This was my submission for a project in my Advanced Computational Physics class (33-456).

##Dependencies: python 3, numpy, matplotlib

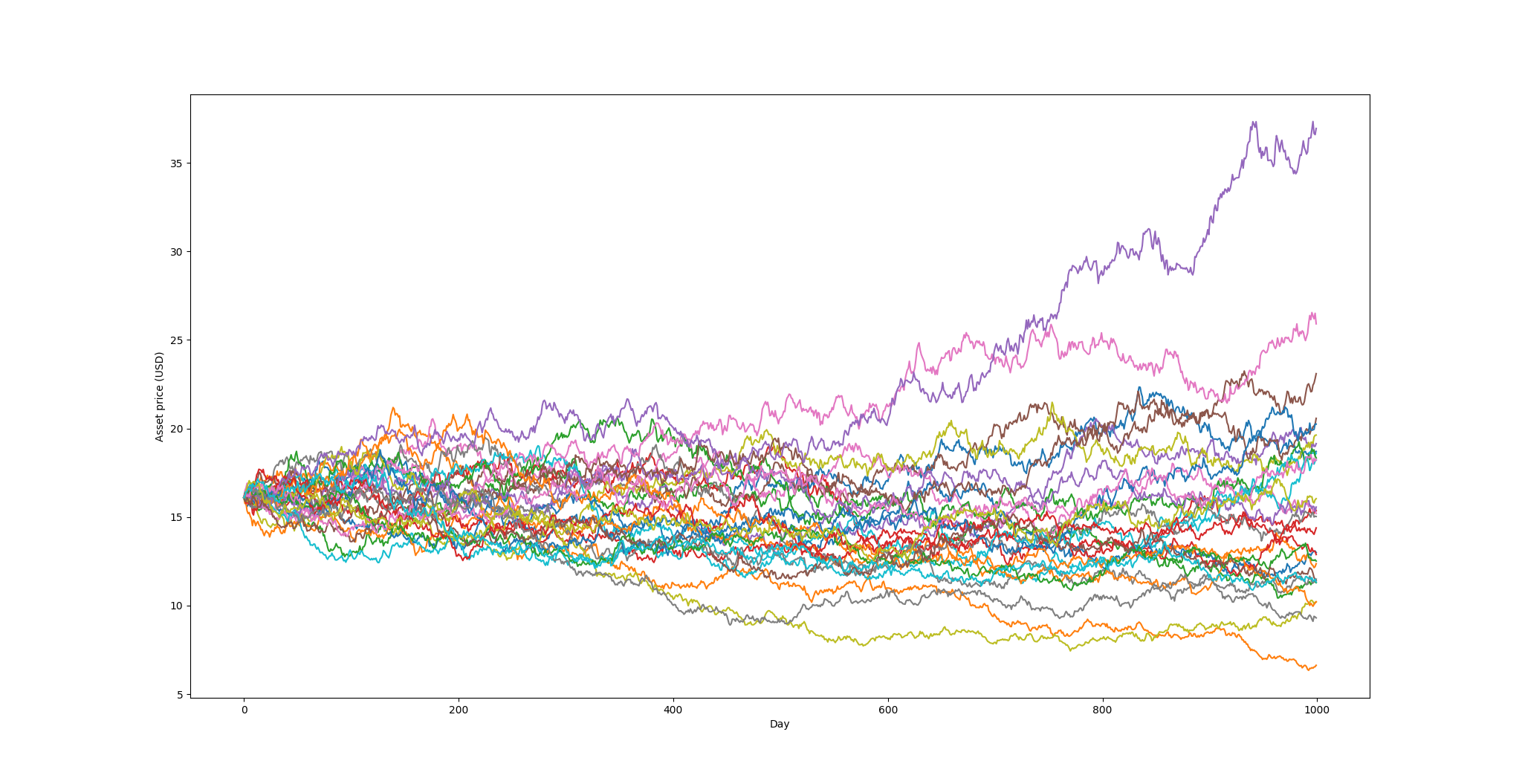

Two files are included. simStock.py simulates paths of stock prices given some input parameters. simTwitter.py simulates paths of twitter shares. Both codes estimate optimal call and put prices.

To run the code, type the following into your command line:

python simTwitter.py

You'll be prompted by some input fields - please fill them out with numerical input.

A matplotlib window will pop up, displaying each simulated path. Close the window to see optimal call and put prices in the output.