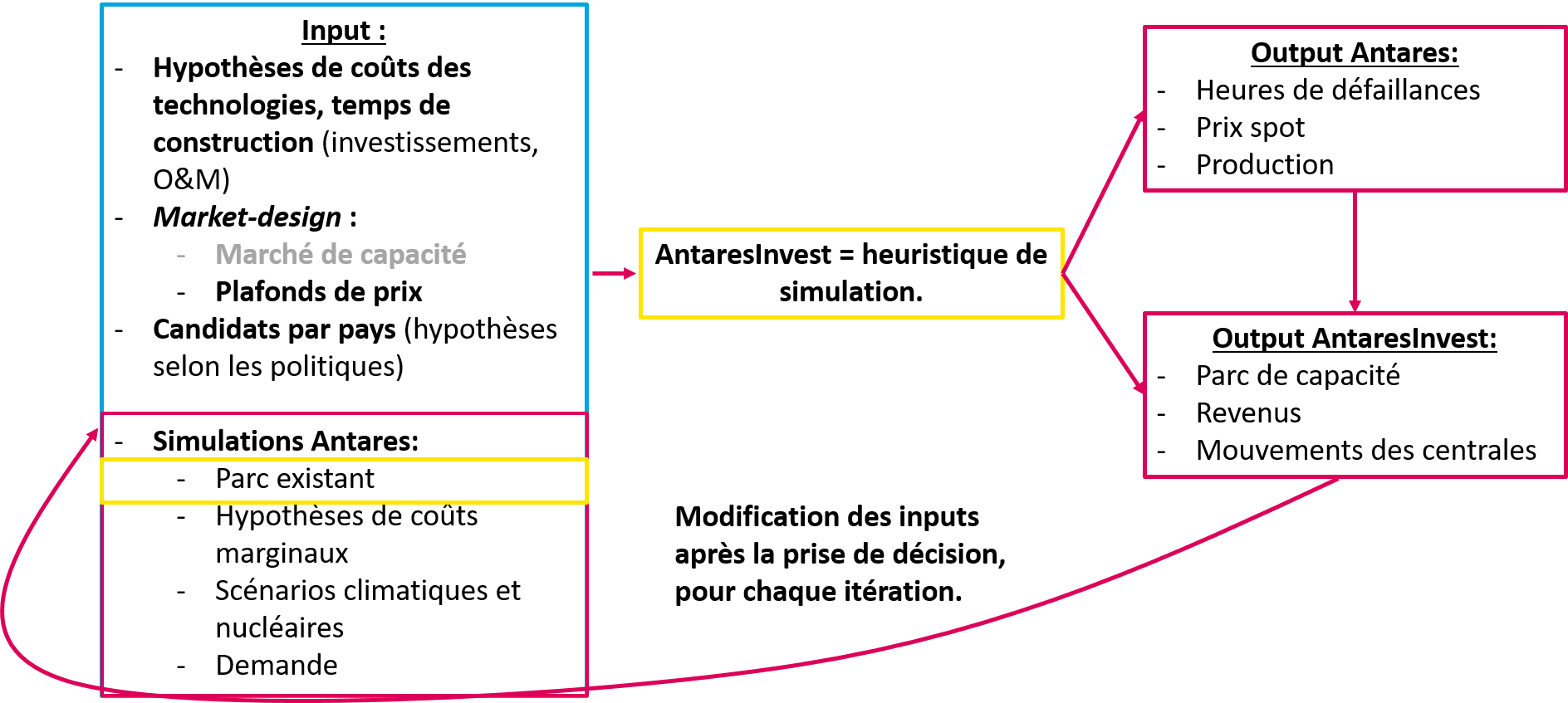

AntaresInvest is an extension of Antares Simulator optimization solution provided by Rte to model the european power system. Antares is a unit commitment tool and makes the dispatch over the EU power system whereas AntaresInvest works as the multi-year investment simulation model. AntaresInvest computes revenues of the energy-only market based on Antares Simulation. Then, other market architectures are implemented such as capacity remuneration mechanism or service system for example. Investors make decisions to retire or invest based on economic assumptions and revenues computation. Powerfleet is updated based on these decisions and time moves on. Iterations over the same year are made. Powerfleet is adapted following rules implemented.

- Architecture of the model

- Quick start!

- Project's architecture

- Parameters description

- Scripts description

- Data format description

- Make outputs of the model

- Interact with AntaresWeb through API

- Modelling elements

- Authors and contributions

| Dynamic functioning of the model | Data organization & pipeline |

|---|---|

|

|

- Investment decisions is made if following conditions are filled for a capacity c on year t:

- Retirement is assumed if :

- Limit of investment & retirement for each country and year :

- For adaptative power increment option, the new power increment is computed as :

- For the 25% remaining iteration,

where :

energy: energy revenuescrm: capacity remuneration mechanism revenuesss: service system revenuesOC: maintenance & operational costsγ: discount rateα: threshold to consider revenues as negativeIC: investement costsLOLD: Loss of load durationRS: Reliability standard

Here find examples and insights to get started with AntaresInvest.

Here is the project's architecture :

The package has different parameters config yaml file. YAML is a structured text file easy to load in R and keeps the data structure. Here are the different config files :

Find here a full description.

Find here a full description.

In the model, the data format mainly used to keep data organised and tracked are the R lists (eg. dictionnaries for Python addict). There are 5 main variables to do so.

Find here a full description.

Here find examples of how to complete make_outputs() functions. To build such graphics and output excel files :

Here find examples to get to know how to handle API of AntaresWeb with R.

Here find modelling choices.

AntaresInvest is licensed under the open source MIT License.

Copyright 2022 - Now Rte - AntaresInvest developpers.

To contribute, follow the guidelines.