- Stock2vec Clustering

- make dailty log-return series Embedding Vectors by Word2vec-Skipgram

- pass the embedding vectors to K-Means Clustering Algorithm

- num_clusters : 5

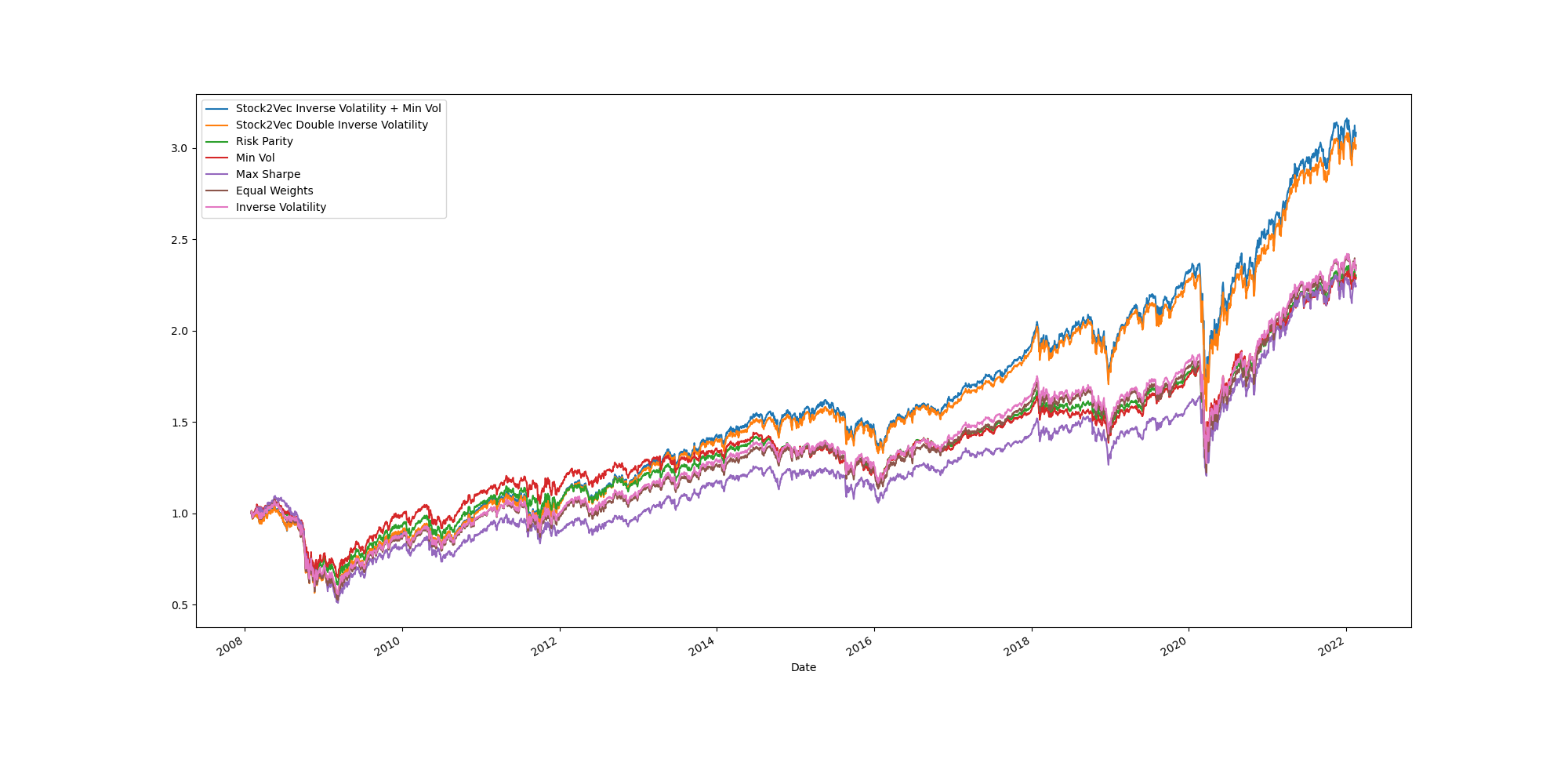

- Stock2Vec Clustering + Double Inverse Volatility

- inverse volatility between assets in one cluster

- inverse volatility between clusters

- Stock2Vec Clustering + inverse volatility + min volatility

- inverse volatility between assets in one cluster

- minimize portfolio volatility using clusters

- Risk parity

- Minimum Volatility

- Maximum Sharpe Ratio

- Equal Weight

- Inverse Volatility

python main.py

- ETF (2008.01 ~ 2022.02)

- VTI : Vanguard Total Stock Market Index Fund ETF

- VEA : Vanguard Developed Markets Index Fund ETF

- VWO : Vanguard Emerging Markets Stock Index Fund ETF

- IAU : iShares COMEX Gold Trust ETF

- DBC : Invesco DB Commodity Index Tracking Fund

- XLB : Materials Select Sector SPDR Fund

- XLE : Energy Select Sector SPDR Fund

- XLF : Financial Select Sector SPDR Fund

- XLI : Industrial Select Sector SPDR Fund

- XLK : Technology Select Sector SPDR Fund

- XLP : Consumer Staples Select Sector SPDR Fund

- XLU : Utilities Select Sector SPDR Fund

- XLV : Health Care Select Sector SPDR Fund

- XLY : 미 경기소비재 ETF

finance-datareader==0.9.31

gensim==4.1.2

matplotlib

numpy==1.19.3

pandas==1.3.4

scikit-learn==1.0.2

scipy==1.8.0

tqdm==4.62.3