Postman collections for Mastercard Open Banking Europe.

These are the Postman collections for Mastercard Open Banking Europe APIs.

Our PSD2 compliant service is an out of the box ready, no license required, no hassle. You can get started with one line of code.

Compliant and reliable Open Banking Payments & Data services from day one.

Pay & Data Environment - Sandbox JSON ⤓

Verify Account Balance and Account Owner through our simple API.

Insights Environment - Sandbox JSON ⤓

If you already hold an Open Banking license, you can also use our solutions tailored for your use cases. You can get started with one line of code.

Open Banking Payments & Data services through our simple API.

Enterprise Environment - Sandbox JSON ⤓

Verify Account Balance, Account Owner and Account Income through our simple API.

Enterprise Insights Collection JSON ⤓

Enterprise Insights Environment - Sandbox JSON ⤓

-

Fire up a browser and go to our developer portal

-

Click on the “Sign up (or log in)” button

-

Log in with your username/password or either a GitHub or Google account. If you don't have an account, don't worry. Click “Sign up” and create one for free.

-

Create an app on the client portal

-

Go to your newly created app

-

Take note of your

Client IDandClient Secret

Notice

Please be aware that these credentials will only give you access to the sandbox environment and will therefore only expose Test banks. When you're ready to go live, go to the Production access section of our documentation to learn how to get access to actual production data. 🚀

- Click here:

- Select the environment (top right) and update

client_id,client_secretandclient_redirect_urivariables. We'll talk about these in more detail in the next section. - Click Send on individual requests

- Explore the various folders and update the collection as you wish

Time to test connecting your first user to your service.

First, you need to find your Client ID and Client Secret that we noted down earlier. These are located within your app(s), which you can find in the apps section.

Found them? Great! Make sure you add them to your Postman Environment on the top right.

Now it’s time to connect your first user. In this example, the user is asked to share accounts and transaction data with you, as indicated by the scope. You should send the following request in Postman:

Connect / OAuth2 Connect

The redirect_uri is where the user will be redirected to after finishing the log-in flow. This needs to match one of the redirects you specified when you created your application on the developer portal. For more details on how to onboard users and what functionality you can request, please check out connect flow and scopes.

Notice

Connect flow is very similar to the OAuth flow, which you might be familiar with. To access your end users' transaction data, we need to get their consent. We also need an additional consent to pass that data on to you.

The response will be a 302 (Found or Moved Temporarily) that you'll need to follow in order to redirect the user. Please look in the location header to figure out where you should redirect the user to.

Header / Location: https://app-sandbox.aiia.eu/#/one-time?sessionId=fada3b2f-5e57-4a41-9156-b43ed32148fe&closeUrl=https%3A%2F%2Fhttpbin.org&culture=en

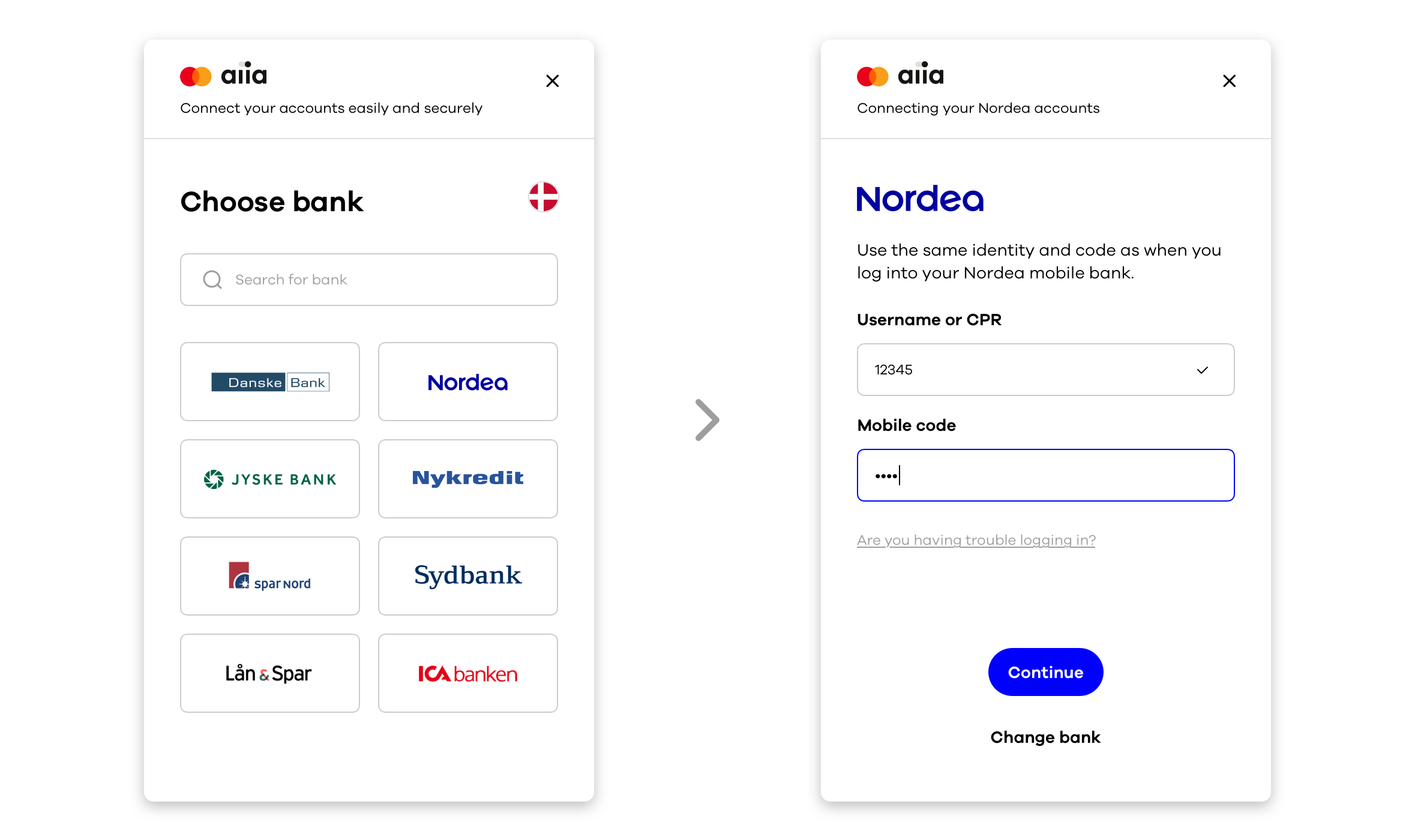

After navigating the user to the connect URL, the user signs up and connects their accounts. This consists of the following steps:

-

Enter email address

-

Enter the verification code from the email received

-

Accept consent if presented

-

Log in to

Test bank with data #1 DKK. It'll accept any username and any numeric password. -

Choose one or more accounts

-

Accept consent to pass data on to your app

After completing the flow, the user will be redirected back to the provided redirect_uri with a code that you'll use in the next step.

Here's an example of what a redirect_uri looks like:

https://httpbin.org/anything?code=ygAAAAVDaXBoZXJ0ZXh0AJAAAAAAoy734oFjfPFDa9TmOtOAYwcTMKcWZ2782qTQEnjFtW1FsEjone0S6UrXUnD87WrEvidMfCleZgm6K3ysf0eG9hwjylyqUzehya7SIssvR9QwUjtXHCSDPUQV8mYbubbIUGOacfSjqe%2Fnkeop4N37k786234wDrBwW1zJeFZb4af6Ljk7wuzmIR5DzYlutM66vsqCMmNBUl2ABAAAAAAuhPflJ4fuLP45FJmAp4FkBBLZXlJ7923AAAAAAAA%3D%3D

Take note of the code. You'll use it in the next step to get your session and log-in tokens.

Notice

We have an array of test banks that can test different configurations.

Use the code from Step 2 to get an access token for the user. Please notice that the code may be URL encoded if you received it in your browser. Therefore, you must remember to decode it if you're walking through this guide step by step. You can use this or any other URL decoder to do the magic. Make sure use the decoded URL in the code.

The redirect_uri should be automatically filled in by the postman environment.

Now make the following request from Postman:

Connect / Code Exchange

Notice

Acodecan only be used once and expires after one minute.

The response contains two tokens: access_token and refresh_token. This is an example of a successful response:

{

"access_token": "eyJhbGciOiJIUzI1Ni978juanR5cCI6IkpXVCJ9.eyJ1c2VySWQiOiJmYTE4OTI3MS1mOTY1LTRmNWMtOTlmOS1lNDViNzNiYzI4MzkiLCJjbGllbnRJZCI6InZpaWEtZnBwIiwicm9sZSI6IkNsaWVudFVzZXIiLCJzZ67623aW9uSWQiOiJlZmE1NWU0ZS0xZTUxLTQ1YWMtYWEyYy01OThhNjFjMTZlOTYiLCJuYmYiOjE1Njc0MTQxNzMsImV4cCI6MTU2NzQxNzc3MywiaWF0IjoxNTY3NDE0MTczfQ.7QD6zGcdonYy79384buXOqsykWrbWa3L6LW4d9uzb-zA",

"expires_in": 3600,

"redirect_uri": "https://httpbin.org/anything",

"refresh_token": "eyJhbGciOiJIUzI1NiIsInR5cCI687234pXVCJ9.eyJ1c2VySWQiOiJmYTE4OTI3MS1mOTY1LTRmNWMtOTlmOS1lNDViNzNiYzI4MzkiLCJjbGllbnRJZCI6InZpaWEtZnBwIiwiY29uc2VudElkIjoiYTYyODExYWYtNzUxMS00ZWQ0LoyiauasiYTEtMjAwNzc2NGQ1MTIwIiwic2Vzc2lvbklkIjoiZWZhNTVlNGUtMWU1MS00NWFjLWFhMmMtNTk4YTYxYzE2ZTk2Iiwicm9sZSI6IlJlZnJlc2hUb2tlbiIsIm5iZiI6MTU2NzQxNDE3MywiZXhwIjoxNTY4NjIzNzczLCJpYXQiOjE1Njc0MTQxNzN9.5-x0NNg5lMxPnZRYtu983764q0sbPcSb7U9b23e3Zwx0Ss9I",

"token_type": "bearer"

}The access_token you have received will now automatically get populated into your Postman Environment. You'll be using it in the next step to get a list of all the accounts that the end user has given you access to.

Now you're all set to access the user's data. You do so by sending the following request in Postman:

Data / List Accounts

This endpoint will produce a response that contains an overview of the user's accounts.

{

"accounts": [

{

"accountProvider": {

"id": "TestDataBank1",

"name": "Test bank with data #1 DKK"

},

"available": null,

"availableBalance": null,

"booked": {

"currency": "DKK",

"value": 6439.15

},

"bookedBalance": 6439.15,

"currency": "DKK",

"id": "ZmExODkyNzEtZjk2NS00ZjVjLTk5ZjktZTQ1YjczYmMyODM5fFRlc3REYXRhQmFuazF6823DZ0NFBrOXVORGdpejdKQ0tjSzN2aXM5ZFIzd0gzLWhSNWJhY21nSEZCdy4x",

"lastSynchronized": "2019-09-02T08:52:16.5816944Z",

"nagApiAccountId": "T6t4Pk9uNDgiz7JCKcK3vis9dR3wH3-hR5bacmgHFBw.1",

"name": "Direct Debit",

"number": {

"bban": "0001-245787654",

"bbanParsed": {

"accountNumber": "245787654",

"bankCode": "0001"

},

"bbanType": "0001-245787654",

"card": null,

"iban": null

},

"owner": "Christian Thomsen",

"type": "Consumption"

},

]

}Now that you've gotten account access, you can either proceed to access transactions from those accounts or to make payments. Please take note of the id of one of the accounts, as you will need it when proceeding.

Read on to learn about accessing transactions or jump straight to our documentation on payments.

By using the id of an account from Step 4, we can start pulling out user transactions by sending the following request on Postman:

Data / List Transactions

This will produce a response with a list of transactions (default: 50 transactions) that looks like this:

{

"pagingToken": "...",

"transactions": [

{

"accountId": "ZmExODkyNzEtZjk2NS00ZjVjLTk5Z6782tZTQ1YjczYmMyODM5fFRlc3REYXRhQmFuazF8bkx5dXRxZlYwdnkwaElSSW9wNnRDakVHenllUFMyem43UVl2LUpWT3YwUS4w",

"amount": -291.0,

"balance": {

"currency": "DKK",

"value": -3954.0

},

"creationDate": "0001-01-01T00:00:00",

"currency": "DKK",

"date": "2019-09-02",

"detail": { // You need to contact sales to get this info, otherwise it's just null

"currencyConversion": null,

"destination": {

"account": null,

"address": null,

"merchantCategoryCode": null,

"merchantCategoryName": null,

"name": "DSB Kastrup AUT 23228"

},

"executionDate": null,

"identifiers": {

"creditorReference": null,

"document": null,

"endToEndId": null,

"reference": "0130Y9C6LY212",

"sequenceNumber": null,

"terminal": null

},

"message": null,

"reward": null,

"source": {

"account": {

"bban": null,

"bbanParsed": null,

"bbanType": null,

"card": {

"cardHolder": "Henrik Madsen",

"expireMonth": null,

"expireYear": null,

"maskedPan": "0524 XXXX XXXX 3413"

},

"iban": null

},

"address": null,

"merchantCategoryCode": null,

"merchantCategoryName": null,

"name": null

},

"valueDate": null

},

"id": "8f6b6b78-6e97-73ba-a6de-4a732fcff09bd",

"nagApiTransactionId": null,

"originalText": "DSB Kastrup AUT 23228",

"state": "Booked",

"text": "DSB Kastrup AUT",

"transactionAmount": {

"currency": "DKK",

"value": -291.0

},

"type": "Card"

}

]

}Congratulations! You've successfully started your journey with Mastercard Open Banking Europe.

Now that you've connected an account, you're all set to explore our API further 🚀

-

Access account information – See more details on how to use accounts and transactions 🧭

-

Payments – Discover our payment products and see how to get started 🧭

-

Event notifications – Explore how you can start receiving notifications. They'll give you a real-time experience by notifying you of any changes. They can be used for accounts, transactions and payments 🧭

-

API Reference – Explore our API reference to see all the amazing things our API exposes to you 🧭

-

Sample projects – You can find several sample applications here to view the endless capabilities of Mastercard Open Banking Europe

✈️