Building a Stock Visualization Website with Python/Django and Alpha Vantage APIs

Data visualization is becoming a must-have feature for more and more web and mobile applications. This trend is even more salient for financial market data, where data visualization is often used for market analysis, technical charting, and other mission-critical business scenarios.

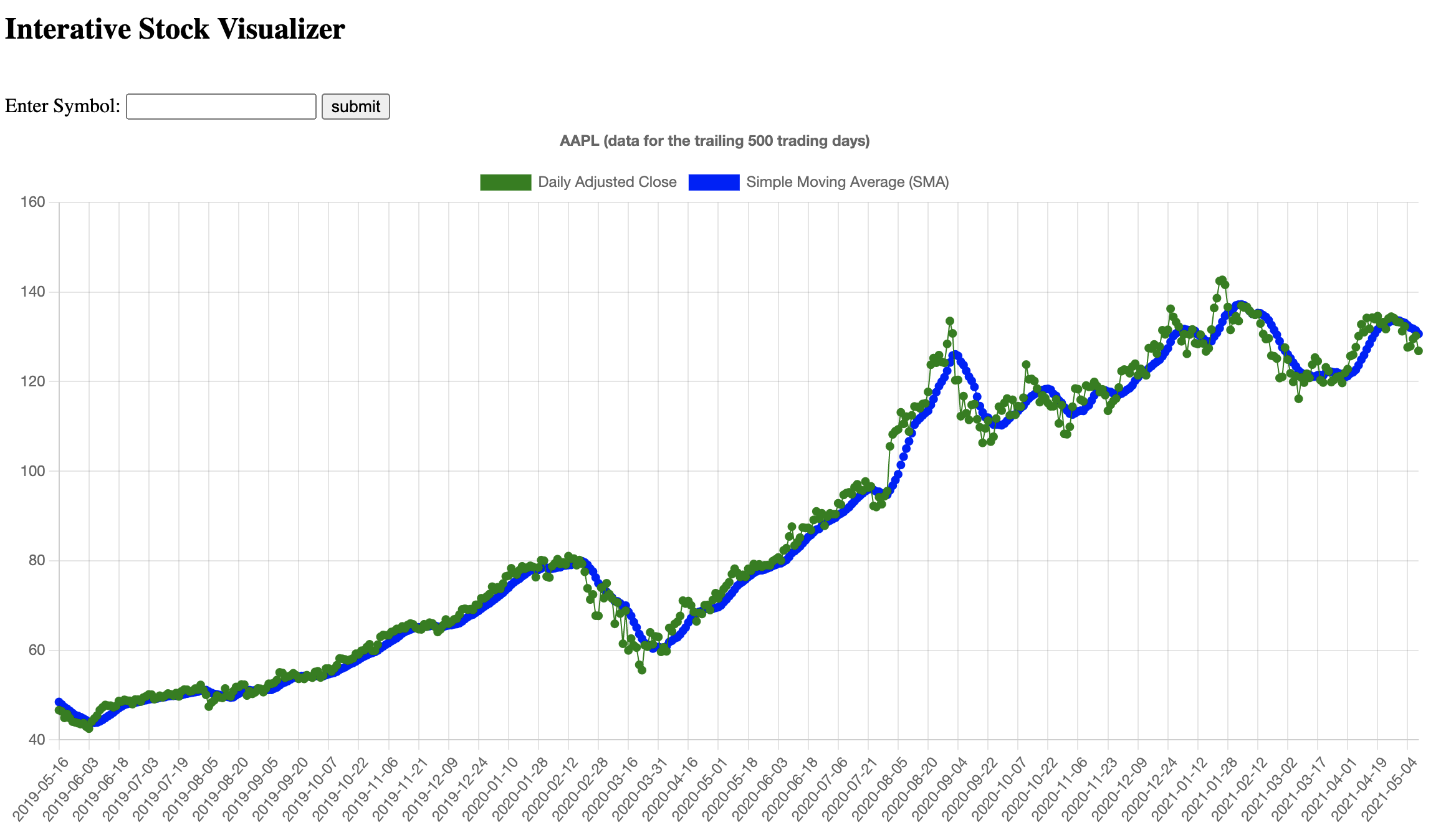

In this project, we will create an interactive stock visualization website (screenshot below) with Python/Django and Alpha Vantage APIs. We will cover key software engineering and web development concepts such as AJAX, server-side scripting, and database models - in fewer than 400 lines of code.

The project is comprised of the following sections:

- Install dependencies and set up project

- Create database model

- Create frontend UI

- Create backend logic

- Set up Django URL routing

- Run the web application locally

To minimize your cognitive load, we have included all the necessary code scripts and command line prompts directly in this document. By the time you finish this tutorial, you will have a stock data visualization website with frontend, backend, and database all ready for prime time. Let's get started!

Install dependencies and set up project

We recommend Python 3.6 or higher. If you do not yet have Python installed, please follow the download instructions on the official python.org website.

Once you have Python installed in your environment, please use your command line interface to install the following Python libraries:

The pip installer above should already be included in your system if you are using Python 3.6 or higher downloaded from python.org. If you are seeing a "pip not found" error message, please refer to the pip installation guide.

Please also obtain a free Alpha Vantage API key here. You will use this API key to query financial market data from the Alpha Vantage APIs as you develop this stock visualization web application.

Now, we are ready to create the Django project!

Open a new command line window and type in the following prompt:

(home) $ django-admin startproject alphaVantageYou have just created a blank Django project in a folder called alphaVantage.

Now, let's switch from your home directory to the alphaVantage project directory with the following command line prompt:

(home) $ cd alphaVantageFor the rest of this project, we will be operating inside the alphaVantage root directory.

Now, let's create a stockVisualizer app within the blank Django project:

(alphaVantage) $ python manage.py startapp stockVisualizerWe will also create an HTML file for our homepage. Enter the following 4 command line prompts in order:

Step 1: create a new folder called "templates"

(alphaVantage) $ mkdir templatesStep 2: go to the "templates" folder

(alphaVantage) $ cd templatesStep 3: create an empty home.html file in the templates folder

If you are using Mac or Linux:

(templates) $ touch home.htmlIf you are using Windows:

(templates) $ type nul > home.htmlStep 4: return to our alphaVantage root directory

(templates) $ cd ../At this stage, the file structure of your Django project should look similar to the one below. You may want to import the project into an IDE such as PyCharm, Visual Studio, or Sublime Text to visualize the file structure more easily.

alphaVantage/

alphaVantage/

__init__.py

asgi.py

settings.py

urls.py

wsgi.py

stockVisualizer/

migrations/

__init__.py

__init__.py

admin.py

apps.py

models.py

tests.py

views.py

templates/

home.html

manage.py

Let's take a closer look at some of the key files:

manage.py: A command-line utility that lets you interact with this Django project in various ways. You can read all the details about manage.py in django-admin and manage.py.__init__.py: An empty file that tells Python that this directory should be considered a Python package. Please keep it empty!settings.py: Settings/configuration for this Django project.urls.py: The URL declarations for this Django project; a “table of contents” of your Django-powered site.models.py: this is the file you will use to define database objects and schemaviews.py: this is where all the backend logic gets implemented and relayed to the frontend (views)home.html: the HTML file that determines the look and behavior of the homepage

Specify the database model

Databases are essential components of most modern web and mobile applications. For our stock visualization website, we will create a simple (two-column) database model to store stock market data.

Before we create the database model, however, let's open the settings.py file and quickly modify the following 3 places in the script:

- Near the top of

settings.py, addimport os:

from pathlib import Path

import os #add this line to settings.py- Inside the

INSTALLED_APPS, add thestockVisualizerapp:

INSTALLED_APPS = [

'django.contrib.admin',

'django.contrib.auth',

'django.contrib.contenttypes',

'django.contrib.sessions',

'django.contrib.messages',

'django.contrib.staticfiles',

'stockVisualizer', #add this line to settings.py

]- Inside

TEMPLATES, include thetemplatesdirectory we've created earlier in this project:

TEMPLATES = [

{

'BACKEND': 'django.template.backends.django.DjangoTemplates',

'DIRS': [os.path.join(BASE_DIR, 'templates')], #modify this line in settings.py

'APP_DIRS': True,

'OPTIONS': {

'context_processors': [

'django.template.context_processors.debug',

'django.template.context_processors.request',

'django.contrib.auth.context_processors.auth',

'django.contrib.messages.context_processors.messages',

],

},

},

]Now, let's define a Django database model called StockData in models.py.

The model has two fields:

- a

symbolfield that stores the ticker string of the stock - a

datafield that stores the historical prices and moving average values for a given ticker

#models.py

from django.db import models

# Create your models here.

class StockData(models.Model):

symbol = models.TextField(null=True)

data = models.TextField(null=True)With models.py updated, let's notify Django about the newly created database model via the following command line prompts:

(alphaVantage) $ python manage.py makemigrations(alphaVantage) $ python manage.py migrateAt this stage, your file structure should look similar to the one below:

alphaVantage/

alphaVantage/

__init__.py

asgi.py

settings.py

urls.py

wsgi.py

stockVisualizer/

migrations/

0001_initial.py #you should see this after running the database migration commands

__init__.py

__init__.py

admin.py

apps.py

models.py

tests.py

views.py

templates/

home.html

manage.py

db.sqlite3 #you should see this after running the database migration commands

The db.sqlite3 file indicates that we have registered our StockData model in the local SQLite database. As its name suggests, SQLite is a lightweight SQL database frequently used for web development (especially in local test environment). SQLite is automatically included in Django/Python, so there is no need to install it separately :-)

There are now only two major steps left:

- Set up the homepage file (home.html) so that we can visualize stock prices and moving averagas of a given stock

- Create the backend logic (views.py) so that we have the proper stock data to feed into the frontend UI

Let's proceed!

Create frontend UI

Before we dive into the code implementation, let's first summarize the expected behavior of our homepage (screenshots below) at a high level:

- Upon loading, the page will display the adjusted close prices and simple moving average (SMA) values of Apple (AAPL), covering the most recent 500 trading days.

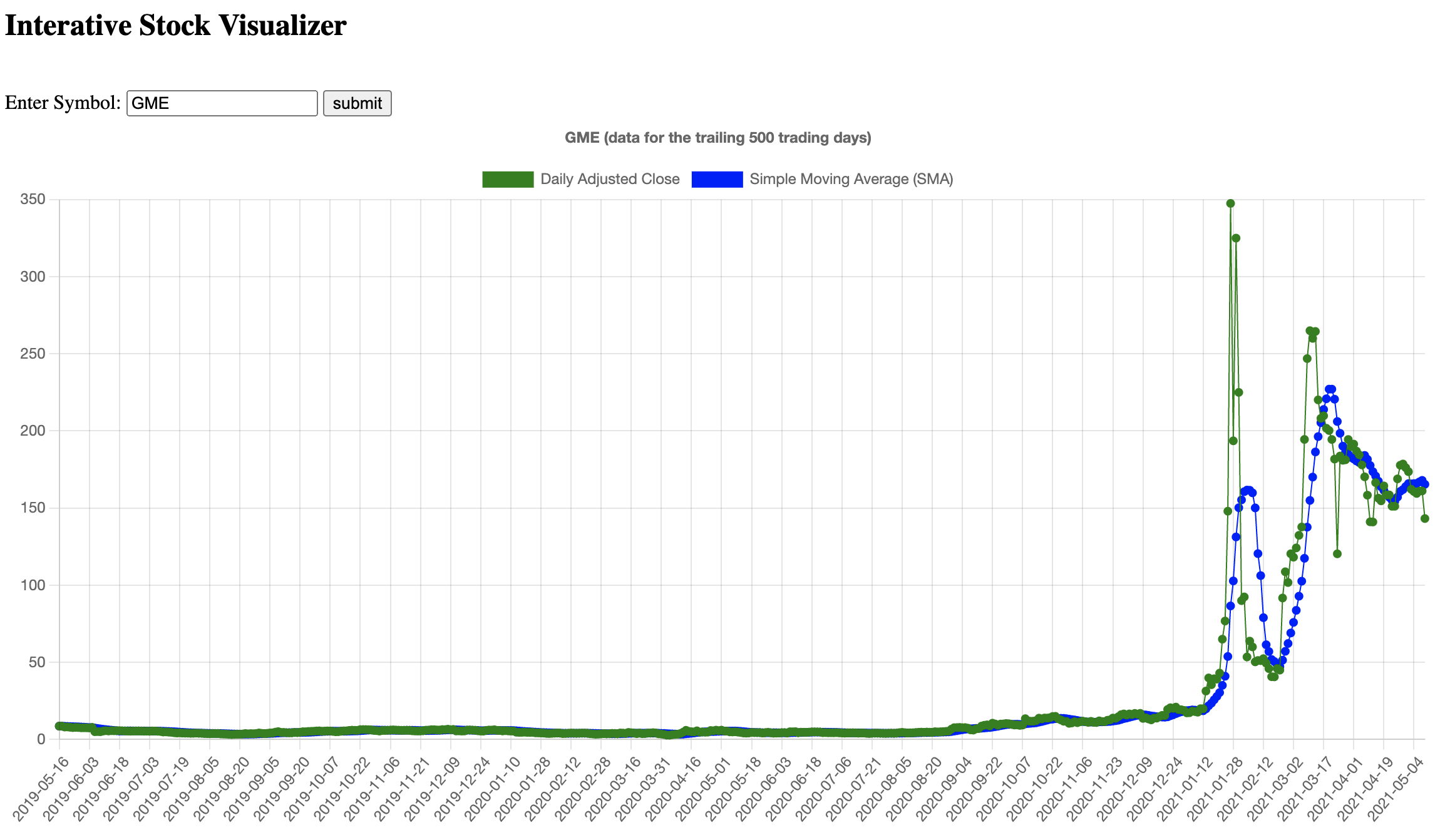

- When the user enters a new stock ticker in the textbox and hits "submit", the existing chart on the page will be replaced with the adjusted close and SMA data of the new ticker.

When the homepage is first loaded

When the user enters a new symbol (such as GME)

With the above page layout and behavior defined, let's implement the homepage frontend accordingly.

Open the (empty) home.html and paste the following content into it:

<!DOCTYPE html>

<html>

<head>

<!--<link rel="stylesheet" href="style.css">-->

<script src="https://cdn.jsdelivr.net/npm/chart.js@3.2.1/dist/chart.min.js"></script>

<script src="https://code.jquery.com/jquery-3.6.0.min.js"></script>

<title>Stock Visualizer</title>

</head>

<body>

<h2>Interative Stock Visualizer</h2>

<br>

<label for="ticker-input">Enter Symbol:</label>

<input type="text" id="ticker-input">

<input type="button" value="submit" id="submit-btn">

<br>

<div id="graph-area" style="height:80%; width:80%;">

<canvas id="myChart"></canvas>

</div>

<br>

<div>

Friendly reminder: if the graphing function stops working after several successful instances, don't worry! It is likely that you have reached the 5 requests/minute rate limit of the free Alpha Vantage API key. The graph should work again in the next minute or after you obtain a <a href="https://www.alphavantage.co/premium/" target="_blank">premium API key</a> with a higher rate limit.

</div>

<script>

$(document).ready(function(){

// Right after the page is loaded, we get the stock data (default to AAPL) from the Django backend (the 'get_stock_data' function) for plotting

$.ajax({

type: "POST",

url: "/get_stock_data/",

data: {

'ticker': 'AAPL',

},

success: function (res, status) {

// AAPL's stock price and SMA data is now in the "res" object

var tickerDisplay = res['prices']['Meta Data']['2. Symbol'];

var graphTitle = tickerDisplay + ' (data for the trailing 500 trading days)'

var priceSeries = res['prices']['Time Series (Daily)'];

var daily_adjusted_close = [];

var dates = [];

price_data_parse = function(){

for (let key in priceSeries) {

daily_adjusted_close.push(Number(priceSeries[key]['5. adjusted close']));

dates.push(String(key));

}

};

price_data_parse();

var smaSeries = res['sma']['Technical Analysis: SMA'];

var sma_data = [];

sma_data_parse = function(){

for (let key in smaSeries) {

sma_data.push(Number(smaSeries[key]['SMA']));

}

};

sma_data_parse();

// only keep the latest 500 data points (i.e., data for the latest 500 trading days) for the three lists below

daily_adjusted_close.reverse().slice(500);

sma_data.reverse().slice(500);

dates.reverse().slice(500);

//instruct Chart.js to plot the graph, with "dates" as the x-axis labels and "daily_adjusted_close" and "sma_data" as the y-axis values

var ctx = document.getElementById('myChart').getContext('2d');

var myChart = new Chart(ctx, {

type: 'line',

data: {

labels: dates.slice(-500),

datasets: [

{

label: 'Daily Adjusted Close',

data: daily_adjusted_close.slice(-500),

backgroundColor: [

'green',

],

borderColor: [

'green',

],

borderWidth: 1

},

{

label: 'Simple Moving Average (SMA)',

data: sma_data.slice(-500),

backgroundColor: [

'blue',

],

borderColor: [

'blue',

],

borderWidth: 1

},

]

},

options: {

responsive: true,

scales: {

y: {

//beginAtZero: false

}

},

plugins: {

legend: {

position: 'top',

},

title: {

display: true,

text: graphTitle

}

}

}

});

}

});

});

$('#submit-btn').click(function() {

// when the user specifies a new ticker, we call the Django backend (the 'get_stock_data' function) to get the stock data and refresh the graph.

// obtain the ticker string from the input textbox

var tickerText = $('#ticker-input').val();

$.ajax({

type: "POST",

url: "/get_stock_data/",

data: {

'ticker': tickerText,

},

success: function (res, status) {

// stock price and SMA data for the user-specified ticker is now in the "res" object

var tickerDisplay = res['prices']['Meta Data']['2. Symbol'];

var graphTitle = tickerDisplay + ' (data for the trailing 500 trading days)'

var priceSeries = res['prices']['Time Series (Daily)'];

var daily_adjusted_close = [];

var dates = [];

price_data_parse = function(){

for (let key in priceSeries) {

daily_adjusted_close.push(Number(priceSeries[key]['5. adjusted close']));

dates.push(String(key));

}

};

price_data_parse();

var smaSeries = res['sma']['Technical Analysis: SMA'];

var sma_data = [];

sma_data_parse = function(){

for (let key in smaSeries) {

sma_data.push(Number(smaSeries[key]['SMA']));

}

};

sma_data_parse();

// only keep the latest 500 data points (i.e., data for the latest 500 trading days) for the three lists below

daily_adjusted_close.reverse().slice(500);

sma_data.reverse().slice(500);

dates.reverse().slice(500);

//instruct Chart.js to plot the graph, with "dates" as the x-axis labels and "daily_adjusted_close" and "sma_data" as the y-axis values

$('#myChart').remove(); // this is my <canvas> element

$('#graph-area').append('<canvas id="myChart"><canvas>');

var ctx = document.getElementById('myChart').getContext('2d');

var myChart = new Chart(ctx, {

type: 'line',

data: {

labels: dates.slice(-500),

datasets: [

{

label: 'Daily Adjusted Close',

data: daily_adjusted_close.slice(-500),

backgroundColor: [

'green',

],

borderColor: [

'green',

],

borderWidth: 1

},

{

label: 'Simple Moving Average (SMA)',

data: sma_data.slice(-500),

backgroundColor: [

'blue',

],

borderColor: [

'blue',

],

borderWidth: 1

},

]

},

options: {

responsive: true,

scales: {

y: {

//beginAtZero: false

}

},

plugins: {

legend: {

position: 'top',

},

title: {

display: true,

text: graphTitle

}

}

}

});

}

});

});

</script>

</body>

</html>This is a chunky block of code! Don't worry - we can break it down into the following 4 steps:

- Load the Javascript dependencies:

<script src="https://cdn.jsdelivr.net/npm/chart.js@3.2.1/dist/chart.min.js"></script>loads the powerful Chart.js library for data visualization<script src="https://code.jquery.com/jquery-3.6.0.min.js"></script>loads the jquery library that streamlines common frontend development tasks.

- Define the page layout

<input type="text" id="ticker-input">is the input text box for a user to enter a new stock ticker<input type="button" value="submit" id="submit-btn">is the submit button<canvas id="myChart"></canvas>is the canvas on which Chart.js will generate the beautiful graph for stock data visualization

- Define the behavior upon page loading

The $(document).ready(function(){...} code block specifies the page behavior when it's first loaded:

- First, it will make an AJAX POST request to a Django backend function called

get_stock_datato get the price and simple moving average data for AAPL. AJAX stands for Asynchronous JavaScript And XML, which is a popular Javascript design pattern that enables a developer to (1) update a web page without reloading the page, (2) request data from a backend server - after the page has loaded, (3) receive data from a backend server - after the page has loaded, among other benefits. - Once AAPL's data is returned by the backend to the frontend (the data is stored in the

resvariable ofsuccess: function (res, status) {...}), it is parsed by several lines of Javascript codes into three lists:dates,daily_adjusted_close, andsma_data. - The three lists above are then all truncated into a size of 500 elements (i.e., data for the trailing 500 trading days) to be visualized by Chart.js. Specifically, the values in

datesare used for the X axis; values indaily_adjusted_closeandsma_dataare used for the Y axis.

- Define the behavior for when a new ticker is submitted by the user

The $('#submit-btn').click(function(){...} code block specifies the page behavior when a user enters a new ticker symbol:

- First, it will make an AJAX POST request to a Django backend function called

get_stock_datato get the price and simple moving average data for the ticker entered by the user. The linevar tickerText = $('#ticker-input').val();takes care of extracting the ticker string from the input textbox. - Once the ticker's data is returned by the backend to the frontend (the data is again stored in the

resvariable ofsuccess: function (res, status) {...}), it is parsed by several lines of Javascript codes into three lists:dates,daily_adjusted_close, andsma_data. - The three lists above are then all truncated into a size of 500 elements (i.e., data for the trailing 500 trading days) to be visualized by Chart.js. Specifically, the values in

datesare used for the X axis; values indaily_adjusted_closeandsma_dataare used for the Y axis.

As you can see, the get_stock_data backend function is now the only missing piece in the frontend-backend communication loop. We will implement it right away!

Create backend logic (views.py)

Now, let's update views.py to the following. Don't forget to replace the my_alphav_api_key string with your actual Alpha Vantage API key.

from django.shortcuts import render

from django.http import HttpResponse

from django.views.decorators.csrf import csrf_exempt

from .models import StockData

import requests

import json

APIKEY = 'my_alphav_api_key'

#replace 'my_alphav_api_key' with your actual Alpha Vantage API key obtained from https://www.alphavantage.co/support/#api-key

DATABASE_ACCESS = True

#if False, the app will always query the Alpha Vantage APIs regardless of whether the stock data for a given ticker is already in the local database

#view function for rendering home.html

def home(request):

return render(request, 'home.html', {})

@csrf_exempt

def get_stock_data(request):

if request.is_ajax():

#get ticker from the AJAX POST request

ticker = request.POST.get('ticker', 'null')

ticker = ticker.upper()

if DATABASE_ACCESS == True:

#checking if the database already has data stored for this ticker before querying the Alpha Vantage API

if StockData.objects.filter(symbol=ticker).exists():

#We have the data in our database! Get the data from the database directly and send it back to the frontend AJAX call

entry = StockData.objects.filter(symbol=ticker)[0]

return HttpResponse(entry.data, content_type='application/json')

#obtain stock data from Alpha Vantage APIs

#get adjusted close data

price_series = requests.get(f'https://www.alphavantage.co/query?function=TIME_SERIES_DAILY_ADJUSTED&symbol={ticker}&apikey={APIKEY}&outputsize=full').json()

#get SMA (simple moving average) data

sma_series = requests.get(f'https://www.alphavantage.co/query?function=SMA&symbol={ticker}&interval=daily&time_period=10&series_type=close&apikey={APIKEY}').json()

#package up the data in an output dictionary

output_dictionary = {}

output_dictionary['prices'] = price_series

output_dictionary['sma'] = sma_series

#save the dictionary to database

temp = StockData(symbol=ticker, data=json.dumps(output_dictionary))

temp.save()

#return the data back to the frontend AJAX call

return HttpResponse(json.dumps(output_dictionary), content_type='application/json')

else:

message = "Not Ajax"

return HttpResponse(message)Let's look at the above backend code a bit closer.

The variable DATABASE_ACCESS = True means the get_stock_data function will check if there is existing data in the local database before making API calls to Alpha Vantage. If you set DATABASE_ACCESS = False, the script will bypass any local database lookups and proceed directly to calling Alpha Vantage APIs everytime a new ticker is queried. We have included a paragraph titled "Data Freshness vs. Speed Trade-off" under the References section of this tutorial to discuss the nuances of getting data from local databases vs. querying an API.

The function def home(request) is the standard way for a Django backend to render an HTML file (in our case, home.html).

The function def get_stock_data(request) takes an AJAX POST request from the home.html file and returns a JSON dictionary of stock data back to the AJAX loop. Let's unpack it here:

if request.is_ajax()makes sure the request is indeed an AJAX POST request from the frontend.ticker = request.POST.get('ticker', 'null')obtains the ticker string from the AJAX request. The ticker string is always AAPL when the page is first loaded, but will change to other strings based on user input at the frontend.- The code block under

if DATABASE_ACCESS == Truechecks if the data for a given ticker already exists in our local database. If yes, theget_stock_datafunction will simply get the data from the database and return it back to the AJAX loop. If not, the script continues to the next steps. (If you are familiar with SQL, the codeStockData.objects.filter(symbol=ticker)is Django's way of sayingSELECT * FROM StockData WHERE symbol = ticker.) - The part

price_series = requests.get(f'https://www.alphavantage.co/query?function=TIME_SERIES_DAILY_ADJUSTED&symbol={ticker}&apikey={APIKEY}&outputsize=full').json()queries Alpha Vantage's Daily Adjusted API and parse the data into a JSON dictionary through the.json()routine. Below is a sample JSON output from the daily adjusted API:

{

"Meta Data": {

"1. Information": "Daily Time Series with Splits and Dividend Events",

"2. Symbol": "AAPL",

"3. Last Refreshed": "2021-05-10",

"4. Output Size": "Full size",

"5. Time Zone": "US/Eastern"

},

"Time Series (Daily)": {

"2021-05-10": {

"1. open": "129.41",

"2. high": "129.54",

"3. low": "126.81",

"4. close": "126.85",

"5. adjusted close": "126.85",

"6. volume": "88071229",

"7. dividend amount": "0.0000",

"8. split coefficient": "1.0"

},

"2021-05-07": {

"1. open": "130.85",

"2. high": "131.2582",

"3. low": "129.475",

"4. close": "130.21",

"5. adjusted close": "130.21",

"6. volume": "78973273",

"7. dividend amount": "0.2200",

"8. split coefficient": "1.0"

},

"2021-05-06": {

"1. open": "127.89",

"2. high": "129.75",

"3. low": "127.13",

"4. close": "129.74",

"5. adjusted close": "129.521163843",

"6. volume": "78128334",

"7. dividend amount": "0.0000",

"8. split coefficient": "1.0"

},

...

}

}

Please note that we are primarily interested the adjusted close field (5. adjusted close) of Alpha Vantage's daily adjusted API to remove any artificial price turbulences due to stock splits and dividend payout events. It is generally considered an industry best practice to use split/dividend-adjusted prices instead of raw close prices (4. close) to model stock price movements.

- The part

sma_series = requests.get(f'https://www.alphavantage.co/query?function=SMA&symbol={ticker}&interval=daily&time_period=10&series_type=close&apikey={APIKEY}').json()queries Alpha Vantage's Simple Moving Average (SMA) API and parse the data into a JSON dictionary through the.json()routine. Below is a sample JSON output from the SMA API:

{

"Meta Data": {

"1: Symbol": "AAPL",

"2: Indicator": "Simple Moving Average (SMA)",

"3: Last Refreshed": "2021-05-10",

"4: Interval": "daily",

"5: Time Period": 10,

"6: Series Type": "close",

"7: Time Zone": "US/Eastern"

},

"Technical Analysis: SMA": {

"2021-05-10": {

"SMA": "130.6427"

},

"2021-05-07": {

"SMA": "131.4070"

},

"2021-05-06": {

"SMA": "131.7953"

},

"2021-05-05": {

"SMA": "132.0150"

},

...

}

}

The remainder of the get_stock_data function (reproduced below) (1) packages up the adjusted close JSON data and the simple moving average JSON data into a single dictionary output_dictionary, (2) save the newly acquired stock data to database (so that we can recycle the data from the database next time without querying the Alpha Vantage APIs again), and (3) return the data back to the AJAX POST loop (via HttpResponse(json.dumps(output_dictionary), content_type='application/json')) for charting at the frontend.

#package up the data as a dictionary

output_dictionary['prices'] = price_series

output_dictionary['sma'] = sma_series

#save the dictionary to database

temp = StockData(symbol=ticker, data=json.dumps(output_dictionary))

temp.save()

#return the data back to the frontend AJAX call

return HttpResponse(json.dumps(output_dictionary), content_type='application/json')

This is it! We have implemented both the frontend (home.html) and the backend (views.py). These components can now "talk" to each other seamlessly and perform read/write interactions with the database.

URL routing

Just one last thing: let's update urls.py with the latest URL routings for the views we just created in views.py:

path("", stockVisualizer.views.home)makes sure thehomefunction inviews.pyis called when a user visits the homepage in their web browserpath('get_stock_data/', stockVisualizer.views.get_stock_data)makes sure theget_stock_datafunction inviews.pyis called when home.html makes an AJAX POST request to the/get_stock_data/URL.

from django.contrib import admin

from django.urls import path

import stockVisualizer.views

urlpatterns = [

path('admin/', admin.site.urls),

path("", stockVisualizer.views.home),

path('get_stock_data/', stockVisualizer.views.get_stock_data),

]Running the website locally

Now we are ready to run the website in your local environment.

Enter the following prompt in your command line window (please make sure you are still in the alphaVantage root directory):

(alphaVantage) $ python manage.py runserverIf you go to http://localhost:8000/ in your web browser (e.g., Chrome, Firefox, etc.), you should see the website in full action!

References

Source code: link

Food for thought #1: richer data visualization

The current web application supports the visualization of adjusted close prices and simple moving average (SMA) values for a given stock. We will leave it to your creativitiy to enrich the visualization. For example, how about plotting cryptocurrency prices along with the stock prices? How about adding more technical indicators to the chart or enable users to draw support/resistance lines directly on the chart? We look forward to your creation!

Food for thought #2: data freshness vs. website speed trade-off

In the get_stock_data function of views.py, we first search the local database for existing data of a given ticker before querying the Alpha Vantage APIs. In general, accessing data via local databases or in-memory caches is often faster (and computationally cheaper) than querying an online API. On the other hand, querying the Alpha Vantage API will guarantee you the latest data for a given ticker, while data in the local database is static in nature and will gradually become outdated over time. The trade-off (fresh data but lower website speed vs. stale data but faster website speed) is a common dilemma faced by developers of data-intensitve applications. Can you find a way out of this dilemma? For example, write a cron job to refresh the database on a daily basis so that the local data won't get outdated? Overall, database optimization is one of the most challenging yet rewarding tasks in the software development process.