Financial Econometrics Practical

This Readme will outline all the following questions by means of explaining, interpreting and reasoning through all the necessary code and functions, whereafter a simplified output will be reproduced within each respective question folders.

First, I sanitize my working environment and source all the necessary functions that will be incorporated into our analyses.

Now I procceed with the respective questions.

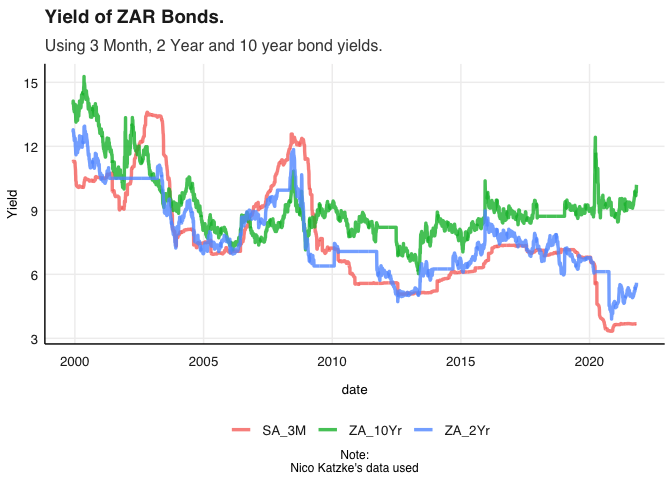

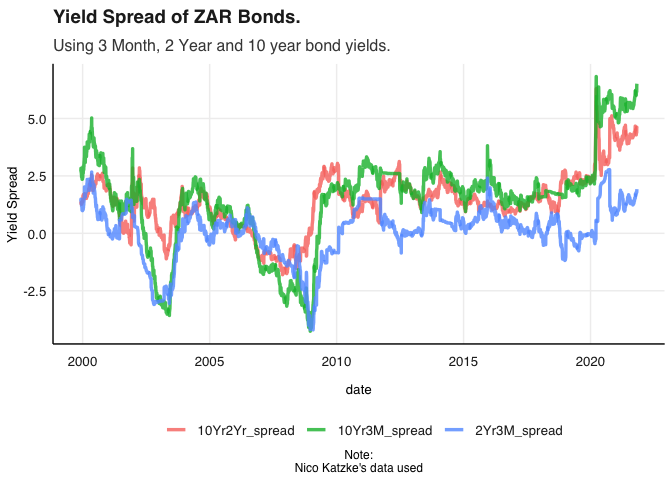

Since the beginning of 2020 the current Yield spreads in local mid-to-longer dated bond yields have been the highest in decades. This is conventionally expressed as the difference in these yields of these instruments in percentage points or basis points.

To investigate this I will conduct a brief analysis on what is the driving is healed spreads. I begin by initialising my data:

Here I gather the data and plot the three South African bond yields. Here are the yields are plotted against time And it is clear that other than a few notable periods such as crashes of 2001 to 2003, And the financial crisis, There is a consistent pattern where the longer term bonds yields slightly higher but all three follow similar trajectories. What is becoming noticeable now in most return series is in a similar manner to the financial crisis various patterns are observed from the beginning of the Covid pandemic.

## Loading required package: xts

## Loading required package: zoo

##

## Attaching package: 'zoo'

## The following objects are masked from 'package:base':

##

## as.Date, as.Date.numeric

##

## Attaching package: 'xts'

## The following objects are masked from 'package:dplyr':

##

## first, last

##

## Attaching package: 'PerformanceAnalytics'

## The following object is masked from 'package:graphics':

##

## legend

I notice

several places where rates stagnate and thus check for missing values in

the data.

I notice

several places where rates stagnate and thus check for missing values in

the data.

It appears that all the data is present, with this I conduct further analysis of the actual spreads between the various bonds.

At first glance an immediate divergence can be observed between the three bond yields, specifically with the three-month and two-year yields diverging from the longer 10 year bond yield. Before investigating this from an economic and qualitative perspective further, it is worth investigating it more formally.

bond_Adj_yield <- SA_bonds %>%

arrange(date) %>%

mutate("10Yr2Yr_spread" = ZA_10Yr - ZA_2Yr,"10Yr3M_spread" = ZA_10Yr - SA_3M,"2Yr3M_spread" = ZA_2Yr - SA_3M ) %>% select(date, "10Yr3M_spread","10Yr2Yr_spread","2Yr3M_spread" )

bond_Adj_yield_tdy <- bond_Adj_yield %>% gather(bondpair, Spread , -date) %>% arrange(date)

bondplot2 <- bond_Adj_yield_tdy %>% ggplot() + geom_line(aes(x = date, y = Spread, color = bondpair), alpha = 0.8, size = 1.2)

bondplot2 <- bondplot2 + fmxdat::theme_fmx() + theme(legend.position = "bottom") + labs(x = "date",

y = "Yield Spread", title = "Yield Spread of ZAR Bonds.", subtitle = "Using 3 Month, 2 Year and 10 year bond yields.", caption = "Note:\nNico Katzke's data used")

print(bondplot2) Here the

data has been groups in three prepares where the difference is taken

between the longer maturity bond from within the pair. As mentioned

earlier there are various periods where the yields exhibit Volatile

behaviour. Consistent with the two periods mentioned earlier, negative

or inverted yields are observed from 2001 to 2004 and again from 2006 to

2009. This will be addressed again later but is worth noting in terms of

the behaviour of participants in the market. To get a better

understanding of addressing the question at hand I subsets the data to

address only the previous decade.

Here the

data has been groups in three prepares where the difference is taken

between the longer maturity bond from within the pair. As mentioned

earlier there are various periods where the yields exhibit Volatile

behaviour. Consistent with the two periods mentioned earlier, negative

or inverted yields are observed from 2001 to 2004 and again from 2006 to

2009. This will be addressed again later but is worth noting in terms of

the behaviour of participants in the market. To get a better

understanding of addressing the question at hand I subsets the data to

address only the previous decade.

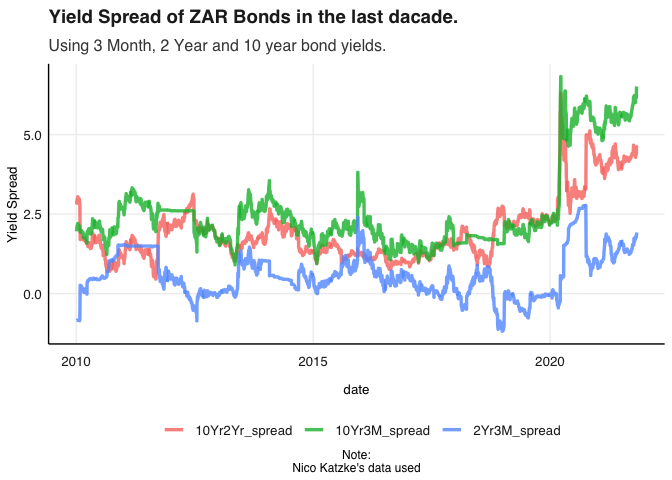

bond_Adj_yield_tdy2010 <- bond_Adj_yield %>% gather(bondpair, Spread , -date) %>% arrange(date) %>%

filter(date > "2010-01-01")

bondplot3 <- bond_Adj_yield_tdy2010 %>% ggplot() + geom_line(aes(x = date, y = Spread, color = bondpair), alpha = 0.8, size = 1.2)

bondplot3 <- bondplot3 + fmxdat::theme_fmx() + theme(legend.position = "bottom") + labs(x = "date",

y = "Yield Spread", title = "Yield Spread of ZAR Bonds in the last dacade.", subtitle = "Using 3 Month, 2 Year and 10 year bond yields.", caption = "Note:\nNico Katzke's data used")

print(bondplot3) It is

clear from the above Graaf that’s-year-old spreads were quite stable up

and till the beginning of the pandemic and a significant level increase

is observed for all three assets.

It is

clear from the above Graaf that’s-year-old spreads were quite stable up

and till the beginning of the pandemic and a significant level increase

is observed for all three assets.

Index investing is often seen as a safe a benchmark to sector specific portfolios in conventional financial theory, For this slightly outdated reason as well as the key drivers of indices giving important information about the vulnerability to systemic risk, Understanding the concentration and commonality of returns within an index Provides key insights. Often times indices are used as a low beta benchmarks or are used as controls in econometric regressions. Here I unpack the returns from the J200 return series specifically as follows

get return series for just j200

#pacman::p_load("tidyverse", "devtools", "FactoMineR", "factoextra",

# "broom", "rmsfuns")

#T40 <- read_rds("data/T40.rds")

#Q2ALSIRTN <- T40 %>% arrange(date) %>% select(date, Tickers, Return, J200) %>% drop_na()

#colSums(is.na(Q3ALSIRTN))

#WghtALSIRTN <- Q3ALSIRTN %>% mutate(effectivereturn = Return*J200) %>%

# group_by(date) %>% summarise(portfolio_return = sum(effectivereturn)) %>% ungroup()

# this is for Q2 ## date Tickers Return

## 0 0 0

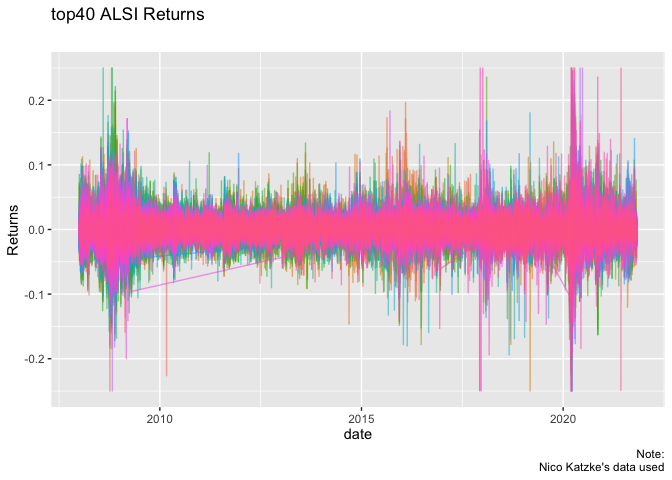

In this analysis specifically it is the over-arching relations between constituents, and of movements of the all the in general, that are desirable. For this reason it is acceptable to winsorise the data as observed above to obtain cleaner estimates.

As a sanity check I also take note that no columns are left out.My process of thinking here was to arrange the data in terms of the J200 series with non-weighted J 400 constituents, whereafter the J400 SWIX constituents were removed.

Q3plot1 <- Q3ALSIRTN %>% ggplot() + geom_line(aes(date, Return, color=Tickers, alpha =0.9)) +

labs(x = "date", y = "Returns", title = "top40 ALSI Returns", subtitle = "", caption = "Note:\nNico Katzke's data used") + theme(legend.position = "none")

Q3plot1 Before a

principal component analysis is conducted it is worthwhile ensuring that

the series has been standardised around zero, As was insured above.

Whilst the values were not in the N.a format that can be observed in the

graph above that some values were not desirable, For a successful

correlation matrix to be run and R I need to fill any values that might

cause problems,

Before a

principal component analysis is conducted it is worthwhile ensuring that

the series has been standardised around zero, As was insured above.

Whilst the values were not in the N.a format that can be observed in the

graph above that some values were not desirable, For a successful

correlation matrix to be run and R I need to fill any values that might

cause problems,

The above code is a direct way in which I imputed the returns of individual stocks taken from the distribution of all of the constituents of the return series. As this is a PCA directed approach it made sense to use a collective distribution so that the overall influence of orthogonal shocks could still be accurately analised. Below I convert this newlyformed matrix type data frame into a covariance matrix after the date is removed.

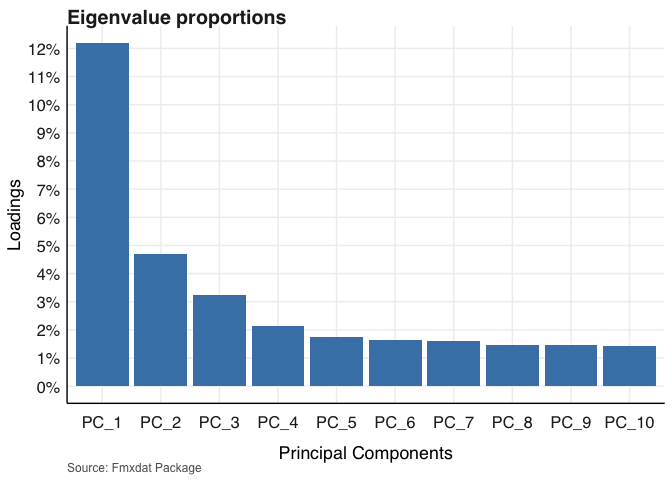

print(prop)Here the proportions of the effects of the principal components are briefly reviewed although I will present them more conveniently below.

prop <- tibble(Loadings = prop) %>% mutate(PC = paste0("PC_",

row_number()))

prop[, "PC"][[1]] <- factor(prop[, "PC"][[1]], levels = prop$PC)

Prop2 <- prop %>% slice_head(n=10)

g <- Prop2 %>%

ggplot() + geom_bar(aes(PC, Loadings), stat = "identity", fill = "steelblue") +

fmxdat::theme_fmx(axis.size.title = fmxdat::ggpts(38), axis.size = fmxdat::ggpts(35),

title.size = fmxdat::ggpts(42), CustomCaption = T) +

scale_y_continuous(breaks = scales::pretty_breaks(10), labels = scales::percent_format(accuracy = 1)) +

labs(x = "Principal Components", y = "Loadings", title = "Eigenvalue proportions",

caption = "Source: Fmxdat Package")

g Before

interpreting these values I make mention of the fact that I subsets the

principal component to only show the first 10 in the graph. As is

typical of the nature of these eigenvalue proportions in this PCA

framework, After the fourth principal component, each additional

component only explains between 1.5% to 2% of the variation within the

top40. In re-visiting the first principal component I note that 12% of

the variation within the top 40 is explained by a single component and

although we might not know with certainty what this factor is, it has

been calculated linearly as observed. Normally in an analysis of the

style the next step would be to represent the eigenvector proportions or

loading victors graphically, In this case the size of the components

makes this a numeric exercise is a poster visual one. For the sake of

completeness It is worth mentioning that in this Eigenvector analysis

the distribution of the effects of the Different principal components

can be observed for the manner in which they load into different

variables.

Before

interpreting these values I make mention of the fact that I subsets the

principal component to only show the first 10 in the graph. As is

typical of the nature of these eigenvalue proportions in this PCA

framework, After the fourth principal component, each additional

component only explains between 1.5% to 2% of the variation within the

top40. In re-visiting the first principal component I note that 12% of

the variation within the top 40 is explained by a single component and

although we might not know with certainty what this factor is, it has

been calculated linearly as observed. Normally in an analysis of the

style the next step would be to represent the eigenvector proportions or

loading victors graphically, In this case the size of the components

makes this a numeric exercise is a poster visual one. For the sake of

completeness It is worth mentioning that in this Eigenvector analysis

the distribution of the effects of the Different principal components

can be observed for the manner in which they load into different

variables.

The direction I take from here is that as instead of loading supplementary variables onto the PCA analysis, I instead investigate correlations From a CAPM portfolio-theory perspective. For a slightly different perspective on the concentration of this index. Here the SA 3 Month bond is used as a proxy for the risk free rate. Below I convert it to a timeseries table and apply a CAPM, Three month rolling correlation.

library(PerformanceAnalytics)

library(tbl2xts)

rf <-read_rds("data/SA_Bonds.rds") %>%

select(date, SA_3M) %>% gather(Bond, Yield, -date) %>%

arrange(date)

rfxts <- tbl_xts(rf)

xtsQ3ALSIRTN <- tbl_xts(Q3ALSIRTN)

chart.RollingCorrelation(Ra = xtsQ3ALSIRTN , Rb=rfxts, width = 62, xaxis = TRUE,

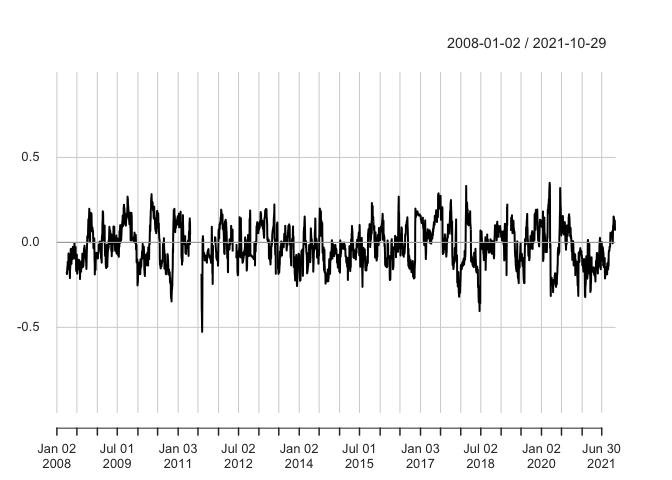

legend.loc = NULL, colorset = (1:12), fill = NA)  This

rolling correlation is promising from a diversification perspective as

it is clearly observable that it revolves around a zero mean

consistently meaning that periods of high positive and high negative

correlation persistence is unlikely. Taking into account that the

highest factor influencing the first principal component was only 12%

and drop down to below 5% for the second principal component it is

substantiated that there are low levels of commonality of returns within

the top 40 index. Before moving on to the following questions it is

worth noting that having a portion of a portfolio in bonds during the

pandemic would have provided good diversification against that of

emerging markets and specifically South African equity as can be

observed above.This does of course need to be analysed with in an

optimisation routine of course.

This

rolling correlation is promising from a diversification perspective as

it is clearly observable that it revolves around a zero mean

consistently meaning that periods of high positive and high negative

correlation persistence is unlikely. Taking into account that the

highest factor influencing the first principal component was only 12%

and drop down to below 5% for the second principal component it is

substantiated that there are low levels of commonality of returns within

the top 40 index. Before moving on to the following questions it is

worth noting that having a portion of a portfolio in bonds during the

pandemic would have provided good diversification against that of

emerging markets and specifically South African equity as can be

observed above.This does of course need to be analysed with in an

optimisation routine of course.

In this question I conduct a simple univariate-GARCH estimation procedure To identify a pure form of volatility of the rand where after I comment on its relation to other currencies.

## Rows: 1792 Columns: 8

## ── Column specification ────────────────────────────────────────────────────────

## Delimiter: ","

## chr (5): LOCATION, INDICATOR, SUBJECT, MEASURE, FREQUENCY

## dbl (2): TIME, Value

## lgl (1): Flag Codes

##

## ℹ Use `spec()` to retrieve the full column specification for this data.

## ℹ Specify the column types or set `show_col_types = FALSE` to quiet this message.

With the data loaded it is important that before a comparison is made a true volatility for the rand itself needs to be identified in order for us to understand how volatile currency is completed self.I note here that an external package is loaded which is labelled PPP and is the real purchasing power parity of the rand compare to the dollar.

Q4cncieszar <- cncy %>% spread(Name, Price) %>% select(date, SouthAfrica_Cncy) %>% gather(Spot, Price, -date) %>% mutate(Spot = gsub("_Cncy", "", Spot)) %>%

mutate(Spot = gsub("SouthAfrica", "USD/ZAR", Spot))

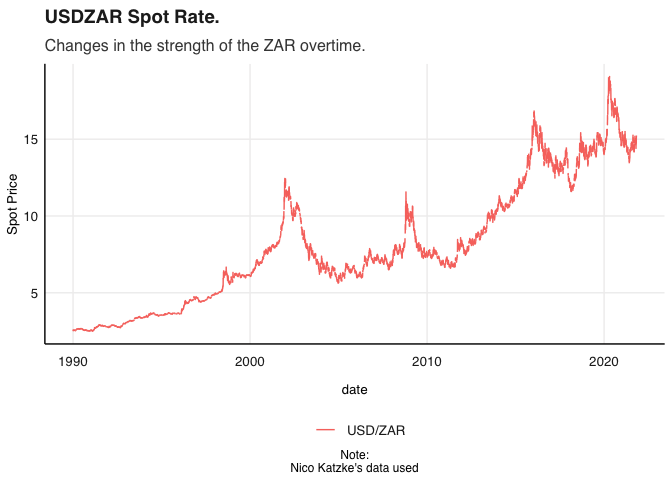

Q4cnciesplot <- Q4cncieszar %>% ggplot() + geom_line(aes(date, Price, color = Spot)) + fmxdat::theme_fmx() + labs(x = "date",

y = "Spot Price", title = "USDZAR Spot Rate.", subtitle = "Changes in the strength of the ZAR overtime.", caption = "Note:\nNico Katzke's data used")

Q4cnciesplot With

this iPod is the movement of the USDZAR Currency pair across time.

With

this iPod is the movement of the USDZAR Currency pair across time.

library(lubridate)##

## Attaching package: 'lubridate'

## The following objects are masked from 'package:base':

##

## date, intersect, setdiff, union

Q4PPP <- PPP %>% select(TIME, LOCATION, Value) %>% spread(LOCATION, Value) %>%

select(TIME, ZAF, USA) %>% gather(Spot, Price, -TIME)

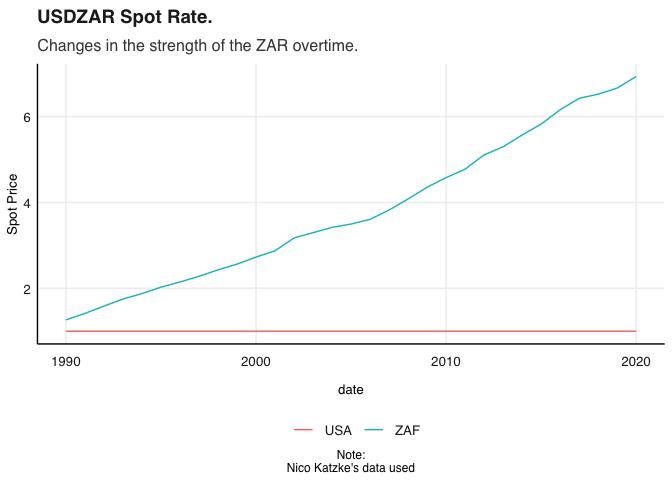

Q4cnciesplot2 <- Q4PPP %>% ggplot() + geom_line(aes(TIME, Price, color = Spot)) + fmxdat::theme_fmx() + labs(x = "date",

y = "Spot Price", title = "USDZAR Spot Rate.", subtitle = "Changes in the strength of the ZAR overtime.", caption = "Note:\nNico Katzke's data used")

Q4cnciesplot2 Immediately here after I present the increase in purchasing power parity

in relation to the increasing value of the UUSDZAR spot, Although this

is simple often times the initial projection biases further analysis in

the direction of a “weakening” rand. I then put the distribution of the

rand and show that it is definitely not normally distributed with a

large positive skew.

Immediately here after I present the increase in purchasing power parity

in relation to the increasing value of the UUSDZAR spot, Although this

is simple often times the initial projection biases further analysis in

the direction of a “weakening” rand. I then put the distribution of the

rand and show that it is definitely not normally distributed with a

large positive skew.

library(tbl2xts)

Q4dlogzar <- Q4cncieszar %>% mutate(Price = na.locf(Price)) %>% arrange(date) %>% mutate(dlogret = log(Price) - log(lag(Price))) %>% mutate(scaledret = (dlogret - mean(dlogret,na.rm =T))) %>% filter(date > dplyr::first(date))

Q4plot3 <- Q4dlogzar %>% ggplot() + geom_line(aes(x = date, y = scaledret, colour = Spot,

alpha = 0.5)) +

ggtitle("Log-Scaled USD/ZAR Returns") +

guides(alpha = "none") +

fmxdat::theme_fmx()

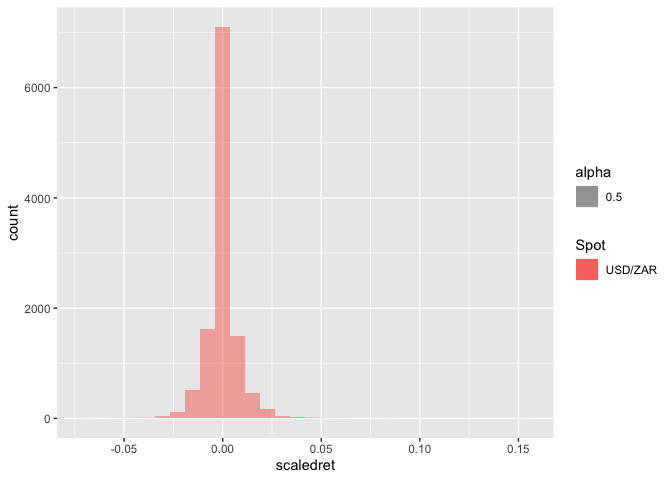

ggplot(Q4dlogzar) +

geom_histogram(aes(x = scaledret, fill = Spot, alpha = 0.5))## `stat_bin()` using `bins = 30`. Pick better value with `binwidth`.

This

presents a high potential for bias due to clumping which in turn means

that there is also persistence in returns. For this reason I clean the

data further as follows:

This

presents a high potential for bias due to clumping which in turn means

that there is also persistence in returns. For this reason I clean the

data further as follows:

Rtn <- Q4dlogzar %>% # Easier to work with ymd here

tbl_xts(., cols_to_xts = dlogret, spread_by = Spot)## The spread_by column only has one category.

## Hence only the column name was changed...

Rtn[is.na(Rtn)] <- 0

Plotdata = cbind(Rtn, Rtn^2, abs(Rtn))

colnames(Plotdata) = c("Returns", "Returns_Sqd", "Returns_Abs")

Plotdata <-

Plotdata %>% xts_tbl() %>%

gather(ReturnType, Returns, -date)

ggplot(Plotdata) +

geom_line(aes(x = date, y = Returns, colour = ReturnType, alpha = 0.5)) +

ggtitle("Return Type Persistence: USD/ZAR") +

facet_wrap(~ReturnType, nrow = 3, ncol = 1, scales = "free") +

guides(alpha = "none", colour = "none") +

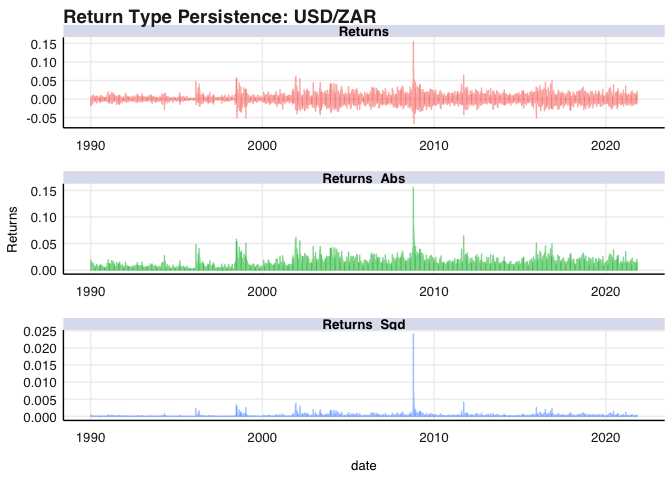

fmxdat::theme_fmx() From the

above figure it is clear that there is persistance in certain periods of

USDZAR returns. The three main takeaway’s here are of first order and

second order persistance as well as clear evidence of long-term memory

in the second order process. I now graph this below:

From the

above figure it is clear that there is persistance in certain periods of

USDZAR returns. The three main takeaway’s here are of first order and

second order persistance as well as clear evidence of long-term memory

in the second order process. I now graph this below:

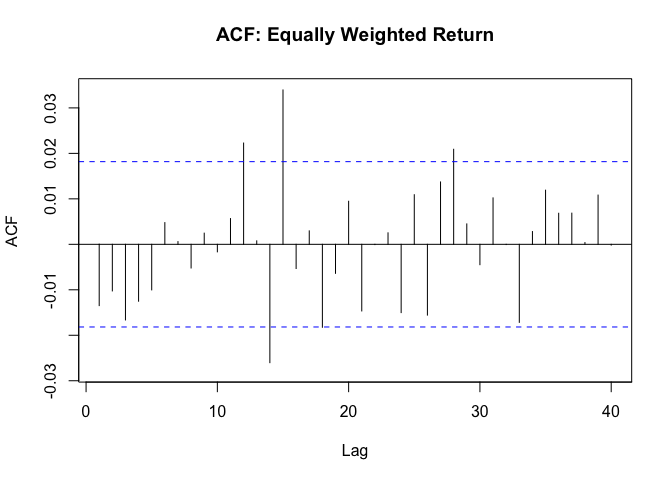

forecast::Acf(Rtn, main = "ACF: Equally Weighted Return")## Registered S3 method overwritten by 'quantmod':

## method from

## as.zoo.data.frame zoo

The

above proves what I expected - There is clear evidence of strong

conditional heteroscedasticity and long memory can also be observed.

Therefore I run a formal test for the effects as follows:

The

above proves what I expected - There is clear evidence of strong

conditional heteroscedasticity and long memory can also be observed.

Therefore I run a formal test for the effects as follows:

Box.test(coredata(Rtn^2), type = "Ljung-Box", lag = 12)##

## Box-Ljung test

##

## data: coredata(Rtn^2)

## X-squared = 1757.2, df = 12, p-value < 2.2e-16

As this test reject the null hypothesis that there are no ARCH effects, I control is therefore needed for a walk your return series.

library(rugarch)## Loading required package: parallel

##

## Attaching package: 'rugarch'

## The following object is masked from 'package:purrr':

##

## reduce

## The following object is masked from 'package:stats':

##

## sigma

garch11 <-

ugarchspec(

variance.model = list(model = c("sGARCH","gjrGARCH","eGARCH","fGARCH","apARCH")[1],

garchOrder = c(1, 1)),

mean.model = list(armaOrder = c(1, 0), include.mean = TRUE),

distribution.model = c("norm", "snorm", "std", "sstd", "ged", "sged", "nig", "ghyp", "jsu")[1])

# Now to fit, I use as.matrix and the data - this way the plot functions we will use later will work.

garchfit1 = ugarchfit(spec = garch11,data = Rtn)

# Note it saved a S4 class object - having its own plots and functionalities:

class(garchfit1)## [1] "uGARCHfit"

## attr(,"package")

## [1] "rugarch"

I then use the above function to estimate the most optimal specification for a univariate GARCH process and display the results below.

## [1] "fit" "model"

## [1] "hessian" "cvar" "var" "sigma"

## [5] "condH" "z" "LLH" "log.likelihoods"

## [9] "residuals" "coef" "robust.cvar" "A"

## [13] "B" "scores" "se.coef" "tval"

## [17] "matcoef" "robust.se.coef" "robust.tval" "robust.matcoef"

## [21] "fitted.values" "convergence" "kappa" "persistence"

## [25] "timer" "ipars" "solver"

## [1] "modelinc" "modeldesc" "modeldata" "pars" "start.pars"

## [6] "fixed.pars" "maxOrder" "pos.matrix" "fmodel" "pidx"

## [11] "n.start"

garchfit1@fit$matcoef Estimate Std. Error t value Pr(>|t|)

mu 1.091702e-04 4.360069e-05 2.5038644 0.01228451 ar1 1.834999e-03 1.004088e-02 0.1827529 0.85499189 omega 1.766632e-07 2.550788e-07 0.6925829 0.48857134 alpha1 6.373138e-02 5.751895e-03 11.0800655 0.00000000 beta1 9.352686e-01 5.500684e-03 170.0276956 0.00000000

pacman::p_load(xtable)

Table <- xtable(garchfit1@fit$matcoef)

print(Table, type = "latex", comment = FALSE)persistence(garchfit1)## [1] 0.999

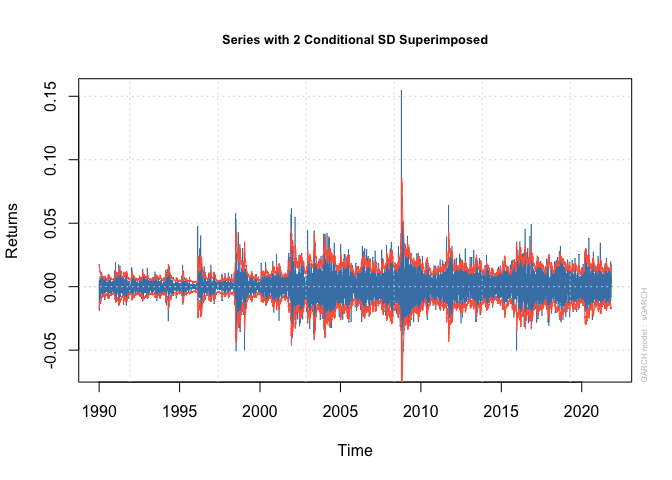

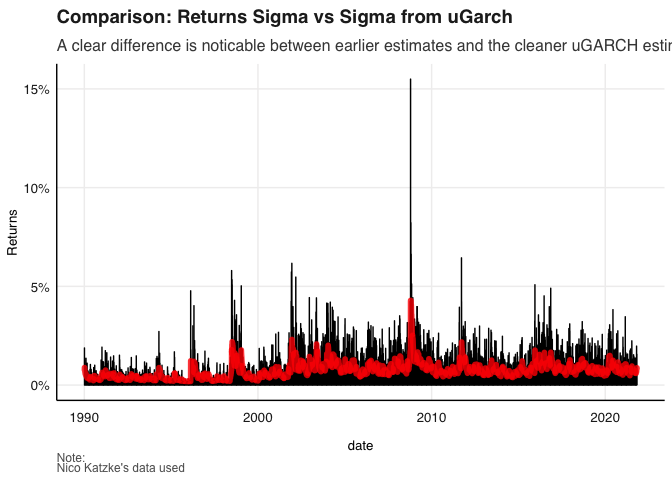

The cleaner estimates are then fitted to be original time series and it is clear that a more pure process is observed.

sigma <- sigma(garchfit1) %>% xts_tbl()

colnames(sigma) <- c("date", "sigma")

sigma <- sigma %>% mutate(date = as.Date(date))

gg <-

ggplot() +

geom_line(data = Plotdata %>% filter(ReturnType == "Returns_Sqd") %>% select(date, Returns) %>%

unique %>% mutate(Returns = sqrt(Returns)), aes(x = date, y = Returns)) +

geom_line(data = sigma, aes(x = date, y = sigma), color = "red", size = 2, alpha = 0.8) +

# scale_y_continuous(limits = c(0, 0.35)) +

labs(title = "Comparison: Returns Sigma vs Sigma from uGarch",

subtitle = "A clear difference is noticable between earlier estimates and the cleaner uGARCH estimates.",

caption = "Note:\nNico Katzke's data used") +

fmxdat::theme_fmx(CustomCaption = TRUE)

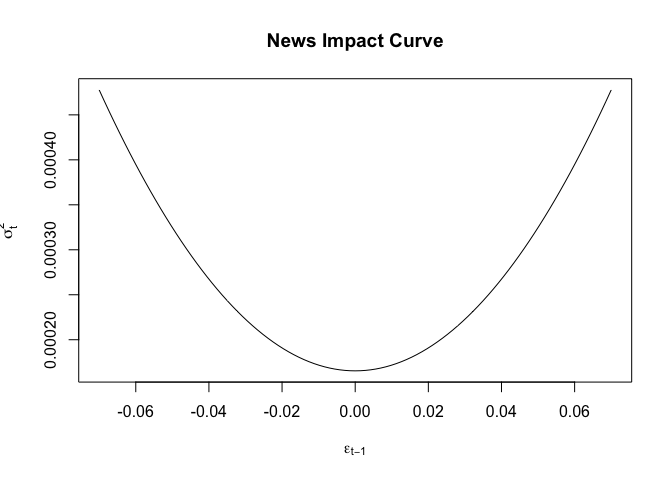

fmxdat::finplot(gg, y.pct = T, y.pct_acc = 1) A news

impact curve is also fitted as follows.

A news

impact curve is also fitted as follows.

ni <- newsimpact(z = NULL, garchfit1)

plot(ni$zx, ni$zy, ylab = ni$yexpr, xlab = ni$xexpr, type = "l",

main = "News Impact Curve")## [1] TRUE

##

## Akaike -7.245377

## Bayes -7.242212

## Shibata -7.245378

## Hannan-Quinn -7.244314

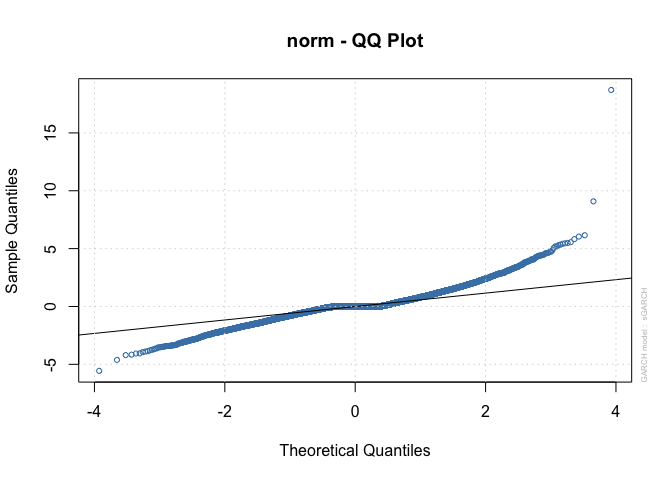

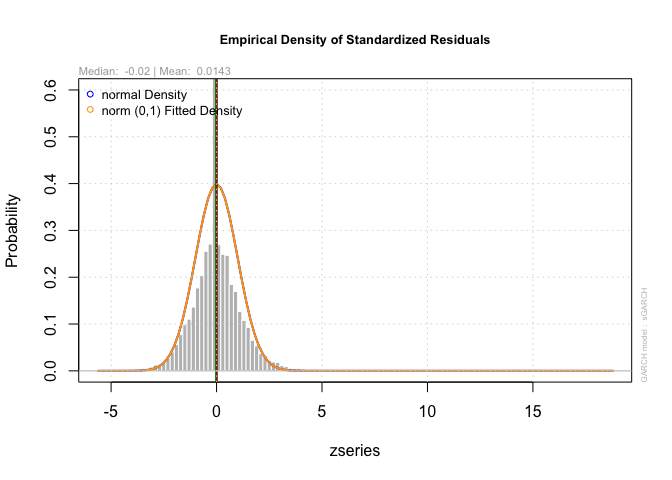

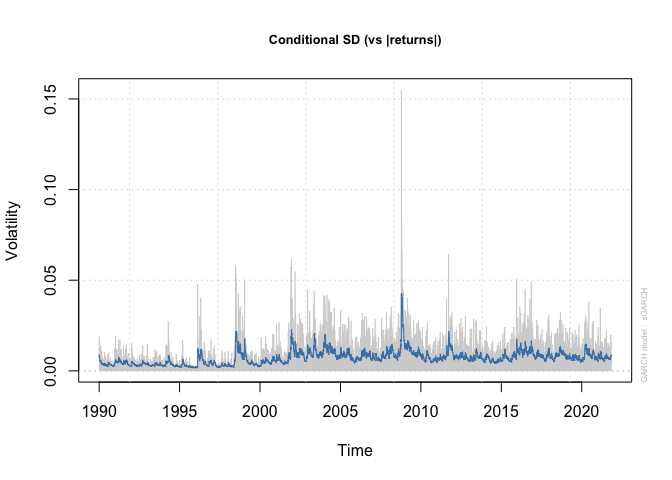

plot(garchfit1, which = 1)plot(garchfit1, which = 9)plot(garchfit1, which = 8)plot(garchfit1, which = 3) From

above a variety of graphs are also plotted, the most notable conclusions

of which, are that a high degree of non-normality persists in the data

which might bias the results but the estimates are clearly much cleaner

than the original estimates.

From

above a variety of graphs are also plotted, the most notable conclusions

of which, are that a high degree of non-normality persists in the data

which might bias the results but the estimates are clearly much cleaner

than the original estimates.

gjrgarch11 = ugarchspec(variance.model = list(model = c("sGARCH","gjrGARCH","eGARCH","fGARCH","apARCH")[2],

garchOrder = c(1, 1)),

mean.model = list(armaOrder = c(1, 0), include.mean = TRUE),

distribution.model = c("norm", "snorm", "std", "sstd", "ged", "sged", "nig", "ghyp", "jsu")[3])

# Now to fit, I use as.matrix and the data - this way the plot functions we will use later will work.

garchfit2 = ugarchfit(spec = gjrgarch11, data = as.matrix(Rtn))

garchfit2@fit$matcoef %>% xtable()## % latex table generated in R 4.0.4 by xtable 1.8-4 package

## % Sun Dec 5 09:10:10 2021

## \begin{table}[ht]

## \centering

## \begin{tabular}{rrrrr}

## \hline

## & Estimate & Std. Error & t value & Pr($>$$|$t$|$) \\

## \hline

## mu & 0.00 & 0.00 & 1.02 & 0.31 \\

## ar1 & -0.02 & 0.01 & -2.37 & 0.02 \\

## omega & 0.00 & 0.00 & 0.07 & 0.95 \\

## alpha1 & 0.05 & 0.00 & 15.92 & 0.00 \\

## beta1 & 0.96 & 0.00 & 2032.78 & 0.00 \\

## gamma1 & -0.02 & 0.00 & -5.14 & 0.00 \\

## shape & 3.01 & 0.10 & 29.31 & 0.00 \\

## \hline

## \end{tabular}

## \end{table}

Diversification across different asset classes is An important tool in constructing portfolios do you to its ability to mitigate risk. These Asset classes are distributed along a plane most well described by growth and inflation And each class Performs in a particular manner given the stage of market/bussiness cycle. Equities are on the opposite side of the growth spectrum to Long-term Treasuries for example. The statement that the return profile across acid classes have converged in the past decade is cause for concern as it minimises the ability for diversification to be in effective tool in managing risk.

Firstly the data is assessed:

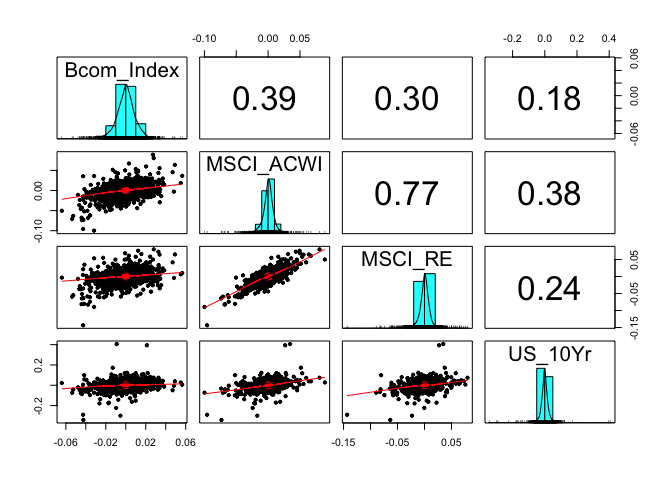

with this in mind we evaluate the MSCI returns and how we can investigate whether true returns are converging( are correlations between assets classes increasing) or are other systemic factors conflating the true signal of volatility in typical market analysis. Consistent with the following question, a good proxy needs to be established for each type of asset: MSCI_RE is used for property, MSCI_ACWI to track global equity, the US ten year treasury is used as a bond proxy and the Bloomberg commodity index is used to represent commodities. Consistant with standardising returns we ensure TRI series are considered.

library(lubridate)

Q5MSCI <-msci %>% spread(Name, Price) %>% select(date, MSCI_ACWI, MSCI_RE)

Q5bond <- bonds %>% spread(Name, Bond_10Yr) %>% select(date, US_10Yr)

Q5Com <- comms %>% spread(Name, Price) %>% select(date, Bcom_Index)

Q5Diverspotential <- Q5MSCI %>% left_join( Q5bond, by = c("date")) %>%

left_join( Q5Com, by = c("date")) %>% gather(Tickers, Price, -date) %>%

group_by(Tickers) %>%

filter(date > as.Date("2000-01-01")) %>% arrange(date) %>%

group_by(Tickers) %>% mutate(dlogret = log(Price) - log(lag(Price))) %>% mutate(scaledret = (dlogret - mean(dlogret, na.rm = T))) %>% filter(date > dplyr::first(date)) %>% ungroup()Above I compiled a joint Index in wide format in order to accommodate the series and then mutate using the statistical measures for returns so that I can easily apply PCA procedures.

pacman::p_load("MTS", "robustbase")

pacman::p_load("tidyverse", "devtools", "rugarch", "rmgarch",

"forecast", "tbl2xts", "lubridate", "PerformanceAnalytics",

"ggthemes")

Q5xts_rtn <- Q5Diverspotential %>% tbl_xts(., cols_to_xts = "dlogret", spread_by = "Tickers")

MarchTest(Q5xts_rtn)## Q(m) of squared series(LM test):

## Test statistic: 10164.13 p-value: 0

## Rank-based Test:

## Test statistic: 3155.677 p-value: 0

## Q_k(m) of squared series:

## Test statistic: 15395.03 p-value: 0

## Robust Test(5%) : 4092.611 p-value: 0

DCCPre <- dccPre(Q5xts_rtn, include.mean = T, p = 0)## Sample mean of the returns: 0.000208785 0.0001418141 -0.0002536672 2.035793e-05

## Component: 1

## Estimates: 1e-06 0.113459 0.875184

## se.coef : 0 0.009054 0.009283

## t-value : 6.241081 12.53092 94.27625

## Component: 2

## Estimates: 1e-06 0.104172 0.882701

## se.coef : 0 0.009086 0.009786

## t-value : 5.841421 11.46542 90.1977

## Component: 3

## Estimates: 1e-06 0.067626 0.932375

## se.coef : 0 0.005651 0.00529

## t-value : 3.767026 11.96606 176.2464

## Component: 4

## Estimates: 1e-06 0.042187 0.951532

## se.coef : 0 0.00422 0.004845

## t-value : 4.224749 9.997587 196.413

A quick glance of the following table shows that a clear violation of is present.

Vol <- DCCPre$marVol

colnames(Vol) <- colnames(Q5xts_rtn)

Vol <-

data.frame( cbind( date = index(Q5xts_rtn), Vol)) %>% # Add date column which dropped away...

mutate(date = as.Date(date)) %>% tbl_df() # make date column a date column...## Warning: `tbl_df()` was deprecated in dplyr 1.0.0.

## Please use `tibble::as_tibble()` instead.

## This warning is displayed once every 8 hours.

## Call `lifecycle::last_lifecycle_warnings()` to see where this warning was generated.

TidyVol <- Vol %>% gather(Stocks, Sigma, -date)

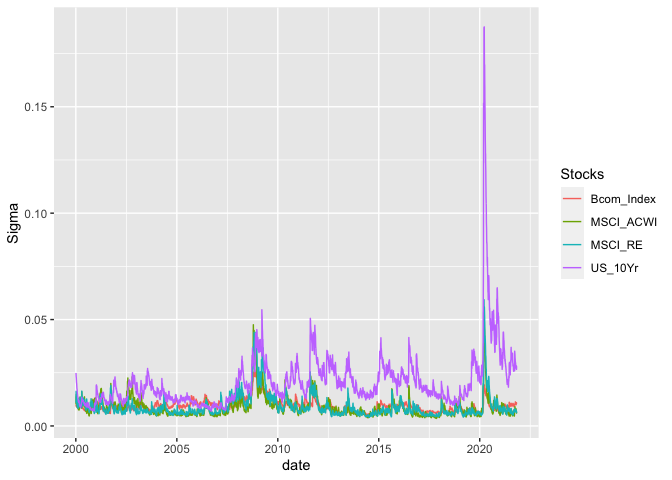

ggplot(TidyVol) + geom_line(aes(x = date, y = Sigma, colour = Stocks)) I also

briefly Graph the initial volatility showing a high degree of

variability which I will clean for a purer signal.

I also

briefly Graph the initial volatility showing a high degree of

variability which I will clean for a purer signal.

StdRes <- DCCPre$sresi

cl = makePSOCKcluster(10)

pacman::p_load("tidyverse", "tbl2xts", "broom")

uspec <- ugarchspec(

variance.model = list(model = "gjrGARCH",

garchOrder = c(1, 1)),

mean.model = list(armaOrder = c(1,

0), include.mean = TRUE),

distribution.model = "sstd")

multi_univ_garch_spec <- multispec(replicate(ncol(Q5xts_rtn), uspec))

spec.go <- gogarchspec(multi_univ_garch_spec,

distribution.model = 'mvnorm', # or manig.

ica = 'fastica') # Note: we use the fastICA

cl <- makePSOCKcluster(10)

multf <- multifit(multi_univ_garch_spec, Q5xts_rtn, cluster = cl)

fit.gogarch <- gogarchfit(spec.go,

data = Q5xts_rtn,

solver = 'hybrid',

cluster = cl,

gfun = 'tanh',

maxiter1 = 40000,

epsilon = 1e-08,

rseed = 100)

print(fit.gogarch)##

## *------------------------------*

## * GO-GARCH Fit *

## *------------------------------*

##

## Mean Model : CONSTANT

## GARCH Model : sGARCH

## Distribution : mvnorm

## ICA Method : fastica

## No. Factors : 4

## No. Periods : 5694

## Log-Likelihood : 74784.65

## ------------------------------------

##

## U (rotation matrix) :

##

## [,1] [,2] [,3] [,4]

## [1,] -0.9147 -0.0633 0.1693 0.361

## [2,] -0.3874 0.2252 -0.1166 -0.886

## [3,] 0.0271 0.9719 0.0109 0.234

## [4,] -0.1117 -0.0269 -0.9786 0.171

##

## A (mixing matrix) :

##

## [,1] [,2] [,3] [,4]

## [1,] 0.001093 0.000467 -0.005396 -0.00838

## [2,] 0.000278 -0.000890 0.001151 -0.01071

## [3,] 0.023901 0.000784 -0.003527 -0.00580

## [4,] 0.000542 0.009137 -0.000441 -0.00381

Above I plots a go-GARCH fit with the optimal specificationS.

gog.time.var.cor <- rcor(fit.gogarch)

gog.time.var.cor <- aperm(gog.time.var.cor,c(3,2,1))

dim(gog.time.var.cor) <- c(nrow(gog.time.var.cor), ncol(gog.time.var.cor)^2)renamingdcc <- function(ReturnSeries, DCC.TV.Cor) {

ncolrtn <- ncol(ReturnSeries)

namesrtn <- colnames(ReturnSeries)

paste(namesrtn, collapse = "_")

nam <- c()

xx <- mapply(rep, times = ncolrtn:1, x = namesrtn)

nam <- c()

for (j in 1:(ncolrtn)) {

for (i in 1:(ncolrtn)) {

nam[(i + (j-1)*(ncolrtn))] <- paste(xx[[j]][1], xx[[i]][1], sep="_")

}

}

colnames(DCC.TV.Cor) <- nam

DCC.TV.Cor <-

data.frame( cbind( date = index(ReturnSeries), DCC.TV.Cor)) %>%

mutate(date = as.Date(date)) %>% tbl_df()

DCC.TV.Cor <- DCC.TV.Cor %>% gather(Pairs, Rho, -date)

DCC.TV.Cor

}

gog.time.var.cor <- renamingdcc(ReturnSeries = Q5xts_rtn, DCC.TV.Cor = gog.time.var.cor)Here I am carrying out various procedures in order to convert the return series into the correct matrix notation so that the correlation matrix can be dealt with correctly.

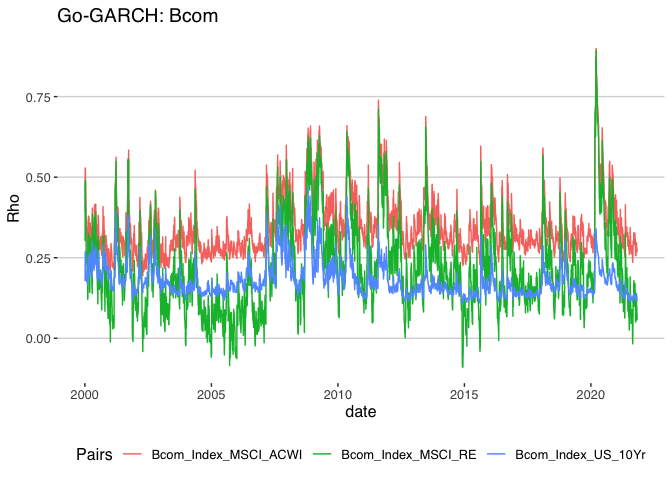

Q5compplot <- ggplot(gog.time.var.cor %>% filter(grepl("Bcom_", Pairs),

!grepl("_Bcom", Pairs))) + geom_line(aes(x = date, y = Rho,

colour = Pairs)) + theme_hc() + ggtitle("Go-GARCH: Bcom")

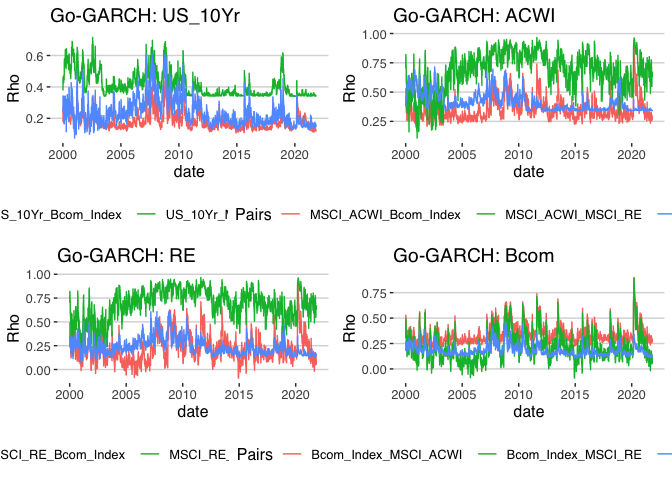

print(Q5compplot) What

follows here is for pairwise MV_GARCH Regressions for a cleaner analysis

of the correlation of funds within the MSCI Indices. Other than the

start of the pandemic which is a clear systemic shock the commodity

index correlation with other funds has remained consistent.

What

follows here is for pairwise MV_GARCH Regressions for a cleaner analysis

of the correlation of funds within the MSCI Indices. Other than the

start of the pandemic which is a clear systemic shock the commodity

index correlation with other funds has remained consistent.

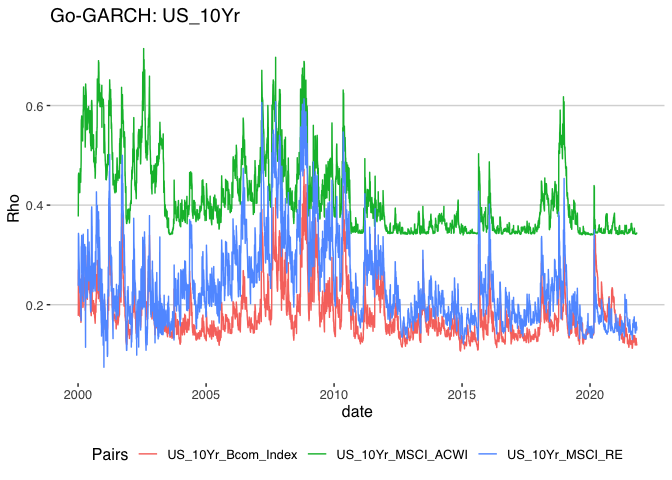

Q5bondplot <- ggplot(gog.time.var.cor %>% filter(grepl("US_10Yr", Pairs),

!grepl("_US", Pairs))) + geom_line(aes(x = date, y = Rho,

colour = Pairs)) + theme_hc() + ggtitle("Go-GARCH: US_10Yr")

print(Q5bondplot) Again it

is not surprising that during the debt crisis the correlation of US

bonds rose with other assets in terms of correlation.

Again it

is not surprising that during the debt crisis the correlation of US

bonds rose with other assets in terms of correlation.

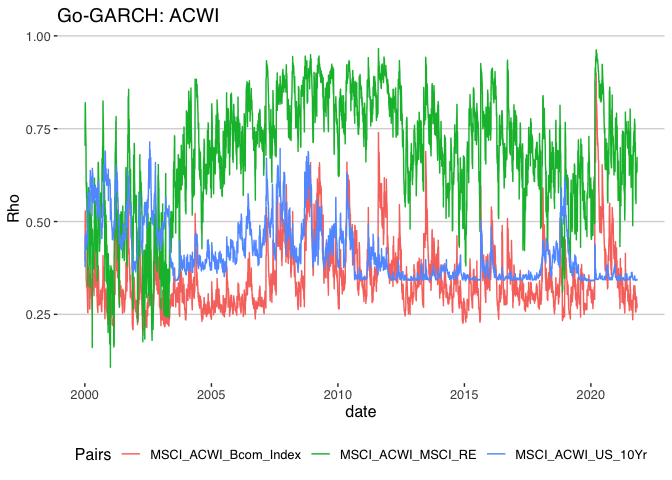

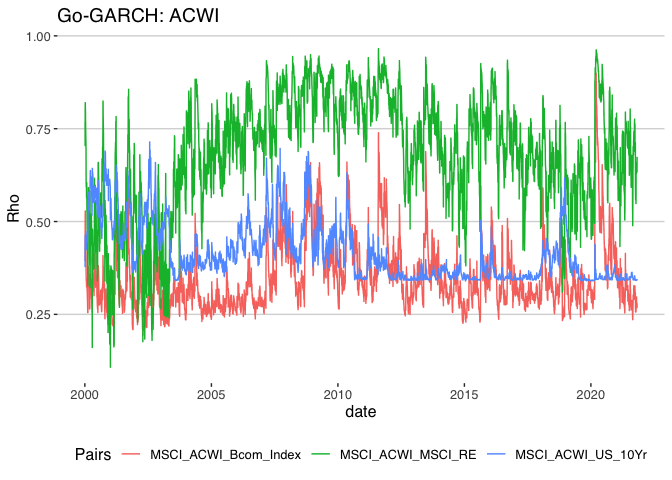

Q5ACWIplot <- ggplot(gog.time.var.cor %>% filter(grepl("MSCI_ACWI", Pairs),

!grepl("_MSCI_ACWI", Pairs))) + geom_line(aes(x = date, y = Rho,

colour = Pairs)) + theme_hc() + ggtitle("Go-GARCH: ACWI")

print(Q5ACWIplot) This

graph was quite surprising and shows that over time the room for

diversification between global equity and real estate has shrunk

significantly with coronation becoming significantly higher over time.

This

graph was quite surprising and shows that over time the room for

diversification between global equity and real estate has shrunk

significantly with coronation becoming significantly higher over time.

Q5REplot <- ggplot(gog.time.var.cor %>% filter(grepl("MSCI_RE", Pairs),

!grepl("_MSCI_RE", Pairs))) + geom_line(aes(x = date, y = Rho,

colour = Pairs)) + theme_hc() + ggtitle("Go-GARCH: RE")

print(Q5ACWIplot)library(cowplot)##

## Attaching package: 'cowplot'

## The following object is masked from 'package:ggthemes':

##

## theme_map

## The following object is masked from 'package:lubridate':

##

## stamp

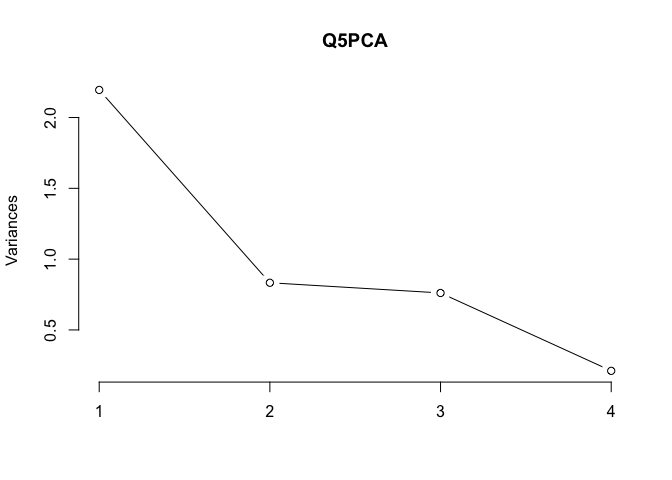

plot_grid(Q5bondplot, Q5ACWIplot, Q5REplot , Q5compplot, labels = c('', '', '','')) Above I

simplify the above correlation estimates in terms of visual analysis by

compiling an into a single plot . I then conduct a brief principal

component analysis of the now clean Sigma estimates and produce a

pairwise panel of the data showing correlations and distributions.

Above I

simplify the above correlation estimates in terms of visual analysis by

compiling an into a single plot . I then conduct a brief principal

component analysis of the now clean Sigma estimates and produce a

pairwise panel of the data showing correlations and distributions.

library(factoextra)

library(FactoMineR)

Q5PCAdata <- Q5Diverspotential %>% select(date, Tickers, dlogret)%>% spread(Tickers,

dlogret) %>% select(-date)

Q5PCA <- prcomp(Q5PCAdata, center = TRUE, scale. = TRUE)

Q5PCA$rotation## PC1 PC2 PC3 PC4

## Bcom_Index 0.4011844 -0.42224868 0.8076376 -0.09207931

## MSCI_ACWI 0.6152749 -0.06339778 -0.2540008 0.74357321

## MSCI_RE 0.5704492 -0.20246396 -0.4630326 -0.64745409

## US_10Yr 0.3675263 0.88130308 0.2623086 -0.13936816

plot(Q5PCA, type = "l")summary(Q5PCA)## Importance of components:

## PC1 PC2 PC3 PC4

## Standard deviation 1.4814 0.9128 0.8724 0.45949

## Proportion of Variance 0.5487 0.2083 0.1903 0.05278

## Cumulative Proportion 0.5487 0.7570 0.9472 1.00000

pacman::p_load("psych")

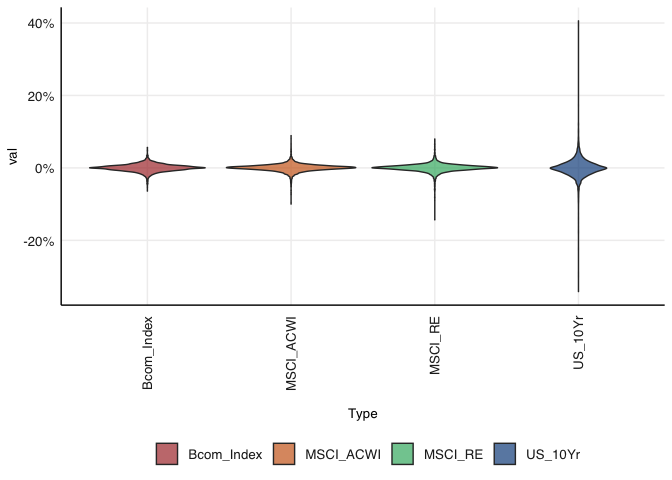

pairs.panels(Q5PCAdata)gviolion <- Q5PCAdata %>% gather(Type, val) %>% ggplot() + geom_violin(aes(Type,

val, fill = Type), alpha = 0.7) + fmxdat::theme_fmx() + fmxdat::fmx_fills()

fmxdat::finplot(gviolion, y.pct = T, y.pct_acc = 1, x.vert = T) This is

extremely useful as it reports on the behaviour of these returns and

shows how the density of distribution changes with the change in pairs.

Most notably the US 10 year year shows significantly higher degrees of

dispersion and clearly follows a different distribution process to the

other three indices.

This is

extremely useful as it reports on the behaviour of these returns and

shows how the density of distribution changes with the change in pairs.

Most notably the US 10 year year shows significantly higher degrees of

dispersion and clearly follows a different distribution process to the

other three indices.

In this question we construct a global balanced index fund portfolio using a mix of traded global indices that we load below. From the question I can already gain a clear understanding of the type of optimiser that will be preferred from a subjective perspective. What I mean by this is that The constraints are structured in a way that suggest a more moderate wealth preserving type portfolio need be constructed.As I’ve spent some time trying to build optimisers by hand in preparation for this question I’ve come across a helpful package but I feel does the best job of allowing for very flexible constraints.For this reason I load the data in and open the portfolio analytics package. Before integrating it straight in I clean the data as normal.

Q6MAA <- read_rds("data/MAA.rds")

Q6msci <- read_rds("data/msci.rds") %>%

filter(Name %in% c("MSCI_ACWI", "MSCI_USA", "MSCI_RE", "MSCI_Jap"))For easeability in the constraints section of the optimisation procedure I’ve proceeded to rename the indices so that the object orientated group-by constraints are easily carried out.

Q6MAAwide <- Q6MAA %>% select(date, Ticker, Price) %>% spread(Ticker, Price)

Q6msciwide <- Q6msci %>% spread(Name, Price)

Q6totalrtn <- Q6MAAwide %>% left_join(Q6msciwide, by = c("date")) %>% rename(

"Asian_Currency" = `ADXY Index` ,

"US_Currency" = `DXY Index` ,

"Global_Bond1" = `LGAGTRUH Index`,

"US_Bond1" = `LUAGTRUU Index`,

"Euro_Bond1" = `LEATTREU Index`,

"Global_Bond2" = `LGCPTRUH Index`,

"US_Bond2" = `LUACTRUU Index`,

"Euro_Bond2" = `LP05TREH Index`,

"Commodity" = `BCOMTR Index`,

"Japan_Equity" = `MSCI_Jap`,

"US_Property" = `MSCI_RE`,

"US_Equity" = `MSCI_USA`,

"Global Equity" = `MSCI_ACWI`

)

Q6totalrtn2 <- Q6totalrtn %>% gather(Tickers, Price, -date) %>%

group_by(Tickers) %>% filter(date > as.Date("2000-01-01")) %>% arrange(date) %>%

group_by(Tickers) %>% mutate(dlogret = log(Price) - log(lag(Price))) %>% mutate(scaledret = (dlogret - mean(dlogret, na.rm = T))) %>% filter(date > dplyr::first(date)) %>%

ungroup()

Q6totalrtn3 <- Q6totalrtn2 %>% select(date, Tickers, dlogret) %>%

spread(Tickers, dlogret)I will once more emphasise that the mean variance optimiser as well as other packages such as CVXR are quite tricky in terms of flexible constraints. Whilst I will give this optimisation procedure various objectives the main objective will be a wolf preserving risk adjusted return objective.

I then convert the data into a timeseries and load in the packages and plugins.

Q6rtn <- Q6totalrtn3 %>% tbl_xts()

library(ROI)## ROI: R Optimization Infrastructure

## Registered solver plugins: nlminb, glpk, quadprog.

## Default solver: auto.

library(ROI.plugin.quadprog)

library(ROI.plugin.glpk)

library(PerformanceAnalytics)

library(PortfolioAnalytics)## Loading required package: foreach

##

## Attaching package: 'foreach'

## The following objects are masked from 'package:purrr':

##

## accumulate, when

## Registered S3 method overwritten by 'PortfolioAnalytics':

## method from

## print.constraint ROI

##

## Attaching package: 'PortfolioAnalytics'

## The following objects are masked from 'package:ROI':

##

## is.constraint, objective

Below I specify the portfolio that will take on the constraint arguments there after the specific constraints that I specify are as follows: Full investment must take place and long only positions are added. And objective is then added to minimise portfolio standard deviation as an initial starting point in this optimiser but will be changed later on.The optimisation procedure is then initiated and the return on investment method is specified.

port_spec <- portfolio.spec(colnames(Q6rtn))

port_spec <- add.constraint(portfolio =port_spec, type = "full_investment")

port_spec <- add.constraint(portfolio = port_spec, type = "long_only")

port_spec <- add.objective(portfolio = port_spec, type = "risk", name = "StdDev")

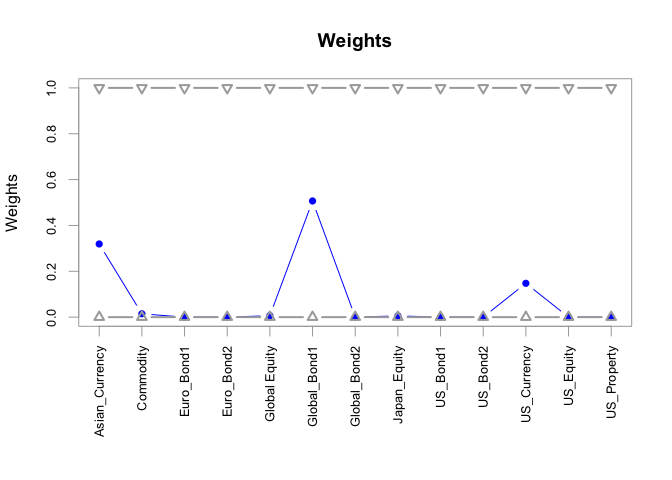

opt <- optimize.portfolio(Q6rtn, portfolio = port_spec, optimize_method = "ROI")

print(opt)## ***********************************

## PortfolioAnalytics Optimization

## ***********************************

##

## Call:

## optimize.portfolio(R = Q6rtn, portfolio = port_spec, optimize_method = "ROI")

##

## Optimal Weights:

## Asian_Currency Commodity Euro_Bond1 Euro_Bond2 Global Equity

## 0.3192 0.0146 0.0000 0.0000 0.0064

## Global_Bond1 Global_Bond2 Japan_Equity US_Bond1 US_Bond2

## 0.5067 0.0000 0.0055 0.0000 0.0000

## US_Currency US_Equity US_Property

## 0.1476 0.0000 0.0000

##

## Objective Measure:

## StdDev

## 0.0009714

extractWeights(opt)## Asian_Currency Commodity Euro_Bond1 Euro_Bond2 Global Equity

## 3.191607e-01 1.460856e-02 1.075704e-17 3.207724e-18 6.407276e-03

## Global_Bond1 Global_Bond2 Japan_Equity US_Bond1 US_Bond2

## 5.067218e-01 2.167819e-17 5.501330e-03 1.091242e-18 8.035830e-18

## US_Currency US_Equity US_Property

## 1.476003e-01 0.000000e+00 -8.041650e-19

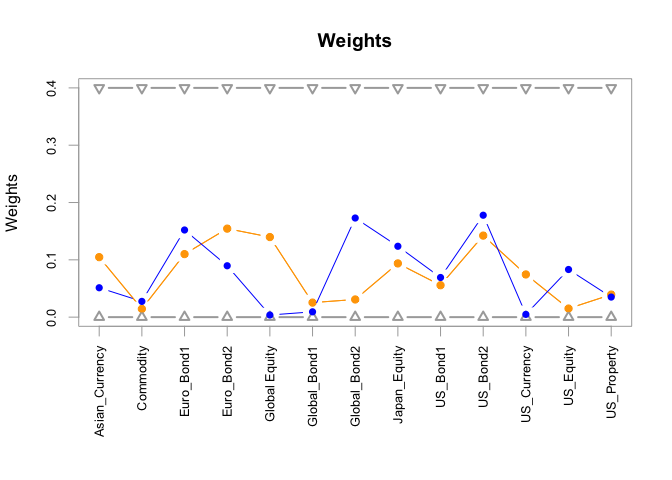

chart.Weights(opt) As

mentioned we explore the most simple case above and we print out the

results in terms of weights it now becomes clear why the names were

changed.

As

mentioned we explore the most simple case above and we print out the

results in terms of weights it now becomes clear why the names were

changed.

print(port_spec)## **************************************************

## PortfolioAnalytics Portfolio Specification

## **************************************************

##

## Call:

## portfolio.spec(assets = colnames(Q6rtn))

##

## Number of assets: 13

## Asset Names

## [1] "Asian_Currency" "Commodity" "Euro_Bond1" "Euro_Bond2"

## [5] "Global Equity" "Global_Bond1" "Global_Bond2" "Japan_Equity"

## [9] "US_Bond1" "US_Bond2"

## More than 10 assets, only printing the first 10

##

## Constraints

## Enabled constraint types

## - full_investment

## - long_only

##

## Objectives:

## Enabled objective names

## - StdDev

V last three constraints are then implemented below into a more complex optimiser as follows: A box constraint is implemented when no single asset may constitute more than 40% of the portfolio, And following this to group constraints are initialised for equity and bond instruments where equity cannot collectively constitute more than 60% and bonds can’t constitute more than 25%.

port_spec <- add.constraint(portfolio = port_spec, type = "weight_sum", min_sum = 1, max_sum = 1)

port_spec <- add.constraint(portfolio = port_spec, type = "box", min = 0, max = 0.4)

port_spec <- add.constraint(portfolio = port_spec, type = "group", groups = list(c(3, 4, 6, 7, 9, 10)), group_min = 0, group_max = 0.25)

port_spec <- add.constraint(portfolio = port_spec, type = "group", groups = list(c(5, 8, 12)), group_min = 0, group_max = 0.6)

print(port_spec)## **************************************************

## PortfolioAnalytics Portfolio Specification

## **************************************************

##

## Call:

## portfolio.spec(assets = colnames(Q6rtn))

##

## Number of assets: 13

## Asset Names

## [1] "Asian_Currency" "Commodity" "Euro_Bond1" "Euro_Bond2"

## [5] "Global Equity" "Global_Bond1" "Global_Bond2" "Japan_Equity"

## [9] "US_Bond1" "US_Bond2"

## More than 10 assets, only printing the first 10

##

## Constraints

## Enabled constraint types

## - full_investment

## - long_only

## - weight_sum

## - box

## - group

## - group

##

## Objectives:

## Enabled objective names

## - StdDev

Following this the objectives and constraints are once again specified.

port_spec <- add.objective(portfolio = port_spec, type = "return", name = "mean")

# Added a risk objective to minimize portfolio standard deviation

port_spec <- add.objective(portfolio = port_spec, type = "risk", name = "StdDev")

# Add a risk budget objective

port_spec <- add.objective(portfolio = port_spec, type = "risk_budget", name = "StdDev", min_prisk = 0.05, max_prisk = 0.1)

print(port_spec)## **************************************************

## PortfolioAnalytics Portfolio Specification

## **************************************************

##

## Call:

## portfolio.spec(assets = colnames(Q6rtn))

##

## Number of assets: 13

## Asset Names

## [1] "Asian_Currency" "Commodity" "Euro_Bond1" "Euro_Bond2"

## [5] "Global Equity" "Global_Bond1" "Global_Bond2" "Japan_Equity"

## [9] "US_Bond1" "US_Bond2"

## More than 10 assets, only printing the first 10

##

## Constraints

## Enabled constraint types

## - full_investment

## - long_only

## - weight_sum

## - box

## - group

## - group

##

## Objectives:

## Enabled objective names

## - StdDev

## - mean

## - StdDev

## - StdDev

With the risk budget and the minimised portfolio standard deviation objective added we now run a single parent optimisation first.

rp <- random_portfolios(portfolio=port_spec, permutations = 50, rp_method ='simplex')## Warning: executing %dopar% sequentially: no parallel backend registered

opt <- optimize.portfolio(R = Q6rtn, portfolio = port_spec, optimize_method = "random", rp = rp, trace = TRUE)## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

print(opt)## ***********************************

## PortfolioAnalytics Optimization

## ***********************************

##

## Call:

## optimize.portfolio(R = Q6rtn, portfolio = port_spec, optimize_method = "random",

## trace = TRUE, rp = rp)

##

## Optimal Weights:

## Asian_Currency Commodity Euro_Bond1 Euro_Bond2 Global Equity

## 0.0513 0.0275 0.1521 0.0896 0.0037

## Global_Bond1 Global_Bond2 Japan_Equity US_Bond1 US_Bond2

## 0.0093 0.1730 0.1237 0.0692 0.1778

## US_Currency US_Equity US_Property

## 0.0048 0.0831 0.0350

##

## Objective Measures:

## StdDev

## 0.002787

##

## contribution :

## Asian_Currency Commodity Euro_Bond1 Euro_Bond2 Global Equity

## 4.321e-05 8.348e-05 1.244e-04 7.462e-05 2.217e-05

## Global_Bond1 Global_Bond2 Japan_Equity US_Bond1 US_Bond2

## 4.284e-06 2.035e-04 1.213e-03 5.150e-05 2.904e-04

## US_Currency US_Equity US_Property

## -7.099e-06 4.288e-04 2.547e-04

##

## pct_contrib_StdDev :

## Asian_Currency Commodity Euro_Bond1 Euro_Bond2 Global Equity

## 0.015506 0.029956 0.044654 0.026778 0.007954

## Global_Bond1 Global_Bond2 Japan_Equity US_Bond1 US_Bond2

## 0.001537 0.073018 0.435188 0.018479 0.104202

## US_Currency US_Equity US_Property

## -0.002547 0.153887 0.091389

##

##

## mean

## 4.321e-05

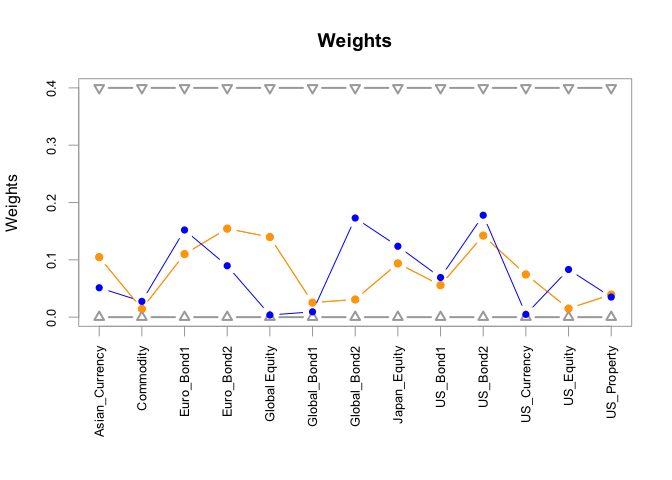

chart.Weights(opt) With

this initial waiting procedure estimated we now run a periodic

rebalancing optimisation using the 60 day rolling window and quarterly

re-balancing.

With

this initial waiting procedure estimated we now run a periodic

rebalancing optimisation using the 60 day rolling window and quarterly

re-balancing.

opt_rebal <- optimize.portfolio.rebalancing(R = Q6rtn, portfolio = port_spec, optimize_method = "random", rp = rp, trace = TRUE, search_size = 1000, rebalance_on = "quarters", training_period = 60, rolling_window = 60)## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

## Leverage constraint min_sum and max_sum are restrictive,

## consider relaxing. e.g. 'full_investment' constraint should be min_sum=0.99 and max_sum=1.01

print(opt_rebal)

extractObjectiveMeasures(opt)Above we observe that rebalance states are also given within the portfolio.

head(extractObjectiveMeasures(opt_rebal))extractWeights(opt)## Asian_Currency Commodity Euro_Bond1 Euro_Bond2 Global Equity

## 0.051281439 0.027468279 0.152051626 0.089642112 0.003716800

## Global_Bond1 Global_Bond2 Japan_Equity US_Bond1 US_Bond2

## 0.009268695 0.172951483 0.123664660 0.069167981 0.177829690

## US_Currency US_Equity US_Property

## 0.004803425 0.083124285 0.035029525

chart.Weights(opt) With the

optimal rebalance procedure undertaken the weights are then given where

after they are charted as seen above. This is then compared to the

optimal chart wait to observe the difference between the in and out of

sample fit.

With the

optimal rebalance procedure undertaken the weights are then given where

after they are charted as seen above. This is then compared to the

optimal chart wait to observe the difference between the in and out of

sample fit.

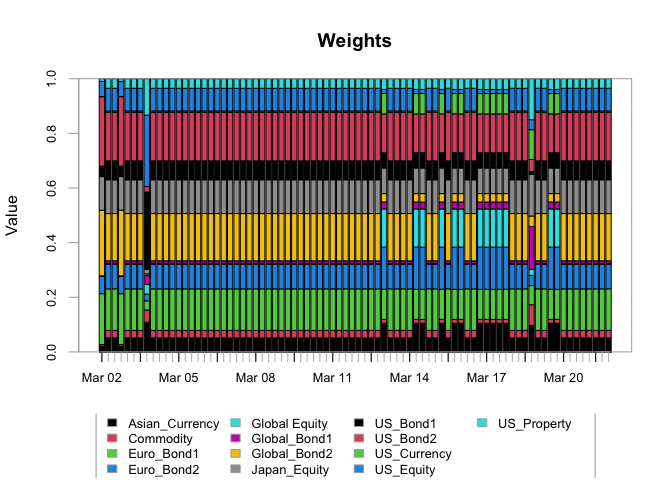

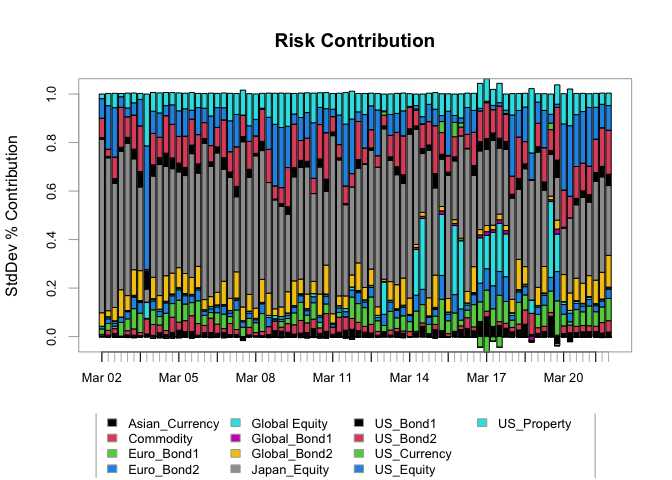

chart.Weights(opt_rebal) Lastly

from our econometric background it is clear that not all assets display

the same amount of contribution towards risk for this reason we plug the

risk contribution and observe that global equity US bonds and US

property display the highest Degrees of risks.

Lastly

from our econometric background it is clear that not all assets display

the same amount of contribution towards risk for this reason we plug the

risk contribution and observe that global equity US bonds and US

property display the highest Degrees of risks.

chart.RiskBudget(opt_rebal, match.col = "StdDev", risk.type = "percentage") We

conclude with a mention of the initial objective which was a wealthy

preserving optimiser given the type of constraints for this reason we

see a very modest return but very well risk adjusted.

We

conclude with a mention of the initial objective which was a wealthy

preserving optimiser given the type of constraints for this reason we

see a very modest return but very well risk adjusted.