- Introduction

- Setup

- Running the Application

- Example

- Results

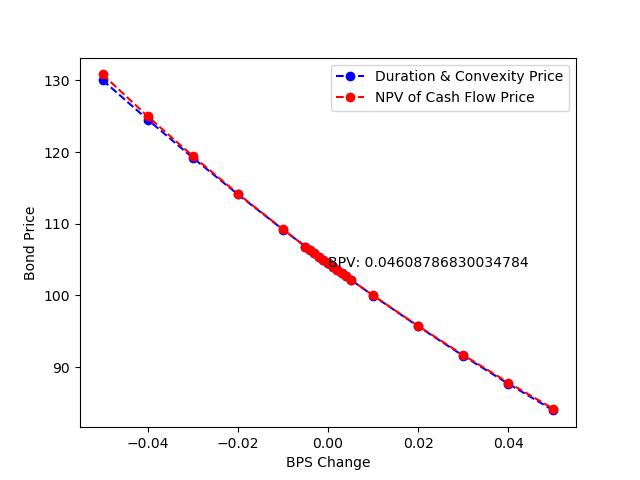

This application allows the user to reprice a vanilla bond using the net present value of cash flows methodology or by using duration and convexity. This renders itself useful for stress testing based on changes in the yield curve.

To properly run the application, you will need a python 3 environment (preferably 3.7) with numpy, pandas, and matplotlib installed.

To run the application, open the project in your favorite IDE and activate your python environment from above. Run the main.py file.

If you prefer the command line, enter the directory of the project and activate your python environment created above and run:

python main.py

Output png files will be saved and the simulation statistics will be printed in the terminal.

Under the current settings, we reprice a vanilla bond at various increments of basis point changes in the yield. For simplicity we instantiate the bond with the following price, face value, yield-to-maturity, coupon rate, coupon frequency, and years to maturity below:

Bond(price=100, face_value=100, ytm=0.04, coupon_rate=0.05, coupon_freq=2, years=5)

We recalculate the bond price for basis point changes between -0.05 and +0.05. The BPV (DV01) is the change in bond price from a 1 basis point change in the yield, which is annotated below.

The new prices via duration and convexity:

Basis Point Change Bond Price

-0.050 130.05

-0.040 124.54

-0.030 119.22

-0.020 114.11

-0.010 109.20

-0.005 106.82

-0.004 106.35

-0.003 105.88

-0.002 105.42

-0.001 104.95

0.000 104.49

0.000 104.49

0.001 104.03

0.002 103.57

0.003 103.12

0.004 102.66

0.005 102.21

0.010 99.98

0.020 95.68

0.030 91.57

0.040 87.67

0.050 83.96

New prices via net present value of cash flow:

Basis Point Change Bond Price

-0.050 130.841772

-0.040 125.000000

-0.030 119.460824

-0.020 114.206957

-0.010 109.222185

-0.005 106.825917

-0.004 106.354118

-0.003 105.884770

-0.002 105.417859

-0.001 104.953371

0.000 104.491293

0.000 104.491293

0.001 104.031609

0.002 103.574307

0.003 103.119373

0.004 102.666793

0.005 102.216554

0.010 100.000000

0.020 95.734899

0.030 91.683395

0.040 87.833656

0.050 84.174564