-

Company Name-Fundrise

-

Year of Incorporation-Founded in 2010 and launched in 2012

-

Founders-Dan Miller and Ben Miller

-

Origin of the Company-Dan and Ben both worked in commerical real estate in Washington D.C. They came up with the idea to allow local residents to invest in D.C. area real estate that the brothers were developing. Dan and Ben raised $325,000 from 175 investors to invest in their first project. Fundrise was subsequently contacted by real estate companies looking to raise capital on their platform. Dan and Ben expanded upon the platform and began raising capital from investors across the United States. Fundrise became the first company to successfully crowdfund money for real estate.

-

Funding History-According to Crunchbase, Fundrise has raised a total of $55.5 million across 7 different funding rounds.

-

Financial Problem Being Solved-Investing in commerical real estate historically has only been accessible to institutional or accredited investors. Accredited investors must have an annual income of $200,000 for two consecutive years or a net worth exceeding $1 million. This portion of the population comprises less than 10% of total investors. This is unfair to individual investors who could benefit by gaining access to this to a valuable asset class that has outperformed the stock market:

Not only has commerical real estate performed well over the years, but it also provides valuable diverisfication benefits, has a low correlation with with the stock market, and typically provides higher yields. Real estate also happens to be the world's largest asset class worth estimated $228 trillion. Individual investors are not being given the same access to both the largest and one of the best performing assset classes. Unsurpisingly, as a result, individual investors are underweight this alternative investment class. Fundrise proposes to change the average investor's portfolio allocation, which typically consists of stocks and bonds only:

Fundrise allows for individual investors to invest as little as $500 in high quality commerical real estate. Fundrise does all the work; they source the deals, perform the necessary due dilligence, and partner with local operators to develop the properties. After determining the investor's risk preference, Fundrise deploys the money into a diverse portfolio of real estate projects. The vertically integrated platform also charges lower fees by cutting out brokers and thid parties.

-

Intended Customer/Market Size/Competitive Advantage-Fundrise is able to raise money from both accredited and non-accredited investors. Fundrise markets itself as a simple way to diversify one's porfolio and gain exposure to an important asset class. It leverages technology to drive costs down and automatically puts all investors in a diversified portfolio of properties. While investors can invest as little as $500, the average investment on the platform is $5,000. This would likely indicate that most of folks investing on the platform are retail investors.

The market size is arguably quite large. Any U.S. resident over the age of 18 can invest. While it is probably unrealstic that retail investors portfolios will ever mimic the complex strategies employed by large insitutions, retail investors have trillions invested in investable assets. Fundrise does not require a huge fundamental shift in asset allocations to be successful. Fundrise also offers support for essentially every account type except via a 401(k):

- Individual account

- Joint account

- Entity account

- Trust account

- IRA

Fundrise has a number of competitors in the crowdfunding real estate field. Some of these companies competitors include Crowdstreet, Realty Mogul, Peerstreet, AcreTrader etc. Fundrise has a few advantages over these competitors. First and perhaps most importantly, Fundrise does not require accredited investors to invest on their platform. Secondly, investors are offered a diversified portfolio of properties (in a vehicle Fundrise calls an eReit). Third, quarterly redemptions are available, eamngng this is more liquid than a traditional alternative investment. Lastly, Fundrise has a longer and more successful track record:

-

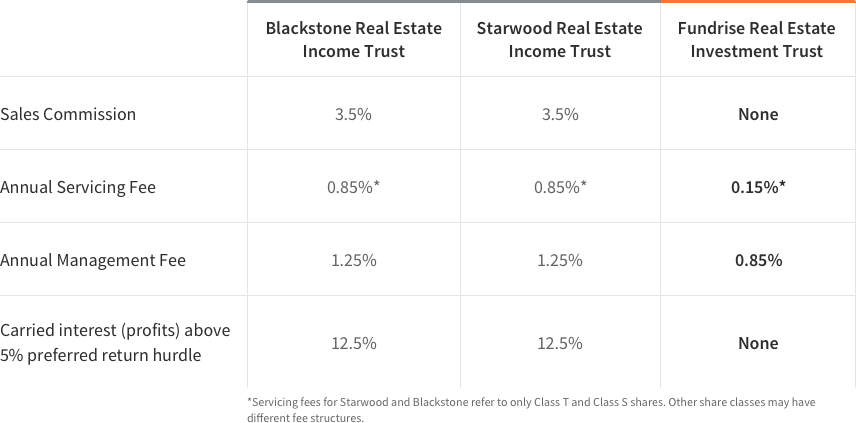

Technologies Being Used-Fundrise claims that it has designed a "full-stack financial integration". Specifically, the company has developed a proprietary cloud-based software with a team of securities, programming and finance professionals, which enables vertically integrated transactions. According to Fundrise, this helps to explain why its fees are lower than than the (publicly traded) products that were launched in the last few years by their much large and better funded competitors-Blackstone and Starwood. The additional reason for the lower costs is due to charging the developers for origination fees rather than investors:

-

Financial Industry Domain-Fundrise is in the lending/crowfunding domain of the fintech world.

-

Major Trends and Innovations-Crowdfunding generated $17.2 billion in North America in 2019. This was an increase of almost 34% YoY. The capital committed to real estate development in the crowdfunding sector has outgrown other industries in this space. The outperformance is likely due to the strong appeal from both developers and investors:

-

Other Major Companies in the Domain-There are several competitors in the real estate crowdfunding space. Example include CrowdStreet, PeerStreet, EquityMultiple, RealtyMogul, RealCrowd etc. Generally the 3 biggest differences between Fundrise and other real estate crowdfunding platforms are as follows:

- Lower minimum investment threshold

- Only able to invest in a porfolio of properties

- Not required to be an accredited investor

-

Business Impact-In 2019, over 100,000 investors participated in real estate crowdfunding syndications, with an average size ofering of $2.3 million. The average preferred return was anywhere between 5-10%. The returns earned by these investors may not have been possible without the real estate crowfunding platforms. Not only does this help individuals to gain wealth, but the platforms also help to create more efficiency in the market. As technology disrupts the industry and more people are able to invest in real estate, this will create more transparency in an industry typically categorized by a select few (i.e. brokers).

-

Core Metrics- As of December 31, 2018, Fundrise had originated ~$660 million in both equity and debt investments. This was deployed across ~$3.2 of real estate property. The company had $488 million in AUM and over 60,000 active investors. AUM and active investors increased 94% and 153% respectively YoY. This business continues to thrive as one of the first companies in the real estate crowdfunding space:

-

Performance Relative to Competition-Fundrise was selected for the Forbes Fintech 50 list in 2015, 2016, 2017 and 2019. Interestingly, compared to the other real estate focused companies on Forbes list, Fundrise had the least amount of funding. As an example, one of the other real estate companies on Forbes list, Cadre, has received funding from legendary VC firm Andreessen Horowitz and was valued at $800 million. Cadre also boats about hiring people from top tier firms such as Apple, Goldman Sachs and Blackstone. Other notable firms on the Forbes list include companies like Acorns, Robinhood and Coibase. It is quite telling that Fundrise made this list.

-

Advice to Fundrise-Fundrise has a solid track record and good name recognition as one of the first movers in the real estate crowdfunding space. They are recognized in the industry and have over 60,000 investors. With that said, 60,000 investors is a very small percentage of the total retail investors in the U.S.. I think it would make sense for Fundrise to partner with a large brokerage firm like Fidelity or Schwab. The case for investing in real estate is compelling; real estate should be a cornerstone of investors portfolios.

-

How Partnering Would Benefit Fundrise-Fundrise needs assets to invest. Large brokerage firms like Schwab and Fidelity have trillions in assets and they are constantly trying to innovate as they compete with new Fintech startups such as Acorns and Robinhood. If a large brokerage could explain to their millions of retail investors on how real estate can benefit one's portfolio, and without having to build their own platform, it would be a win-win for both companies.

-

Additional Technologies Needed-Some integration would be required so that retail investors could see their stock and real estate portfolios on the same platform. There are a number of investment tracking apps that could potentially be utilized such as Personal Capital, SigFig Portfolio Tracker, and Mint.com. Perhaps Fundrise and their brokerage partner might encourage their client to use one of the websites to manage all their entire portfolios.

-

Whether Technologies are Appropiate-If Fundrise and their partner brokerage firm could not integrate their platforms, then there might be privacy or cyber security concerns if all their clients link their data to a third party website. Investors may be less likely to invest in Fundrise if they cannot obtain a holistic view of their portfolio.

- https://blogs.wsj.com/venturecapital/2014/09/26/renren-backed-fundrise-bulks-up-in-real-estate-crowdfunding-sector/

- https://www.fool.com/millionacres/real-estate-investing/crowdfunding/fundrise-review-commercial-real-estate-crowdfunding/3.

- https://www.bizjournals.com/washington/blog/techflash/2014/09/fundrise-the-jobs-act-and-how-crowdfunding-came-to.html

- https://www.financialsamurai.com/how-does-real-estate-crowdfunding-work/

- https://en.wikipedia.org/wiki/Fundrise

- https://www.forbes.com/fintech/2019/#ac946f92b4c6

- https://www.smartowner.com/blog/savills-report-how-much-is-the-world-worth/