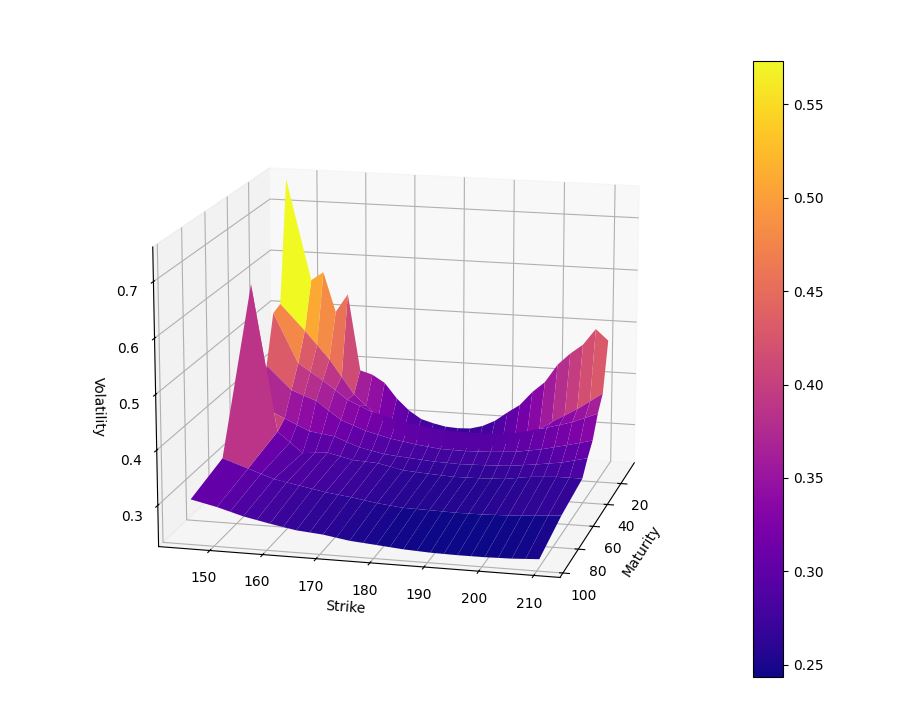

This Python script generates a volatility surface for a given underlying asset using option prices retrieved from Yahoo Finance. It employs the Black-Scholes-Merton (BSM) model for implied volatility calculation.

- Python 3.x

- yfinance

- pandas

- numpy

- scipy

- matplotlib

- tkinter

-

Clone the repository:

git clone https://github.com/Gologoye/volatility-surface-yfinance.git

-

Install the required dependencies:

pip install -r requirements.txt

-

Run the script:

python volatility_surface.py

-

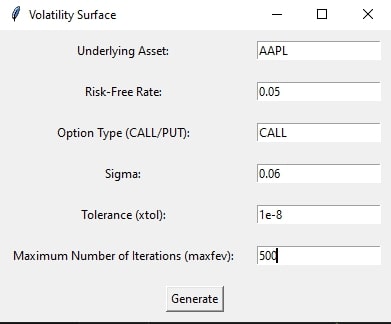

Enter the required parameters in the GUI window:

- Underlying Asset: Enter the ticker symbol of the underlying asset, to find the right ticker, look on finance.yahoo.com..

- Risk-Free Rate: Enter the risk-free rate (decimal).

- Option Type (CALL/PUT): Enter the type of option to analyze (CALL or PUT).

- Sigma: Enter the initial guess for volatility (decimal).

- Tolerance (xtol): Enter the tolerance for the solver.

- Maximum Number of Iterations (maxfev): Enter the maximum number of iterations for the solver.

-

Click the "Generate" button to generate the volatility surface plot.

- The script retrieves historical stock data and option chain data from Yahoo Finance.

- It filters option contracts based on strike price proximity to the current stock price.

- The BSM model is used to calculate implied volatility.

- The GUI is implemented using Tkinter.