This project demonstrates the construction of a cloud-native API using multiple services across cloud providers. The API supports user-specifiable scaling and provides risk analysis for trading strategies. By combining specific trading signals with a Monte Carlo method, we calculate risk values and profitability metrics.

- Cloud-Native API for Risk Analysis of Trading Strategies

Our goal is to build an API that allows users to analyze the risks and profitability of trading strategies. Users can input historical price data, trading decisions (buy or sell), and the desired time horizon for profit calculation. The API will generate risk values and provide insights into potential gains or losses.

Trading strategies require thorough risk analysis. Our API aims to address the following challenges:

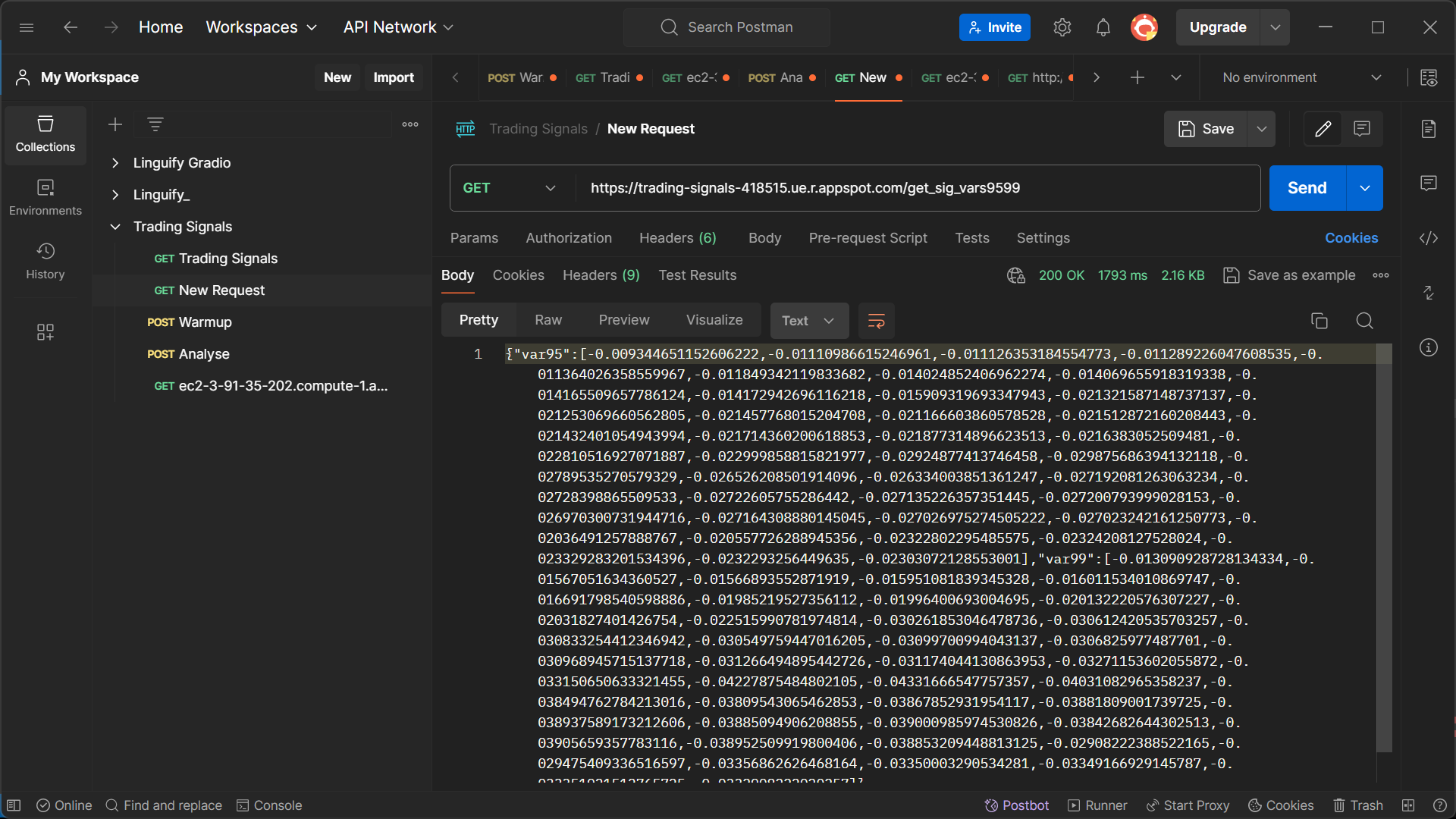

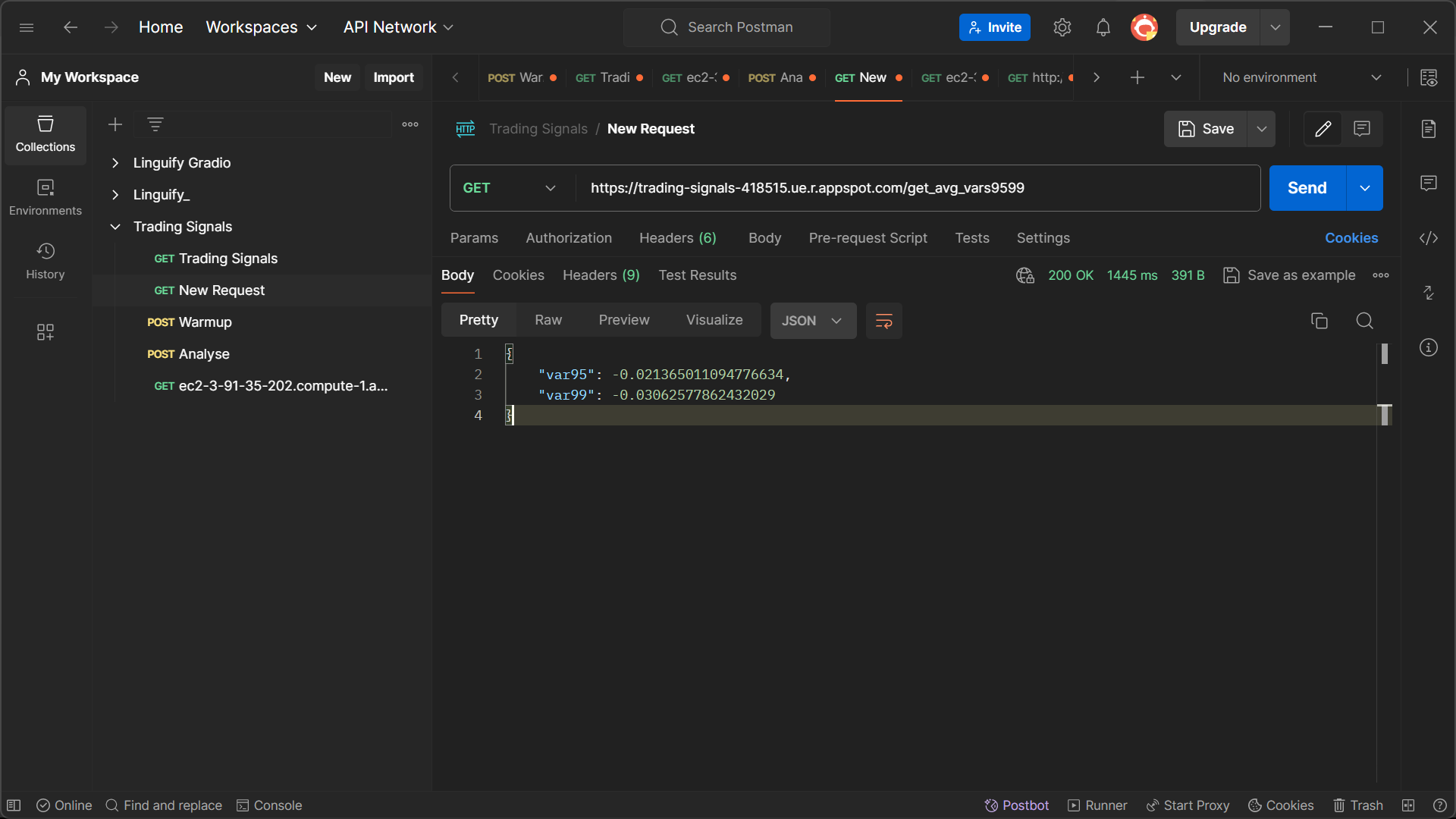

- Risk Calculation: Calculate 95% and 99% VaR (Value at Risk) values based on historical data.

- Profit/Loss Simulation: Simulate profit or loss based on trading decisions.

- Scalability: Implement scalable services for parallel analysis.

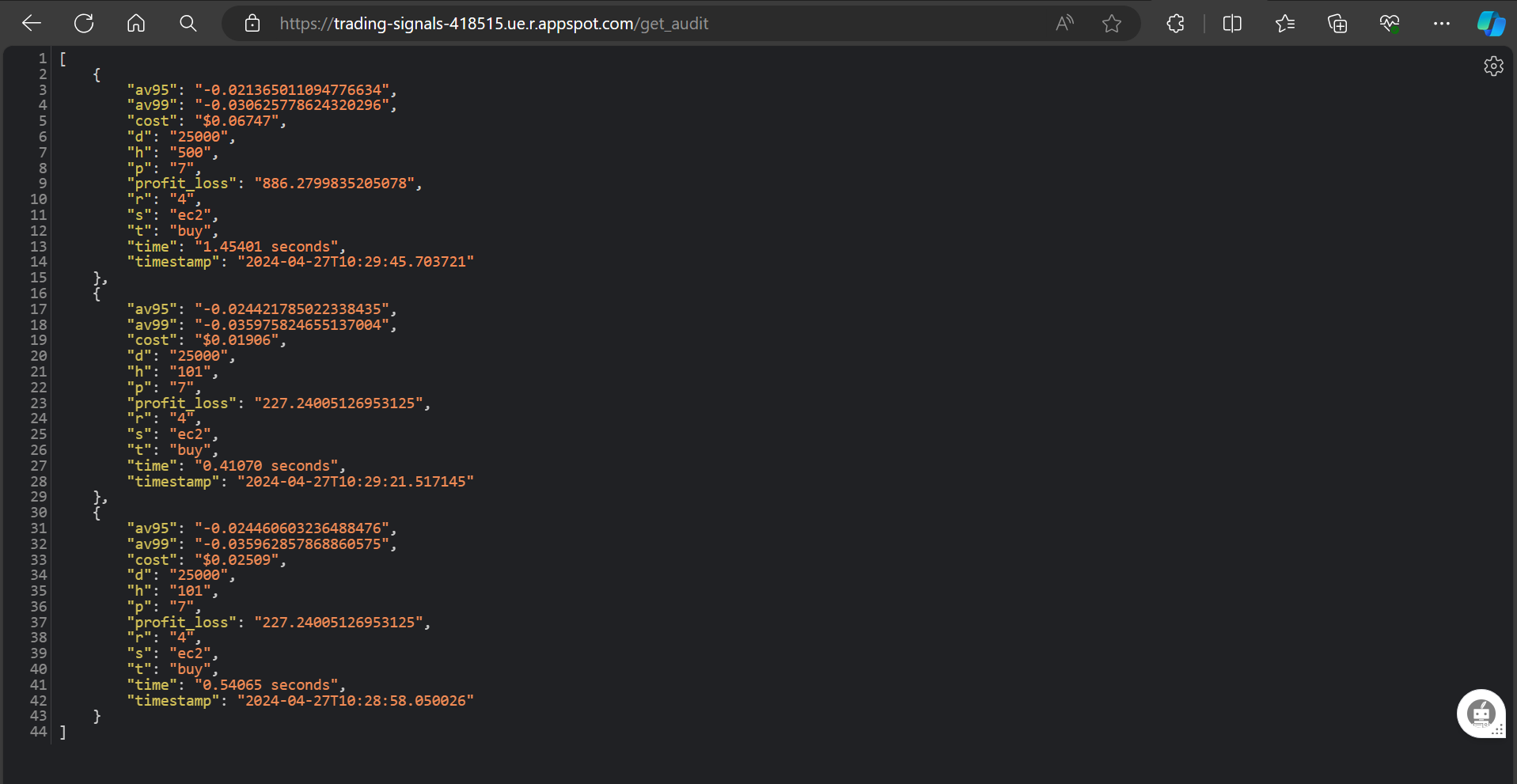

- Audit Information: Maintain an audit log with execution time, costs, and other relevant data.

- Google App Engine (GAE): Manages the API and collects average simulated risk values.

- AWS Lambda: Mediates communication between GAE and other AWS services.

- Elastic Compute Cloud (EC2): For parallel analysis.

- Offers a persistent API for user interaction.

- Scalable services generate simulated risk values.

- Users specify the scale-out factor (

r) for parallel analysis. - Implement a "warm-up" process for all scalable services.

- Provide endpoints for readiness checks, warm-up time, and cost estimation.

- Input parameters:

h: Length of price history for mean and standard deviation calculation.d: Number of data points for risk calculation.t: Buy or sell (for separate analysis).p: Number of days to check price difference for profit or loss.

- Calculate 95% and 99% VaR values.

- Simulate profit or loss based on trading decisions.

- Risk values per signal and average risk over signals.

- Profit/loss values related to each signal.

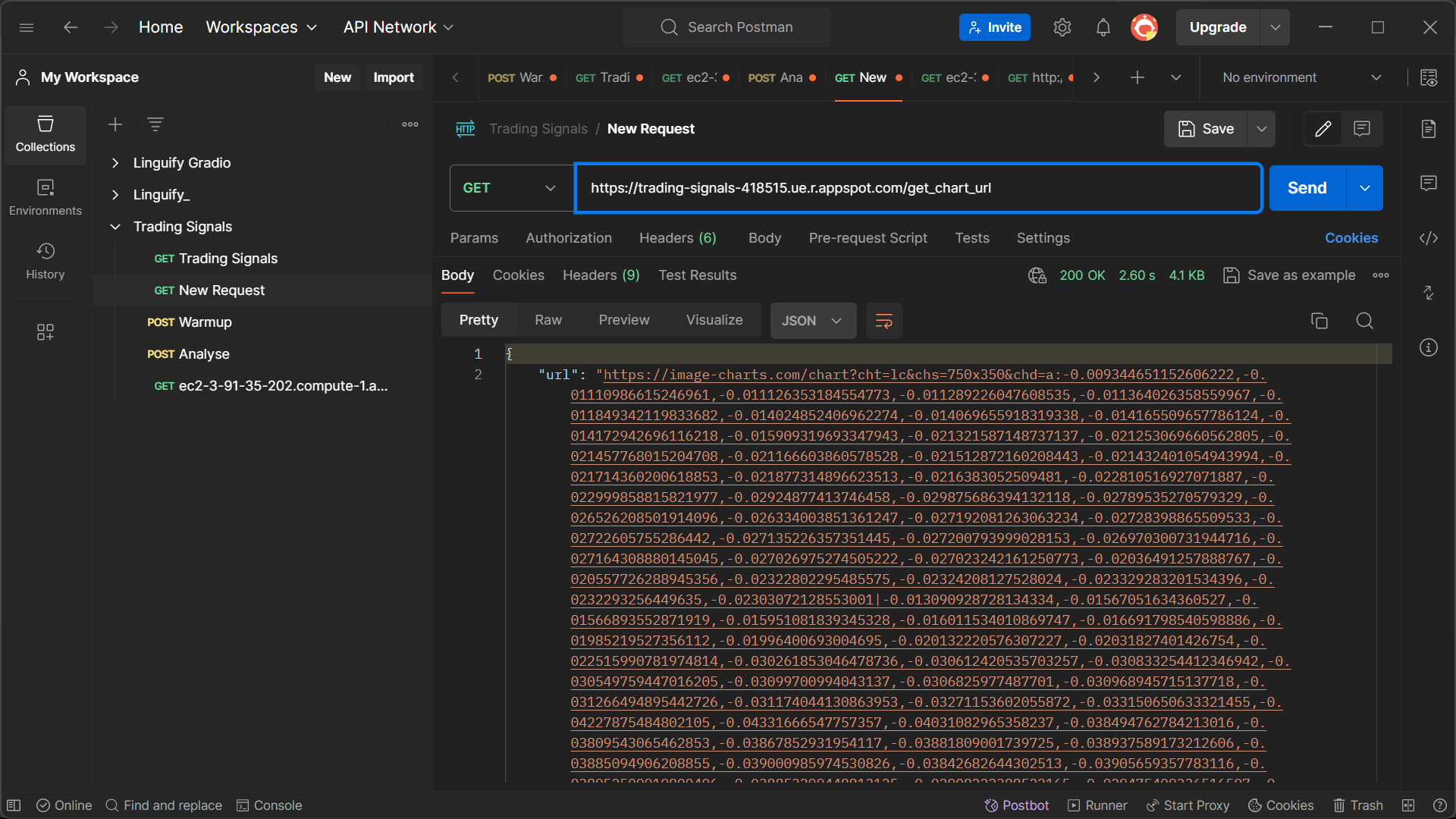

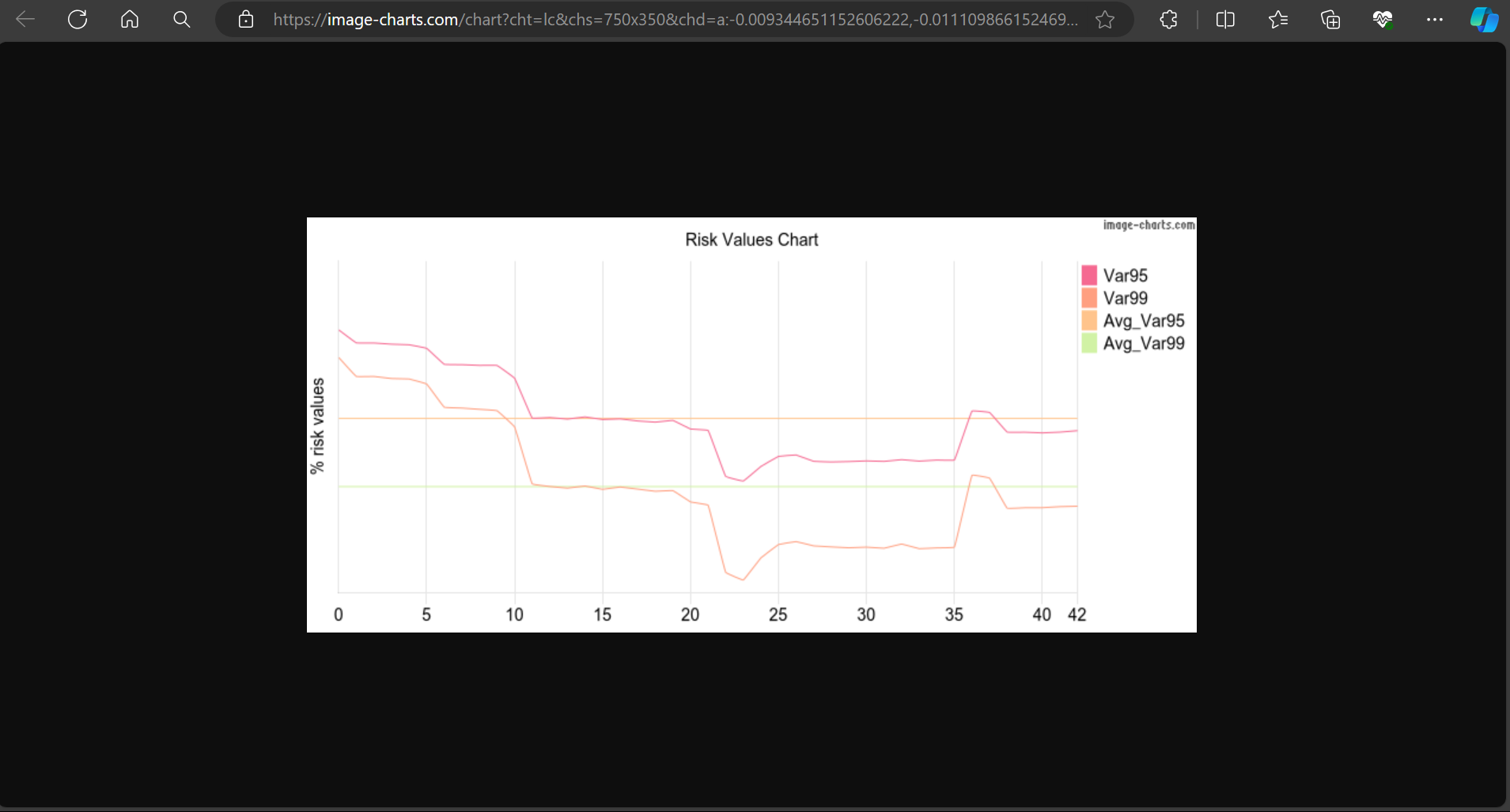

- Chart showing risk values.

- Maintain an audit log with selections of parameters, total profit/loss, execution time, and costs.

- Clone this repository.

- Set up your GAE project and AWS credentials.

- Implement the API endpoints and risk analysis logic.

- Deploy the API and monitor performance.

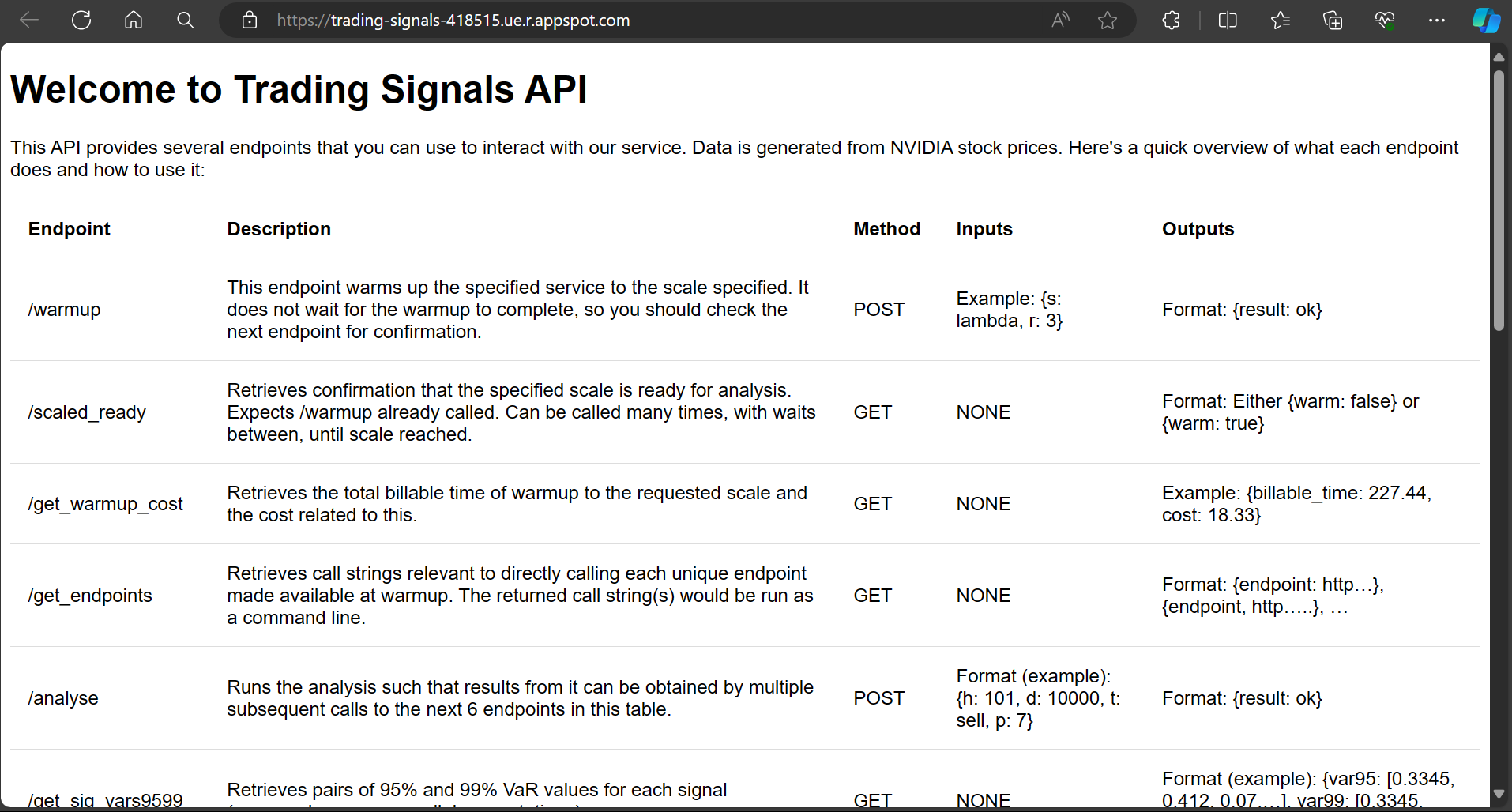

/scaled_ready: Check if scalable resources are ready./get_warmup_cost: Estimate warm-up costs./get_endpoints: Retrieve endpoints for direct testing./analyse: Perform risk analysis (POST request)./get_chart_url: Generate a chart URL for risk values./get_audit: View audit information./reset: Reset resources./terminate: Terminate resources./scaled_terminated: Check if instances have been terminated./get_avg_vars9599: Get average VaR values./get_sig_profit_loss: Get each signals profit/loss values./get_tot_profit_loss: Get total profit/loss./get_time_cost: Get execution time and cost./warmup: Initialize resources for parallel analysis./get_sig_vars9599: Get each signals VaR values.

README.md

app.yaml # Google App Engine configuration

helper.py # Utility functions

lambda # AWS Lambda functions (reset.py & risk_analysis.py)

|-- reset.py

|-- risk_analysis.py

main.py # API endpoints and risk analysis logic

requirements.txt # Required packages

risk_analysis.py # Risk analysis logic - This was not used in the final implementation but was rather used to test the risk analysis logic, after which it was included in the user_data.sh script

static # Static files (css/style.css)

|-- css

| |-- style.css

templates # HTML templates (index.html)

|-- index.html

test.py # Original risk analysis logic using DataFrames

user_data.sh # User data script for EC2 instances-

Clone the Repository:

git clone git@github.com:Jojo-GitH2/Trading-Signals.git cd Trading-Signals -

Set Up Virtual Environment (Optional):

- On Linux/macOS:

python3 -m venv venv source venv/bin/activate- On Windows:

python -m venv venv .\venv\Scripts\Activate -

Install Dependencies:

pip install -r requirements.txt

-

Run the Application:

python main.py

-

Access the API: Open your web browser and navigate to

http://localhost:8080.

-

Create a GAE Project:

- Set up a new project on Google Cloud Console.

- Enable the App Engine API.

-

Configure

app.yaml:- Customize the

app.yamlfile to match your project settings. - Specify the runtime, handlers, and other configuration options.

- Customize the

-

Enable Secret Manager API:

-

Access the Secret Manager API from the Google Cloud Console.

-

Select your project and enable the API.

-

Deploy AWS Credentials to Secret Manager.

Note: The AWS credentials are stored in the ~/.aws/credentials file. You can deploy them to Secret Manager using the following command:

gcloud secrets create aws-credentials --data-file=~/.aws/credentials -

Check the main.py file for information about this command.

-

-

Grant Permissions:

- Grant the necessary permissions to the App Engine service account.

- Add the Secret Manager Admin role to the App Engine service account.

- Enable the Cloud Build API.

-

Deploy to GAE:

gcloud app deploy

-

Access the Deployed API: Visit the URL provided after successful deployment.

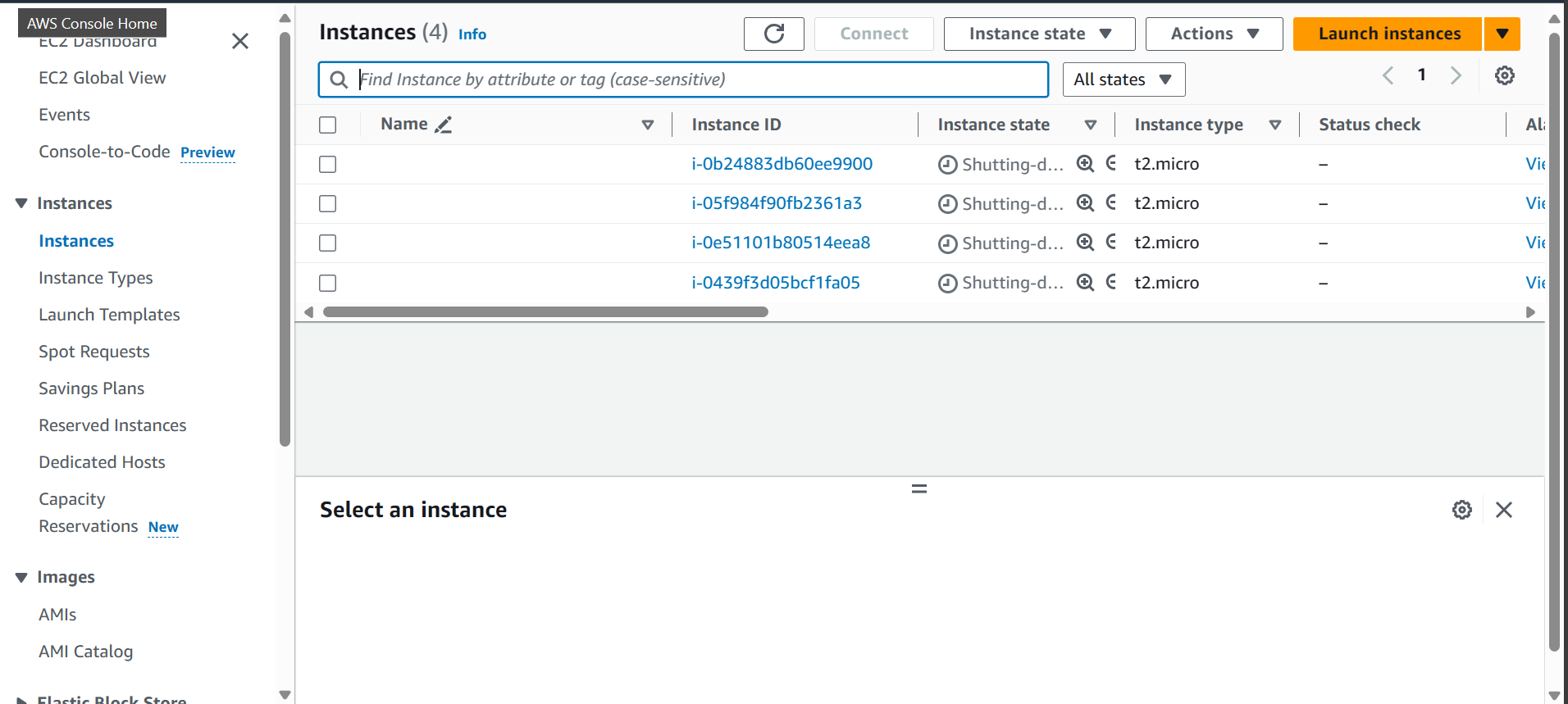

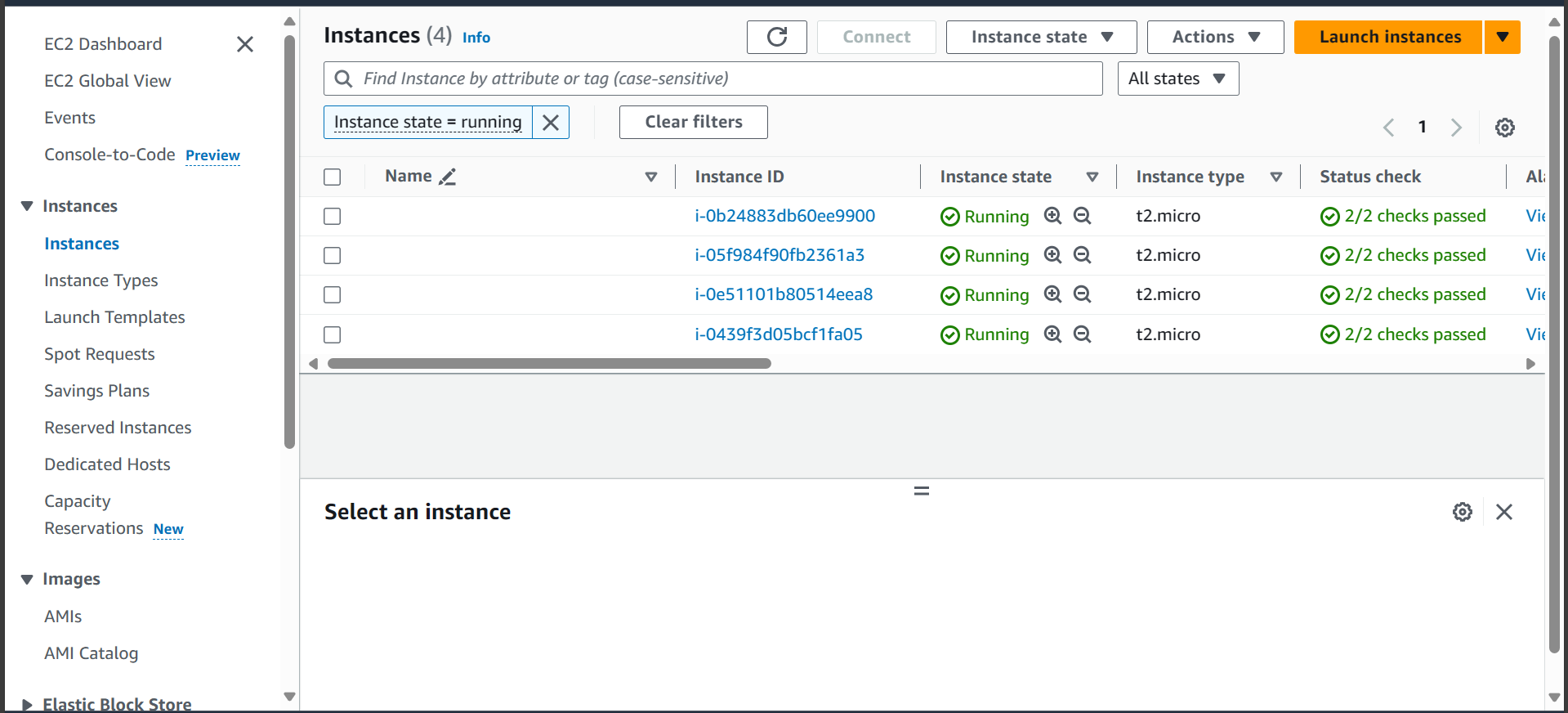

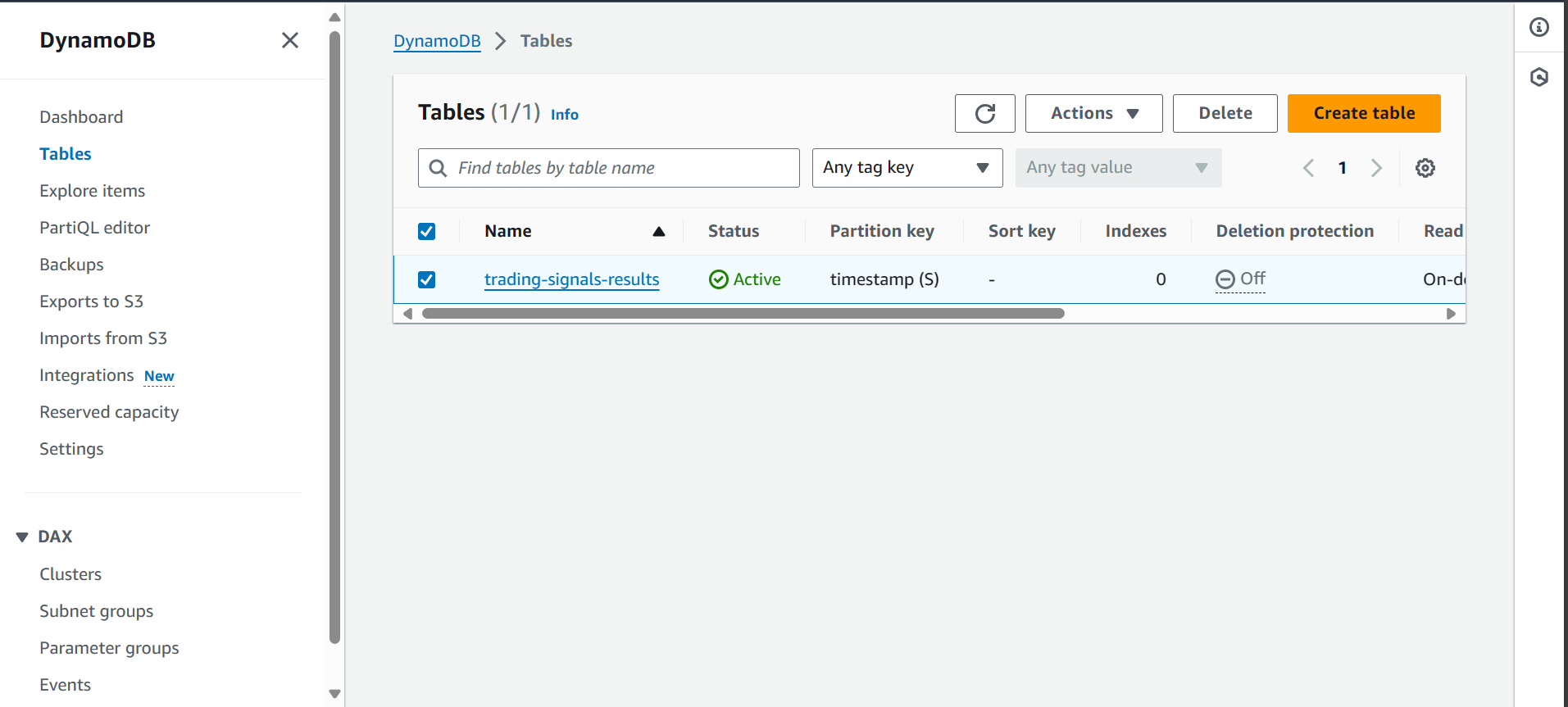

Provisioned EC2 instances and DynamoDB Table

Provisioned EC2 instances and DynamoDB Table

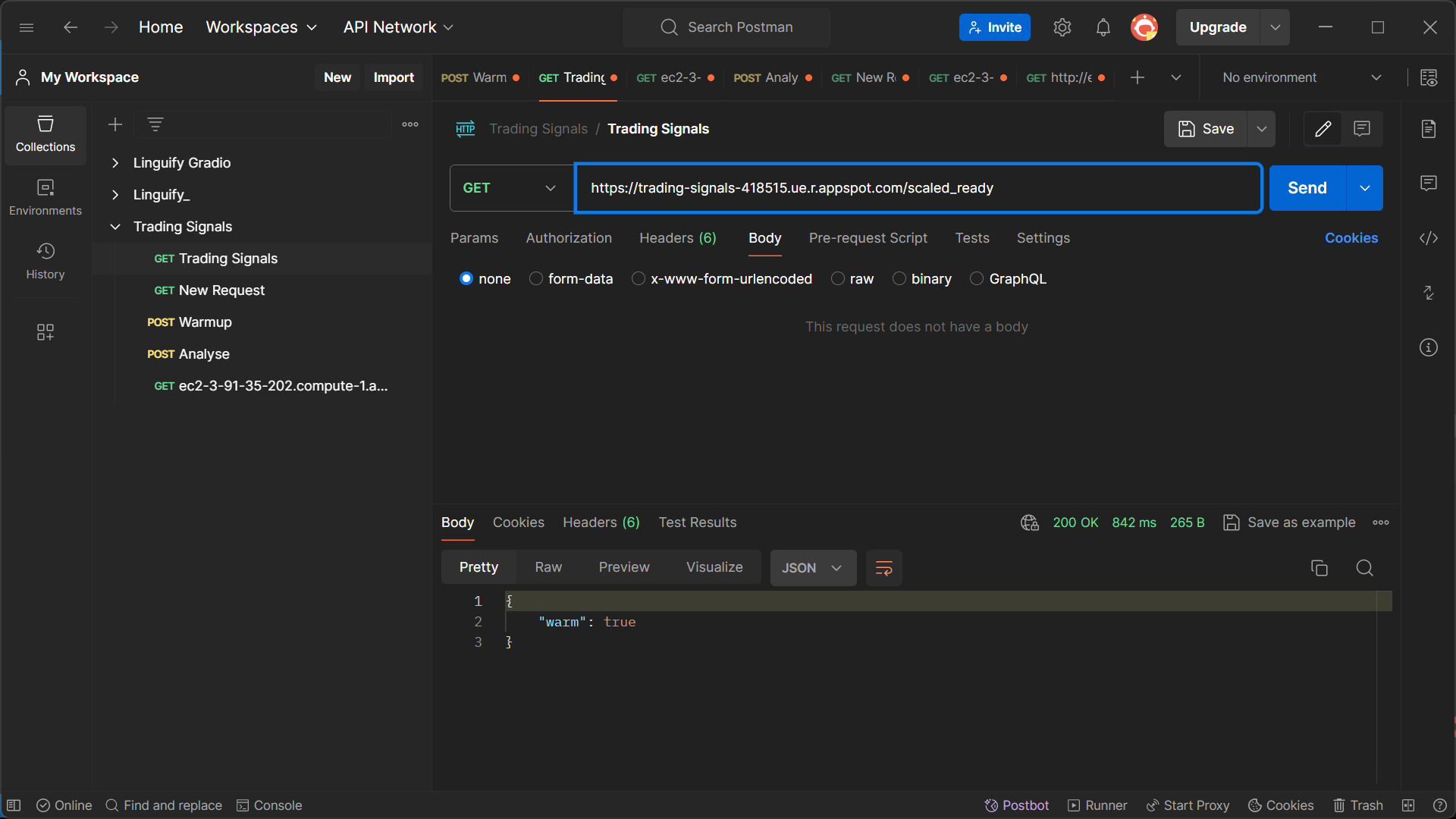

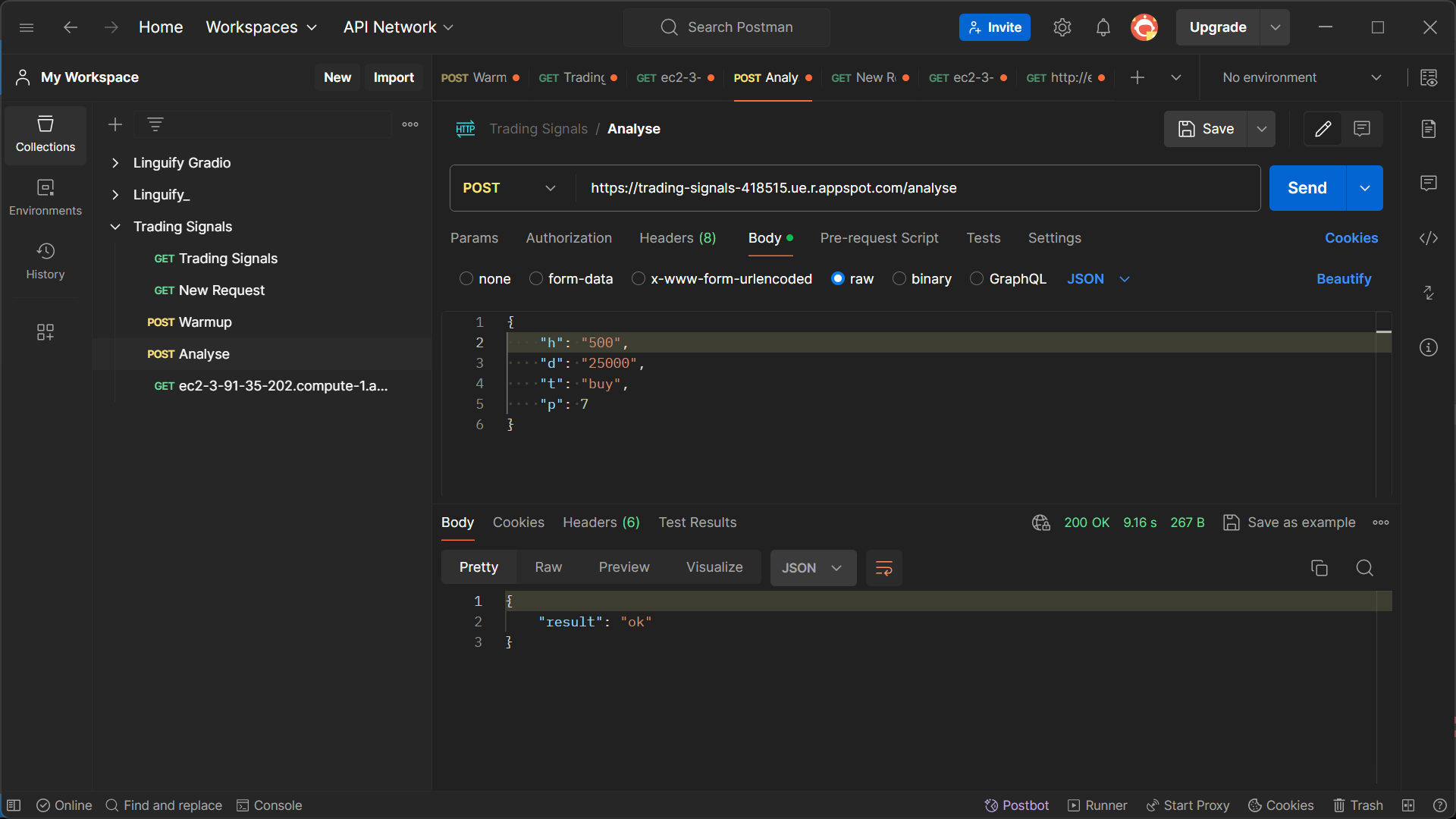

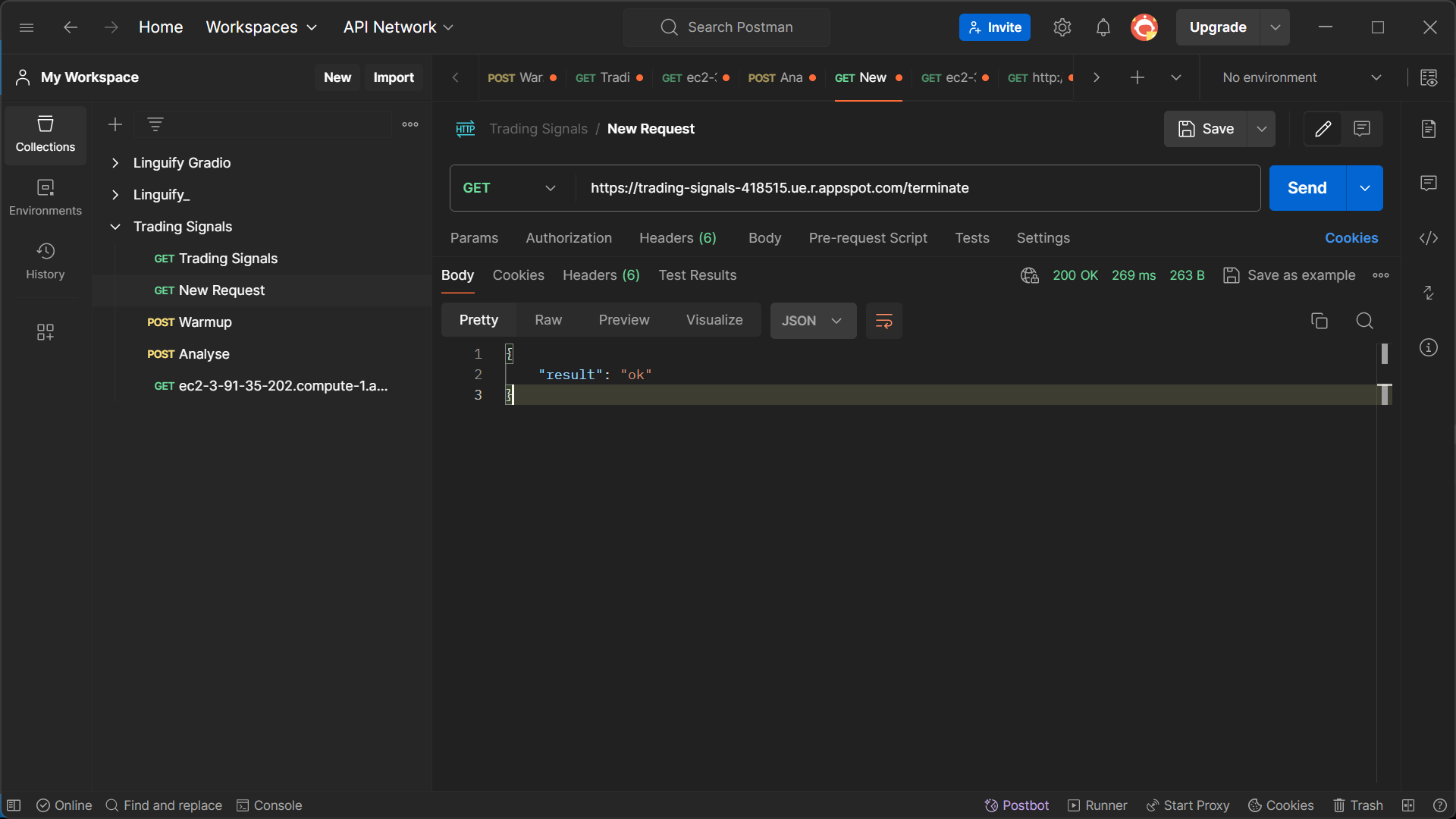

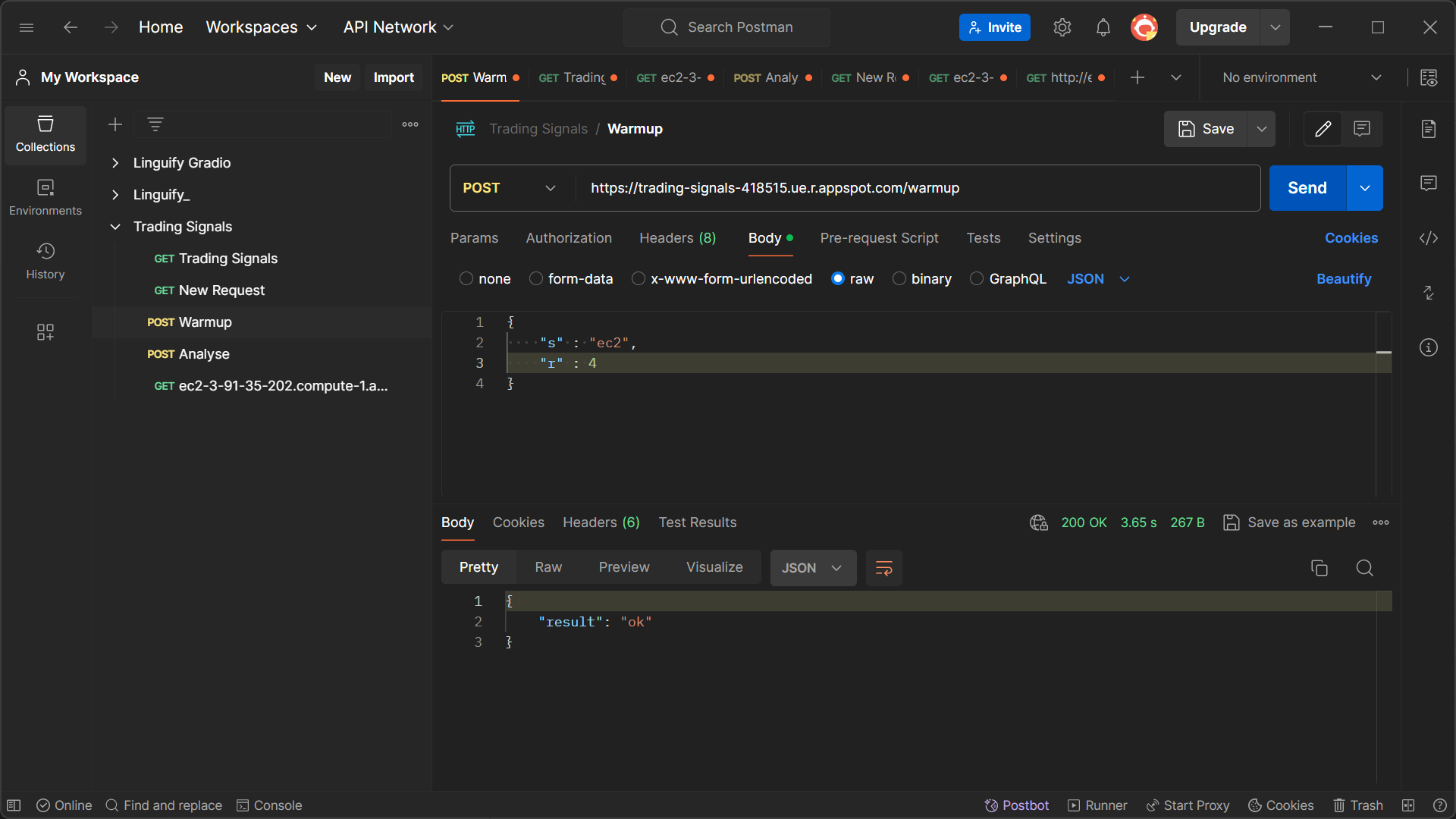

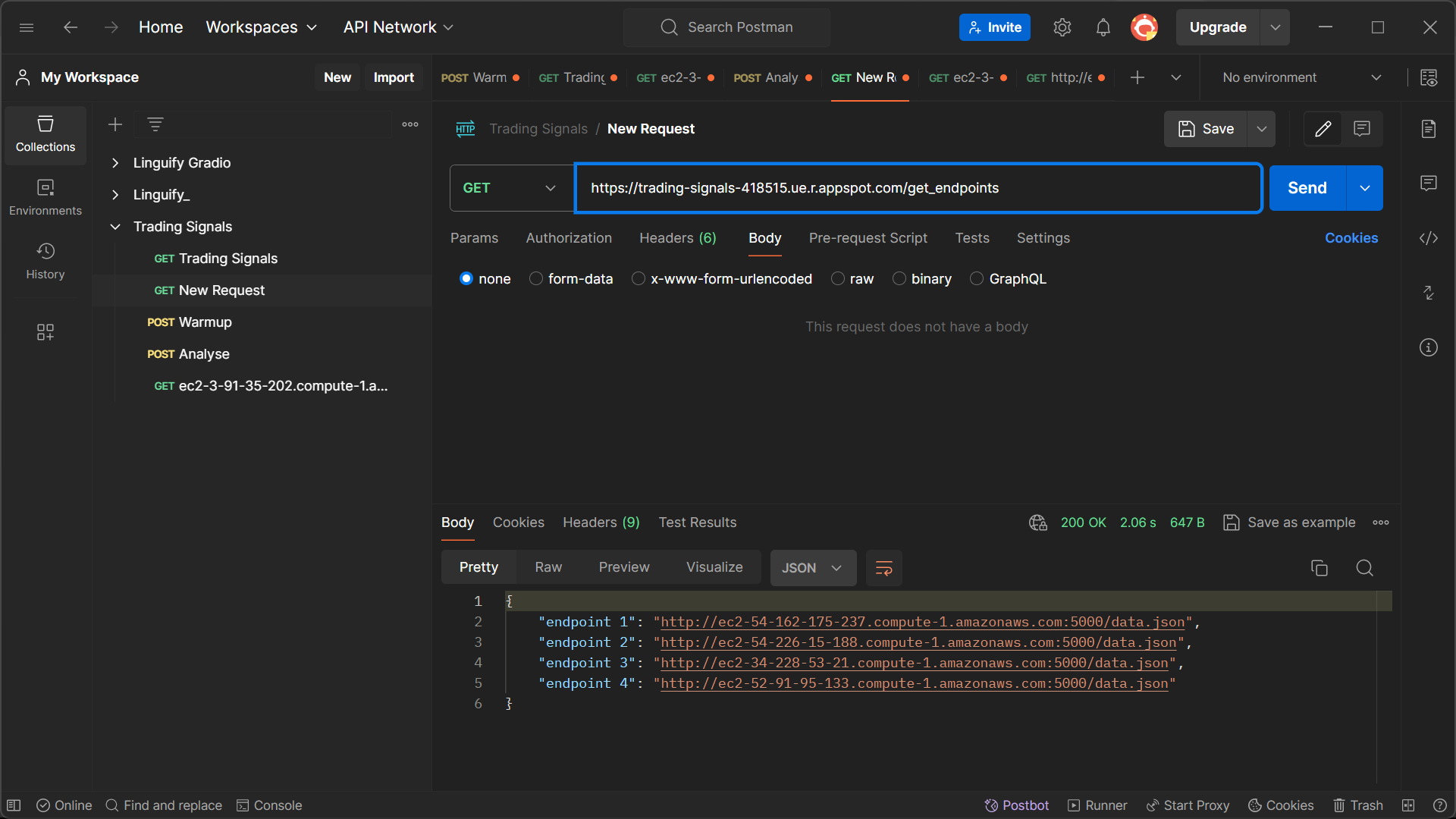

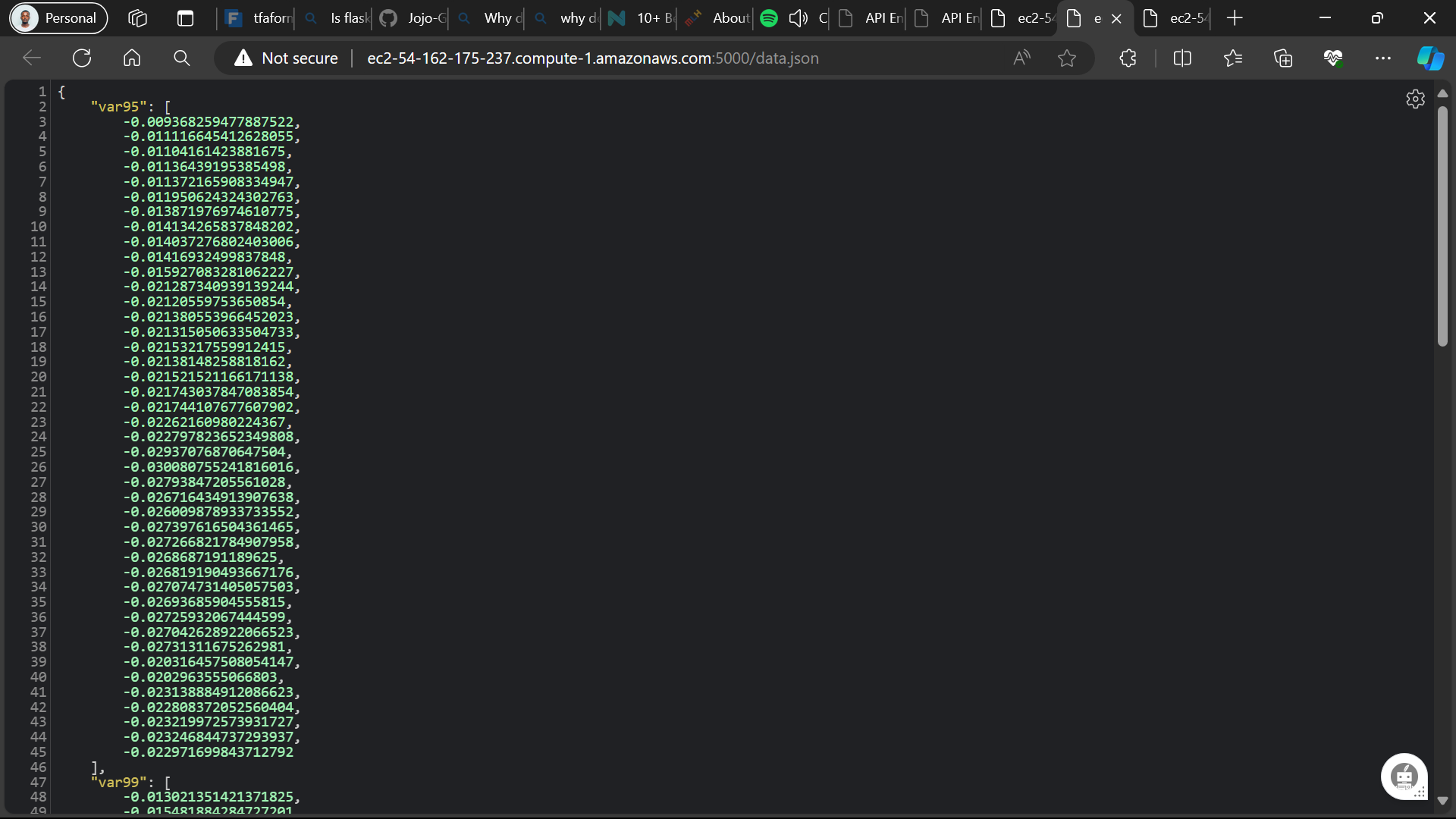

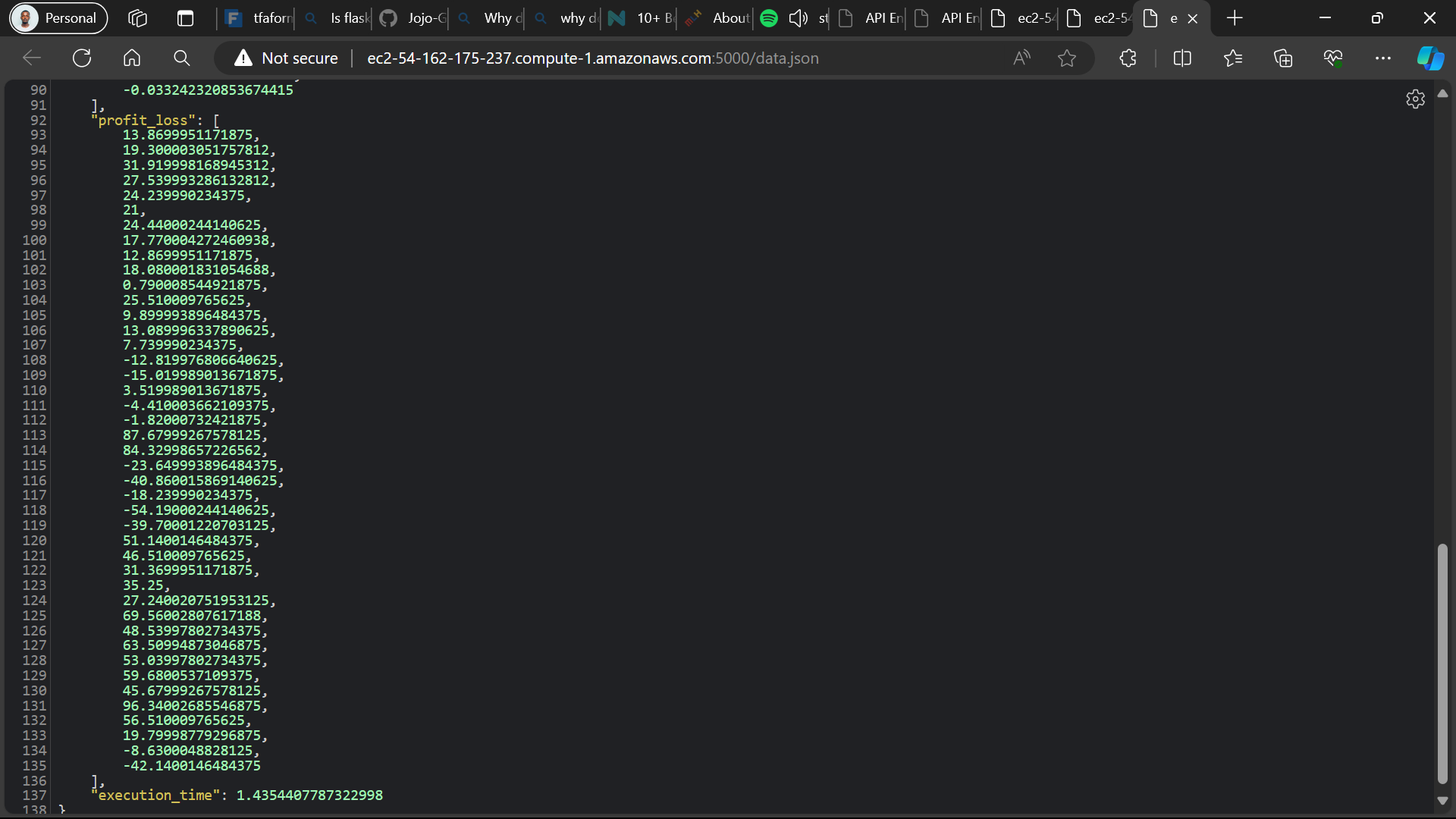

Checking out a single endpoint

Checking out a single endpoint

Note: The other endpoints can be accessed in a similar manner. Each ec2 instance produces a risk values at 95% and 99% confidence levels, profit and loss values, and a execution time.

Note: The average VaR values are calculated by taking the average of the VaR values produced by each ec2 instance. The same applies to the profit and loss values.

This project is licensed under the MIT License - see the LICENSE file for details.