"I came across PandaPy last week and have already used it in my current project. It is a fascinating Python library with a lot of potential to become mainstream."

Snow, Derek (2020), PandaPy: A Wrapper Around Structured Arrays to Mimic ‘structs’ in the C Language, SSRN

@software{pandapy,

title = {{PandaPy}: A Wrapper Around Structured Arrays to Mimic ‘structs’ in the C Language.},

author = {Snow, Derek},

url = {https://github.com/firmai/pandapy/},

version = {1.11},

date = {2020-05-13},

}

Install

!pip3 install pandapy

Load

import pandapy as pp- Maintains the full functionality and speed of structured NumPy datatype (eg.,

array[col1] + array[col2], or np.log(array[col1]) - If you have smaller pandas dataframes (<50K number of records) in a production environment, then it is worth considering PandaPy, you will see a significant speed up and a large reduction in memory usage.

- When using mixed data types (int, float, datatime, str), PandaPy generally consumes (roughly a 1/3rd) less memory than Pandas.

- Pandas outperform PandaPy at the same point when Pandas outperform NumPy. NumPy generally performs better than pandas for 50K rows or less. Pandas generally performs better than numpy for 500K rows or more; from 50K to 500K rows it is a toss up depending on the operation.

- Because both Pandas and PandaPy is built on NumPy, the performance difference can be attributed to Pandas overhead. For larger datasets Pandas' hash tables and columnar data format gives it the upperhand on many operations.

- The performance claims therefore hold for small datasets, 1,000-100,000 numpy rows. There is however many PandaPy operations that improve relative to Pandas as the number of rows increase: rename, column drop, fillna mean, correlation matrix, filter (

array > 0), value reads(a=array[col]), singular value access (array[col][pos]), atomic functions (sqrt, power), and np. calculations differences even out (np.log, np.exp, etc). - Provides wrapper functions over NumPy to give you the usability of Pandas (eg.,

pp.group(array, [col1, col2, col2], ['mean', 'std'], ['Adj_Close','Close']) - If you need Pandas for speciality functions, you can easily

df = pp.pandas(array)and backarray = pp.structured(df) - For simple calculations on a small dataset (i.e, plus, mult, log) PandaPy is 25x - 80x faster than Pandas.

- For table functions (i.e., group, pivot, drop, concat, fillna) on a small data set PandaPy is 5x - 100x times faster than Pandas.

- For most use cases with small data, PandaPy is faster than Dask, Modin Ray and Pandas.

- The best competing python package for performance on table functions is datatable, it is 2x - 10x faster than PandaPy.

- The problem is that datatable is 5x - 10x slower with simple calculations (plus, mult, returns), it is less intuitive, does not have a large range of functions, have very few complementary libraries, e.g. matplotlib, and doesn't leave you in a Numpy datatype.

- For finance applications the speed of simple calculations takes preference over table function speed.

- PandaPy is not created to allow you to scale up to clusters for multiple computer processing like Dask, Modin, and Spark, instead it is focused on speed and usability within a single computer's Memory.

- Machines are getting large, EC2 X1 has 2TB of RAM and is remarkably affordable. If it can be done on a single machine then it should be done on a single machine. Quoting Dask - "For data that fits into RAM, Pandas {PandaPy, NumPy} can often be faster and easier to use than Dask DataFrame"

- If your dataset is very small you can load your data using PandaPy's

read()function, for medium sized data, it is best to load it with datatable or pyspark and convert it to structured Numpy, if it is large, pyspark, Dask, or Modin, if it is very large use pyspark. - Lastly PandaPy can have as input any multidimensional object and does not have to conform to the basic NumPy datatypes. It can include nested datatypes, subarrays, functions as long as each column conforms to the array lenght, this allows for a great amount of flexibility. You can for example,

add(array, "panda function",[[pd for i in range(len(multiple_stocks))]])to create a list of the panda (pd) module and access it along any index valuearray["panda function"][0].read_csv(url).

PandaPy software, similar to the original Pandas project, is developed to improve the usability of python for finance. Structured datatypes are designed to be able to mimic ‘structs’ in the C language, and share a similar memory layout. PandaPy currently houses more than 30 functions. Structured NumPy are meant for interfacing with C code and for low-level manipulation of structured buffers, for example for interpreting binary blobs. For these purposes they support specialized features such as subarrays, nested datatypes, and unions, and allow control over the memory layout of the structure.

Note this is a fledgling project, much room for improvement, all feedback appreciated (issues tab)

A Structured NumPy Array is an array of structures. NumPy arrays can only contain one data type, but structured arrays in a sense create an array of homogeneous structures. This is done without moving out of NumPy such as is required with Xarray. For structured arrays the data type only has to be the same per column like an SQL data base. Each column can be another multidimensional object and does not have to conform to the basic NumPy datatypes.

PandaPy comes with similar functionality like Pandas, such as groupby, pivot, and others. The biggest benefit of this approach is that NumPy dtype(data type) directly maps onto a C structure definition, so the buffer containing the array content can be accessed directly within an appropriately written C program. If you find yourself writing a Python interface to a legacy C or Fortran library that manipulates structured data, you'll probably find structured arrays quite useful.

- Play around with speed tests here and some more here.

- Test and explore the package with this Google Colab Notebook.

- Get in touch on LinkedIn or Twitter.

- Use

table(array)to get a pandas looking table printout - You can read the paper on SSRN for a little more information.

Read In Arrays (read)

To Pandas (unstructured)

Pandas to Structured (structured)

To Unstructured (to_unstruct)

To Structured (to_struct)

Print Table (table)

Descriptive Statistics (describe) (5x)

Correlation Array (corr) (2x)

Returns (returns) (50x)

Portfolio Value (portfolio_value) (50x)

Cummulative Value (cummulative_return) (50x)

Column Lags (lags) (7x)

Drop Null Rows (dropnarow) (30x)

Drop Column/s (drop) (100x)

Add Column/s (add) (3x)

Concatenate (concat) (rows 25x columns 70x)

Merge (merge) (2x)

Group by (group) (10x)

Pivot (pivot) (20x)

Fill Nulls (fillna) (20x)

Shift Column (shift) (50x)

Rename (rename) (500x)

Update (array[col] = values) (60x)

Addition (array[col] + array[col]) (80x)

Multiplication (array[col] * array[col]) (80x)

Log (np.log(array[col]) (25x)

note speed tests done on financial dataset only

Read In Arrays

# First Example

multiple_stocks = pp.read('https://github.com/firmai/random-assets-two/blob/master/numpy/multiple_stocks.csv?raw=true')

closing = multiple_stocks[['Ticker','Date','Adj_Close']]

piv = pp.pivot(closing,"Date","Ticker","Adj_Close"); piv

closing = pp.to_struct(piv, name_list = [x for x in np.unique(multiple_stocks["Ticker"])])

# Second Example

tsla = pp.read('https://github.com/firmai/random-assets-two/raw/master/numpy/tsla.csv')

crm = pp.read('https://github.com/firmai/random-assets-two/raw/master/numpy/crm.csv')

tsla_sub = tsla[["Date","Adj_Close","Volume"]]

crm_sub = crm[["Date","Adj_Close","Volume"]]

crm_adj = crm[['Date','Adj_Close']]closing

array([(37.24206924, 100.45429993, 44.57522202, 20.72605705, 130.59109497, 35.80251312, 41.9791832 , 81.51140594, 66.33999634),

(35.08446503, 97.62433624, 43.83200836, 20.34561157, 128.53627014, 35.80251312, 41.59314346, 80.89860535, 66.15000153),

(35.34244537, 97.63354492, 42.79874039, 19.90727234, 125.76422119, 36.07437897, 40.98268127, 80.28580475, 64.58000183),

...,

(21.57999992, 289.79998779, 59.08000183, 11.18000031, 135.27000427, 55.34999847, 158.96000671, 137.53999329, 88.37000275),

(21.34000015, 291.51998901, 58.65999985, 11.07999992, 132.80999756, 55.27000046, 157.58999634, 136.80999756, 87.95999908),

(21.51000023, 293.6499939 , 58.47999954, 11.15999985, 134.03999329, 55.34999847, 157.69999695, 136.66999817, 88.08999634)],

dtype=[('AA', '<f8'), ('AAPL', '<f8'), ('DAL', '<f8'), ('GE', '<f8'), ('IBM', '<f8'), ('KO', '<f8'), ('MSFT', '<f8'), ('PEP', '<f8'), ('UAL', '<f8')])

Rename

pp.rename(closing,["AA","AAPL"],["GAP","FAF"])[:5]array([(37.24206924, 100.45429993, 44.57522202, 20.72605705, 130.59109497, 35.80251312, 41.9791832 , 81.51140594, 66.33999634),

(35.08446503, 97.62433624, 43.83200836, 20.34561157, 128.53627014, 35.80251312, 41.59314346, 80.89860535, 66.15000153),

(35.34244537, 97.63354492, 42.79874039, 19.90727234, 125.76422119, 36.07437897, 40.98268127, 80.28580475, 64.58000183),

(36.25707626, 99.00255585, 42.57216263, 19.91554451, 124.94229126, 36.52467346, 41.50337982, 82.63342285, 65.52999878),

(37.28897095, 102.80648041, 43.67792892, 20.15538216, 127.65791321, 36.966465 , 42.72432327, 84.13523865, 66.63999939)],

dtype=[('GAP', '<f8'), ('FAF', '<f8'), ('DAL', '<f8'), ('GE', '<f8'), ('IBM', '<f8'), ('KO', '<f8'), ('MSFT', '<f8'), ('PEP', '<f8'), ('UAL', '<f8')])

pp.rename(closing,"AA", "GALLY")[:5]array([(37.24206924, 100.45429993, 44.57522202, 20.72605705, 130.59109497, 35.80251312, 41.9791832 , 81.51140594, 66.33999634),

(35.08446503, 97.62433624, 43.83200836, 20.34561157, 128.53627014, 35.80251312, 41.59314346, 80.89860535, 66.15000153),

(35.34244537, 97.63354492, 42.79874039, 19.90727234, 125.76422119, 36.07437897, 40.98268127, 80.28580475, 64.58000183),

(36.25707626, 99.00255585, 42.57216263, 19.91554451, 124.94229126, 36.52467346, 41.50337982, 82.63342285, 65.52999878),

(37.28897095, 102.80648041, 43.67792892, 20.15538216, 127.65791321, 36.966465 , 42.72432327, 84.13523865, 66.63999939)],

dtype=[('GALLY', '<f8'), ('AAPL', '<f8'), ('DAL', '<f8'), ('GE', '<f8'), ('IBM', '<f8'), ('KO', '<f8'), ('MSFT', '<f8'), ('PEP', '<f8'), ('UAL', '<f8')])

Statistics

described = pp.describe(closing)| Describe | observations | minimum | maximum | mean | variance | skewness | kurtosis |

|---|---|---|---|---|---|---|---|

| AA | 1258.00 | 15.97 | 60.23 | 31.46 | 99.42 | 0.67 | -0.58 |

| AAPL | 1258.00 | 85.39 | 293.65 | 149.45 | 2119.86 | 0.66 | -0.28 |

| DAL | 1258.00 | 30.73 | 62.69 | 47.15 | 44.33 | -0.01 | -0.78 |

| GE | 1258.00 | 6.42 | 28.67 | 18.85 | 48.45 | -0.25 | -1.54 |

| IBM | 1258.00 | 99.83 | 161.17 | 133.35 | 116.28 | -0.37 | 0.56 |

| KO | 1258.00 | 32.81 | 55.35 | 41.67 | 28.86 | 0.80 | -0.05 |

| MSFT | 1258.00 | 36.27 | 158.96 | 78.31 | 1102.21 | 0.61 | -0.82 |

| PEP | 1258.00 | 78.46 | 139.30 | 102.86 | 229.01 | 0.63 | -0.32 |

| UAL | 1258.00 | 37.75 | 96.70 | 69.22 | 195.65 | 0.02 | -1.04 |

Drop Column/s

removed = pp.drop(closing,["AA","AAPL","IBM"]) ; removed[:5]array([(44.57522202, 20.72605705, 35.80251312, 41.9791832 , 81.51140594, 66.33999634),

(43.83200836, 20.34561157, 35.80251312, 41.59314346, 80.89860535, 66.15000153),

(42.79874039, 19.90727234, 36.07437897, 40.98268127, 80.28580475, 64.58000183),

(42.57216263, 19.91554451, 36.52467346, 41.50337982, 82.63342285, 65.52999878),

(43.67792892, 20.15538216, 36.966465 , 42.72432327, 84.13523865, 66.63999939)],

dtype={'names':['DAL','GE','KO','MSFT','PEP','UAL'], 'formats':['<f8','<f8','<f8','<f8','<f8','<f8'], 'offsets':[16,24,40,48,56,64], 'itemsize':72})

Add Column/s

added = pp.add(closing,["GALLY","FAF"],[closing["IBM"],closing["AA"]]); added[:5] ## set two new columns with that two previous columnnsarray([(37.24206924, 100.45429993, 44.57522202, 20.72605705, 130.59109497, 35.80251312, 41.9791832 , 81.51140594, 66.33999634, 130.59109497, 37.24206924),

(35.08446503, 97.62433624, 43.83200836, 20.34561157, 128.53627014, 35.80251312, 41.59314346, 80.89860535, 66.15000153, 128.53627014, 35.08446503),

(35.34244537, 97.63354492, 42.79874039, 19.90727234, 125.76422119, 36.07437897, 40.98268127, 80.28580475, 64.58000183, 125.76422119, 35.34244537),

(36.25707626, 99.00255585, 42.57216263, 19.91554451, 124.94229126, 36.52467346, 41.50337982, 82.63342285, 65.52999878, 124.94229126, 36.25707626),

(37.28897095, 102.80648041, 43.67792892, 20.15538216, 127.65791321, 36.966465 , 42.72432327, 84.13523865, 66.63999939, 127.65791321, 37.28897095)],

dtype=[('AA', '<f8'), ('AAPL', '<f8'), ('DAL', '<f8'), ('GE', '<f8'), ('IBM', '<f8'), ('KO', '<f8'), ('MSFT', '<f8'), ('PEP', '<f8'), ('UAL', '<f8'), ('GALLY', '<f8'), ('FAF', '<f8')])

Concatenate Arrays by Row

concat_row = pp.concat(removed[["DAL","GE"]], added[["PEP","UAL"]], type="row"); concat_row[:5]array([(44.57522202, 20.72605705), (43.83200836, 20.34561157),

(42.79874039, 19.90727234), (42.57216263, 19.91554451),

(43.67792892, 20.15538216)], dtype=[('DAL', '<f8'), ('GE', '<f8')])

Concatenate Arrays by Column

concat_col = pp.concat(removed[["DAL","GE"]], added[["PEP","UAL"]], type="columns"); concat_col[:5]array([(44.57522202, 20.72605705, 81.51140594, 66.33999634),

(43.83200836, 20.34561157, 80.89860535, 66.15000153),

(42.79874039, 19.90727234, 80.28580475, 64.58000183),

(42.57216263, 19.91554451, 82.63342285, 65.52999878),

(43.67792892, 20.15538216, 84.13523865, 66.63999939)],

dtype=[('DAL', '<f8'), ('GE', '<f8'), ('PEP', '<f8'), ('UAL', '<f8')])

Concatenate by Array

concat_array = pp.concat(removed[["DAL","GE"]], added[["PEP","UAL"]], type="array"); concat_array[:5]array([[(44.57522201538086, 20.726057052612305),

(43.832008361816406, 20.345611572265625),

(42.79874038696289, 19.907272338867188), ...,

(59.08000183105469, 11.180000305175781),

(58.65999984741211, 11.079999923706055),

(58.47999954223633, 11.15999984741211)],

[(81.51140594482422, 66.33999633789062),

(80.89860534667969, 66.1500015258789),

(80.28580474853516, 64.58000183105469), ...,

(137.5399932861328, 88.37000274658203),

(136.80999755859375, 87.95999908447266),

(136.6699981689453, 88.08999633789062)]], dtype=object)

Concatenate by Melt

concat_melt = pp.concat(removed[["DAL","GE"]], added[["PEP","UAL"]], type="melt"); concat_melt[:5]array([(44.57522202, 20.72605705), (43.83200836, 20.34561157),

(42.79874039, 19.90727234), (42.57216263, 19.91554451),

(43.67792892, 20.15538216)], dtype=[('DAL', '<f8'), ('GE', '<f8')])

Merge Array (inner, outer)

merged = pp.merge(tsla_sub, crm_adj, left_on="Date", right_on="Date",how="inner",left_postscript="_TSLA",right_postscript="_CRM"); merged[:5]array([('2019-01-02', 310.11999512, 135.55000305, 11658600),

('2019-01-03', 300.35998535, 130.3999939 , 6965200),

('2019-01-04', 317.69000244, 137.96000671, 7394100),

('2019-01-07', 334.95999146, 142.22000122, 7551200),

('2019-01-08', 335.3500061 , 145.72000122, 7008500)],

dtype=[('Date', '<M8[D]'), ('Adj_Close_TSLA', '<f8'), ('Adj_Close_CRM', '<f8'), ('Volume', '<i8')])

Replace Individual Values

## More work to done on replace (structured)

## replace(merged,original=317.69000244, replacement=np.nan)[:5]Print Table

pp.table(merged[:5])| Date | Adj_Close_TSLA | Adj_Close_CRM | Volume | |

|---|---|---|---|---|

| 0 | 2019-01-02 | 310.120 | 135.550 | 11658600 |

| 1 | 2019-01-03 | 300.360 | 130.400 | 6965200 |

| 2 | 2019-01-04 | 317.690 | 137.960 | 7394100 |

| 3 | 2019-01-07 | 334.960 | 142.220 | 7551200 |

| 4 | 2019-01-08 | 335.350 | 145.720 | 7008500 |

### This is the new function that you should include above

### You can add the same peculuarities to removeAdd and Concatenate

tsla = pp.add(tsla,["Ticker"], "TSLA", "U10")

crm = pp.add(crm,["Ticker"], "CRM", "U10")

combine = pp.concat(tsla[0:5], crm[0:5], type="row"); combinearray([(315.13000488, 298.79998779, 306.1000061 , 310.11999512, 11658600, 310.11999512, '2019-01-02', 'TSLA'),

(309.3999939 , 297.38000488, 307. , 300.35998535, 6965200, 300.35998535, '2019-01-03', 'TSLA'),

(318. , 302.73001099, 306. , 317.69000244, 7394100, 317.69000244, '2019-01-04', 'TSLA'),

(336.73999023, 317.75 , 321.72000122, 334.95999146, 7551200, 334.95999146, '2019-01-07', 'TSLA'),

(344.01000977, 327.01998901, 341.95999146, 335.3500061 , 7008500, 335.3500061 , '2019-01-08', 'TSLA'),

(136.83000183, 133.05000305, 133.3999939 , 135.55000305, 4783900, 135.55000305, '2019-01-02', 'CRM'),

(134.77999878, 130.1000061 , 133.47999573, 130.3999939 , 6365700, 130.3999939 , '2019-01-03', 'CRM'),

(139.32000732, 132.22000122, 133.5 , 137.96000671, 6650600, 137.96000671, '2019-01-04', 'CRM'),

(143.38999939, 138.78999329, 141.02000427, 142.22000122, 9064800, 142.22000122, '2019-01-07', 'CRM'),

(146.46000671, 142.88999939, 144.72999573, 145.72000122, 9057300, 145.72000122, '2019-01-08', 'CRM')],

dtype=[('High', '<f8'), ('Low', '<f8'), ('Open', '<f8'), ('Close', '<f8'), ('Volume', '<i8'), ('Adj_Close', '<f8'), ('Date', '<M8[D]'), ('Ticker', '<U10')])

dropped = pp.drop(combine,["High","Low","Open"]); dropped[:10]array([(310.11999512, 11658600, 310.11999512, '2019-01-02', 'TSLA'),

(300.35998535, 6965200, 300.35998535, '2019-01-03', 'TSLA'),

(317.69000244, 7394100, 317.69000244, '2019-01-04', 'TSLA'),

(334.95999146, 7551200, 334.95999146, '2019-01-07', 'TSLA'),

(335.3500061 , 7008500, 335.3500061 , '2019-01-08', 'TSLA'),

(135.55000305, 4783900, 135.55000305, '2019-01-02', 'CRM'),

(130.3999939 , 6365700, 130.3999939 , '2019-01-03', 'CRM'),

(137.96000671, 6650600, 137.96000671, '2019-01-04', 'CRM'),

(142.22000122, 9064800, 142.22000122, '2019-01-07', 'CRM'),

(145.72000122, 9057300, 145.72000122, '2019-01-08', 'CRM')],

dtype={'names':['Close','Volume','Adj_Close','Date','Ticker'], 'formats':['<f8','<i8','<f8','<M8[D]','<U10'], 'offsets':[24,32,40,48,56], 'itemsize':96})

Pivot Array

piv = pp.pivot(dropped,"Date","Ticker","Adj_Close",display=True)| Adj_Close | CRM | TSLA |

|---|---|---|

| 2019-01-02 | 135.55 | 310.12 |

| 2019-01-03 | 130.40 | 300.36 |

| 2019-01-04 | 137.96 | 317.69 |

| 2019-01-07 | 142.22 | 334.96 |

| 2019-01-08 | 145.72 | 335.35 |

Add New Data types

tsla_extended = pp.add(tsla,"Month",tsla["Date"],'datetime64[M]')

tsla_extended = pp.add(tsla_extended,"Year",tsla_extended["Date"],'datetime64[Y]')Update Existing Column

## faster method elsewhere

year_frame = pp.update(tsla,"Date", [dt.year for dt in tsla["Date"].astype(object)],types="|U10"); year_frame[:5]array([(315.13000488, 298.79998779, 306.1000061 , 310.11999512, 11658600, 310.11999512, 'TSLA', '2019'),

(309.3999939 , 297.38000488, 307. , 300.35998535, 6965200, 300.35998535, 'TSLA', '2019'),

(318. , 302.73001099, 306. , 317.69000244, 7394100, 317.69000244, 'TSLA', '2019'),

(336.73999023, 317.75 , 321.72000122, 334.95999146, 7551200, 334.95999146, 'TSLA', '2019'),

(344.01000977, 327.01998901, 341.95999146, 335.3500061 , 7008500, 335.3500061 , 'TSLA', '2019')],

dtype=[('High', '<f8'), ('Low', '<f8'), ('Open', '<f8'), ('Close', '<f8'), ('Volume', '<i8'), ('Adj_Close', '<f8'), ('Ticker', '<U10'), ('Date', '<U10')])

Group Arrays By

grouped = pp.group(tsla_extended, ['Ticker','Month','Year'],['mean', 'std', 'min', 'max'], ['Adj_Close','Close'], display=True)| Ticker | Month | Year | Adj_Close_mean | Adj_Close_std | Adj_Close_min | Adj_Close_max | Close_mean | Close_std | Close_min | Close_max | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | TSLA | 2019-01-01 | 2019-01-01 | 318.494 | 21.098 | 287.590 | 347.310 | 318.494 | 21.098 | 287.590 | 347.310 |

| 1 | TSLA | 2019-02-01 | 2019-01-01 | 307.728 | 8.053 | 291.230 | 321.350 | 307.728 | 8.053 | 291.230 | 321.350 |

| 2 | TSLA | 2019-03-01 | 2019-01-01 | 277.757 | 8.925 | 260.420 | 294.790 | 277.757 | 8.925 | 260.420 | 294.790 |

| 3 | TSLA | 2019-04-01 | 2019-01-01 | 266.656 | 14.985 | 235.140 | 291.810 | 266.656 | 14.985 | 235.140 | 291.810 |

| 4 | TSLA | 2019-05-01 | 2019-01-01 | 219.715 | 24.040 | 185.160 | 255.340 | 219.715 | 24.040 | 185.160 | 255.340 |

| 5 | TSLA | 2019-06-01 | 2019-01-01 | 213.717 | 12.125 | 178.970 | 226.430 | 213.717 | 12.125 | 178.970 | 226.430 |

| 6 | TSLA | 2019-07-01 | 2019-01-01 | 242.382 | 12.077 | 224.550 | 264.880 | 242.382 | 12.077 | 224.550 | 264.880 |

| 7 | TSLA | 2019-08-01 | 2019-01-01 | 225.103 | 7.831 | 211.400 | 238.300 | 225.103 | 7.831 | 211.400 | 238.300 |

| 8 | TSLA | 2019-09-01 | 2019-01-01 | 237.261 | 8.436 | 220.680 | 247.100 | 237.261 | 8.436 | 220.680 | 247.100 |

| 9 | TSLA | 2019-10-01 | 2019-01-01 | 266.355 | 31.463 | 231.430 | 328.130 | 266.355 | 31.463 | 231.430 | 328.130 |

| 10 | TSLA | 2019-11-01 | 2019-01-01 | 338.300 | 13.226 | 313.310 | 359.520 | 338.300 | 13.226 | 313.310 | 359.520 |

| 11 | TSLA | 2019-12-01 | 2019-01-01 | 377.695 | 36.183 | 330.370 | 430.940 | 377.695 | 36.183 | 330.370 | 430.940 |

Convert Array to Pandas

grouped_frame = pp.pandas(grouped); grouped_frame.head()| Ticker | Month | Year | Adj_Close_mean | Adj_Close_std | Adj_Close_min | Adj_Close_max | Close_mean | Close_std | Close_min | Close_max | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | TSLA | 2019-01-01 | 2019-01-01 | 318.494284 | 21.098362 | 287.589996 | 347.309998 | 318.494284 | 21.098362 | 287.589996 | 347.309998 |

| 1 | TSLA | 2019-02-01 | 2019-01-01 | 307.728421 | 8.052522 | 291.230011 | 321.350006 | 307.728421 | 8.052522 | 291.230011 | 321.350006 |

| 2 | TSLA | 2019-03-01 | 2019-01-01 | 277.757140 | 8.924873 | 260.420013 | 294.790009 | 277.757140 | 8.924873 | 260.420013 | 294.790009 |

| 3 | TSLA | 2019-04-01 | 2019-01-01 | 266.655716 | 14.984572 | 235.139999 | 291.809998 | 266.655716 | 14.984572 | 235.139999 | 291.809998 |

| 4 | TSLA | 2019-05-01 | 2019-01-01 | 219.715454 | 24.039647 | 185.160004 | 255.339996 | 219.715454 | 24.039647 | 185.160004 | 255.339996 |

From Pandas to Structured

struct = pp.structured(grouped_frame); struct[:5]rec.array([('TSLA', '2019-01-01T00:00:00.000000000', '2019-01-01T00:00:00.000000000', 318.49428449, 21.09836186, 287.58999634, 347.30999756, 318.49428449, 21.09836186, 287.58999634, 347.30999756),

('TSLA', '2019-02-01T00:00:00.000000000', '2019-01-01T00:00:00.000000000', 307.72842086, 8.05252198, 291.23001099, 321.3500061 , 307.72842086, 8.05252198, 291.23001099, 321.3500061 ),

('TSLA', '2019-03-01T00:00:00.000000000', '2019-01-01T00:00:00.000000000', 277.75713966, 8.92487345, 260.42001343, 294.79000854, 277.75713966, 8.92487345, 260.42001343, 294.79000854),

('TSLA', '2019-04-01T00:00:00.000000000', '2019-01-01T00:00:00.000000000', 266.65571594, 14.98457194, 235.13999939, 291.80999756, 266.65571594, 14.98457194, 235.13999939, 291.80999756),

('TSLA', '2019-05-01T00:00:00.000000000', '2019-01-01T00:00:00.000000000', 219.7154541 , 24.03964724, 185.16000366, 255.33999634, 219.7154541 , 24.03964724, 185.16000366, 255.33999634)],

dtype=[('Ticker', 'O'), ('Month', '<M8[ns]'), ('Year', '<M8[ns]'), ('Adj_Close_mean', '<f8'), ('Adj_Close_std', '<f8'), ('Adj_Close_min', '<f8'), ('Adj_Close_max', '<f8'), ('Close_mean', '<f8'), ('Close_std', '<f8'), ('Close_min', '<f8'), ('Close_max', '<f8')])

Shift Column

pp.shift(merged["Adj_Close_TSLA"],1)[:5]array([ nan, 310.11999512, 300.35998535, 317.69000244,

334.95999146])

Multiple Lags for Column

tsla_lagged = pp.lags(tsla_extended, "Adj_Close", 5); tsla_lagged[:5]array([(315.13000488, 298.79998779, 306.1000061 , 310.11999512, 11658600, 310.11999512, '2019-01-02', 'TSLA', '2019-01', '2019', nan, nan, nan, nan, nan),

(309.3999939 , 297.38000488, 307. , 300.35998535, 6965200, 300.35998535, '2019-01-03', 'TSLA', '2019-01', '2019', 310.11999512, nan, nan, nan, nan),

(318. , 302.73001099, 306. , 317.69000244, 7394100, 317.69000244, '2019-01-04', 'TSLA', '2019-01', '2019', 300.35998535, 310.11999512, nan, nan, nan),

(336.73999023, 317.75 , 321.72000122, 334.95999146, 7551200, 334.95999146, '2019-01-07', 'TSLA', '2019-01', '2019', 317.69000244, 300.35998535, 310.11999512, nan, nan),

(344.01000977, 327.01998901, 341.95999146, 335.3500061 , 7008500, 335.3500061 , '2019-01-08', 'TSLA', '2019-01', '2019', 334.95999146, 317.69000244, 300.35998535, 310.11999512, nan)],

dtype=[('High', '<f8'), ('Low', '<f8'), ('Open', '<f8'), ('Close', '<f8'), ('Volume', '<i8'), ('Adj_Close', '<f8'), ('Date', '<M8[D]'), ('Ticker', '<U10'), ('Month', '<M8[M]'), ('Year', '<M8[Y]'), ('Adj_Close_lag_1', '<f8'), ('Adj_Close_lag_2', '<f8'), ('Adj_Close_lag_3', '<f8'), ('Adj_Close_lag_4', '<f8'), ('Adj_Close_lag_5', '<f8')])

Correlation Array

correlated = pp.corr(closing)| Correlation | AA | AAPL | DAL | GE | IBM | KO | MSFT | PEP | UAL |

|---|---|---|---|---|---|---|---|---|---|

| AA | 1.00 | 0.21 | 0.24 | -0.17 | 0.39 | -0.09 | 0.05 | -0.04 | 0.12 |

| AAPL | 0.21 | 1.00 | 0.86 | -0.83 | 0.22 | 0.85 | 0.94 | 0.85 | 0.82 |

| DAL | 0.24 | 0.86 | 1.00 | -0.78 | 0.14 | 0.79 | 0.86 | 0.78 | 0.86 |

| GE | -0.17 | -0.83 | -0.78 | 1.00 | 0.06 | -0.76 | -0.86 | -0.69 | -0.76 |

| IBM | 0.39 | 0.22 | 0.14 | 0.06 | 1.00 | 0.07 | 0.15 | 0.24 | 0.18 |

| KO | -0.09 | 0.85 | 0.79 | -0.76 | 0.07 | 1.00 | 0.94 | 0.96 | 0.74 |

| MSFT | 0.05 | 0.94 | 0.86 | -0.86 | 0.15 | 0.94 | 1.00 | 0.93 | 0.83 |

| PEP | -0.04 | 0.85 | 0.78 | -0.69 | 0.24 | 0.96 | 0.93 | 1.00 | 0.75 |

| UAL | 0.12 | 0.82 | 0.86 | -0.76 | 0.18 | 0.74 | 0.83 | 0.75 | 1.00 |

Log Returns

pp.returns(closing,"IBM",type="log")array([ nan, -0.01585991, -0.02180223, ..., 0.0026649 ,

-0.0183533 , 0.0092187 ])

Normal Returns

loga = pp.returns(closing,"IBM",type="normal"); logaarray([ nan, -0.0157348 , -0.02156628, ..., 0.00266845,

-0.0181859 , 0.00926132])

Add Column

close_ret = pp.add(closing,"IBM_log_return",loga); close_ret[:5]array([(37.24206924, 100.45429993, 44.57522202, 20.72605705, 130.59109497, 35.80251312, 41.9791832 , 81.51140594, 66.33999634, nan),

(35.08446503, 97.62433624, 43.83200836, 20.34561157, 128.53627014, 35.80251312, 41.59314346, 80.89860535, 66.15000153, -0.0157348 ),

(35.34244537, 97.63354492, 42.79874039, 19.90727234, 125.76422119, 36.07437897, 40.98268127, 80.28580475, 64.58000183, -0.02156628),

(36.25707626, 99.00255585, 42.57216263, 19.91554451, 124.94229126, 36.52467346, 41.50337982, 82.63342285, 65.52999878, -0.00653548),

(37.28897095, 102.80648041, 43.67792892, 20.15538216, 127.65791321, 36.966465 , 42.72432327, 84.13523865, 66.63999939, 0.02173501)],

dtype=[('AA', '<f8'), ('AAPL', '<f8'), ('DAL', '<f8'), ('GE', '<f8'), ('IBM', '<f8'), ('KO', '<f8'), ('MSFT', '<f8'), ('PEP', '<f8'), ('UAL', '<f8'), ('IBM_log_return', '<f8')])

Drop Array Rows Where Null

close_ret_na = pp.dropnarow(close_ret, "IBM_log_return"); close_ret[:5]array([(37.24206924, 100.45429993, 44.57522202, 20.72605705, 130.59109497, 35.80251312, 41.9791832 , 81.51140594, 66.33999634, nan),

(35.08446503, 97.62433624, 43.83200836, 20.34561157, 128.53627014, 35.80251312, 41.59314346, 80.89860535, 66.15000153, -0.0157348 ),

(35.34244537, 97.63354492, 42.79874039, 19.90727234, 125.76422119, 36.07437897, 40.98268127, 80.28580475, 64.58000183, -0.02156628),

(36.25707626, 99.00255585, 42.57216263, 19.91554451, 124.94229126, 36.52467346, 41.50337982, 82.63342285, 65.52999878, -0.00653548),

(37.28897095, 102.80648041, 43.67792892, 20.15538216, 127.65791321, 36.966465 , 42.72432327, 84.13523865, 66.63999939, 0.02173501)],

dtype=[('AA', '<f8'), ('AAPL', '<f8'), ('DAL', '<f8'), ('GE', '<f8'), ('IBM', '<f8'), ('KO', '<f8'), ('MSFT', '<f8'), ('PEP', '<f8'), ('UAL', '<f8'), ('IBM_log_return', '<f8')])

Portfolio Value from Log Return

pp.portfolio_value(close_ret_na, "IBM_log_return", type="log")array([0.98438834, 0.96338604, 0.95711037, ..., 1.15115429, 1.13040872,

1.14092643])

Cummulative Value from Log Return

pp.cummulative_return(close_ret_na, "IBM_log_return", type="log")array([-0.01561166, -0.03661396, -0.04288963, ..., 0.15115429,

0.13040872, 0.14092643])

Fillna Mean

pp.fillna(tsla_lagged,type="mean")[:5]array([(315.13000488, 298.79998779, 306.1000061 , 310.11999512, 11658600, 310.11999512, 272.95330665, 272.38631982, 271.75180703, 271.10991915, 270.48587024),

(309.3999939 , 297.38000488, 307. , 300.35998535, 6965200, 300.35998535, 310.11999512, 272.38631982, 271.75180703, 271.10991915, 270.48587024),

(318. , 302.73001099, 306. , 317.69000244, 7394100, 317.69000244, 300.35998535, 310.11999512, 271.75180703, 271.10991915, 270.48587024),

(336.73999023, 317.75 , 321.72000122, 334.95999146, 7551200, 334.95999146, 317.69000244, 300.35998535, 310.11999512, 271.10991915, 270.48587024),

(344.01000977, 327.01998901, 341.95999146, 335.3500061 , 7008500, 335.3500061 , 334.95999146, 317.69000244, 300.35998535, 310.11999512, 270.48587024)],

dtype={'names':['High','Low','Open','Close','Volume','Adj_Close','Adj_Close_lag_1','Adj_Close_lag_2','Adj_Close_lag_3','Adj_Close_lag_4','Adj_Close_lag_5'], 'formats':['<f8','<f8','<f8','<f8','<i8','<f8','<f8','<f8','<f8','<f8','<f8'], 'offsets':[0,8,16,24,32,40,112,120,128,136,144], 'itemsize':152})

Fillna Value

pp.fillna(tsla_lagged,type="value",value=-999999)[:5]array([(315.13000488, 298.79998779, 306.1000061 , 310.11999512, 11658600, 310.11999512, -9.99999000e+05, -9.99999000e+05, -9.99999000e+05, -9.99999000e+05, -999999.),

(309.3999939 , 297.38000488, 307. , 300.35998535, 6965200, 300.35998535, 3.10119995e+02, -9.99999000e+05, -9.99999000e+05, -9.99999000e+05, -999999.),

(318. , 302.73001099, 306. , 317.69000244, 7394100, 317.69000244, 3.00359985e+02, 3.10119995e+02, -9.99999000e+05, -9.99999000e+05, -999999.),

(336.73999023, 317.75 , 321.72000122, 334.95999146, 7551200, 334.95999146, 3.17690002e+02, 3.00359985e+02, 3.10119995e+02, -9.99999000e+05, -999999.),

(344.01000977, 327.01998901, 341.95999146, 335.3500061 , 7008500, 335.3500061 , 3.34959991e+02, 3.17690002e+02, 3.00359985e+02, 3.10119995e+02, -999999.)],

dtype={'names':['High','Low','Open','Close','Volume','Adj_Close','Adj_Close_lag_1','Adj_Close_lag_2','Adj_Close_lag_3','Adj_Close_lag_4','Adj_Close_lag_5'], 'formats':['<f8','<f8','<f8','<f8','<i8','<f8','<f8','<f8','<f8','<f8','<f8'], 'offsets':[0,8,16,24,32,40,112,120,128,136,144], 'itemsize':152})

Fillna Forward Fill

pp.fillna(tsla_lagged,type="ffill")[:5]array([(315.13000488, 298.79998779, 306.1000061 , 310.11999512, 11658600, 310.11999512, nan, nan, nan, nan, nan),

(309.3999939 , 297.38000488, 307. , 300.35998535, 6965200, 300.35998535, 310.11999512, nan, nan, nan, nan),

(318. , 302.73001099, 306. , 317.69000244, 7394100, 317.69000244, 300.35998535, 310.11999512, nan, nan, nan),

(336.73999023, 317.75 , 321.72000122, 334.95999146, 7551200, 334.95999146, 317.69000244, 300.35998535, 310.11999512, nan, nan),

(344.01000977, 327.01998901, 341.95999146, 335.3500061 , 7008500, 335.3500061 , 334.95999146, 317.69000244, 300.35998535, 310.11999512, nan)],

dtype={'names':['High','Low','Open','Close','Volume','Adj_Close','Adj_Close_lag_1','Adj_Close_lag_2','Adj_Close_lag_3','Adj_Close_lag_4','Adj_Close_lag_5'], 'formats':['<f8','<f8','<f8','<f8','<i8','<f8','<f8','<f8','<f8','<f8','<f8'], 'offsets':[0,8,16,24,32,40,112,120,128,136,144], 'itemsize':152})

Fillna Backward Fill

pp.fillna(tsla_lagged,type="bfill")[:5]array([(315.13000488, 298.79998779, 306.1000061 , 310.11999512, 11658600, 310.11999512, 310.11999512, 310.11999512, 310.11999512, 310.11999512, 310.11999512),

(309.3999939 , 297.38000488, 307. , 300.35998535, 6965200, 300.35998535, 310.11999512, 310.11999512, 310.11999512, 310.11999512, 310.11999512),

(318. , 302.73001099, 306. , 317.69000244, 7394100, 317.69000244, 300.35998535, 310.11999512, 310.11999512, 310.11999512, 310.11999512),

(336.73999023, 317.75 , 321.72000122, 334.95999146, 7551200, 334.95999146, 317.69000244, 300.35998535, 310.11999512, 310.11999512, 310.11999512),

(344.01000977, 327.01998901, 341.95999146, 335.3500061 , 7008500, 335.3500061 , 334.95999146, 317.69000244, 300.35998535, 310.11999512, 310.11999512)],

dtype={'names':['High','Low','Open','Close','Volume','Adj_Close','Adj_Close_lag_1','Adj_Close_lag_2','Adj_Close_lag_3','Adj_Close_lag_4','Adj_Close_lag_5'], 'formats':['<f8','<f8','<f8','<f8','<i8','<f8','<f8','<f8','<f8','<f8','<f8'], 'offsets':[0,8,16,24,32,40,112,120,128,136,144], 'itemsize':152})

Print Table

pp.table(tsla_lagged,5)| High | Low | Open | Close | Volume | Adj_Close | Date | Ticker | Month | Year | Adj_Close_lag_1 | Adj_Close_lag_2 | Adj_Close_lag_3 | Adj_Close_lag_4 | Adj_Close_lag_5 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 315.130 | 298.800 | 306.100 | 310.120 | 11658600 | 310.120 | 2019-01-02 | TSLA | 2019-01-01 | 2019-01-01 | nan | nan | nan | nan | nan |

| 1 | 309.400 | 297.380 | 307.000 | 300.360 | 6965200 | 300.360 | 2019-01-03 | TSLA | 2019-01-01 | 2019-01-01 | 310.120 | nan | nan | nan | nan |

| 2 | 318.000 | 302.730 | 306.000 | 317.690 | 7394100 | 317.690 | 2019-01-04 | TSLA | 2019-01-01 | 2019-01-01 | 300.360 | 310.120 | nan | nan | nan |

| 3 | 336.740 | 317.750 | 321.720 | 334.960 | 7551200 | 334.960 | 2019-01-07 | TSLA | 2019-01-01 | 2019-01-01 | 317.690 | 300.360 | 310.120 | nan | nan |

| 4 | 344.010 | 327.020 | 341.960 | 335.350 | 7008500 | 335.350 | 2019-01-08 | TSLA | 2019-01-01 | 2019-01-01 | 334.960 | 317.690 | 300.360 | 310.120 | nan |

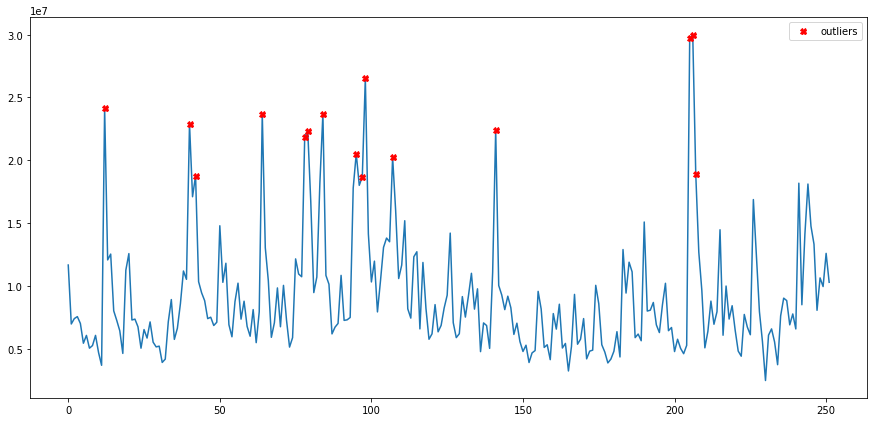

Outliers

signal = tsla_lagged["Volume"]

z_signal = (signal - np.mean(signal)) / np.std(signal)tsla_lagged = pp.add(tsla_lagged,"z_signal_volume",z_signal)outliers = pp.detect(tsla_lagged["z_signal_volume"]); outliers[12, 40, 42, 64, 78, 79, 84, 95, 97, 98, 107, 141, 205, 206, 207]

import matplotlib.pyplot as plt

plt.figure(figsize=(15, 7))

plt.plot(np.arange(len(tsla_lagged["Volume"])), tsla_lagged["Volume"])

plt.plot(np.arange(len(tsla_lagged["Volume"])), tsla_lagged["Volume"], 'X', label='outliers',markevery=outliers, c='r')

plt.legend()

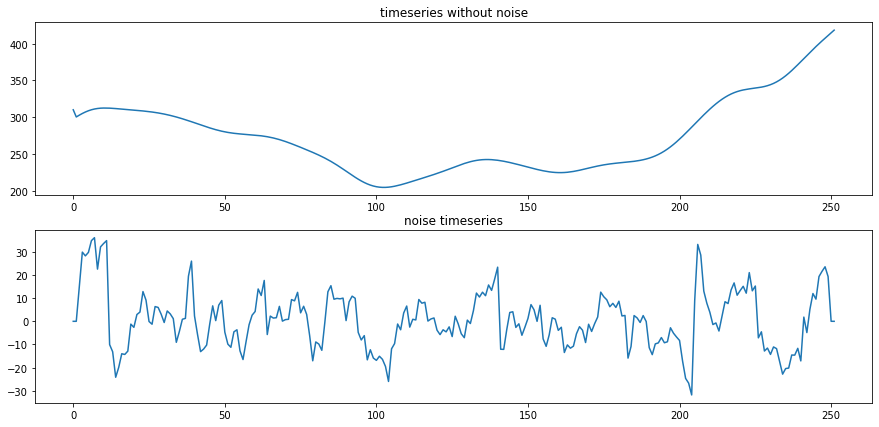

plt.show()Remove Noise

price_signal = tsla_lagged["Close"]

removed_signal = pp.removal(price_signal, 30)

noise = pp.get(price_signal, removed_signal)plt.figure(figsize=(15, 7))

plt.subplot(2, 1, 1)

plt.plot(removed_signal)

plt.title('timeseries without noise')

plt.subplot(2, 1, 2)

plt.plot(noise)

plt.title('noise timeseries')

plt.show()