Stock return prediction using machine learning methods.

Historical stock data for Apple Inc. from Yahoo Finance up until the 30th of May, 2023.

df = yf.Ticker(ticker).history(period=period, prepost=True)To predict whether or not the stock price will increase the following day.

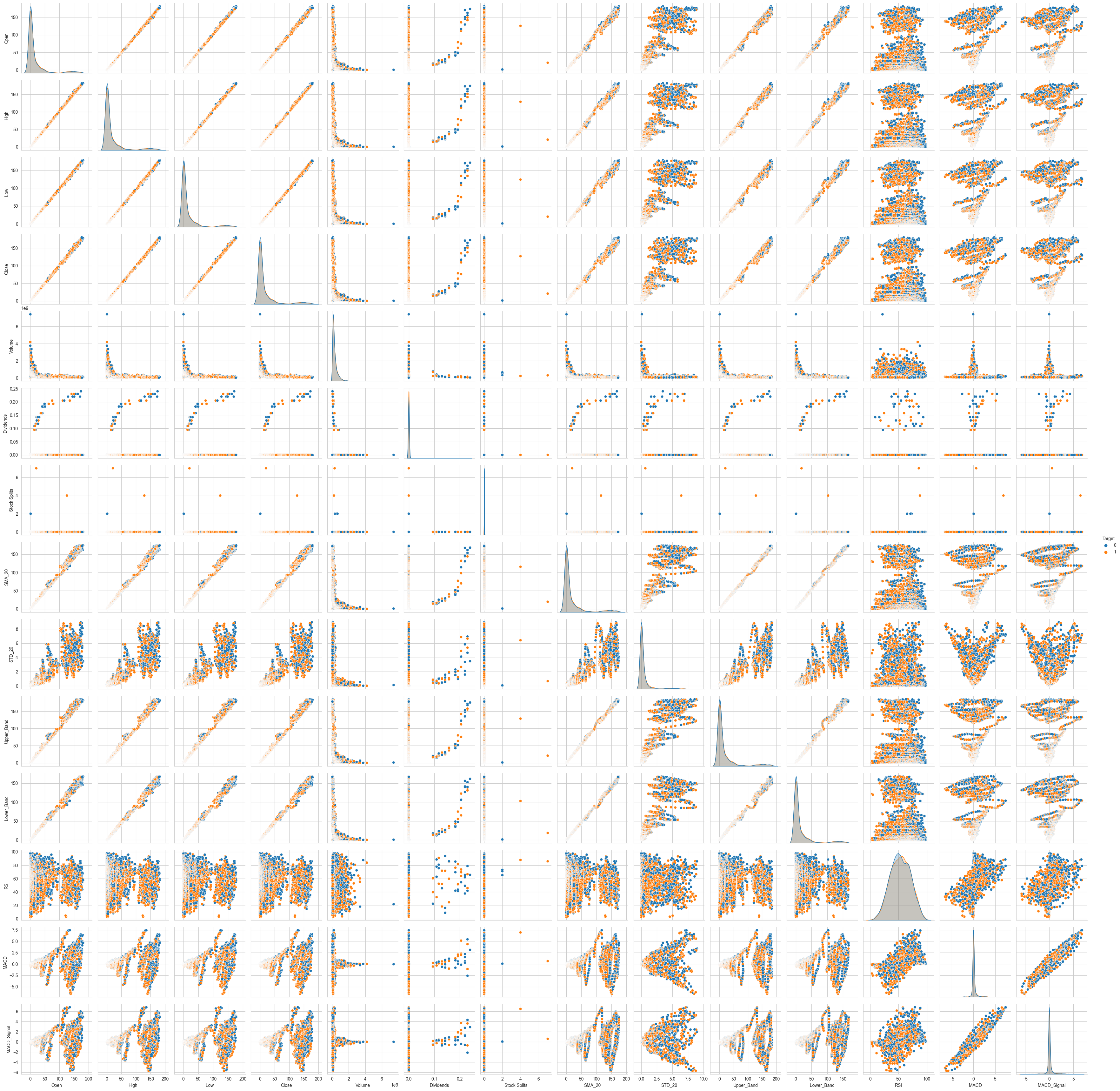

df['Target'] = np.where(df['Close'].shift(-1) > df['Close'], 1, 0) Based on the Open/Close plot and High/Low plot, the price of Apple's stock has been steadily increasing with some fluctuations. Also, the Volume chart shows a substantial increase in trading volume during the years 1998 and 2007. This can be attributed to significant events like the introduction of the iMac and the iPhone, as well as the overall growth of the technology sector during those periods.

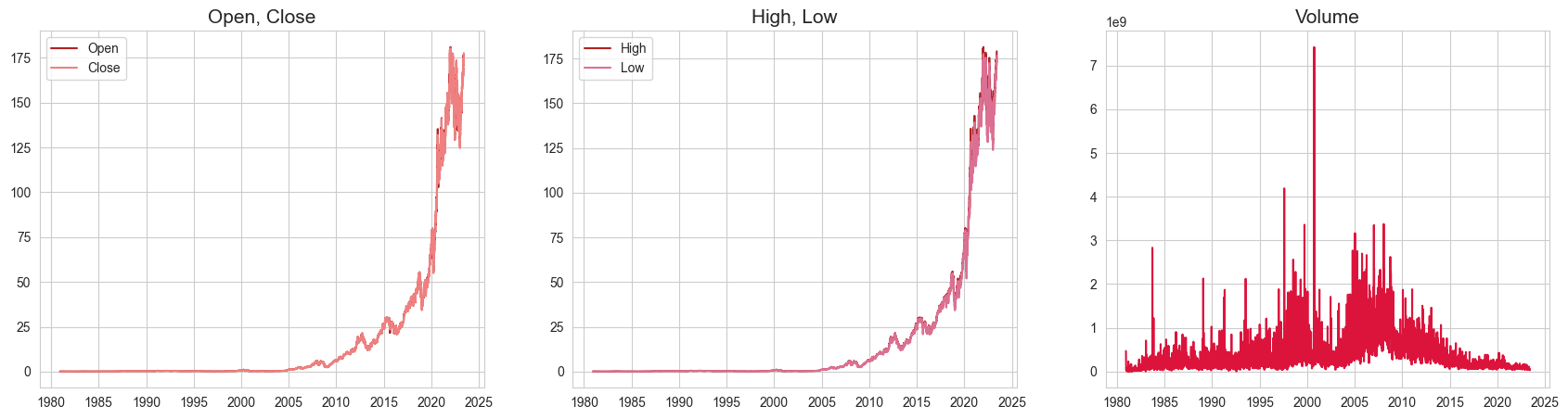

Based on the Open/Close plot and High/Low plot, the price of Apple's stock has been steadily increasing with some fluctuations. Also, the Volume chart shows a substantial increase in trading volume during the years 1998 and 2007. This can be attributed to significant events like the introduction of the iMac and the iPhone, as well as the overall growth of the technology sector during those periods.

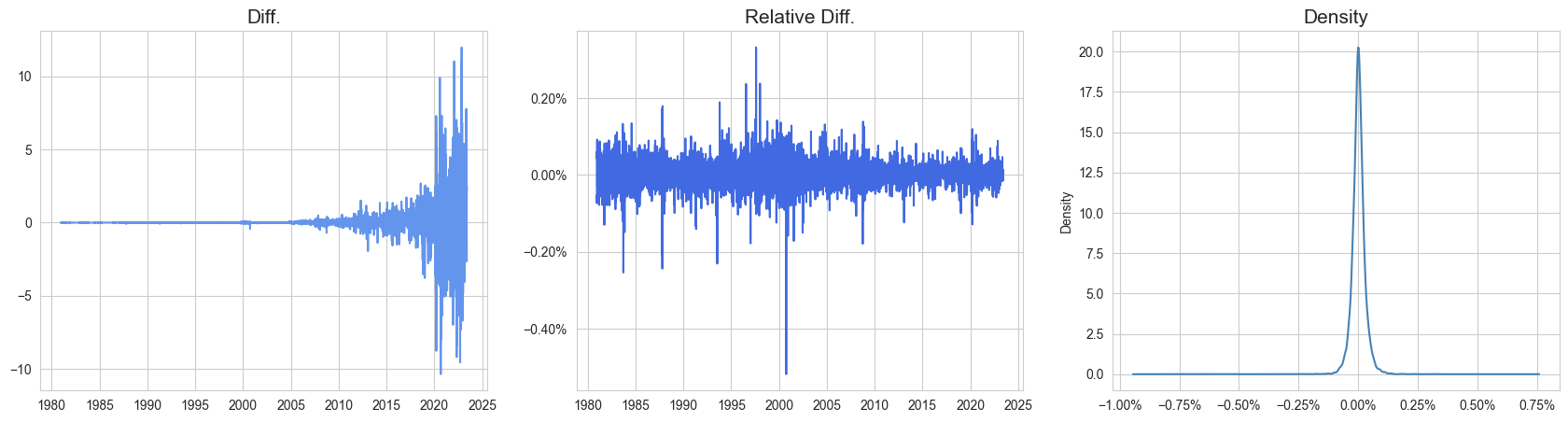

Although the price difference increases as the stock price increases, the relative price change remains mostly consistent over the years.

Although the price difference increases as the stock price increases, the relative price change remains mostly consistent over the years.

The GradientBoostingClassifier is chosen for its strength in capturing non-linear relationships, assessing feature importance, and robustness to outliers and missing data.

from sklearn.ensemble import GradientBoostingClassifier

clf = GradientBoostingClassifier(random_state=0)Backtesting is used to more accurately evaluate the model's performance across diverse market conditions and minimise the impact of market anomalies in the test set.

def backtest(model, X, y, init=1000, test=365, selector=None):

preds = pd.DataFrame()

for i in range(init, len(X), test):

# Train test split

X_train, X_test = X[:i], X[i:i+test]

y_train, y_test = y[:i], y[i:i+test]

close = X_test['Close'].copy()

# Feature selection

if selector is not None:

selector.fit(X_train, y_train)

selected = selector.get_support()

X_train, X_test = X_train.iloc[:, selected], X_test.iloc[:, selected]

# Fit model

model.fit(X_train, y_train)

temp = pd.concat([

close,

y_test,

pd.DataFrame(model.predict(X_test), columns=['y_pred'], index=y_test.index),

pd.DataFrame(model.predict_proba(X_test)[:,1], columns=['y_prob'], index=y_test.index)

], axis=1)

preds = pd.concat([preds, temp], axis=0)

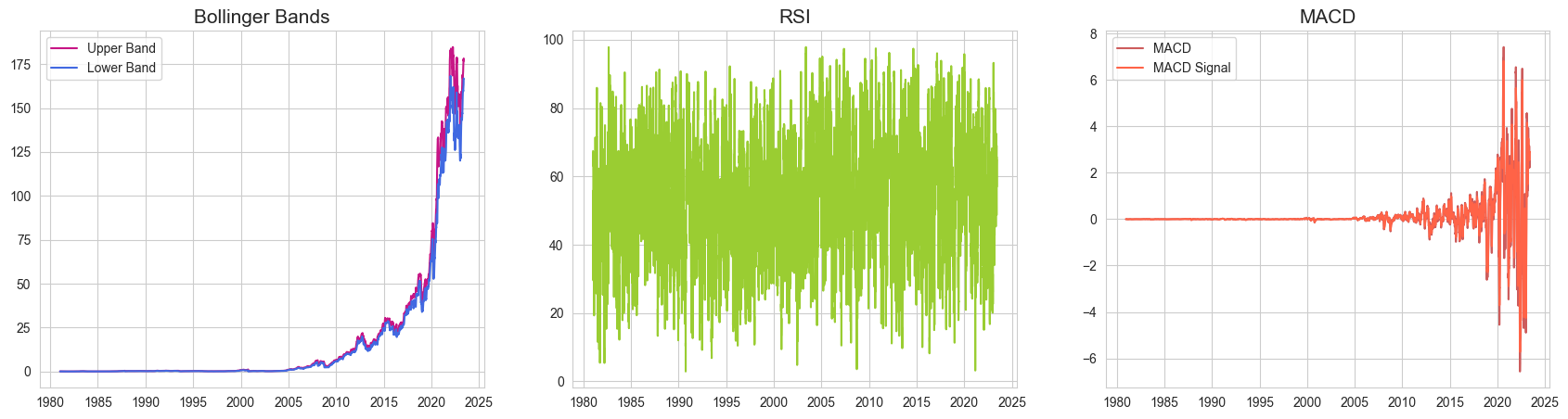

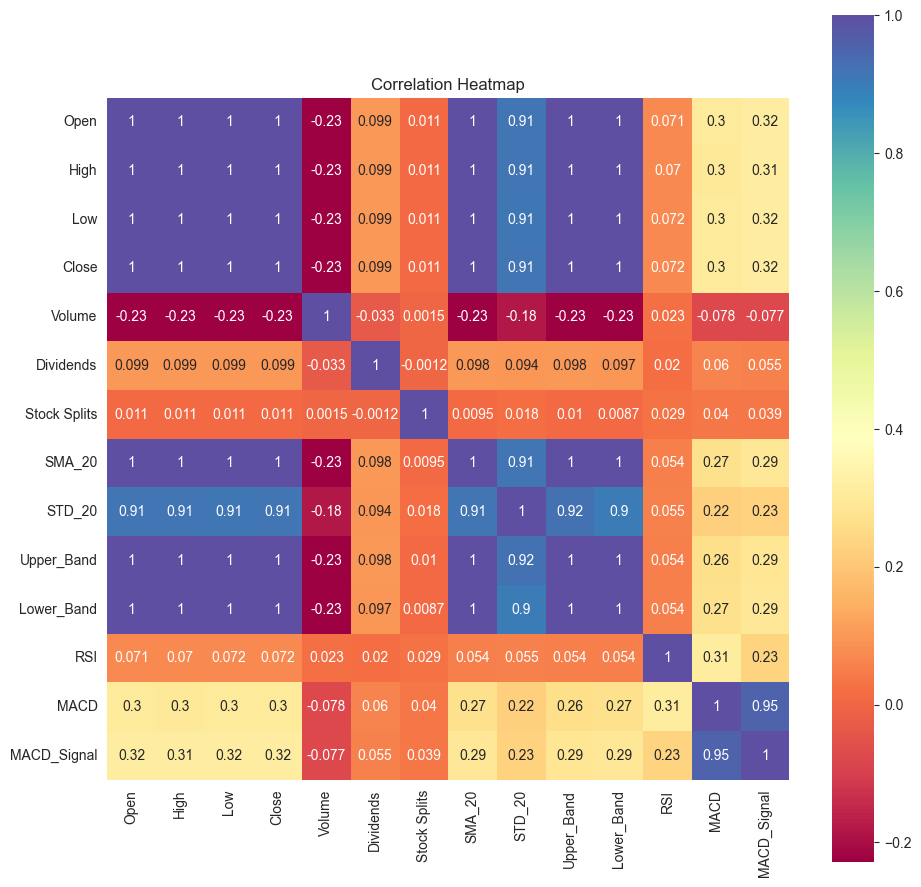

return predsTo enhance the accuracy of the model, the following features have been added:

| Feature | Details |

|---|---|

| SMA (Simple Moving Average) | Moving average of close prices. |

| STD (Moving Standard Deviation) | Moving standard deviation of close prices. |

| Last Dividend Payment Amount | Amount of the most recent dividend payment. |

| Days Since Last Dividend Payment | Number of days passed since the last dividend payment. |

| Days Since Last Stock Split | The number of days since the last stock split occurred. |

| Bollinger Bands | Upper and lower bands that represent price volatility. |

| RSI (Relative Strength Index) | A momentum oscillator that measures the speed and change of price movements. |

| MACD (Moving Average Convergence Divergence) | A trend-following momentum indicator that calculates the relationship between two moving averages of a stock's price. |

| Trend | The sum of the target value over the last seven days. |

| Ratios of Various Features | Ratios of features such as High/Close, Low/Close, SMA_365/SMA_90, and others. |

To further improve the model, scikit-learn's SequentialFeatureSelector is used to select the most relevant features.

from sklearn.feature_selection import SequentialFeatureSelector

selector = SequentialFeatureSelector(clf, n_features_to_select='auto', n_jobs=-1)

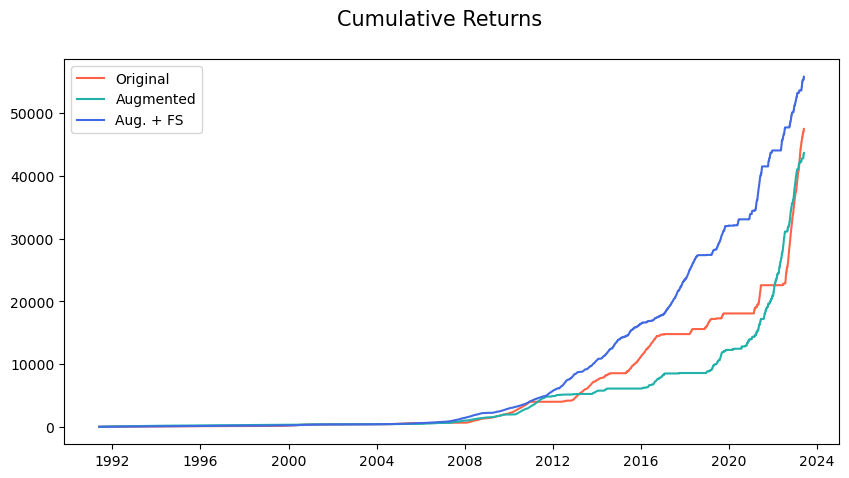

results = backtest(clf, X, y, selector=selector)| precision | recall | f1-score | |

|---|---|---|---|

| Original | 0.51 | 0.33 | 0.40 |

| Augmented | 0.51 | 0.33 | 0.40 |

| Aug. + FS | 0.51 | 0.43 | 0.47 |

The final results still leave much room for improvement, but they have clearly improved compared to the initial results.

Run the notebooks in the following order:

data_preparation.ipynb -> EDA.ipynb -> model.ipynb