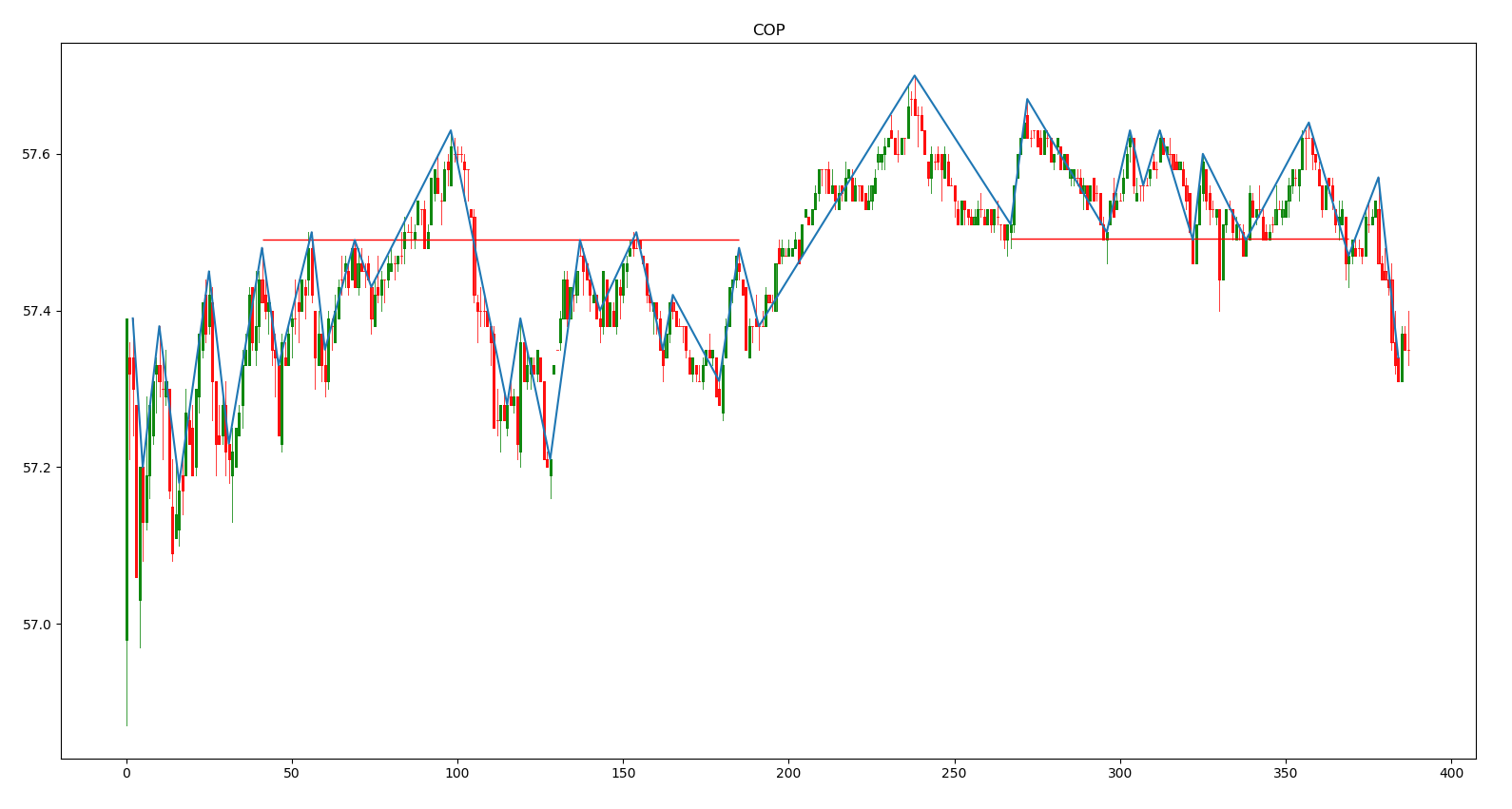

Uses the zig-zag technical indicator to mark reversal points. If there are multiple reversals at a close price range, it averages them out and draws a support/resistance line. Displays a candle-stick chart with the zig-zag indicator and the support/resistance lines marked. Currently loops through a list of s&p500 stocks, getting the data from yahoo finance.

usage: Support&Resistance.py [-h] [-t TICKERS] [-p PERIOD] [-i INTERVAL]

[-d DIF] [--time TIME] [-n NUMBER] [-m MIN]

Algorithmic Support and Resistance

optional arguments:

-h, --help show this help message and exit

-t TICKERS, --tickers TICKERS

Used to look up a specific tickers. Commma seperated.

Example: MSFT,AAPL,AMZN default: List of S&P 500

companies

-p PERIOD, --period PERIOD

Period to look back. valid periods:

1d,5d,1mo,3mo,6mo,1y,2y,5y,10y,ytd,max. default: 1d

-i INTERVAL, --interval INTERVAL

Interval of each bar. valid intervals:

1m,2m,5m,15m,30m,60m,90m,1h,1d,5d,1wk,1mo,3mo.

default: 1m

-d DIF, --dif DIF Max % difference between two points to group them

together. Default: 0.05

--time TIME Max time measured in number of bars between two points

to be grouped together. Default: 150

-n NUMBER, --number NUMBER

Min number of points in price range to draw a

support/resistance line. Default: 3

-m MIN, --min MIN Min number of bars from the start the

support/resistance line has to be at to display chart.

Default: 150