-

use python 2.7

-

feel free to point out if there's any errors

-

You can contribute to the project by reporting bugs, suggesting enhancements. You can also buy me a cup of coffee :)

-

Personal recommendations, RUFOUS COFFEE, the best coffee in Taipei, ranging from $5-.

# -*- coding: utf-8 -*-

# @Author: boyac

# @Date: 2016-05-02 18:28:28

# @Last Modified by: boyac

# @Last Modified time: 2016-05-02 19:09:29

from pandas import np

import pandas_datareader.data as web

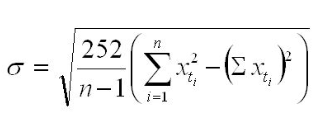

def historical_volatility(sym, days): # stock symbol, number of days

"Return the annualized stddev of daily log returns of picked stock"

try:

# past number of 'days' close price data, normally between (30, 60)

quotes = web.DataReader(sym, 'yahoo')['Close'][-days:]

except Exception, e:

print "Error getting data for symbol '{}'.\n".format(sym), e

return None, None

logreturns = np.log(quotes / quotes.shift(1))

# return square root * trading days * logreturns variance

# NYSE = 252 trading days; Shanghai Stock Exchange = 242; Tokyo Stock Exchange = 246 days?

return np.sqrt(252*logreturns.var())

if __name__ == "__main__":

print historical_volatility('FB', 30) # facebook: 0.296710526109# -*- coding: utf-8 -*-

# @Author: boyac

# @Date: 2016-05-02 18:28:28

# @Last Modified by: boyac

# @Last Modified time: 2016-05-02 19:09:29

from pandas import np

import pandas_datareader.data as web

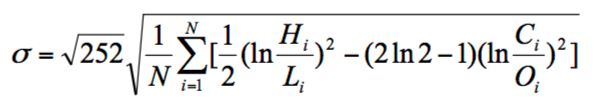

def gk_vol(sym, days):

""""

Return the annualized stddev of daily log returns of picked stock

Historical Open-High-Low-Close Volatility: Garman Klass

sigma**2 = ((h-l)**2)/2 - (2ln(2) - 1)(c-o)**2

ref: http://www.wilmottwiki.com/wiki/index.php?title=Volatility

"""

try:

o = web.DataReader(sym, 'yahoo')['Open'][-days:]

h = web.DataReader(sym, 'yahoo')['High'][-days:]

l = web.DataReader(sym, 'yahoo')['Low'][-days:]

c = web.DataReader(sym, 'yahoo')['Close'][-days:]

except Exception, e:

print "Error getting data for symbol '{}'.\n".format(sym), e

return None, None

sigma = np.sqrt(252*sum((np.log(h/l))**2/2 - (2*np.log(2)-1)*(np.log(c/o)**2))/days)

return sigma

if __name__ == "__main__":

print gk_vol('FB', 30) # facebook: 0.223351260219# -*- coding: utf-8 -*-

# @Author: boyac

# @Date: 2016-05-02 18:28:28

# @Last Modified by: boyac

# @Last Modified time: 2016-05-04 00:27:52

from __future__ import division

from scipy.stats import norm

from math import *

# Cumulative normal distribution

def CND(X):

return norm.cdf(X)

# Black Sholes Function

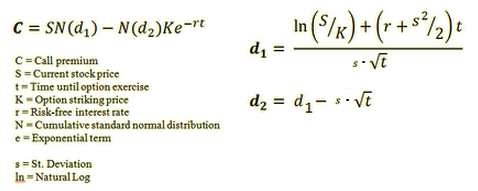

def BlackScholes(CallPutFlag,S,K,t,r,s):

"""

S = Current stock price

t = Time until option exercise (years to maturity)

K = Option striking price

r = Risk-free interest rate

N = Cumulative standard normal distribution

e = Exponential term

s = St. Deviation (volatility)

Ln = NaturalLog

"""

d1 = (log(S/K) + (r + (s ** 2)/2) * t)/(s * sqrt(t))

d2 = d1 - s * sqrt(t)

if CallPutFlag=='c':

return S * CND(d1) - K * exp(-r * t) * CND(d2) # call option

else:

return K * exp(-r * t) * CND(-d2) - S * CND(-d1) # put option

if __name__ == "__main__":

# Number taken from: http://wiki.mbalib.com/wiki/Black-Scholes期权定价模型

print BlackScholes('c', S=164.0, K=165.0, t=0.0959, r=0.0521, s=0.29) # 5.788529972549341