Bank-Marketing-Analysis

Objective

-

Bank Marketing dataset is collected from direct marketing campaign of a bank institution from Portuguese.

-

Marketing campaign can be understood as phone calls to the clients to convince them accept to make a term deposit with their bank.

-

After each call, they are being noted as to no - being the client did not make a deposit and yes - being the client on call accepted to make a deposit.

-

The purpose of this project is to predict if the client on call would accept to make a term deposit or not based on the information of the clients.

-

For More Information refer https://archive.ics.uci.edu/ml/datasets/Bank+Marketing

Main Issues with the dataset

-

There is data imbalance between two classes The number of yes(1) is very low in comparison to no(0)

-

Missing Value in the dataset.

Techniques Used

- Visualizing the data and filling missing value of each column with DecisionTreeClassifier

- To deal with data imbalance we use SMOTE - Synthetic Minority

Over-sampling Technique.

- SMOTE creates synthetic (not duplicate) samples of the minority class. Hence making the minority class equal to the majority class. SMOTE does this by selecting similar records and altering that record one column at a time by a random amount within the difference to the neighbouring records.

- Use Logistic regression for training

Result

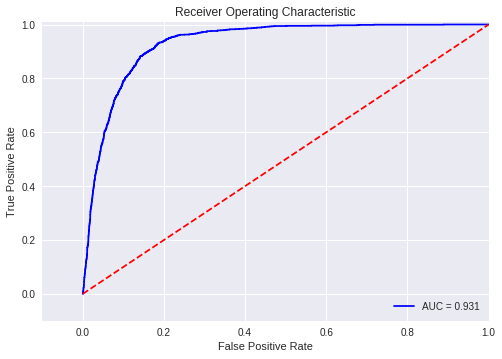

AUC = 0.931

| class | precision | recall | f1-score |

|---|---|---|---|

| 0 | 0.98 | 0.85 | 0.91 |

| 1 | 0.44 | 0.89 | 0.59 |