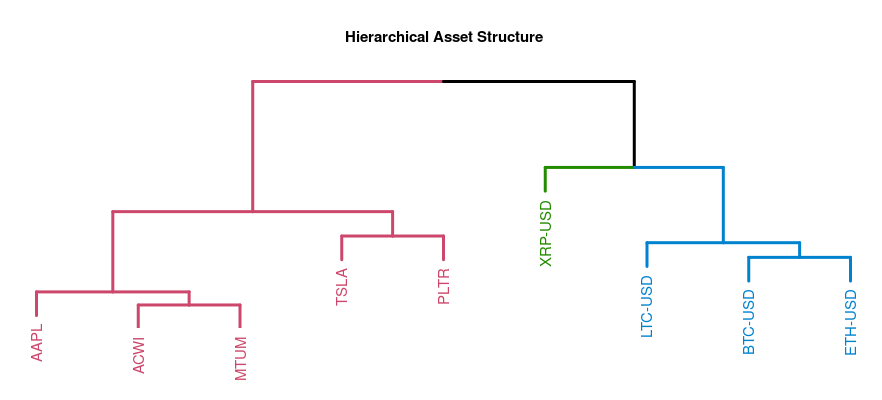

Exemplary Hierarchical Asset Structure

This R Shiny application utilizes the Hierarchical Equal Risk Contribution (HERC) approach, a modern portfolio optimization method developed by Raffinot (2018). It combines the unique strengths of the pioneering Hierarchical Risk Parity (HRP) method by López de Prado (2016) and Hierarchical Clustering-Based Asset Allocation (HCAA) method by Raffinot (2017).

Traditional portfolio optimization suffers from significant instability, primarily due to modeling the vector space of return series as a fully connected graph, where each node can potentially substitute for another. This complicated structure magnifies minute estimation errors, leading to unstable solutions. Hierarchical clustering-based tree structures address this issue by eliminating irrelevant links.

As far as I know, there is no other correct implementation of this methodology in R.

- Use the Ticker table above to enter the securities you wish to invest in. The data is sourced from Yahoo Finance.

- Specify the range of clusters if you wish to narrow this parameter. If not specified, the Silhouette method will determine the optimal number.

- Choose the method to weight the clusters in relation to one another and the assets within each cluster. Risk is defined here as volatility.

- Dendrogram illustrating the hierarchical structure of the securities.

- Pie chart representing the optimized portfolio.

- Table listing each security's portfolio weight and cluster membership.

- Graph depicting the cumulative returns of the securities and the optimized portfolio based on the used data.

- Bar chart comparing the Sharpe ratios of the securities and the optimized portfolio.

The optimal linkage criterion is estimated based on the agglomerative coefficient.

As soon as I find the time, I will make the app more visually appealing and add more features. These include the following:

- Possibility to upload your own data as a csv file.

- More risk metrics, such as Conditional Drawdown at Risk (CDaR)

- Risk-affine weighting

- Shrinkage, denoising and detoning possibilities for the dependency matrix

- Further dependency metrics, such as mutual information.

- Possibility to enter short positions.