# Importing packages for analysis

import numpy as np

import pandas as pd

from datetime import datetime as dt

import matplotlib .pyplot as plt

import seaborn as sns #Importing the dataset for analysis

loan = pd .read_csv ('loan.csv' )

loan .head (5 )D:\HP\Anaconda3\envs\AI\lib\site-packages\IPython\core\interactiveshell.py:3146: DtypeWarning: Columns (47) have mixed types.Specify dtype option on import or set low_memory=False.

interactivity=interactivity, compiler=compiler, result=result)

<style scoped>

.dataframe tbody tr th:only-of-type {

vertical-align: middle;

}

.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

</style>

id

member_id

loan_amnt

funded_amnt

funded_amnt_inv

term

int_rate

installment

grade

sub_grade

...

num_tl_90g_dpd_24m

num_tl_op_past_12m

pct_tl_nvr_dlq

percent_bc_gt_75

pub_rec_bankruptcies

tax_liens

tot_hi_cred_lim

total_bal_ex_mort

total_bc_limit

total_il_high_credit_limit

0

1077501

1296599

5000

5000

4975.0

36 months

10.65%

162.87

B

B2

...

NaN

NaN

NaN

NaN

0.0

0.0

NaN

NaN

NaN

NaN

1

1077430

1314167

2500

2500

2500.0

60 months

15.27%

59.83

C

C4

...

NaN

NaN

NaN

NaN

0.0

0.0

NaN

NaN

NaN

NaN

2

1077175

1313524

2400

2400

2400.0

36 months

15.96%

84.33

C

C5

...

NaN

NaN

NaN

NaN

0.0

0.0

NaN

NaN

NaN

NaN

3

1076863

1277178

10000

10000

10000.0

36 months

13.49%

339.31

C

C1

...

NaN

NaN

NaN

NaN

0.0

0.0

NaN

NaN

NaN

NaN

4

1075358

1311748

3000

3000

3000.0

60 months

12.69%

67.79

B

B5

...

NaN

NaN

NaN

NaN

0.0

0.0

NaN

NaN

NaN

NaN

5 rows × 111 columns

Structure of data: Size, Shape, Data Types.. # Size of the dataframe

loan .shape # Datatypes of all the columns

pd .set_option ('display.max_columns' , 200 )

pd .set_option ('display.max_rows' , 200 )

loan .dtypes id int64

member_id int64

loan_amnt int64

funded_amnt int64

funded_amnt_inv float64

term object

int_rate object

installment float64

grade object

sub_grade object

emp_title object

emp_length object

home_ownership object

annual_inc float64

verification_status object

issue_d object

loan_status object

pymnt_plan object

url object

desc object

purpose object

title object

zip_code object

addr_state object

dti float64

delinq_2yrs int64

earliest_cr_line object

inq_last_6mths int64

mths_since_last_delinq float64

mths_since_last_record float64

open_acc int64

pub_rec int64

revol_bal int64

revol_util object

total_acc int64

initial_list_status object

out_prncp float64

out_prncp_inv float64

total_pymnt float64

total_pymnt_inv float64

total_rec_prncp float64

total_rec_int float64

total_rec_late_fee float64

recoveries float64

collection_recovery_fee float64

last_pymnt_d object

last_pymnt_amnt float64

next_pymnt_d object

last_credit_pull_d object

collections_12_mths_ex_med float64

mths_since_last_major_derog float64

policy_code int64

application_type object

annual_inc_joint float64

dti_joint float64

verification_status_joint float64

acc_now_delinq int64

tot_coll_amt float64

tot_cur_bal float64

open_acc_6m float64

open_il_6m float64

open_il_12m float64

open_il_24m float64

mths_since_rcnt_il float64

total_bal_il float64

il_util float64

open_rv_12m float64

open_rv_24m float64

max_bal_bc float64

all_util float64

total_rev_hi_lim float64

inq_fi float64

total_cu_tl float64

inq_last_12m float64

acc_open_past_24mths float64

avg_cur_bal float64

bc_open_to_buy float64

bc_util float64

chargeoff_within_12_mths float64

delinq_amnt int64

mo_sin_old_il_acct float64

mo_sin_old_rev_tl_op float64

mo_sin_rcnt_rev_tl_op float64

mo_sin_rcnt_tl float64

mort_acc float64

mths_since_recent_bc float64

mths_since_recent_bc_dlq float64

mths_since_recent_inq float64

mths_since_recent_revol_delinq float64

num_accts_ever_120_pd float64

num_actv_bc_tl float64

num_actv_rev_tl float64

num_bc_sats float64

num_bc_tl float64

num_il_tl float64

num_op_rev_tl float64

num_rev_accts float64

num_rev_tl_bal_gt_0 float64

num_sats float64

num_tl_120dpd_2m float64

num_tl_30dpd float64

num_tl_90g_dpd_24m float64

num_tl_op_past_12m float64

pct_tl_nvr_dlq float64

percent_bc_gt_75 float64

pub_rec_bankruptcies float64

tax_liens float64

tot_hi_cred_lim float64

total_bal_ex_mort float64

total_bc_limit float64

total_il_high_credit_limit float64

dtype: object

#Summary of data

loan .describe (include = 'all' )

<style scoped>

.dataframe tbody tr th:only-of-type {

vertical-align: middle;

}

.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

</style>

id

member_id

loan_amnt

funded_amnt

funded_amnt_inv

term

int_rate

installment

grade

sub_grade

emp_title

emp_length

home_ownership

annual_inc

verification_status

issue_d

loan_status

pymnt_plan

url

desc

purpose

title

zip_code

addr_state

dti

delinq_2yrs

earliest_cr_line

inq_last_6mths

mths_since_last_delinq

mths_since_last_record

open_acc

pub_rec

revol_bal

revol_util

total_acc

initial_list_status

out_prncp

out_prncp_inv

total_pymnt

total_pymnt_inv

total_rec_prncp

total_rec_int

total_rec_late_fee

recoveries

collection_recovery_fee

last_pymnt_d

last_pymnt_amnt

next_pymnt_d

last_credit_pull_d

collections_12_mths_ex_med

mths_since_last_major_derog

policy_code

application_type

annual_inc_joint

dti_joint

verification_status_joint

acc_now_delinq

tot_coll_amt

tot_cur_bal

open_acc_6m

open_il_6m

open_il_12m

open_il_24m

mths_since_rcnt_il

total_bal_il

il_util

open_rv_12m

open_rv_24m

max_bal_bc

all_util

total_rev_hi_lim

inq_fi

total_cu_tl

inq_last_12m

acc_open_past_24mths

avg_cur_bal

bc_open_to_buy

bc_util

chargeoff_within_12_mths

delinq_amnt

mo_sin_old_il_acct

mo_sin_old_rev_tl_op

mo_sin_rcnt_rev_tl_op

mo_sin_rcnt_tl

mort_acc

mths_since_recent_bc

mths_since_recent_bc_dlq

mths_since_recent_inq

mths_since_recent_revol_delinq

num_accts_ever_120_pd

num_actv_bc_tl

num_actv_rev_tl

num_bc_sats

num_bc_tl

num_il_tl

num_op_rev_tl

num_rev_accts

num_rev_tl_bal_gt_0

num_sats

num_tl_120dpd_2m

num_tl_30dpd

num_tl_90g_dpd_24m

num_tl_op_past_12m

pct_tl_nvr_dlq

percent_bc_gt_75

pub_rec_bankruptcies

tax_liens

tot_hi_cred_lim

total_bal_ex_mort

total_bc_limit

total_il_high_credit_limit

count

3.971700e+04

3.971700e+04

39717.000000

39717.000000

39717.000000

39717

39717

39717.000000

39717

39717

37258

38642

39717

3.971700e+04

39717

39717

39717

39717

39717

26777

39717

39706

39717

39717

39717.000000

39717.000000

39717

39717.000000

14035.000000

2786.000000

39717.000000

39717.000000

39717.000000

39667

39717.000000

39717

39717.000000

39717.000000

39717.000000

39717.000000

39717.000000

39717.000000

39717.000000

39717.000000

39717.000000

39646

39717.000000

1140

39715

39661.0

0.0

39717.0

39717

0.0

0.0

0.0

39717.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

39661.0

39717.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

39020.000000

39678.0

0.0

0.0

0.0

0.0

unique

NaN

NaN

NaN

NaN

NaN

2

371

NaN

7

35

28820

11

5

NaN

3

55

3

1

39717

26527

14

19615

823

50

NaN

NaN

526

NaN

NaN

NaN

NaN

NaN

NaN

1089

NaN

1

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

101

NaN

2

106

NaN

NaN

NaN

1

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

top

NaN

NaN

NaN

NaN

NaN

36 months

10.99%

NaN

B

B3

US Army

10+ years

RENT

NaN

Not Verified

Dec-11

Fully Paid

n

https://lendingclub.com/browse/loanDetail.acti ...debt_consolidation

Debt Consolidation

100xx

CA

NaN

NaN

Nov-98

NaN

NaN

NaN

NaN

NaN

NaN

0%

NaN

f

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

May-16

NaN

Jun-16

May-16

NaN

NaN

NaN

INDIVIDUAL

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

freq

NaN

NaN

NaN

NaN

NaN

29096

956

NaN

12020

2917

134

8879

18899

NaN

16921

2260

32950

39717

1

210

18641

2184

597

7099

NaN

NaN

370

NaN

NaN

NaN

NaN

NaN

NaN

977

NaN

39717

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

1256

NaN

1125

10308

NaN

NaN

NaN

39717

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

mean

6.831319e+05

8.504636e+05

11219.443815

10947.713196

10397.448868

NaN

NaN

324.561922

NaN

NaN

NaN

NaN

NaN

6.896893e+04

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

13.315130

0.146512

NaN

0.869200

35.900962

69.698134

9.294408

0.055065

13382.528086

NaN

22.088828

NaN

51.227887

50.989768

12153.596544

11567.149118

9793.348813

2263.663172

1.363015

95.221624

12.406112

NaN

2678.826162

NaN

NaN

0.0

NaN

1.0

NaN

NaN

NaN

NaN

0.0

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

0.0

0.0

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

0.043260

0.0

NaN

NaN

NaN

NaN

std

2.106941e+05

2.656783e+05

7456.670694

7187.238670

7128.450439

NaN

NaN

208.874874

NaN

NaN

NaN

NaN

NaN

6.379377e+04

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

6.678594

0.491812

NaN

1.070219

22.020060

43.822529

4.400282

0.237200

15885.016641

NaN

11.401709

NaN

375.172839

373.824457

9042.040766

8942.672613

7065.522127

2608.111964

7.289979

688.744771

148.671593

NaN

4447.136012

NaN

NaN

0.0

NaN

0.0

NaN

NaN

NaN

NaN

0.0

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

0.0

0.0

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

0.204324

0.0

NaN

NaN

NaN

NaN

min

5.473400e+04

7.069900e+04

500.000000

500.000000

0.000000

NaN

NaN

15.690000

NaN

NaN

NaN

NaN

NaN

4.000000e+03

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

0.000000

0.000000

NaN

0.000000

0.000000

0.000000

2.000000

0.000000

0.000000

NaN

2.000000

NaN

0.000000

0.000000

0.000000

0.000000

0.000000

0.000000

0.000000

0.000000

0.000000

NaN

0.000000

NaN

NaN

0.0

NaN

1.0

NaN

NaN

NaN

NaN

0.0

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

0.0

0.0

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

0.000000

0.0

NaN

NaN

NaN

NaN

25%

5.162210e+05

6.667800e+05

5500.000000

5400.000000

5000.000000

NaN

NaN

167.020000

NaN

NaN

NaN

NaN

NaN

4.040400e+04

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

8.170000

0.000000

NaN

0.000000

18.000000

22.000000

6.000000

0.000000

3703.000000

NaN

13.000000

NaN

0.000000

0.000000

5576.930000

5112.310000

4600.000000

662.180000

0.000000

0.000000

0.000000

NaN

218.680000

NaN

NaN

0.0

NaN

1.0

NaN

NaN

NaN

NaN

0.0

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

0.0

0.0

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

0.000000

0.0

NaN

NaN

NaN

NaN

50%

6.656650e+05

8.508120e+05

10000.000000

9600.000000

8975.000000

NaN

NaN

280.220000

NaN

NaN

NaN

NaN

NaN

5.900000e+04

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

13.400000

0.000000

NaN

1.000000

34.000000

90.000000

9.000000

0.000000

8850.000000

NaN

20.000000

NaN

0.000000

0.000000

9899.640319

9287.150000

8000.000000

1348.910000

0.000000

0.000000

0.000000

NaN

546.140000

NaN

NaN

0.0

NaN

1.0

NaN

NaN

NaN

NaN

0.0

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

0.0

0.0

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

0.000000

0.0

NaN

NaN

NaN

NaN

75%

8.377550e+05

1.047339e+06

15000.000000

15000.000000

14400.000000

NaN

NaN

430.780000

NaN

NaN

NaN

NaN

NaN

8.230000e+04

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

18.600000

0.000000

NaN

1.000000

52.000000

104.000000

12.000000

0.000000

17058.000000

NaN

29.000000

NaN

0.000000

0.000000

16534.433040

15798.810000

13653.260000

2833.400000

0.000000

0.000000

0.000000

NaN

3293.160000

NaN

NaN

0.0

NaN

1.0

NaN

NaN

NaN

NaN

0.0

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

0.0

0.0

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

0.000000

0.0

NaN

NaN

NaN

NaN

max

1.077501e+06

1.314167e+06

35000.000000

35000.000000

35000.000000

NaN

NaN

1305.190000

NaN

NaN

NaN

NaN

NaN

6.000000e+06

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

29.990000

11.000000

NaN

8.000000

120.000000

129.000000

44.000000

4.000000

149588.000000

NaN

90.000000

NaN

6311.470000

6307.370000

58563.679930

58563.680000

35000.020000

23563.680000

180.200000

29623.350000

7002.190000

NaN

36115.200000

NaN

NaN

0.0

NaN

1.0

NaN

NaN

NaN

NaN

0.0

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

0.0

0.0

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

NaN

2.000000

0.0

NaN

NaN

NaN

NaN

# Lets check for duplicate records in our data.

loan .drop_duplicates ()

loan .shape

# seeems like there are none. # As we are interested to figure out if a borrower is defaulter or not, the loan_status of interest is FULLY PAID and CHARGED OFF

# Lets remove all loans with statuses = "CURRENT" as its uncertain as to know if they will repay the loan or not

loan = loan .loc [loan ['loan_status' ]!= 'Current' ]

loan .shape # Percentage of null values in columns

total = pd .DataFrame (loan .isnull ().sum ().sort_values (ascending = False ), columns = ['Total' ])

percentage = pd .DataFrame (round (100 * (loan .isnull ().sum ()/ loan .shape [0 ]),2 ).sort_values (ascending = False ),columns = ['Percentage' ])

pd .concat ([total , percentage ], axis = 1 )

<style scoped>

.dataframe tbody tr th:only-of-type {

vertical-align: middle;

}

.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

</style>

Total

Percentage

total_il_high_credit_limit

38577

100.00

il_util

38577

100.00

bc_util

38577

100.00

bc_open_to_buy

38577

100.00

avg_cur_bal

38577

100.00

acc_open_past_24mths

38577

100.00

inq_last_12m

38577

100.00

total_cu_tl

38577

100.00

inq_fi

38577

100.00

total_rev_hi_lim

38577

100.00

all_util

38577

100.00

max_bal_bc

38577

100.00

open_rv_24m

38577

100.00

open_rv_12m

38577

100.00

total_bal_il

38577

100.00

mo_sin_old_rev_tl_op

38577

100.00

mths_since_rcnt_il

38577

100.00

open_il_24m

38577

100.00

open_il_12m

38577

100.00

open_il_6m

38577

100.00

open_acc_6m

38577

100.00

tot_cur_bal

38577

100.00

tot_coll_amt

38577

100.00

total_bc_limit

38577

100.00

dti_joint

38577

100.00

annual_inc_joint

38577

100.00

mths_since_last_major_derog

38577

100.00

next_pymnt_d

38577

100.00

mo_sin_old_il_acct

38577

100.00

verification_status_joint

38577

100.00

mo_sin_rcnt_rev_tl_op

38577

100.00

num_il_tl

38577

100.00

total_bal_ex_mort

38577

100.00

tot_hi_cred_lim

38577

100.00

percent_bc_gt_75

38577

100.00

pct_tl_nvr_dlq

38577

100.00

num_tl_90g_dpd_24m

38577

100.00

num_tl_30dpd

38577

100.00

num_tl_120dpd_2m

38577

100.00

num_sats

38577

100.00

num_rev_tl_bal_gt_0

38577

100.00

num_rev_accts

38577

100.00

num_op_rev_tl

38577

100.00

num_tl_op_past_12m

38577

100.00

num_bc_tl

38577

100.00

num_bc_sats

38577

100.00

num_actv_rev_tl

38577

100.00

num_actv_bc_tl

38577

100.00

num_accts_ever_120_pd

38577

100.00

mths_since_recent_revol_delinq

38577

100.00

mths_since_recent_inq

38577

100.00

mths_since_recent_bc_dlq

38577

100.00

mths_since_recent_bc

38577

100.00

mort_acc

38577

100.00

mo_sin_rcnt_tl

38577

100.00

mths_since_last_record

35837

92.90

mths_since_last_delinq

24905

64.56

desc

12527

32.47

emp_title

2386

6.19

emp_length

1033

2.68

pub_rec_bankruptcies

697

1.81

last_pymnt_d

71

0.18

collections_12_mths_ex_med

56

0.15

chargeoff_within_12_mths

56

0.15

revol_util

50

0.13

tax_liens

39

0.10

title

11

0.03

last_credit_pull_d

2

0.01

purpose

0

0.00

verification_status

0

0.00

url

0

0.00

pymnt_plan

0

0.00

loan_status

0

0.00

issue_d

0

0.00

loan_amnt

0

0.00

annual_inc

0

0.00

home_ownership

0

0.00

sub_grade

0

0.00

grade

0

0.00

installment

0

0.00

int_rate

0

0.00

term

0

0.00

funded_amnt_inv

0

0.00

funded_amnt

0

0.00

addr_state

0

0.00

member_id

0

0.00

zip_code

0

0.00

total_rec_prncp

0

0.00

dti

0

0.00

total_pymnt_inv

0

0.00

acc_now_delinq

0

0.00

application_type

0

0.00

policy_code

0

0.00

last_pymnt_amnt

0

0.00

collection_recovery_fee

0

0.00

recoveries

0

0.00

total_rec_late_fee

0

0.00

total_rec_int

0

0.00

delinq_amnt

0

0.00

total_pymnt

0

0.00

delinq_2yrs

0

0.00

out_prncp_inv

0

0.00

out_prncp

0

0.00

initial_list_status

0

0.00

total_acc

0

0.00

revol_bal

0

0.00

pub_rec

0

0.00

open_acc

0

0.00

inq_last_6mths

0

0.00

earliest_cr_line

0

0.00

id

0

0.00

# Dropping all columns with only null values

loan = loan .dropna (axis = 1 ,how = 'all' )

loan .shape Checkout some of the categorical variables array(['10+ years', '< 1 year', '3 years', '8 years', '9 years',

'4 years', '5 years', '1 year', '6 years', '2 years', '7 years',

nan], dtype=object)

loan .collections_12_mths_ex_med .unique ()loan .chargeoff_within_12_mths .unique ()loan .pub_rec_bankruptcies .unique ()array([ 0., 1., 2., nan])

The columns collections_12_mths_ex_med, chargeoff_within_12_mths and tax_liens has either value of 0 or nan. The range of values that these categorical columns can take is not of any significant impact to the analysis. We can decide to drop these columns for analysis. # Removing columns that is not of interest for our analysis along with columns that has many null values

drop_columns = ['desc' ,'title' ,'url' ,'mths_since_last_record' ,'mths_since_last_delinq' ,'collections_12_mths_ex_med' ,

'last_pymnt_d' ,'revol_util' ,'collections_12_mths_ex_med' ,'chargeoff_within_12_mths' ,'tax_liens' ,

'pymnt_plan' ,'zip_code' ,'initial_list_status' ,'policy_code' ,'application_type' ,'acc_now_delinq' ,'delinq_amnt' ,]

loan = loan .drop (drop_columns , axis = 1 )

loan .shape # Percentage of null values in columns

total = pd .DataFrame (loan .isnull ().sum ().sort_values (ascending = False ), columns = ['Total' ])

percentage = pd .DataFrame (round (100 * (loan .isnull ().sum ()/ loan .shape [0 ]),2 ).sort_values (ascending = False ),columns = ['Percentage' ])

pd .concat ([total , percentage ], axis = 1 )

<style scoped>

.dataframe tbody tr th:only-of-type {

vertical-align: middle;

}

.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

</style>

Total

Percentage

emp_title

2386

6.19

emp_length

1033

2.68

pub_rec_bankruptcies

697

1.81

last_credit_pull_d

2

0.01

funded_amnt

0

0.00

funded_amnt_inv

0

0.00

term

0

0.00

int_rate

0

0.00

installment

0

0.00

grade

0

0.00

addr_state

0

0.00

loan_amnt

0

0.00

member_id

0

0.00

home_ownership

0

0.00

annual_inc

0

0.00

verification_status

0

0.00

issue_d

0

0.00

loan_status

0

0.00

purpose

0

0.00

sub_grade

0

0.00

dti

0

0.00

delinq_2yrs

0

0.00

earliest_cr_line

0

0.00

last_pymnt_amnt

0

0.00

collection_recovery_fee

0

0.00

recoveries

0

0.00

total_rec_late_fee

0

0.00

total_rec_int

0

0.00

total_rec_prncp

0

0.00

total_pymnt_inv

0

0.00

total_pymnt

0

0.00

out_prncp_inv

0

0.00

out_prncp

0

0.00

total_acc

0

0.00

revol_bal

0

0.00

pub_rec

0

0.00

open_acc

0

0.00

inq_last_6mths

0

0.00

id

0

0.00

The columns emp_title, emp_length and pub_rec_bankruptcies have 6.19%, 2.68% and 1.81% missing value respectively. These columns have information about the customer/borrower like their job title and their employment length in years.Lets treat the missing value as it is for our analysis as we do not want to add bias to data by imputing #loan=loan[~loan.emp_title.isnull()]

#loan=loan[~loan.emp_length.isnull()]

#loan=loan[~loan.pub_rec_bankruptcies.isnull()] # Percentage of null values in columns

total = pd .DataFrame (loan .isnull ().sum ().sort_values (ascending = False ), columns = ['Total' ])

percentage = pd .DataFrame (round (100 * (loan .isnull ().sum ()/ loan .shape [0 ]),2 ).sort_values (ascending = False ),columns = ['Percentage' ])

pd .concat ([total , percentage ], axis = 1 )

<style scoped>

.dataframe tbody tr th:only-of-type {

vertical-align: middle;

}

.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

</style>

Total

Percentage

emp_title

2386

6.19

emp_length

1033

2.68

pub_rec_bankruptcies

697

1.81

last_credit_pull_d

2

0.01

funded_amnt

0

0.00

funded_amnt_inv

0

0.00

term

0

0.00

int_rate

0

0.00

installment

0

0.00

grade

0

0.00

addr_state

0

0.00

loan_amnt

0

0.00

member_id

0

0.00

home_ownership

0

0.00

annual_inc

0

0.00

verification_status

0

0.00

issue_d

0

0.00

loan_status

0

0.00

purpose

0

0.00

sub_grade

0

0.00

dti

0

0.00

delinq_2yrs

0

0.00

earliest_cr_line

0

0.00

last_pymnt_amnt

0

0.00

collection_recovery_fee

0

0.00

recoveries

0

0.00

total_rec_late_fee

0

0.00

total_rec_int

0

0.00

total_rec_prncp

0

0.00

total_pymnt_inv

0

0.00

total_pymnt

0

0.00

out_prncp_inv

0

0.00

out_prncp

0

0.00

total_acc

0

0.00

revol_bal

0

0.00

pub_rec

0

0.00

open_acc

0

0.00

inq_last_6mths

0

0.00

id

0

0.00

#Standardise columns

loan .int_rate = loan .int_rate .apply (lambda x : x [:- 1 ]).astype ('float64' )#Lets have two columns 'Charged Off' and 'Fully Paid'

# Based on Loan status CHARGED_OFF column will have the value 1 if Loan status = 'Charged Off', else 0

# and FULLY_PAID column will have the value 1 if Loan status = 'Fully Paid', else 0

loan ['fully_paid' ] = loan ['loan_status' ].apply (lambda x : 1 if x == 'Fully Paid' else 0 )

loan ['charged_off' ] = loan ['loan_status' ].apply (lambda x : 1 if x == 'Charged Off' else 0 )

loan

<style scoped>

.dataframe tbody tr th:only-of-type {

vertical-align: middle;

}

.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

</style>

id

member_id

loan_amnt

funded_amnt

funded_amnt_inv

term

int_rate

installment

grade

sub_grade

emp_title

emp_length

home_ownership

annual_inc

verification_status

issue_d

loan_status

purpose

addr_state

dti

delinq_2yrs

earliest_cr_line

inq_last_6mths

open_acc

pub_rec

revol_bal

total_acc

out_prncp

out_prncp_inv

total_pymnt

total_pymnt_inv

total_rec_prncp

total_rec_int

total_rec_late_fee

recoveries

collection_recovery_fee

last_pymnt_amnt

last_credit_pull_d

pub_rec_bankruptcies

fully_paid

charged_off

0

1077501

1296599

5000

5000

4975.0

36 months

10.65

162.87

B

B2

NaN

10+ years

RENT

24000.0

Verified

Dec-11

Fully Paid

credit_card

AZ

27.65

0

Jan-85

1

3

0

13648

9

0.0

0.0

5863.155187

5833.84

5000.00

863.16

0.00

0.00

0.00

171.62

May-16

0.0

1

0

1

1077430

1314167

2500

2500

2500.0

60 months

15.27

59.83

C

C4

Ryder

< 1 year

RENT

30000.0

Source Verified

Dec-11

Charged Off

car

GA

1.00

0

Apr-99

5

3

0

1687

4

0.0

0.0

1008.710000

1008.71

456.46

435.17

0.00

117.08

1.11

119.66

Sep-13

0.0

0

1

2

1077175

1313524

2400

2400

2400.0

36 months

15.96

84.33

C

C5

NaN

10+ years

RENT

12252.0

Not Verified

Dec-11

Fully Paid

small_business

IL

8.72

0

Nov-01

2

2

0

2956

10

0.0

0.0

3005.666844

3005.67

2400.00

605.67

0.00

0.00

0.00

649.91

May-16

0.0

1

0

3

1076863

1277178

10000

10000

10000.0

36 months

13.49

339.31

C

C1

AIR RESOURCES BOARD

10+ years

RENT

49200.0

Source Verified

Dec-11

Fully Paid

other

CA

20.00

0

Feb-96

1

10

0

5598

37

0.0

0.0

12231.890000

12231.89

10000.00

2214.92

16.97

0.00

0.00

357.48

Apr-16

0.0

1

0

5

1075269

1311441

5000

5000

5000.0

36 months

7.90

156.46

A

A4

Veolia Transportaton

3 years

RENT

36000.0

Source Verified

Dec-11

Fully Paid

wedding

AZ

11.20

0

Nov-04

3

9

0

7963

12

0.0

0.0

5632.210000

5632.21

5000.00

632.21

0.00

0.00

0.00

161.03

Jan-16

0.0

1

0

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

39712

92187

92174

2500

2500

1075.0

36 months

8.07

78.42

A

A4

FiSite Research

4 years

MORTGAGE

110000.0

Not Verified

Jul-07

Fully Paid

home_improvement

CO

11.33

0

Nov-90

0

13

0

7274

40

0.0

0.0

2822.969293

1213.88

2500.00

322.97

0.00

0.00

0.00

80.90

Jun-10

NaN

1

0

39713

90665

90607

8500

8500

875.0

36 months

10.28

275.38

C

C1

Squarewave Solutions, Ltd.

3 years

RENT

18000.0

Not Verified

Jul-07

Fully Paid

credit_card

NC

6.40

1

Dec-86

1

6

0

8847

9

0.0

0.0

9913.491822

1020.51

8500.00

1413.49

0.00

0.00

0.00

281.94

Jul-10

NaN

1

0

39714

90395

90390

5000

5000

1325.0

36 months

8.07

156.84

A

A4

NaN

< 1 year

MORTGAGE

100000.0

Not Verified

Jul-07

Fully Paid

debt_consolidation

MA

2.30

0

Oct-98

0

11

0

9698

20

0.0

0.0

5272.161128

1397.12

5000.00

272.16

0.00

0.00

0.00

0.00

Jun-07

NaN

1

0

39715

90376

89243

5000

5000

650.0

36 months

7.43

155.38

A

A2

NaN

< 1 year

MORTGAGE

200000.0

Not Verified

Jul-07

Fully Paid

other

MD

3.72

0

Nov-88

0

17

0

85607

26

0.0

0.0

5174.198551

672.66

5000.00

174.20

0.00

0.00

0.00

0.00

Jun-07

NaN

1

0

39716

87023

86999

7500

7500

800.0

36 months

13.75

255.43

E

E2

Evergreen Center

< 1 year

OWN

22000.0

Not Verified

Jun-07

Fully Paid

debt_consolidation

MA

14.29

1

Oct-03

0

7

0

4175

8

0.0

0.0

9195.263334

980.83

7500.00

1695.26

0.00

0.00

0.00

256.59

Jun-10

NaN

1

0

38577 rows × 41 columns

#emp_lenght is a categorical variable and the values are as such seems to be fine and self explanatory

#As their value doesnt affect the analysis we need not modify it and lets make use of it as it is

loan .emp_length .value_counts ()10+ years 8488

< 1 year 4508

2 years 4291

3 years 4012

4 years 3342

5 years 3194

1 year 3169

6 years 2168

7 years 1711

8 years 1435

9 years 1226

Name: emp_length, dtype: int64

#Converting the dtype of issue date to datetime

loan .issue_d = pd .to_datetime (loan .issue_d , format = '%b-%y' )

loan .issue_d 0 2011-12-01

1 2011-12-01

2 2011-12-01

3 2011-12-01

5 2011-12-01

...

39712 2007-07-01

39713 2007-07-01

39714 2007-07-01

39715 2007-07-01

39716 2007-06-01

Name: issue_d, Length: 38577, dtype: datetime64[ns]

#split the available date into month and year column

loan ['issue_d_month' ] = loan ['issue_d' ].dt .month

loan ['issue_d_year' ] = loan ['issue_d' ].dt .year

<style scoped>

.dataframe tbody tr th:only-of-type {

vertical-align: middle;

}

.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

</style>

id

member_id

loan_amnt

funded_amnt

funded_amnt_inv

term

int_rate

installment

grade

sub_grade

emp_title

emp_length

home_ownership

annual_inc

verification_status

issue_d

loan_status

purpose

addr_state

dti

delinq_2yrs

earliest_cr_line

inq_last_6mths

open_acc

pub_rec

revol_bal

total_acc

out_prncp

out_prncp_inv

total_pymnt

total_pymnt_inv

total_rec_prncp

total_rec_int

total_rec_late_fee

recoveries

collection_recovery_fee

last_pymnt_amnt

last_credit_pull_d

pub_rec_bankruptcies

fully_paid

charged_off

issue_d_month

issue_d_year

0

1077501

1296599

5000

5000

4975.0

36 months

10.65

162.87

B

B2

NaN

10+ years

RENT

24000.0

Verified

2011-12-01

Fully Paid

credit_card

AZ

27.65

0

Jan-85

1

3

0

13648

9

0.0

0.0

5863.155187

5833.84

5000.00

863.16

0.00

0.00

0.00

171.62

May-16

0.0

1

0

12

2011

1

1077430

1314167

2500

2500

2500.0

60 months

15.27

59.83

C

C4

Ryder

< 1 year

RENT

30000.0

Source Verified

2011-12-01

Charged Off

car

GA

1.00

0

Apr-99

5

3

0

1687

4

0.0

0.0

1008.710000

1008.71

456.46

435.17

0.00

117.08

1.11

119.66

Sep-13

0.0

0

1

12

2011

2

1077175

1313524

2400

2400

2400.0

36 months

15.96

84.33

C

C5

NaN

10+ years

RENT

12252.0

Not Verified

2011-12-01

Fully Paid

small_business

IL

8.72

0

Nov-01

2

2

0

2956

10

0.0

0.0

3005.666844

3005.67

2400.00

605.67

0.00

0.00

0.00

649.91

May-16

0.0

1

0

12

2011

3

1076863

1277178

10000

10000

10000.0

36 months

13.49

339.31

C

C1

AIR RESOURCES BOARD

10+ years

RENT

49200.0

Source Verified

2011-12-01

Fully Paid

other

CA

20.00

0

Feb-96

1

10

0

5598

37

0.0

0.0

12231.890000

12231.89

10000.00

2214.92

16.97

0.00

0.00

357.48

Apr-16

0.0

1

0

12

2011

5

1075269

1311441

5000

5000

5000.0

36 months

7.90

156.46

A

A4

Veolia Transportaton

3 years

RENT

36000.0

Source Verified

2011-12-01

Fully Paid

wedding

AZ

11.20

0

Nov-04

3

9

0

7963

12

0.0

0.0

5632.210000

5632.21

5000.00

632.21

0.00

0.00

0.00

161.03

Jan-16

0.0

1

0

12

2011

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

39712

92187

92174

2500

2500

1075.0

36 months

8.07

78.42

A

A4

FiSite Research

4 years

MORTGAGE

110000.0

Not Verified

2007-07-01

Fully Paid

home_improvement

CO

11.33

0

Nov-90

0

13

0

7274

40

0.0

0.0

2822.969293

1213.88

2500.00

322.97

0.00

0.00

0.00

80.90

Jun-10

NaN

1

0

7

2007

39713

90665

90607

8500

8500

875.0

36 months

10.28

275.38

C

C1

Squarewave Solutions, Ltd.

3 years

RENT

18000.0

Not Verified

2007-07-01

Fully Paid

credit_card

NC

6.40

1

Dec-86

1

6

0

8847

9

0.0

0.0

9913.491822

1020.51

8500.00

1413.49

0.00

0.00

0.00

281.94

Jul-10

NaN

1

0

7

2007

39714

90395

90390

5000

5000

1325.0

36 months

8.07

156.84

A

A4

NaN

< 1 year

MORTGAGE

100000.0

Not Verified

2007-07-01

Fully Paid

debt_consolidation

MA

2.30

0

Oct-98

0

11

0

9698

20

0.0

0.0

5272.161128

1397.12

5000.00

272.16

0.00

0.00

0.00

0.00

Jun-07

NaN

1

0

7

2007

39715

90376

89243

5000

5000

650.0

36 months

7.43

155.38

A

A2

NaN

< 1 year

MORTGAGE

200000.0

Not Verified

2007-07-01

Fully Paid

other

MD

3.72

0

Nov-88

0

17

0

85607

26

0.0

0.0

5174.198551

672.66

5000.00

174.20

0.00

0.00

0.00

0.00

Jun-07

NaN

1

0

7

2007

39716

87023

86999

7500

7500

800.0

36 months

13.75

255.43

E

E2

Evergreen Center

< 1 year

OWN

22000.0

Not Verified

2007-06-01

Fully Paid

debt_consolidation

MA

14.29

1

Oct-03

0

7

0

4175

8

0.0

0.0

9195.263334

980.83

7500.00

1695.26

0.00

0.00

0.00

256.59

Jun-10

NaN

1

0

6

2007

38577 rows × 43 columns

Derived Metrics for our analysis count 38577.000000

mean 11.932219

std 3.691327

min 5.420000

25% 8.940000

50% 11.710000

75% 14.380000

max 24.400000

Name: int_rate, dtype: float64

# Binning the interest rates into different slots

def interest_rate_slot (loan ,cut_points ,label_names ):

column_index = loan .columns .get_loc ('int_rate' ) + 1

loan .insert (loc = column_index ,column = 'interest_rate_bins' ,value = pd .cut (loan ['int_rate' ],cut_points ,labels = label_names , include_lowest = True ))

return loan

cut_points = [5 ,10 ,15 ,25 ]

label_names = ["Low" ,"Medium" ,"High" ]

loan = interest_rate_slot (loan ,cut_points ,label_names )

loan .head ()

<style scoped>

.dataframe tbody tr th:only-of-type {

vertical-align: middle;

}

.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

</style>

id

member_id

loan_amnt

funded_amnt

funded_amnt_inv

term

int_rate

interest_rate_bins

installment

grade

sub_grade

emp_title

emp_length

home_ownership

annual_inc

verification_status

issue_d

loan_status

purpose

addr_state

dti

delinq_2yrs

earliest_cr_line

inq_last_6mths

open_acc

pub_rec

revol_bal

total_acc

out_prncp

out_prncp_inv

total_pymnt

total_pymnt_inv

total_rec_prncp

total_rec_int

total_rec_late_fee

recoveries

collection_recovery_fee

last_pymnt_amnt

last_credit_pull_d

pub_rec_bankruptcies

fully_paid

charged_off

issue_d_month

issue_d_year

0

1077501

1296599

5000

5000

4975.0

36 months

10.65

Medium

162.87

B

B2

NaN

10+ years

RENT

24000.0

Verified

2011-12-01

Fully Paid

credit_card

AZ

27.65

0

Jan-85

1

3

0

13648

9

0.0

0.0

5863.155187

5833.84

5000.00

863.16

0.00

0.00

0.00

171.62

May-16

0.0

1

0

12

2011

1

1077430

1314167

2500

2500

2500.0

60 months

15.27

High

59.83

C

C4

Ryder

< 1 year

RENT

30000.0

Source Verified

2011-12-01

Charged Off

car

GA

1.00

0

Apr-99

5

3

0

1687

4

0.0

0.0

1008.710000

1008.71

456.46

435.17

0.00

117.08

1.11

119.66

Sep-13

0.0

0

1

12

2011

2

1077175

1313524

2400

2400

2400.0

36 months

15.96

High

84.33

C

C5

NaN

10+ years

RENT

12252.0

Not Verified

2011-12-01

Fully Paid

small_business

IL

8.72

0

Nov-01

2

2

0

2956

10

0.0

0.0

3005.666844

3005.67

2400.00

605.67

0.00

0.00

0.00

649.91

May-16

0.0

1

0

12

2011

3

1076863

1277178

10000

10000

10000.0

36 months

13.49

Medium

339.31

C

C1

AIR RESOURCES BOARD

10+ years

RENT

49200.0

Source Verified

2011-12-01

Fully Paid

other

CA

20.00

0

Feb-96

1

10

0

5598

37

0.0

0.0

12231.890000

12231.89

10000.00

2214.92

16.97

0.00

0.00

357.48

Apr-16

0.0

1

0

12

2011

5

1075269

1311441

5000

5000

5000.0

36 months

7.90

Low

156.46

A

A4

Veolia Transportaton

3 years

RENT

36000.0

Source Verified

2011-12-01

Fully Paid

wedding

AZ

11.20

0

Nov-04

3

9

0

7963

12

0.0

0.0

5632.210000

5632.21

5000.00

632.21

0.00

0.00

0.00

161.03

Jan-16

0.0

1

0

12

2011

# Binning the dti values

def dti_slot (loan ,cut_points ,label_names ):

column_index = loan .columns .get_loc ('dti' ) + 1

loan .insert (loc = column_index ,column = 'dti_bins' ,value = pd .cut (loan ['dti' ],cut_points ,labels = label_names , include_lowest = True ))

return loan

cut_points = [0 ,5 ,10 ,15 ,20 ,25 ,30 ]

label_names = ["Less Than 5" ,"Btwn 5 & 10" ,"Btwn 10 & 15" ,"Btwn 15 & 20" ,"Btwn 20 & 25" ,"Btwn 25 & 30" ]

loan = dti_slot (loan ,cut_points ,label_names )

loan .head ()

<style scoped>

.dataframe tbody tr th:only-of-type {

vertical-align: middle;

}

.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

</style>

id

member_id

loan_amnt

funded_amnt

funded_amnt_inv

term

int_rate

interest_rate_bins

installment

grade

sub_grade

emp_title

emp_length

home_ownership

annual_inc

verification_status

issue_d

loan_status

purpose

addr_state

dti

dti_bins

delinq_2yrs

earliest_cr_line

inq_last_6mths

open_acc

pub_rec

revol_bal

total_acc

out_prncp

out_prncp_inv

total_pymnt

total_pymnt_inv

total_rec_prncp

total_rec_int

total_rec_late_fee

recoveries

collection_recovery_fee

last_pymnt_amnt

last_credit_pull_d

pub_rec_bankruptcies

fully_paid

charged_off

issue_d_month

issue_d_year

0

1077501

1296599

5000

5000

4975.0

36 months

10.65

Medium

162.87

B

B2

NaN

10+ years

RENT

24000.0

Verified

2011-12-01

Fully Paid

credit_card

AZ

27.65

Btwn 25 & 30

0

Jan-85

1

3

0

13648

9

0.0

0.0

5863.155187

5833.84

5000.00

863.16

0.00

0.00

0.00

171.62

May-16

0.0

1

0

12

2011

1

1077430

1314167

2500

2500

2500.0

60 months

15.27

High

59.83

C

C4

Ryder

< 1 year

RENT

30000.0

Source Verified

2011-12-01

Charged Off

car

GA

1.00

Less Than 5

0

Apr-99

5

3

0

1687

4

0.0

0.0

1008.710000

1008.71

456.46

435.17

0.00

117.08

1.11

119.66

Sep-13

0.0

0

1

12

2011

2

1077175

1313524

2400

2400

2400.0

36 months

15.96

High

84.33

C

C5

NaN

10+ years

RENT

12252.0

Not Verified

2011-12-01

Fully Paid

small_business

IL

8.72

Btwn 5 & 10

0

Nov-01

2

2

0

2956

10

0.0

0.0

3005.666844

3005.67

2400.00

605.67

0.00

0.00

0.00

649.91

May-16

0.0

1

0

12

2011

3

1076863

1277178

10000

10000

10000.0

36 months

13.49

Medium

339.31

C

C1

AIR RESOURCES BOARD

10+ years

RENT

49200.0

Source Verified

2011-12-01

Fully Paid

other

CA

20.00

Btwn 15 & 20

0

Feb-96

1

10

0

5598

37

0.0

0.0

12231.890000

12231.89

10000.00

2214.92

16.97

0.00

0.00

357.48

Apr-16

0.0

1

0

12

2011

5

1075269

1311441

5000

5000

5000.0

36 months

7.90

Low

156.46

A

A4

Veolia Transportaton

3 years

RENT

36000.0

Source Verified

2011-12-01

Fully Paid

wedding

AZ

11.20

Btwn 10 & 15

0

Nov-04

3

9

0

7963

12

0.0

0.0

5632.210000

5632.21

5000.00

632.21

0.00

0.00

0.00

161.03

Jan-16

0.0

1

0

12

2011

<style scoped>

.dataframe tbody tr th:only-of-type {

vertical-align: middle;

}

.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

</style>

id

member_id

loan_amnt

funded_amnt

funded_amnt_inv

term

int_rate

interest_rate_bins

installment

grade

sub_grade

emp_title

emp_length

home_ownership

annual_inc

verification_status

issue_d

loan_status

purpose

addr_state

dti

dti_bins

delinq_2yrs

earliest_cr_line

inq_last_6mths

open_acc

pub_rec

revol_bal

total_acc

out_prncp

out_prncp_inv

total_pymnt

total_pymnt_inv

total_rec_prncp

total_rec_int

total_rec_late_fee

recoveries

collection_recovery_fee

last_pymnt_amnt

last_credit_pull_d

pub_rec_bankruptcies

fully_paid

charged_off

issue_d_month

issue_d_year

0

1077501

1296599

5000

5000

4975.0

36 months

10.65

Medium

162.87

B

B2

NaN

10+ years

RENT

24000.0

Verified

2011-12-01

Fully Paid

credit_card

AZ

27.65

Btwn 25 & 30

0

Jan-85

1

3

0

13648

9

0.0

0.0

5863.155187

5833.84

5000.00

863.16

0.00

0.00

0.00

171.62

May-16

0.0

1

0

12

2011

1

1077430

1314167

2500

2500

2500.0

60 months

15.27

High

59.83

C

C4

Ryder

< 1 year

RENT

30000.0

Source Verified

2011-12-01

Charged Off

car

GA

1.00

Less Than 5

0

Apr-99

5

3

0

1687

4

0.0

0.0

1008.710000

1008.71

456.46

435.17

0.00

117.08

1.11

119.66

Sep-13

0.0

0

1

12

2011

2

1077175

1313524

2400

2400

2400.0

36 months

15.96

High

84.33

C

C5

NaN

10+ years

RENT

12252.0

Not Verified

2011-12-01

Fully Paid

small_business

IL

8.72

Btwn 5 & 10

0

Nov-01

2

2

0

2956

10

0.0

0.0

3005.666844

3005.67

2400.00

605.67

0.00

0.00

0.00

649.91

May-16

0.0

1

0

12

2011

3

1076863

1277178

10000

10000

10000.0

36 months

13.49

Medium

339.31

C

C1

AIR RESOURCES BOARD

10+ years

RENT

49200.0

Source Verified

2011-12-01

Fully Paid

other

CA

20.00

Btwn 15 & 20

0

Feb-96

1

10

0

5598

37

0.0

0.0

12231.890000

12231.89

10000.00

2214.92

16.97

0.00

0.00

357.48

Apr-16

0.0

1

0

12

2011

5

1075269

1311441

5000

5000

5000.0

36 months

7.90

Low

156.46

A

A4

Veolia Transportaton

3 years

RENT

36000.0

Source Verified

2011-12-01

Fully Paid

wedding

AZ

11.20

Btwn 10 & 15

0

Nov-04

3

9

0

7963

12

0.0

0.0

5632.210000

5632.21

5000.00

632.21

0.00

0.00

0.00

161.03

Jan-16

0.0

1

0

12

2011

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

39712

92187

92174

2500

2500

1075.0

36 months

8.07

Low

78.42

A

A4

FiSite Research

4 years

MORTGAGE

110000.0

Not Verified

2007-07-01

Fully Paid

home_improvement

CO

11.33

Btwn 10 & 15

0

Nov-90

0

13

0

7274

40

0.0

0.0

2822.969293

1213.88

2500.00

322.97

0.00

0.00

0.00

80.90

Jun-10

NaN

1

0

7

2007

39713

90665

90607

8500

8500

875.0

36 months

10.28

Medium

275.38

C

C1

Squarewave Solutions, Ltd.

3 years

RENT

18000.0

Not Verified

2007-07-01

Fully Paid

credit_card

NC

6.40

Btwn 5 & 10

1

Dec-86

1

6

0

8847

9

0.0

0.0

9913.491822

1020.51

8500.00

1413.49

0.00

0.00

0.00

281.94

Jul-10

NaN

1

0

7

2007

39714

90395

90390

5000

5000

1325.0

36 months

8.07

Low

156.84

A

A4

NaN

< 1 year

MORTGAGE

100000.0

Not Verified

2007-07-01

Fully Paid

debt_consolidation

MA

2.30

Less Than 5

0

Oct-98

0

11

0

9698

20

0.0

0.0

5272.161128

1397.12

5000.00

272.16

0.00

0.00

0.00

0.00

Jun-07

NaN

1

0

7

2007

39715

90376

89243

5000

5000

650.0

36 months

7.43

Low

155.38

A

A2

NaN

< 1 year

MORTGAGE

200000.0

Not Verified

2007-07-01

Fully Paid

other

MD

3.72

Less Than 5

0

Nov-88

0

17

0

85607

26

0.0

0.0

5174.198551

672.66

5000.00

174.20

0.00

0.00

0.00

0.00

Jun-07

NaN

1

0

7

2007

39716

87023

86999

7500

7500

800.0

36 months

13.75

Medium

255.43

E

E2

Evergreen Center

< 1 year

OWN

22000.0

Not Verified

2007-06-01

Fully Paid

debt_consolidation

MA

14.29

Btwn 10 & 15

1

Oct-03

0

7

0

4175

8

0.0

0.0

9195.263334

980.83

7500.00

1695.26

0.00

0.00

0.00

256.59

Jun-10

NaN

1

0

6

2007

38577 rows × 45 columns

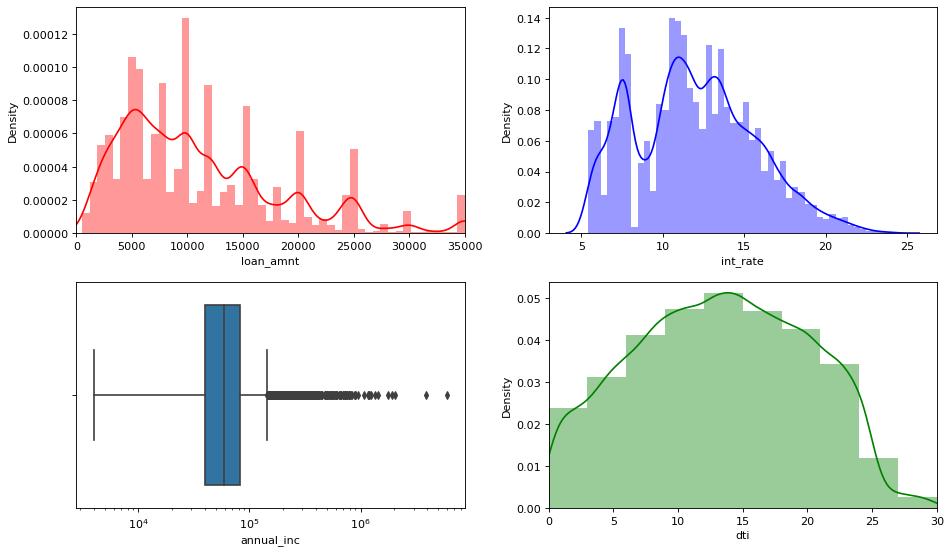

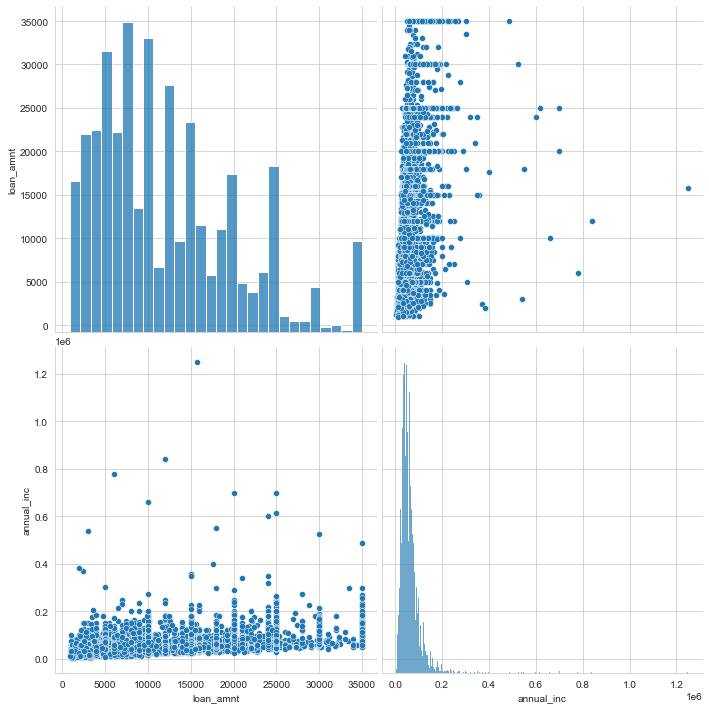

Lets us observe some general trend in Loans based on factors such as loan amounts, interest rates, annual income and dti #charged_off = loan.loc[loan['loan_status']=='Charged Off']

plt .figure (figsize = (12 , 10 ), dpi = 80 , facecolor = 'w' , edgecolor = 'k' )

# subplot 1: loan_amnt

plt .subplot (3 , 2 , 1 )

sns .distplot (loan ['loan_amnt' ], color = 'red' )

plt .xlim ([0 , 35000 ])

# subplot 2: int_rate

plt .subplot (3 , 2 , 2 )

sns .distplot (loan ['int_rate' ], color = 'blue' )

# subplot 3: annual_inc

plt .subplot (3 , 2 , 3 )

plt .xscale ('log' )

sns .boxplot ('annual_inc' , data = loan )

# subplot 4: dti

plt .subplot (3 , 2 , 4 )

sns .distplot (loan ['dti' ], color = 'green' , bins = 10 )

plt .xlim ([0 , 30 ])

plt .tight_layout ()

plt .show ()D:\HP\Anaconda3\envs\AI\lib\site-packages\seaborn\distributions.py:2551: FutureWarning: `distplot` is a deprecated function and will be removed in a future version. Please adapt your code to use either `displot` (a figure-level function with similar flexibility) or `histplot` (an axes-level function for histograms).

warnings.warn(msg, FutureWarning)

D:\HP\Anaconda3\envs\AI\lib\site-packages\seaborn\distributions.py:2551: FutureWarning: `distplot` is a deprecated function and will be removed in a future version. Please adapt your code to use either `displot` (a figure-level function with similar flexibility) or `histplot` (an axes-level function for histograms).

warnings.warn(msg, FutureWarning)

D:\HP\Anaconda3\envs\AI\lib\site-packages\seaborn\_decorators.py:43: FutureWarning: Pass the following variable as a keyword arg: x. From version 0.12, the only valid positional argument will be `data`, and passing other arguments without an explicit keyword will result in an error or misinterpretation.

FutureWarning

D:\HP\Anaconda3\envs\AI\lib\site-packages\seaborn\distributions.py:2551: FutureWarning: `distplot` is a deprecated function and will be removed in a future version. Please adapt your code to use either `displot` (a figure-level function with similar flexibility) or `histplot` (an axes-level function for histograms).

warnings.warn(msg, FutureWarning)

We can see that most of the loans are in the range of 2000 to 16000.

Most Loan interest rates are in between 5% to 10% and 10% to 15%, the trend decreases after 15.

The frequency distribution of dti seems to be symmetric in nature centered around 15.

There are quite a few top outlier values in annual income of borrowers.

Some more Insights based on factors like loan terms, grades, employess lengths, home ownerships, loan verification status, loan purpose and derogatory public records` plt .figure (figsize = (12 , 12 ), dpi = 80 , facecolor = 'w' , edgecolor = 'k' )

# subplot 1: Terms

plt .subplot (4 , 2 , 1 )

sns .countplot (x = 'term' , palette = 'coolwarm' , data = loan )

# subplot 2: Grade

plt .subplot (4 , 2 , 2 )

sns .countplot (x = 'grade' , palette = 'BrBG' , data = loan )

# subplot 3: Emp_length

plt .subplot (4 , 2 , 3 )

sns .countplot (y = 'emp_length' , palette = 'BrBG' , data = loan )

# subplot 4: home_ownership

plt .subplot (4 , 2 , 4 )

sns .countplot (x = 'home_ownership' , palette = 'coolwarm' , data = loan )

# subplot 5: verification_status

plt .subplot (4 , 2 , 5 )

sns .countplot (x = 'verification_status' , palette = 'coolwarm' , data = loan )

# subplot 6: loan_status

plt .subplot (4 , 2 , 6 )

sns .countplot (x = 'loan_status' , palette = 'BrBG' , data = loan )

# subplot 7: purpose

plt .subplot (4 , 2 , 7 )

sns .countplot (y = 'purpose' , palette = 'BrBG' , data = loan )

plt .tight_layout ()

plt .show ()

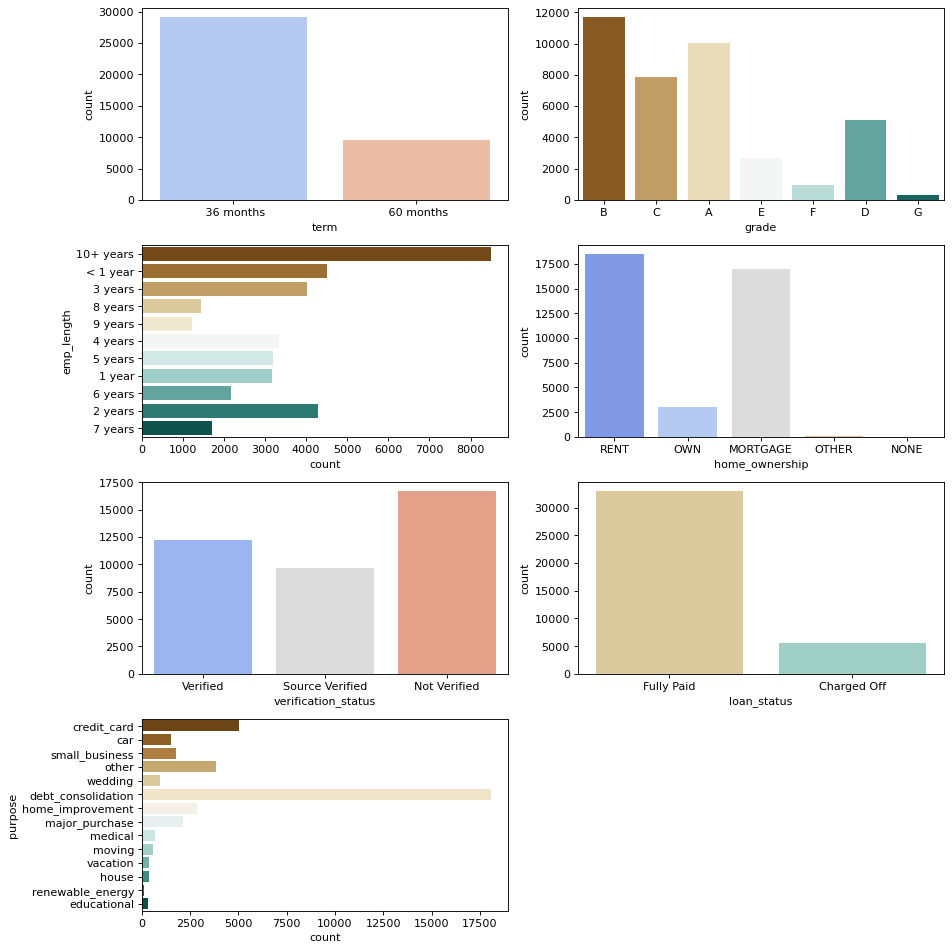

Most of the approved loans seems to be having loan term of 36 months.

B, A and C Grade loans seems to be more compared to others

We can say that most loans are borrowed by people with either 0-3 years of exp or greater than 10 years.

Rented homes and mortgage seems to be predominant over people who own a house.

Most of the accepted loans are not verified.

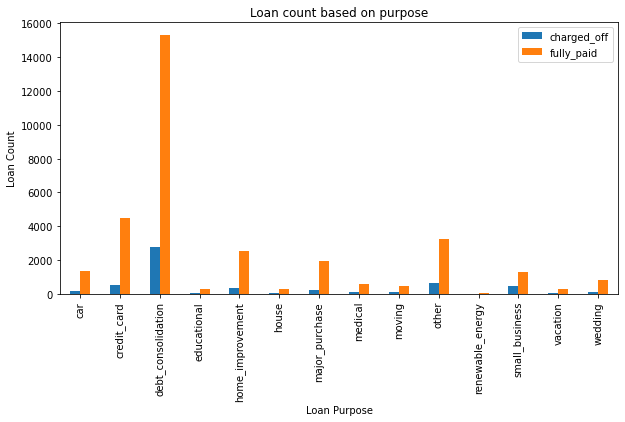

About 1/6th of all accepted loans are 'Charged off'. The rest are fully paid.

Debt consolidation and Credit card loan appears to be the primary purpose for loan application .

print ("%.2f" % (loan .loc [loan ['loan_status' ] == 'Charged Off' ].loan_status .count () * 100 / len (loan )))Approximately 14.6% of loans in the dataset are defaulted.

loan_purpose = pd .DataFrame (loan .groupby ('purpose' )['charged_off' ,'fully_paid' ].sum ().reset_index ())

loan_purpose D:\HP\Anaconda3\envs\AI\lib\site-packages\ipykernel_launcher.py:1: FutureWarning: Indexing with multiple keys (implicitly converted to a tuple of keys) will be deprecated, use a list instead.

"""Entry point for launching an IPython kernel.

<style scoped>

.dataframe tbody tr th:only-of-type {

vertical-align: middle;

}

.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

</style>

purpose

charged_off

fully_paid

0

car

160

1339

1

credit_card

542

4485

2

debt_consolidation

2767

15288

3

educational

56

269

4

home_improvement

347

2528

5

house

59

308

6

major_purchase

222

1928

7

medical

106

575

8

moving

92

484

9

other

633

3232

10

renewable_energy

19

83

11

small_business

475

1279

12

vacation

53

322

13

wedding

96

830

#bar chart

loan_purpose .plot .bar (x = 'purpose' , y = ['charged_off' ,'fully_paid' ],figsize = [10 ,5 ])

plt .ylabel ('Loan Count' )

plt .xlabel ('Loan Purpose' )

plt .title ("Loan count based on purpose" )Text(0.5, 1.0, 'Loan count based on purpose')

# Calculate percentage

r = [0 ,1 ,2 ,3 ,4 ,5 ,6 ,7 ,8 ,9 ,10 ,11 ,12 ,13 ]

totals = [i + j for i ,j in zip (loan_purpose ['charged_off' ], loan_purpose ['fully_paid' ])]

charged_off = [i / j * 100 for i ,j in zip (loan_purpose ['charged_off' ], totals )]

fully_paid = [i / j * 100 for i ,j in zip (loan_purpose ['fully_paid' ], totals )]

names = list (loan_purpose ['purpose' ])

# plot

plt .figure (figsize = (8 , 15 ), dpi = 80 , facecolor = 'w' , edgecolor = 'k' )

# subplot 1: stacked bar

plt .subplot (3 , 1 , 1 )

barWidth = 0.85

# Create charged_off Bars

plt .bar (r , charged_off , color = '#b5ffb9' , edgecolor = 'white' , width = barWidth )

# Create fully paid Bars

plt .bar (r , fully_paid , bottom = [i for i in charged_off ], color = '#a3acff' , edgecolor = 'white' , width = barWidth )

# Custom x axis

plt .xticks (r , names , rotation = 'vertical' )

plt .legend (['charged_off' ,'fully_paid' ],frameon = True , fontsize = 'small' , shadow = 'True' , title = 'Loan Status' , bbox_to_anchor = (1.05 , 1 ), loc = 2 , borderaxespad = 0. )

plt .title ("Percentage of Defaulted Loans out of Total loans for different types of loans" )Text(0.5, 1.0, 'Percentage of Defaulted Loans out of Total loans for different types of loans')

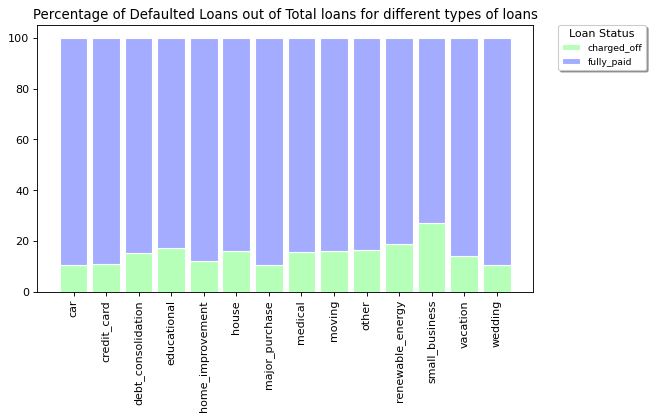

Small business have highest % of charged off loans.

Debt_consolidation has highest no of charged off loans.

loan_term = pd .DataFrame (loan .groupby ('term' )['charged_off' ,'fully_paid' ].sum ().reset_index ())

loan_term D:\HP\Anaconda3\envs\AI\lib\site-packages\ipykernel_launcher.py:1: FutureWarning: Indexing with multiple keys (implicitly converted to a tuple of keys) will be deprecated, use a list instead.

"""Entry point for launching an IPython kernel.

<style scoped>

.dataframe tbody tr th:only-of-type {

vertical-align: middle;

}

.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

</style>

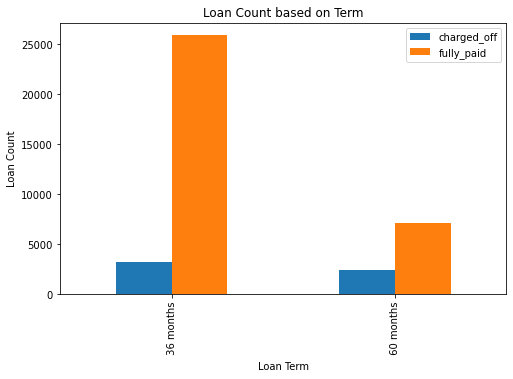

term

charged_off

fully_paid

0

36 months

3227

25869

1

60 months

2400

7081

#bar chart

loan_term .plot .bar (x = 'term' , y = ['charged_off' ,'fully_paid' ],figsize = [8 ,5 ])

plt .ylabel ('Loan Count' )

plt .xlabel ('Loan Term' )

plt .title ("Loan Count based on Term" )Text(0.5, 1.0, 'Loan Count based on Term')

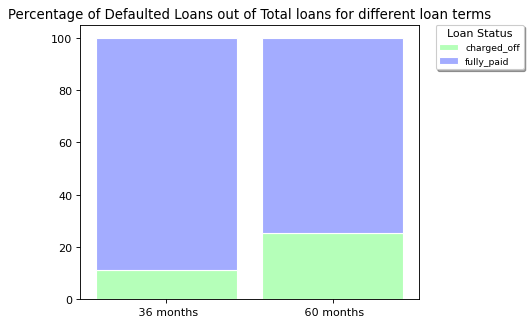

#Calculate percentage

r = [0 ,1 ]

totals = [i + j for i ,j in zip (loan_term ['charged_off' ], loan_term ['fully_paid' ])]

charged_off = [i / j * 100 for i ,j in zip (loan_term ['charged_off' ], totals )]

fully_paid = [i / j * 100 for i ,j in zip (loan_term ['fully_paid' ], totals )]

names = list (loan_term ['term' ])

# plot

plt .figure (figsize = (12 , 10 ), dpi = 80 , facecolor = 'w' , edgecolor = 'k' )

#stacked bar

plt .subplot (2 , 2 , 1 )

barWidth = 0.85

# Create charged_off Bars

plt .bar (r , charged_off , color = '#b5ffb9' , edgecolor = 'white' , width = barWidth )

# Create fully paid Bars

plt .bar (r , fully_paid , bottom = [i for i in charged_off ], color = '#a3acff' , edgecolor = 'white' , width = barWidth )

# Custom x axis

plt .xticks (r , names )

plt .legend (['charged_off' ,'fully_paid' ],frameon = True , fontsize = 'small' , shadow = 'True' , title = 'Loan Status' , bbox_to_anchor = (1.05 , 1 ), loc = 2 , borderaxespad = 0. )

plt .title ("Percentage of Defaulted Loans out of Total loans for different loan terms" )Text(0.5, 1.0, 'Percentage of Defaulted Loans out of Total loans for different loan terms')

Loans whose term is over 60 months have deafault rate that is twice that of deafault rate of loans whose term is 36 months.

We can also observe that more deafulters are observed in loans that spans over 36 months as compared to loans that spans over 60months

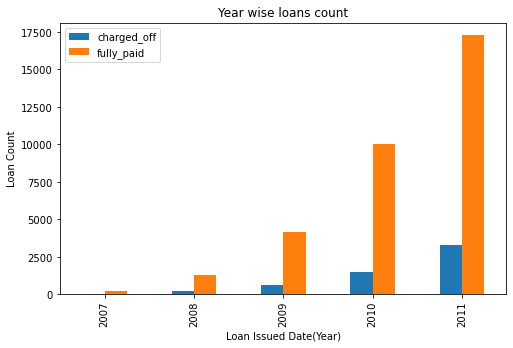

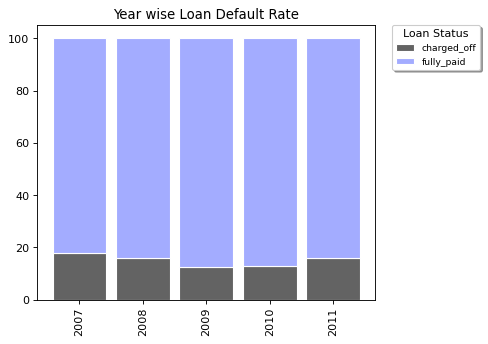

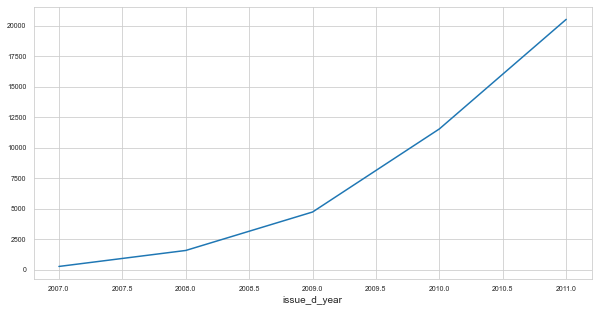

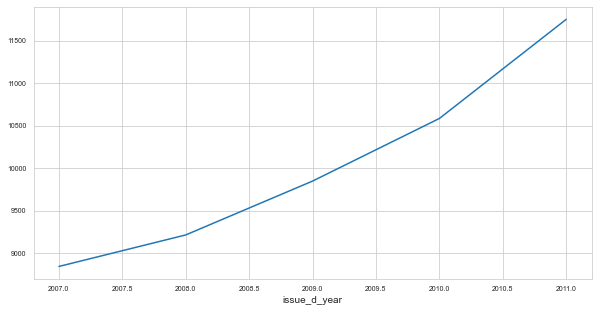

loan_issue_yr = pd .DataFrame (loan .groupby ('issue_d_year' )['charged_off' ,'fully_paid' ].sum ().reset_index ())

loan_issue_yr D:\HP\Anaconda3\envs\AI\lib\site-packages\ipykernel_launcher.py:1: FutureWarning: Indexing with multiple keys (implicitly converted to a tuple of keys) will be deprecated, use a list instead.

"""Entry point for launching an IPython kernel.

<style scoped>

.dataframe tbody tr th:only-of-type {

vertical-align: middle;

}

.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

</style>

issue_d_year

charged_off

fully_paid

0

2007

45

206

1

2008

247

1315

2

2009

594

4122

3

2010

1485

10047

4

2011

3256

17260

#bar chart