It is a Technical Analysis library useful to do feature engineering from financial time series datasets (Open, Close, High, Low, Volume). It is built on Pandas and Numpy.

The library has implemented 43 indicators:

| ID | Name | Class | defs |

|---|---|---|---|

| 1 | Money Flow Index (MFI) | MFIIndicator | money_flow_index |

| 2 | Accumulation/Distribution Index (ADI) | AccDistIndexIndicator | acc_dist_index |

| 3 | On-Balance Volume (OBV) | OnBalanceVolumeIndicator | on_balance_volume |

| 4 | Chaikin Money Flow (CMF) | ChaikinMoneyFlowIndicator | chaikin_money_flow |

| 5 | Force Index (FI) | ForceIndexIndicator | force_index |

| 6 | Ease of Movement (EoM, EMV) | EaseOfMovementIndicator | ease_of_movement sma_ease_of_movement |

| 7 | Volume-price Trend (VPT) | VolumePriceTrendIndicator | volume_price_trend |

| 8 | Negative Volume Index (NVI) | NegativeVolumeIndexIndicator | negative_volume_index |

| 9 | Volume Weighted Average Price (VWAP) | VolumeWeightedAveragePrice | volume_weighted_average_price |

| ID | Name | Class | defs |

|---|---|---|---|

| 10 | Average True Range (ATR) | AverageTrueRange | average_true_range |

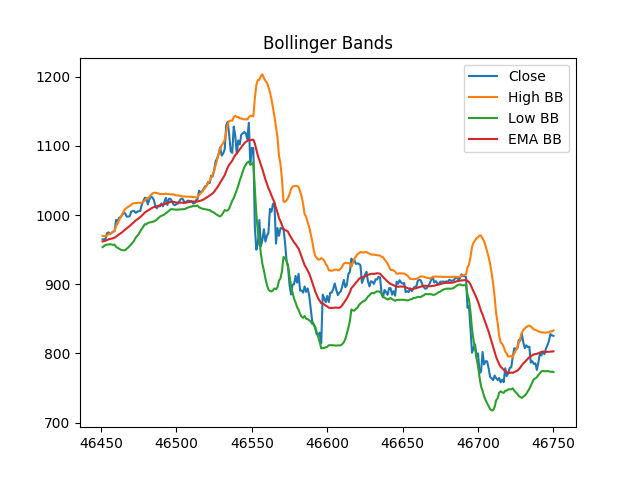

| 11 | Bollinger Bands (BB) | BollingerBands | bollinger_hband bollinger_hband_indicator bollinger_lband bollinger_lband_indicator bollinger_mavg bollinger_pband bollinger_wband |

| 12 | Keltner Channel (KC) | KeltnerChannel | keltner_channel_hband keltner_channel_hband_indicator keltner_channel_lband keltner_channel_lband_indicator keltner_channel_mband keltner_channel_pband keltner_channel_wband |

| 13 | Donchian Channel (DC) | DonchianChannel | donchian_channel_hband donchian_channel_lband donchian_channel_mban donchian_channel_pband donchian_channel_wband |

| 14 | Ulcer Index (UI) | UlcerIndex | ulcer_index |

| ID | Name | Class | defs |

|---|---|---|---|

| 15 | Simple Moving Average (SMA) | SMAIndicator | sma_indicator |

| 16 | Exponential Moving Average (EMA) | EMAIndicator | ema_indicator |

| 17 | Weighted Moving Average (WMA) | WMAIndicator | wma_indicator |

| 18 | Moving Average Convergence Divergence (MACD) | MACD | macd macd_diff macd_signal |

| 19 | Average Directional Movement Index (ADX) | ADXIndicator | adx adx_neg adx_pos |

| 20 | Vortex Indicator (VI) | VortexIndicator | vortex_indicator_neg vortex_indicator_pos |

| 21 | Trix (TRIX) | TRIXIndicator | trix |

| 22 | Mass Index (MI) | MassIndex | mass_index |

| 23 | Commodity Channel Index (CCI) | CCIIndicator | cci |

| 24 | Detrended Price Oscillator (DPO) | DPOIndicator | dpo |

| 25 | KST Oscillator (KST) | KSTIndicator | kst kst_sig |

| 26 | Ichimoku Kinkō Hyō (Ichimoku) | IchimokuIndicator | ichimoku_a ichimoku_b ichimoku_base_line ichimoku_conversion_line |

| 27 | Parabolic Stop And Reverse (Parabolic SAR) | PSARIndicator | psar_down psar_down_indicator psar_up psar_up_indicator |

| 28 | Schaff Trend Cycle (STC) | STCIndicator | stc |

| 29 | Aroon Indicator | AroonIndicator | aroon_down aroon_up |

| ID | Name | Class | defs |

|---|---|---|---|

| 30 | Relative Strength Index (RSI) | RSIIndicator | rsi |

| 31 | Stochastic RSI (SRSI) | StochRSIIndicator | stochrsi stochrsi_d stochrsi_k |

| 32 | True strength index (TSI) | TSIIndicator | tsi |

| 33 | Ultimate Oscillator (UO) | UltimateOscillator | ultimate_oscillator |

| 34 | Stochastic Oscillator (SR) | StochasticOscillator | stoch stoch_signal |

| 35 | Williams %R (WR) | WilliamsRIndicator | williams_r |

| 36 | Awesome Oscillator (AO) | AwesomeOscillatorIndicator | awesome_oscillator |

| 37 | Kaufman's Adaptive Moving Average (KAMA) | KAMAIndicator | kama |

| 38 | Rate of Change (ROC) | ROCIndicator | roc |

| 39 | Percentage Price Oscillator (PPO) | PercentagePriceOscillator | ppo ppo_hist ppo_signal |

| 40 | Percentage Volume Oscillator (PVO) | PercentageVolumeOscillator | pvo pvo_hist pvo_signal |

| ID | Name | Class | defs |

|---|---|---|---|

| 41 | Daily Return (DR) | DailyReturnIndicator | daily_return |

| 42 | Daily Log Return (DLR) | DailyLogReturnIndicator | daily_log_return |

| 43 | Cumulative Return (CR) | CumulativeReturnIndicator | cumulative_return |

https://technical-analysis-library-in-python.readthedocs.io/en/latest/

$ pip install --upgrade taTo use this library you should have a financial time series dataset including Timestamp, Open, High, Low, Close and Volume columns.

You should clean or fill NaN values in your dataset before add technical analysis features.

You can get code examples in examples_to_use folder.

You can visualize the features in this notebook.

import pandas as pd

from ta import add_all_ta_features

from ta.utils import dropna

# Load datas

df = pd.read_csv('ta/tests/data/datas.csv', sep=',')

# Clean NaN values

df = dropna(df)

# Add all ta features

df = add_all_ta_features(

df, open="Open", high="High", low="Low", close="Close", volume="Volume_BTC")import pandas as pd

from ta.utils import dropna

from ta.volatility import BollingerBands

# Load datas

df = pd.read_csv('ta/tests/data/datas.csv', sep=',')

# Clean NaN values

df = dropna(df)

# Initialize Bollinger Bands Indicator

indicator_bb = BollingerBands(close=df["Close"], window=20, window_dev=2)

# Add Bollinger Bands features

df['bb_bbm'] = indicator_bb.bollinger_mavg()

df['bb_bbh'] = indicator_bb.bollinger_hband()

df['bb_bbl'] = indicator_bb.bollinger_lband()

# Add Bollinger Band high indicator

df['bb_bbhi'] = indicator_bb.bollinger_hband_indicator()

# Add Bollinger Band low indicator

df['bb_bbli'] = indicator_bb.bollinger_lband_indicator()

# Add Width Size Bollinger Bands

df['bb_bbw'] = indicator_bb.bollinger_wband()

# Add Percentage Bollinger Bands

df['bb_bbp'] = indicator_bb.bollinger_pband()$ git clone https://github.com/bukosabino/ta.git

$ cd ta

$ pip install -r requirements-play.txt

$ make testThank you to OpenSistemas! It is because of your contribution that I am able to continue the development of this open source library.

- https://en.wikipedia.org/wiki/Technical_analysis

- https://pandas.pydata.org

- https://github.com/FreddieWitherden/ta

- https://github.com/femtotrader/pandas_talib

- Automated tests for all the indicators.

- Use NumExpr to speed up the NumPy/Pandas operations? Article Motivation

- Add more technical analysis features.

- Wrapper to get financial data.

- Use of the Pandas multi-indexing techniques to calculate several indicators at the same time.

- Use Plotly/Streamlit to visualize features

Check the changelog of project.

If you think ta library help you, please consider buying me a coffee.

Developed by Darío López Padial (aka Bukosabino) and other contributors.

Please, let me know about any comment or feedback.

Also, I am a software engineer freelance focused on Data Science using Python tools such as Pandas, Scikit-Learn, Backtrader, Zipline or Catalyst. Don't hesitate to contact me if you need to develop something related with this library, Python, Technical Analysis, AlgoTrading, Machine Learning, etc.