Portfolio Optimization

Disclaimer: Past does not always repeat itself, we can just learn the wisom from it.

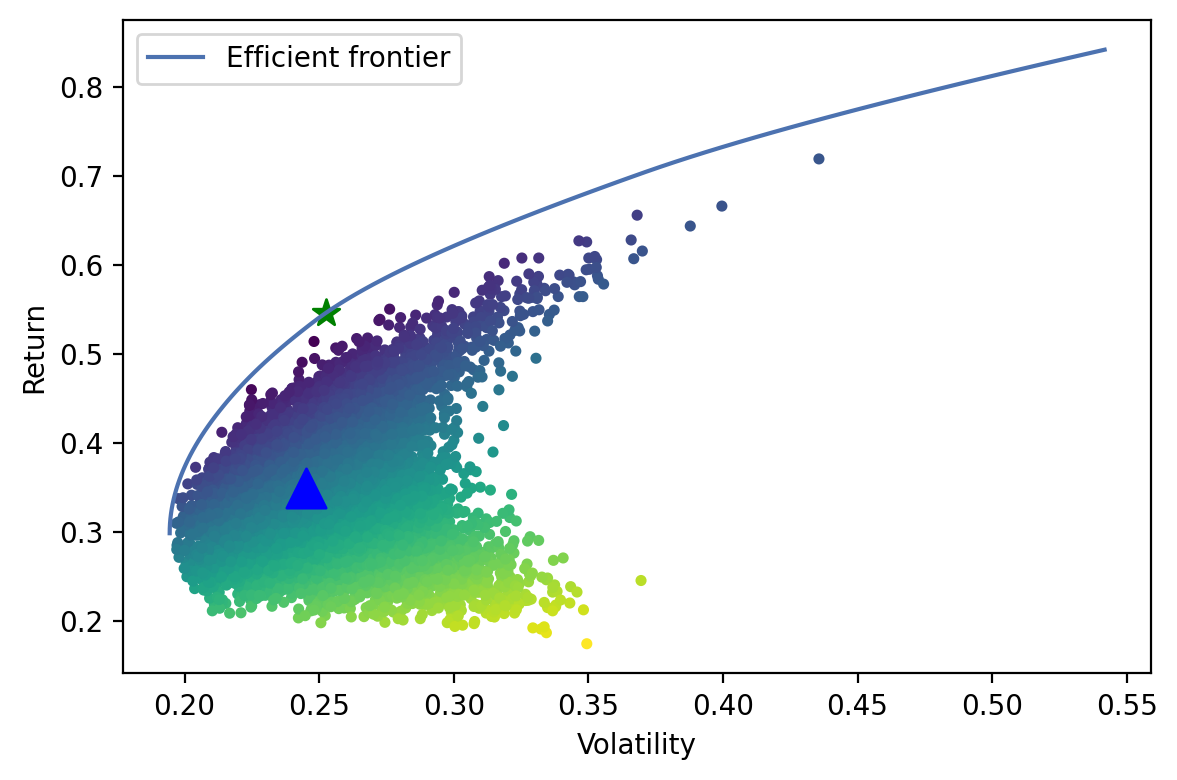

This is a small experiment done with the help of very nice library pyportfolioopt where we are trying to find a portfolio distribution with maximum sharpe ratio (return/risk) from past nifty index data(MPT). And also explore the efficient frontier and where nifty index lie(blue triangle in graph) in terms of risk and reurns.

import pandas as pd

from pypfopt import EfficientFrontier

from pypfopt import risk_models

from pypfopt import expected_returns

from pypfopt import plotting

import os

import numpy as np

from datetime import datetime

import matplotlib.pyplot as plt

import time

from ipynb.fs.full.prepare import index_df, topk

plt.rcParams['figure.dpi'] = 200split RELIANCE 1645.4 2.0112455690013444 818.1

split RELIANCE 2194.7 8.345758072013917 528.9011030752401

split HDFCBANK 2187.75 1.9869669860587622 1101.05

split HDFCBANK 2519.7 19.661766684358625 254.6343263627014

split INFY 1434.25 1.9456691311130707 737.15

split INFY 1975.05 7.548897276749774 509.05366393585496

split INFY 4349.85 116.56160069377809 281.71001962761125

split INFY 3385.65 27348.90761583446 14.429709183719028

split HDFC 3008.95 4.84377012234385 621.2

split ICICIBANK 1794.1 4.953340695748206 362.2

split TCS 3514.1 2.018379713391344 1741.05

split TCS 778.0 8.144572754105939 192.80316652912552

split TCS 1899.7 135.72602072222847 113.99615769064606

split KOTAKBANK 1425.6 2.016122189223589 707.1

split KOTAKBANK 864.6 7.729011898731478 225.53196548821552

split KOTAKBANK 464.75 136.93248427402247 26.232331203070895

split AXISBANK 1985.75 5.022764638927533 395.35

print('Start')Start

index_df

<style scoped>

.dataframe tbody tr th:only-of-type {

vertical-align: middle;

}

</style>

.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

| RELIANCE | HDFCBANK | INFY | HDFC | ICICIBANK | TCS | KOTAKBANK | HINDUNILVR | AXISBANK | |

|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||

| 2005-01-07 | 64.973127 | 24.934178 | 0.074987 | 149.955506 | 72.415774 | 9.872462 | 2.074745 | 141.05 | 37.847682 |

| 2005-01-10 | 64.002574 | 24.908748 | 0.072943 | 150.801954 | 70.437311 | 9.780365 | 2.084969 | 142.75 | 38.245869 |

| 2005-01-11 | 62.996075 | 24.585787 | 0.072092 | 148.954220 | 70.810796 | 9.679426 | 1.990762 | 141.15 | 37.419631 |

| 2005-01-12 | 62.091424 | 24.461179 | 0.069701 | 149.078090 | 69.670152 | 9.563752 | 1.921385 | 139.40 | 36.105614 |

| 2005-01-13 | 62.319084 | 25.374119 | 0.071972 | 148.582609 | 71.477014 | 9.525808 | 1.989302 | 140.05 | 34.970781 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2021-04-26 | 1937.850000 | 1404.800000 | 1343.550000 | 2509.800000 | 591.100000 | 3100.800000 | 1759.650000 | 2360.65 | 700.450000 |

| 2021-04-27 | 1988.650000 | 1438.700000 | 1348.500000 | 2518.400000 | 598.750000 | 3132.000000 | 1750.300000 | 2379.85 | 699.550000 |

| 2021-04-28 | 1997.300000 | 1476.800000 | 1356.000000 | 2577.000000 | 621.350000 | 3124.100000 | 1811.450000 | 2406.55 | 708.150000 |

| 2021-04-29 | 2024.050000 | 1472.500000 | 1356.350000 | 2538.850000 | 621.450000 | 3115.250000 | 1805.000000 | 2407.60 | 719.400000 |

| 2021-04-30 | 1994.500000 | 1412.300000 | 1354.350000 | 2420.100000 | 600.500000 | 3035.650000 | 1748.800000 | 2353.75 | 714.900000 |

4045 rows × 9 columns

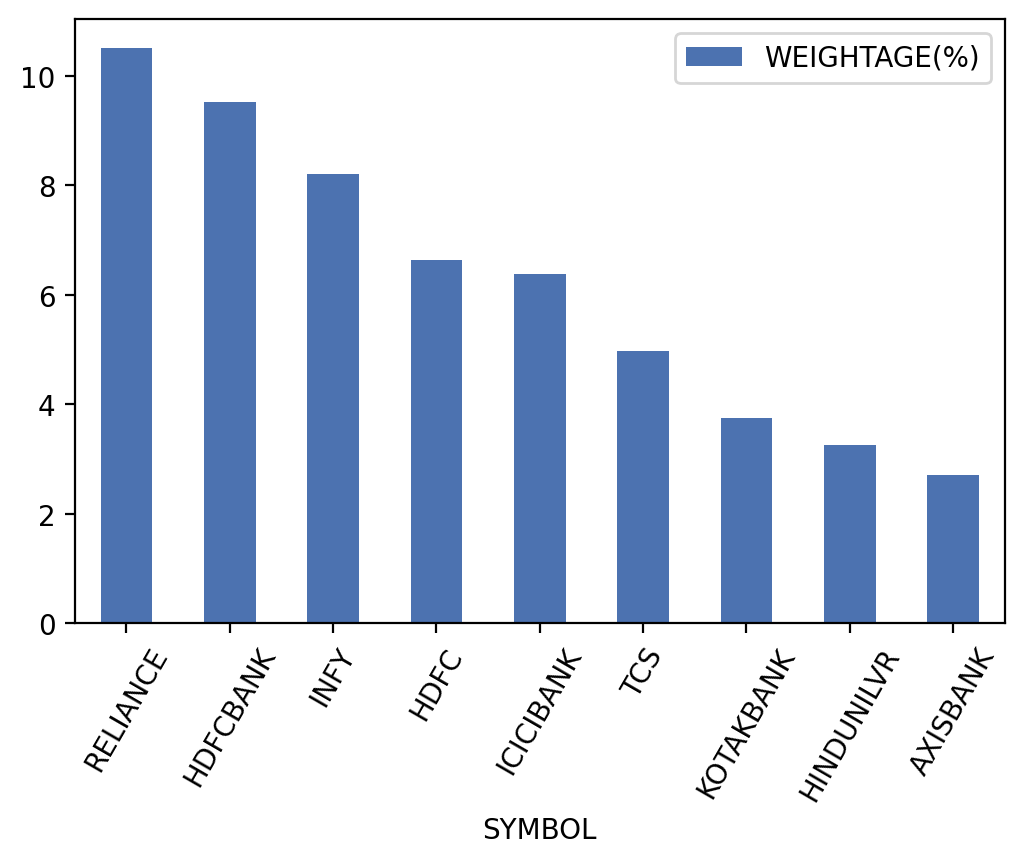

topk.plot(y='WEIGHTAGE(%)', x='SYMBOL', kind='bar', rot=60)<AxesSubplot:xlabel='SYMBOL'>

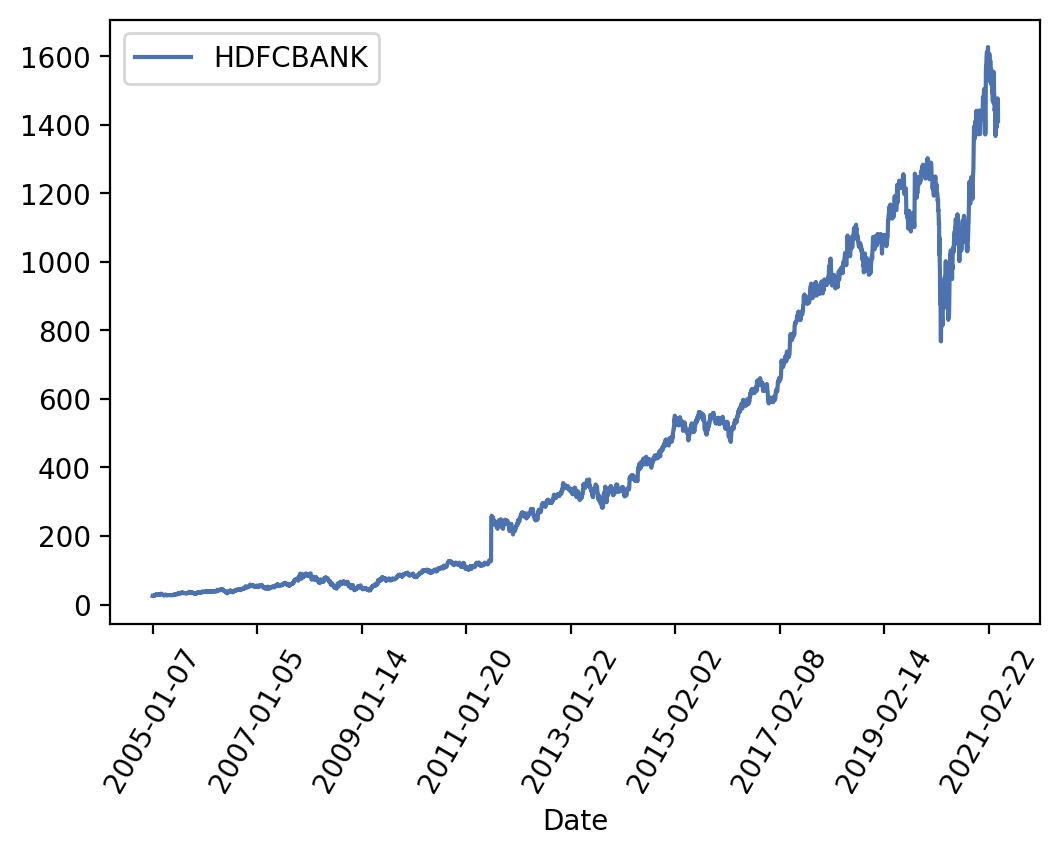

index_df.plot(y='HDFCBANK', kind='line', rot=60)<AxesSubplot:xlabel='Date'>

# index_df.plot(kind='line',y='LT',color='red')# Calculate expected returns and sample covariance

mu = expected_returns.mean_historical_return(index_df, compounding=True)muRELIANCE 0.237850

HDFCBANK 0.286014

INFY 0.841863

HDFC 0.189236

ICICIBANK 0.140899

TCS 0.428985

KOTAKBANK 0.521663

HINDUNILVR 0.191715

AXISBANK 0.200953

dtype: float64

expected_returns.mean_historical_return(index_df, compounding=False)RELIANCE 0.290637

HDFCBANK 0.315050

INFY 7.862403

HDFC 0.236050

ICICIBANK 0.216091

TCS 0.739331

KOTAKBANK 0.811720

HINDUNILVR 0.214057

AXISBANK 0.272611

dtype: float64

S = risk_models.exp_cov(index_df)# Optimize for maximal Sharpe ratio

ef = EfficientFrontier(mu, S)

ef<pypfopt.efficient_frontier.efficient_frontier.EfficientFrontier at 0x132e8deb0>

# raw_weights = ef.max_sharpe()

# w = ef.nonconvex_objective(objective_functions.sharpe_ratio, objective_args=(ef.expected_returns, ef.cov_matrix), weights_sum_to_one=True)# raw_weights# cleaned_weights = ef.clean_weights()

# ef.save_weights_to_file("weights.csv") # saves to file

# print(cleaned_weights)

# ef.portfolio_performance(verbose=True)fig, ax = plt.subplots()

plotting.plot_efficient_frontier(ef, ax=ax, show_assets=False)

# Find the tangency portfolio

raw_weights = ef.max_sharpe()

ret_tangent, std_tangent, _ = ef.portfolio_performance()

ax.scatter(std_tangent, ret_tangent, marker="*", s=100, c="g", label="Max Sharpe")

# Generate random portfolios

n_samples = 10000

w = np.random.dirichlet(np.ones(len(mu)), n_samples)

rets = w.dot(mu)

stds = np.sqrt(np.diag(w @ S @ w.T))

sharpes = rets / stds

ax.scatter(stds, rets, marker=".", c=sharpes, cmap="viridis_r")

# Nifty Top

nifty = np.array([(topk["WEIGHTAGE(%)"]/sum(topk["WEIGHTAGE(%)"])).values])

rets1 = nifty.dot(mu)

stds1 = np.sqrt(np.diag(nifty @ S @ nifty.T))

ax.scatter(stds1, rets1, marker="^", c='b', s=200)

# # Output

# ax.set_title("Efficient Frontier with random portfolios")

# ax.legend()

# plt.tight_layout()

# plt.savefig("ef_scatter.png", dpi=200)

# plt.show()<matplotlib.collections.PathCollection at 0x134fae190>

# nifty.dot(mu)

# w.dot(mu).shape

# np.sqrt(np.diag(w @ S @ w.T)).shape

rets1

# stds1array([0.3494463])

np.sqrt(np.diag(nifty @ S @ nifty.T)).shape(1,)

nifty * S

<style scoped>

.dataframe tbody tr th:only-of-type {

vertical-align: middle;

}

</style>

.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

| RELIANCE | HDFCBANK | INFY | HDFC | ICICIBANK | TCS | KOTAKBANK | HINDUNILVR | AXISBANK | |

|---|---|---|---|---|---|---|---|---|---|

| RELIANCE | 0.019174 | 0.007469 | 0.004650 | 0.004972 | 0.006003 | 0.002778 | 0.002661 | 0.001389 | 0.002650 |

| HDFCBANK | 0.008237 | 0.018093 | 0.004144 | 0.010680 | 0.011066 | 0.001919 | 0.004818 | 0.001004 | 0.003656 |

| INFY | 0.005952 | 0.004811 | 0.043097 | 0.003603 | 0.002809 | 0.005419 | 0.002829 | 0.001493 | 0.001204 |

| HDFC | 0.007882 | 0.015351 | 0.004462 | 0.016174 | 0.012722 | 0.002347 | 0.005200 | 0.001343 | 0.004499 |

| ICICIBANK | 0.009905 | 0.016556 | 0.003621 | 0.013241 | 0.019703 | 0.001898 | 0.005595 | 0.001104 | 0.006705 |

| TCS | 0.005863 | 0.003673 | 0.008933 | 0.003125 | 0.002428 | 0.006553 | 0.001204 | 0.001461 | 0.000956 |

| KOTAKBANK | 0.007459 | 0.012243 | 0.006193 | 0.009194 | 0.009503 | 0.001599 | 0.007797 | 0.001326 | 0.003459 |

| HINDUNILVR | 0.004477 | 0.002934 | 0.003761 | 0.002731 | 0.002157 | 0.002233 | 0.001525 | 0.003544 | 0.000744 |

| AXISBANK | 0.010276 | 0.012855 | 0.003647 | 0.011006 | 0.015760 | 0.001757 | 0.004787 | 0.000895 | 0.009024 |

topk["WEIGHTAGE(%)"]/sum(topk["WEIGHTAGE(%)"])0 0.187846

1 0.170331

2 0.146738

3 0.118499

4 0.113852

5 0.089008

6 0.067024

7 0.058266

8 0.048436

Name: WEIGHTAGE(%), dtype: float64

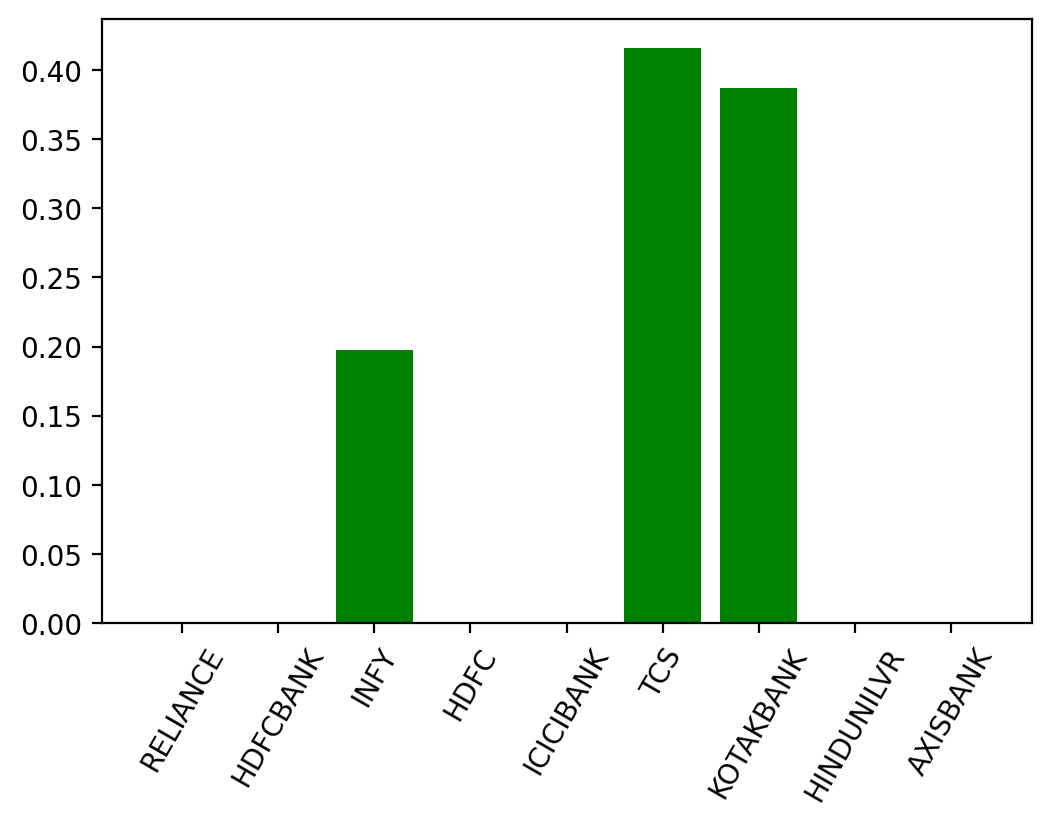

raw_weightsOrderedDict([('RELIANCE', 0.0),

('HDFCBANK', 0.0),

('INFY', 0.1974132196509596),

('HDFC', 0.0),

('ICICIBANK', 0.0),

('TCS', 0.4157200297654416),

('KOTAKBANK', 0.3868667505835988),

('HINDUNILVR', 0.0),

('AXISBANK', 0.0)])

plt.bar(list(raw_weights.keys()), raw_weights.values(), color='g')

plt.xticks(rotation=60)([0, 1, 2, 3, 4, 5, 6, 7, 8],

[Text(0, 0, ''),

Text(0, 0, ''),

Text(0, 0, ''),

Text(0, 0, ''),

Text(0, 0, ''),

Text(0, 0, ''),

Text(0, 0, ''),

Text(0, 0, ''),

Text(0, 0, '')])

Leanings

- I always used to feel that index is safest and the most efficient bet(max sharpe ratio), because markets fill up all inefficiencies and are always self correcting, but this might not be always true.

- Index top 10 have still very good risk to reward ratio, hence a good investment choice among all passively managed vehicles.

- "Compounding is the eight wonder": Einstein