The 80-20 strategy keeps at least 80% of collateral in an external yield-generating protocol, such as Curve or GMX and uses ~20% of collateral to provide liquidity on Rage Trade's ETH-USD perp. This approach allows users to essentially recycle liquidity, providing Rage liquidity with LP tokens from other protocols. For more details, see the Rage Trade docs.

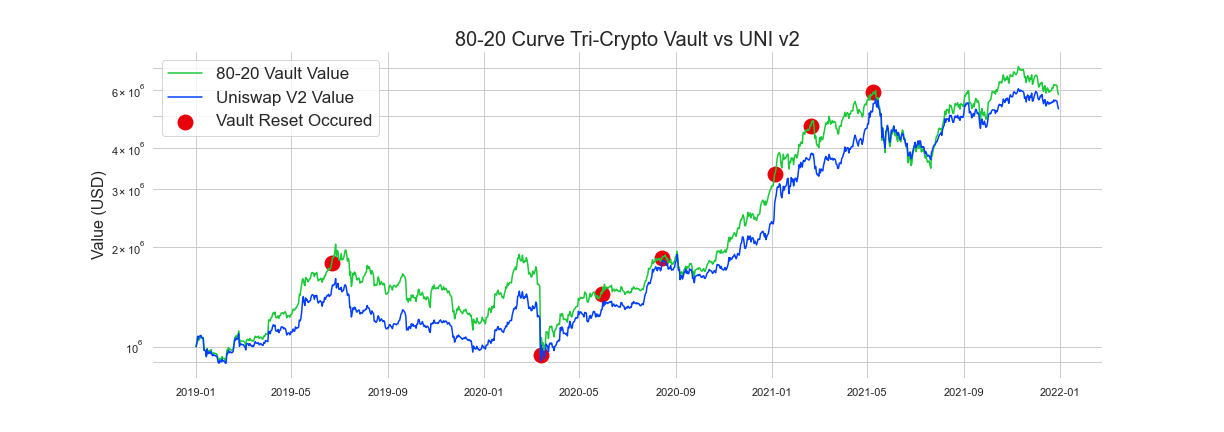

This repo provides simulation code to backtest the Rage Trade 80-20 vault over the past 3 years of market data. We can see from the below graph that the 80-20 TriCrypto strategy performed slightly better than Uniswap V2, particularly during bull runs.

Note that these results do not include fee collection, though we expect that Rage will collect more trading fees than Uniswap V2 as it supports buying on margin.

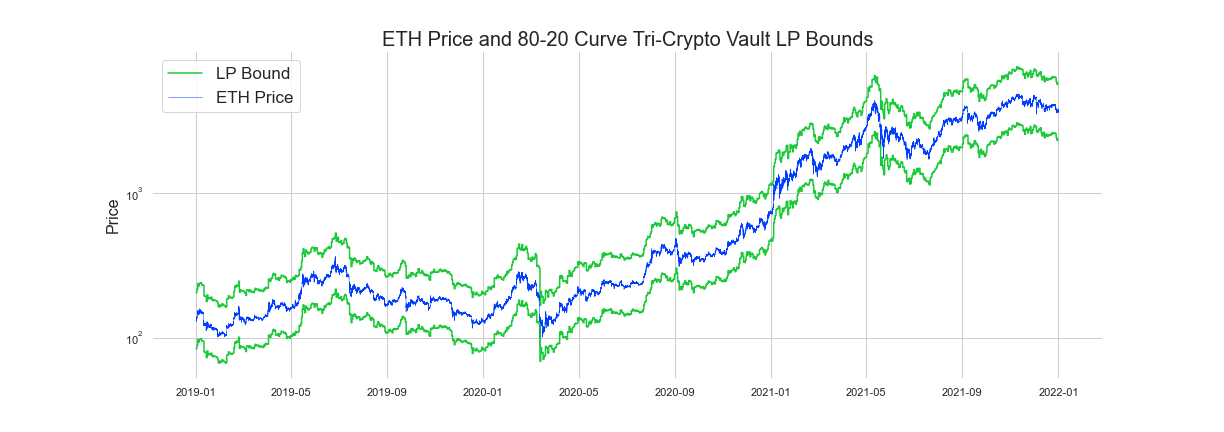

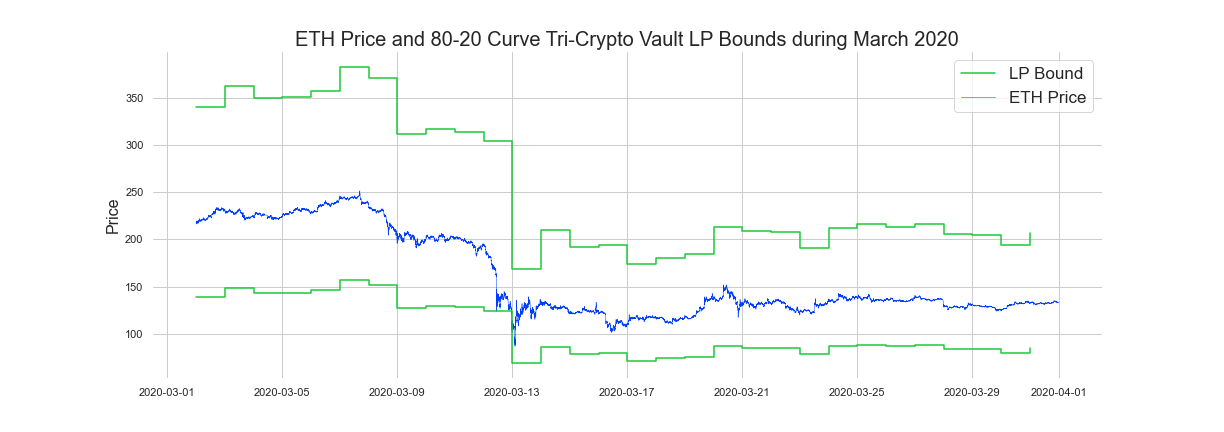

In Uniswap V3, LPs want to keep the price within their active liquidity, so they maximize their fee collection. The 80-20 vault rebalances Rage liquidity daily to keep the liquidity around the current price. The graphs below shows that over the past 3 years, the price never left the LP range.

The price even stayed within range during March 2020.

To run the code, first make sure pipenv is installed. Then create the environment:

pipenv shell

pipenv install

Open jupyter lab

jupyter lab

Open run_simulations.ipynb

Run the notebook from the top to generate the graphs.

To change the backtest settings, modify the constants in backtest.py.

To change the collateral settings, or test with your own collateral, check out collateral_utils.py

The backtest() function returns a DataFrame with the following columns:

time: starting time of the current time intervalcurrent_price: ETH price at current row'stimefuture_price: ETH price at next row'stimecollateral_value: total collateral value attimeliquidity: Uniswap V3 "liquidity" provided attimelower_tick: lower tick for the Rage LP rangeupper_tick: upper tick for the Rage LP rangeeth_deployed: amount of ETH deployed in Rage LP positionusd_deployed: amount of USD deployed in Rage LP positionlp_eth_position: the total ETH position the LP has accumulated since the previous resetlp_usd_position: the total amount of USD the LP has received from the position since the previous resetfees_collected: estimate of USD fees collected over current time intervalreset_triggered: True or False indicates whether a reset was triggered that row (takes effect next row)lp_pnl: The total LP P&L since the previous resetlp_pnl_change: The change in LP P&L since the previous rebalance