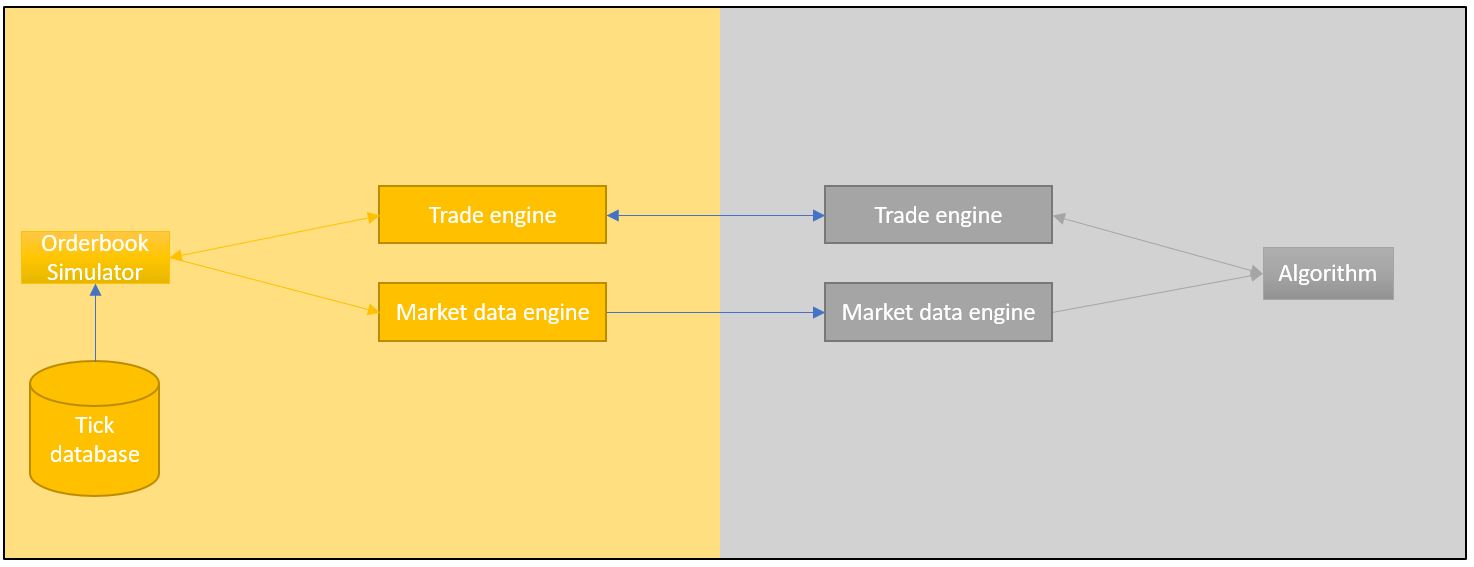

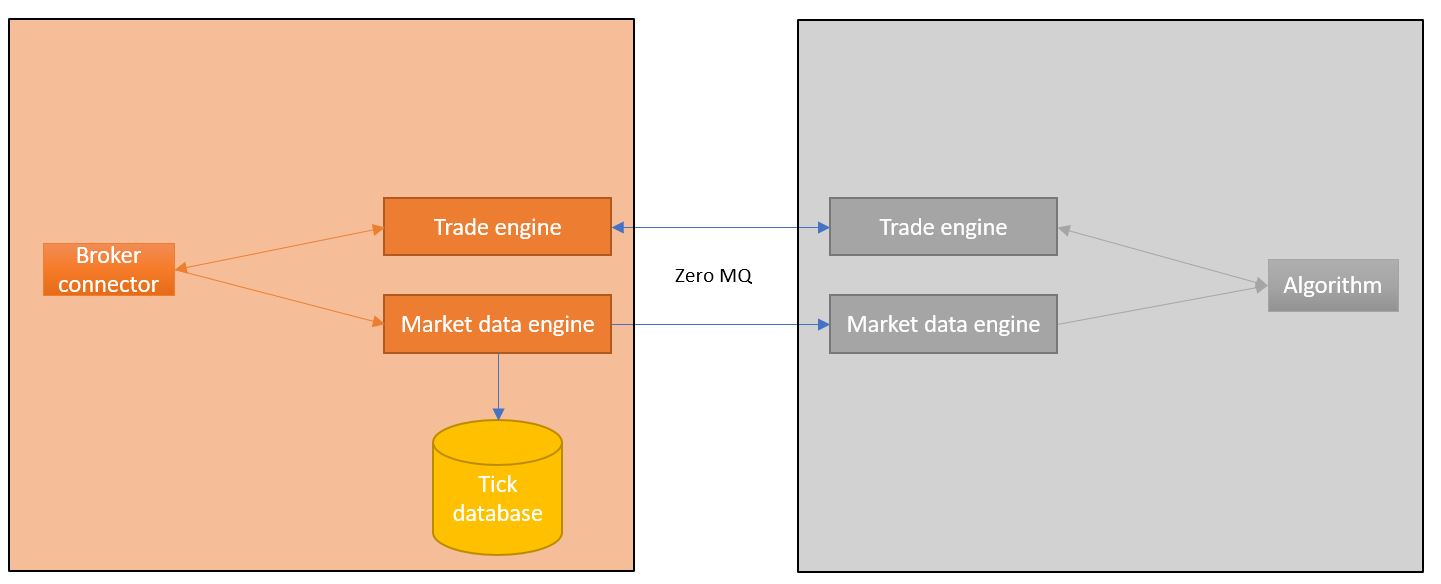

Java / Python Framework used in my research,it can be connected to live markets using zeroMQ using the same code as in backtesting, Backtesting is a L2 backtest simulating orderbook changes and market trades.Some Latencies can be simulated. Data for backtesting should be in parquets like in data folder and has to be configured by the environment or application properties.

Framework and algorithms are all in the java code but backtest can be called from python and different tools and utilities from python can be used on the backtest results , like parameter tuning or plot the pnl and parameters.

Market connectors can have a persistance layer to save market data in parquets that can be used in backtesting. Open to suggestions/changes/modifications

Best example is found on jupyter notebook ConstantSpread example.

On this example we are running from notebook a backtest for the

- java strategy ConstantSpread and LinearConstantSpread called from notebook

- python code ConstantSpread and LinearConstantSpread

This code is part of a bigger private repository with more algos and more connectors. If you see something wrong or is not compiling , please contact me by email

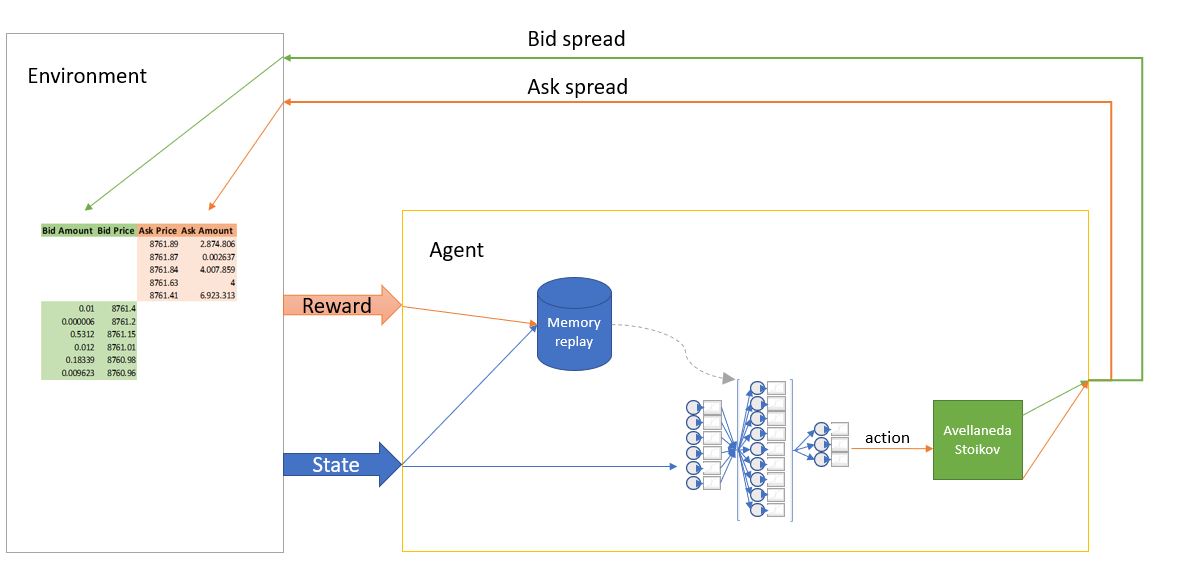

IS my research where and Avellaneda Stoikov market making implementation is going to be manage by RL. RL is going to configure the different Avellaneda stoikov parameters dinamically based on market state.

Where the algorithm logics , backtest and execution happens [JAVA 11 required]

first install maven modules

- parent_pom

- common

- algorithmic_trading_framework

- trading_algorithms

- backtest_engine

- executables

then package executables -> Backtest.jar Backtest.jar is going to be our python launcher to get backtest results

Grateful for the libraries directly used

- Binance API

- JavaLOB

- Apache commons

- ... etc

- LAMBDA_PARQUET_TICK_DB= Folder where the parquets DB is saved

- LAMBDA_DATA_PATH = Old Folder where the DB was saved

- LAMBDA_OUTPUT_PATH = base path where the ml models will be saved

- LAMBDA_INPUT_PATH = base path where the configuration of algorithms will be read automatically, soon

- LAMBDA_OUTPUT_PATH = output of java algorithms must be the same as applicaiton.properties

- LAMBDA_TEMP_PATH = temp of java algorithms must be the same as applicaiton.properties

- LAMBDA_JAR_PATH = path of the backtest jar path to run from python

- LAMBDA_LOGS_PATH = where we are going to save the java logs

To get backtest results compare , optimize parameters -> Algo trading strategies are just and enumeration.Business logic must be in java compile and package java first! Grateful for the libraries directly used

- mlfinlab

- Pandas

- Numpy

- seaborn

- Darwinex-ticks

- dwx-zeromq-connector

- ...etc