Application of Mixed Integer Non-Linear Optimization in Hotel Building Design, Commercial Real Estate Development

Introduction

In commercial real estate development, the generally accepted methodology in the design of hotel projects is to commission a market study to ascertain the economic supply and demand of a local market the hotel will serve, and then construct the hotel such that it will contain on average the mean number of room types (1 bedroom, 2 bedroom, suites, etc) and amenities (meeting rooms, restaurants, fitness center, pool, etc) as its market competitors. In doing so, the developer aims to achieve a mean rate of return on his building, assuming the market is stable and he is able to capture the mean economic demand of the local market. The only way in which the developer can maximize his returns to equity is thus to add leverage or debt to his capital structure to finance construction of the project. His return mathematically is presented below1:

Total Equity Return Rate (IRR) = Returnequity + (Returnequity --

Costdebt)*Debt/Equity

Thus as he increases leverage (debt/equity ratio) and under normal

financing transactions as his cost of debt is less than his cost of

equity (Returnequity), the developer will maximize his equity returns

and achieve superior risk adjusted returns for his project than if he

financed construction with 100% equity.

The purpose of this study (the Study) will be to apply mixed integer non-linear optimization (MINLP) in the design of a hotel property in order to maximize the annual profit of the asset subject to various design and construction constraints. NPS formulation will be utilized in the definition of the objective function and formulation of the MINLP model throughout this Study.

Study Model Formulation

The Study is a special application of the union of two disjoint knapsack

linear optimization problems subject to the same convex set defined by

the problem constraints hyperplanes. Specifically, the Study aims to

achieve optimal profit from the union of two disjoint assets in a

commercial real estate hotel design project: the number of hotel room

types and amenities the hotel offers. We define profit as Net Operating

Income (NOI), which is equivalent to: Revenuerooms+amenities --

Variable_Costsrooms+amenities -- Fixed_Costshotel2. For purposes

of this Study we explicitly exclude the effect of income taxes and

financing costs on profit, consistent with the manner in which NOI is

computed3.

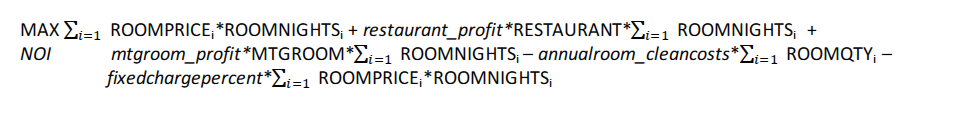

We thus define the objective function for the Study as follows4:

By simple inspection we note the objective function is multivariate, nonlinear and non-convex since various decision variables interact with each other.

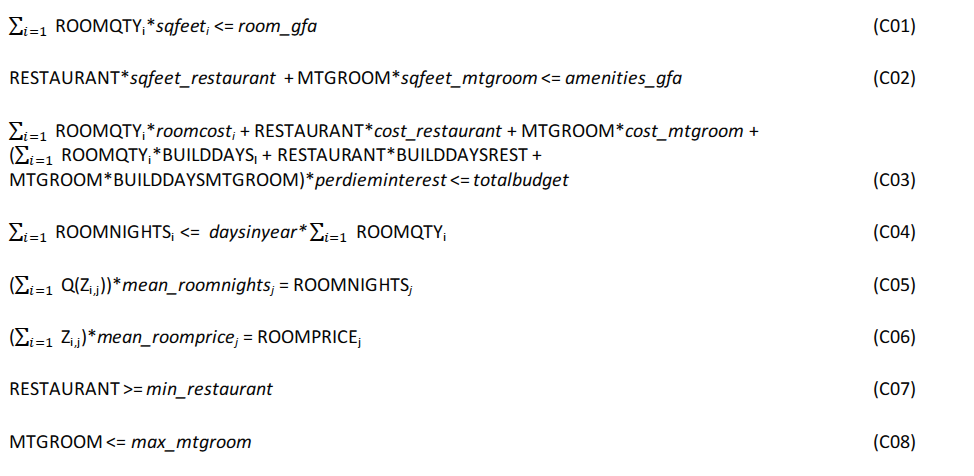

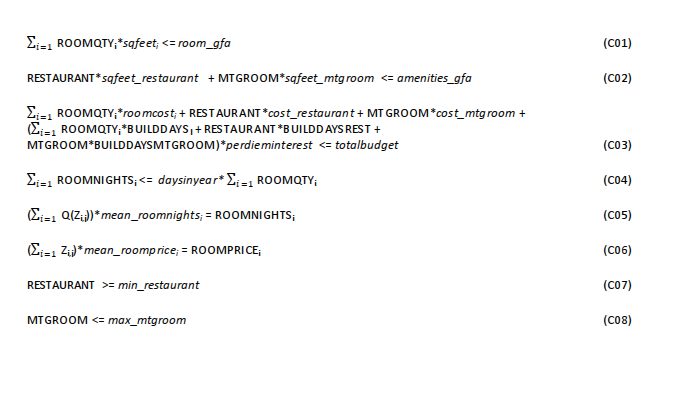

We define the relevant constraint functions below that serve to create the convex hull of feasible solutions and provide a brief discussion of each5.

Constraints (C01 and C02) limit the quantity of hotel room types and

number of restaurants and meeting rooms the property can build subject

to the maximum gross square footage allocated to each in the building.

Constraint (C03) limits the quantity of room types, restaurants, and

meeting rooms built subject to the maximum allowable budget. Here the

constraint resource of time, represented by decision variables

BUILDDAYSi, BUILDDAYSREST, and BUILDDAYSMTGROOM is an unconstrained

resource and thus unbounded, but bounds (C03) by assessing an interest

cost penalty per diem of construction days (time) used. Constraint (C04)

limits the annual quantity of rooms demanded to the maximum annual

quantity of the total number of rooms built and similarly constraints

(C07 and C08) require a minimum number of restaurants and maximum number

of meeting rooms to be built on the subject asset, respectively.

Constraints (C06 and C07) serve to approximate the quantity demanded of

a room type as a function of its price utilizing a linear approximation

of an exponential function that captures the elasticity of demand with

respect to price for the specific room type. As further discussed below

in Section "Data Gathering", the short run natural log demand

elasticity, dQ/dP was found to be -0.7. Thus we formulate a function to

estimate the annual demand of a room type as: Qi(p) =

mean_roomnightsi*e^(-0.07p). Since the coefficient -0.7 represents

the per cent change in quantity per the per cent change in price, we

define p to be the per cent change from the mean room price of a

particular room type in the hotel property. For the purposes of the

Study we created five intervals within which to measure ROOMNIGHTSi =

Qi(p) and ROOMPRICEi to optimize the objective function.

Data Gathering

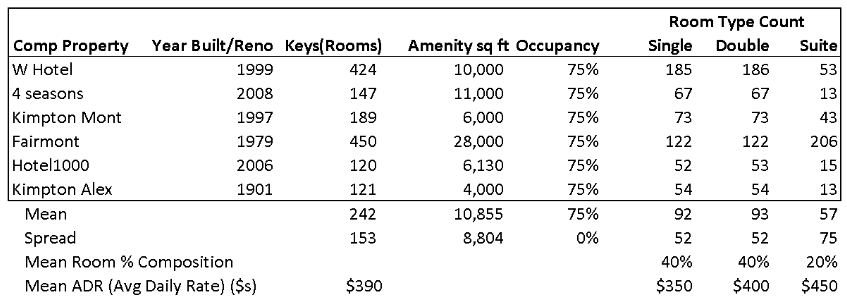

The MINLP model formulated in this Study can be applied to any hotel asset type in any location. For the purposes of this Study, however we define the hotel asset to be a five star, luxury asset that will be centrally located in a submarket of the City of Seattle, WA. Using a previously commissioned market study and appraisal for a similar asset in the same submarket, six hotel competitors were identified as follows6:

Thus, the mean_roompricei for the hotel in the Study was taken as

the mean ADR of each room type across the six competitor hotels. The

mean_roomnightsi, which reflects the mean quantity of room nights

demanded (sold) by room type of the hotel asset in the Study assuming

ROOMPRICEi = mean_roompricei was computed as the average of the

(i) maximum room nights quantity demanded per room type and (ii) the

mean room nights quantity demanded per room type, assuming the 75%

occupancy was distributed uniformly over the composition % per room

type. The basis of this assumption is that the quantity demanded per

room type varies by competitor notwithstanding the same price due to

non-price factors including: location, recent build, network effect

(guest rewards program), height (views), distance to public

transportation, among other factors.

Elasticity of demand for a hotel property is most directly impacted by the market in which the hotel operates and the chain scale of the property (luxury, midscale, economy, etc). The selected asset for the Study is defined to be an upper luxurious property in a top 50 MSA market. Thus, the demand elastic value of -0.7 was chosen, which reflects the per unit natural log change in quantity of rooms sold by the per unit natural log change in price7.

Obtaining an Optimal Solution

The MINLP model was formulated in Python Gurobi and solved in approximately 3 seconds. An optimal solution was found that maximized NOI to approximately $26.5MM with a room type composition for single, double and suite rooms of 50%, 25%, and 25% respectively, in comparison to the competitive set of 40%, 40%, 20%. Pricing per room was higher than mean room ADR rates in the optimal solution by approximately 20%, 35%, and 34% per room type, respectively8. The most common measure of profitability for a developer for a newly constructed asset is yield to cost, defined as NOI / total project costs. The yield to cost found by the nonlinear solver is 22.60% on total project cost of $117MM. The model was also run with decision variables set to the mean parameters of the competitive set (the Developer Scenario), which a developer would typically follow under standard hotel development assumptions. Under this scenario, the NOI was computed to be $14.22MM on total project costs of $122MM, resulting in a yield to cost of 11.65%. Mathematical optimization thus resulted in a 1.97x improved yield over standard development assumptions under a Developer Scenario.

Conclusion & Limitations

MINLP optimization for commercial real estate design and development is a special application of the knapsack optimization problem and lends itself well to optimizing the return of the asset subject to resource, time and capital constraints to construct the asset. Although the Study yielded superior returns compared the traditional Developer Scenario, further refinement of the MINLP model in this Study is warranted. Specifically, the demand curve, which is exponential in nature can be better approximated by increasing the number of intervals by which the curve is linearly approximated. Further refinement of the demand elastic coefficient is also necessary, through a combination study of market research and predictive modeling/multivariate regression techniques. Computation of interest cost per day, which serves as the cost coefficient for the time constraints can be better approximated since interests costs are not linear but represent a cubic shape with respect to total construction costs, congruent with the total construct project S-curve that is commonly exhibited in the market. Finally, although MINLP found a superior optimal solution, its building efficiency use, defined as % of total buildable sq ft was 87% compared to 95% of buildable square ft under the Developer Scenario. Common industry practice in commercial real estate development is to use 100% of buildable square feet. Additional decision variables such as penalty costs for non-utilized buildable square feet and alternative leasing revenue for non-utilized buildable square feet, where applicable in the building design, can be introduced into the model to better maximize building efficiency. Use of Bender's Decomposition rather than LP model relaxation can help achieve better upper bounds on the maximum achievable NOI rather than LP relaxation which tends to produce poor upper bounds under a MINLP optimization.

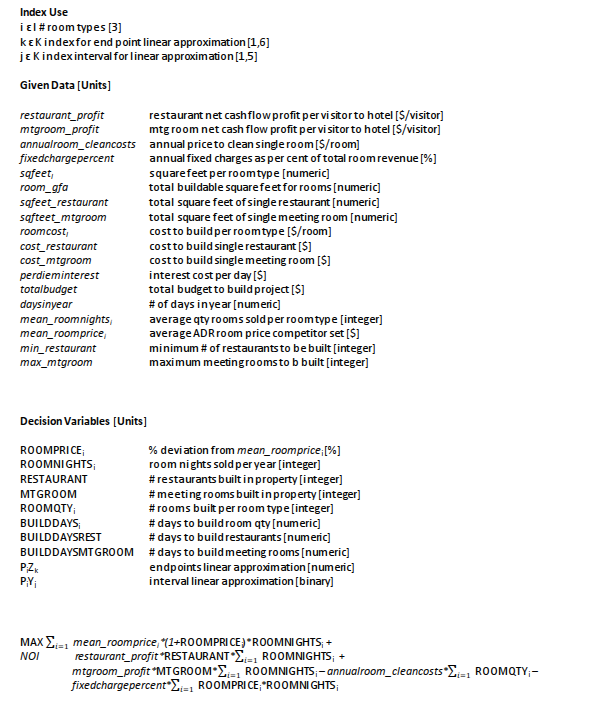

Appendix 1 -- NPS Formulation

Footnotes

-

Moglidiani & Miller, Proposition II ↩

-

Not in NPS formulation ↩

-

The Dictionary of Real Estate Appraisal, The Appraisal Institute ↩

-

Refer Appendix 1 for NPS Formulation definitions ↩

-

Refer Appendix 1 for entire problem formulation ↩

-

Sources: Jones Lang Lasalle Market Research report, Seattle, Sep

2017; www.hotelplanner.com ↩

-

Journal of Hospitality Financial Management, Hotel Industry Demand

Curves, 2012 ↩

-

For full table of decision variable results, refer Appendix 2 ↩