This repository contains a simple AI system aimed at predicting the trend of the NVIDIA stock prices using machine learning.

The data needed for the analysis are imported through yfinance, an open-source tool that uses Yahoo's publicly available APIs to retrieve data about listed stocks.

The financial and banking sectors are incredibly data-rich, with millions of transactions and transfers occurring every day. Machine learning models can be used to understand emerging and underlying trends in order to gain advantage in the financial sector.

Check out the Colab Notebook to review the execution of the project.

Since the project relies on some external libraries, it is important to keep the dependencies up-to-date with the latest stable versions of all the libraries and tools used. The list of the requirements is automatically updated by Renovate, which opens a pull request as soon as new updates in the project dependencies are available.

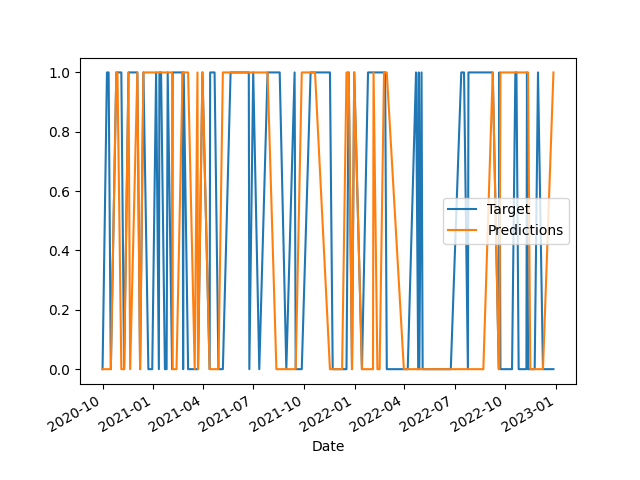

The goal of the model is to predict whether we should buy the stock (target = 1), meaning that the price is going to increase in the future, or sell the stock (target = 0), when the price is going to decrease in the future. The model is trained using data about NVIDIA stock (Open, High, Low, Close, Volume) analyzed over a given period of time, as well as data about main business stakeholders and key financial indicators.

The regression and classification algorithms used in the project are featured by the scikit-learn machine learning library, while data modeling is mainly performed using the pandas software library.

The project shows three different machine learning models which use different variables and algorithms:

The first model is trained by using ohlcv data of BTC, the Bitcoin USD price from 2020 until today, and uses the RandomForestClassifier as learning algorithm.

The second model uses the same learning algorithm but is trained using some key financial indicators like SMA, RSI, OBV and others.

Whereas the third model uses LinearRegression with the exponential moving average (EMA) as a predictor for the stock closing price.

Clone the git repository:

git clone https://github.com/CescaNeri/ML-stocks-prediction.git && cd ML-stocks-predictionSet up a virtual environment to install dependencies:

python3 -m venv /path/for/the/virtual/environmentActivate the virtual environment:

source path/bin/activateInstall the dependencies:

pip install -r requirements.txtNow that dependencies are in place, we can deactivate the virtual environment and run the program:

python stock-prediction.pyThe program wil ask you to choose a model among three options:

Select a Machine Learning model among these three:

1. Bitcoin Model (type: 1)

2. Financial Indicators Model (type: 2)

3. Regression Model (type: 3)

The first and the second model will display the final accuracy level directly on the terminal and, at the same time, will save a picture plotting target values vs predicted values over the analyzed period.

The third model will display some key metrics useful to evaluate the regression model, which are:

- Standard Deviation

- Mean Absolute Error

- Coefficient of Determination (R2)

As any one of us could guess, the stock market is unstable and, more than often, unpredictable. Of course, fundamental factors such as a company’s intrinsic value, assets, quarterly performance, recent investments, and strategies all affect the traders’ trust in the company and thus the price of its stock.

Only a few of the latter can be incorporated effectively into a mathematical model, making stock price prediction using machine learning challenging and unreliable to a certain extent.