This Visual Studio project is my coursework for CMP 202 at Abertay University, Scotland.

Using a Value at Risk approach we try to make a statement similar to this: I am X percent certain there will not be a loss of more than V dollars in the next N days. (Hull, 2012) So X is the confidence level, where V is the loss and n is the holding period.

dS = μ S dt + σ S ds

S = stock price

μ = exp. return

σ = volatility

repeat n times

repeat t times

generate normal distributed number

update end price

save end price to path array

extract the 0th quantile

print results

- Assuming a stock without dividend payments

- single stock portfolio

- using C++ AMP

- extents that don't require padding

- optimized for a NVIDIA GeForce 940MX

- Commandline parsing is handled through TCLAP

- Concurrency Visualizer Marker through Visual Studio Extension

- Random number generation through amprng

Using the program is simple:

cd path

REM access help for explanation on cl arguments

C:\path>ConsoleApplication3 --help

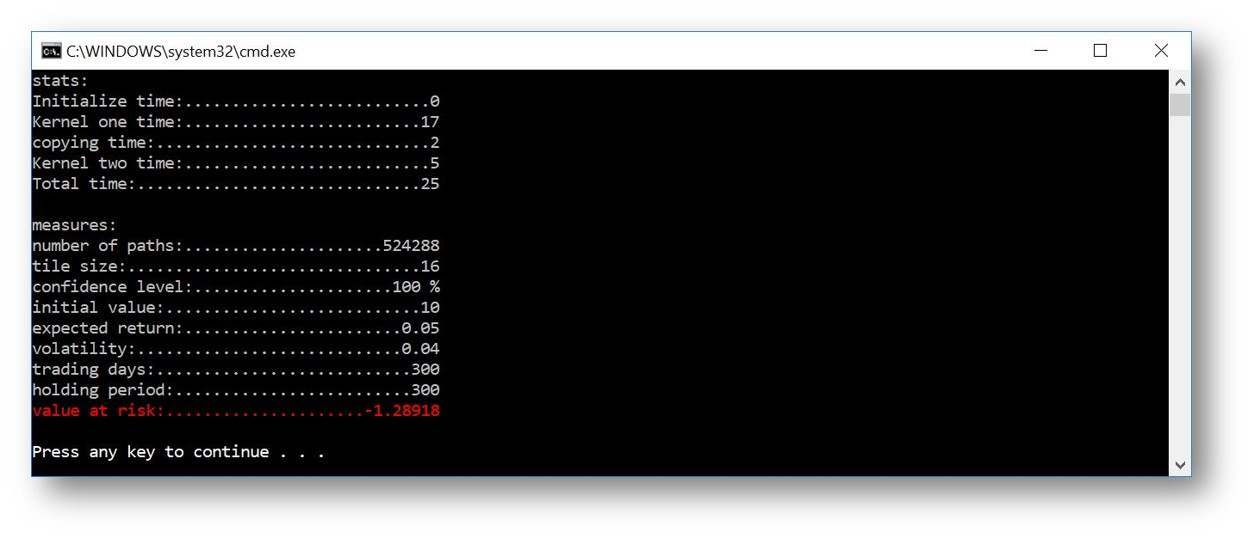

REM sample usage of calculation with a tile size of 16 and 512k paths

C:\path>ConsoleApplication3 -x 16 -p 524288 -i 10 -r 0.05 -v 0.04 -d 300 -t 300

- Prepare proposal

- Implement MC kernel

- Implement path array to value at risk functionality

- Optimize memory access,

loop unrollingetc. - measure performance

- Prepare presentation

- Enhance to a multi stock portfolio (optional)

- Download historical data from quandl (optional)

- Calculate volatility using EWMA method (optional)

Feel free to send me a mail