This Python script calculates the Effective Annual Rate (EAR) for different bank accounts and visualizes the total return after one year for a range of initial amounts. The script uses both matplotlib and plotly for visualization. Currently it outputs some Neobanks with great offers to the Swiss Public.

The script is divided into several functions:

calculate_ear(i, n, t=1): Calculates the EAR given an interest ratei, number of compounding periodsn, and timet.calculate_return(amount, ear_tiers): Calculates the total return for a given amount and a list of EAR tiers.calculate_returns_for_all_amounts(initial_amounts, ear_tiers): Calculates the total returns for a list of initial amounts and a list of EAR tiers.calculate_ear_vectorized(i, n, t=1): Vectorized version ofcalculate_earfor arrays.calculate_return_vectorized(amounts, ear_tiers): Vectorized calculation of returns for a range of amounts.create_and_show_figure(initial_amounts, accounts, colors): Creates a matplotlib figure and shows it.create_and_show_figure_plotly(initial_amounts, accounts, colors): Creates a plotly figure and saves it as an HTML file.

The script then defines a range of initial amounts and EAR tiers for each account, and uses the above functions to calculate the total return for each account and visualize the results.

To use this script, you need to have numpy, matplotlib, and plotly installed in your Python environment. You can then run the script in a Jupyter notebook or any Python environment.

You can customize the script by modifying the accounts dictionary to add or remove accounts and their EAR tiers, and the colors dictionary to change the colors used in the plots.

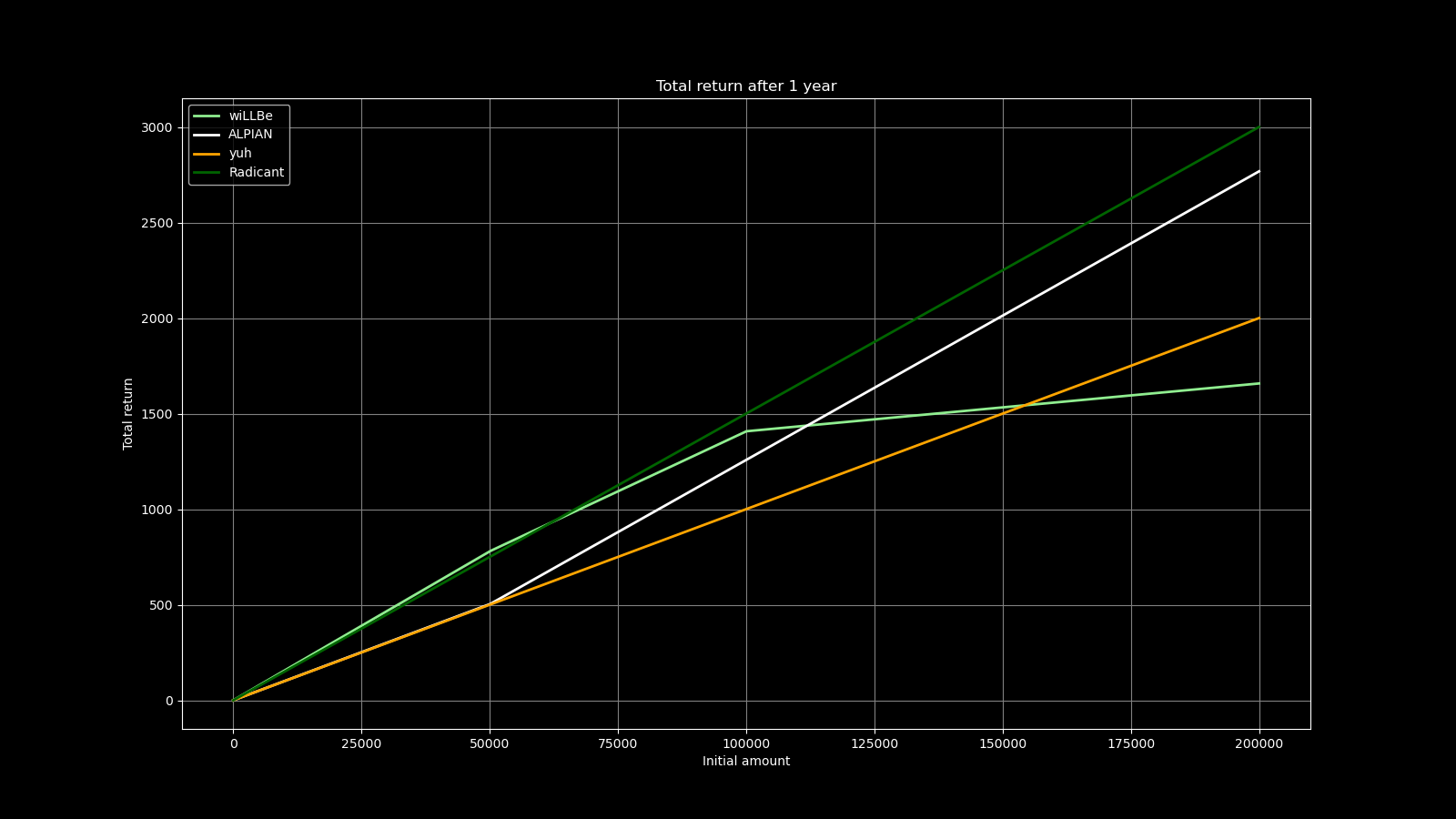

The script outputs a matplotlib figure and a plotly figure, both showing the total return after one year for each account for a range of initial amounts. The matplotlib figure is saved as 'total_return.png', and the plotly figure is saved as 'total_return.html'.

For December 2023 the following figure is valid:

So wiLLbe is the best until you reach around 62k, then you can use Radicant for up to 250k, and after that Alpian offers 1.5% up to 1 million... You can also go to the interactive Plotly Plot to check out everything.

This project is licensed under The Unlicense.