BinanceTools

version 1.3.0

This Python code is used to automize some tedious tasks in Binance Crypto Exchange:

postOrder.py- opening multiple limit orderstrailingOrder.py- monitoring current price and posting market order once price reaches it's local min or max

1. Requirements:

1.1 Libraries

pip install python-binance

pip install pandas

pip install numpy1.2 API

Generate an API KEY, assign relevant permissions:

- Enable Reading

- Enable Spot & Margin Trading

Save your keys in file parameters/keys.py as:

Public = '<PASTE YOUR API Key HERE>'

Secret = '<PASTE YOUR Secret Key HERE>'2. Posting limit orders

Main file to generate orders is postOrder.py:

For example, if you wish to open 30 orders to buy Bitcoin with 1k Tether, starting at 52k and ending at 54k with equal size orders, your code should look like:

from exchange.basics import connect, portfolio

from functions.misc import check_params

from functions.orders import order_manager

if __name__ == '__main__':

client = connect()

portfolio = portfolio(client)

coin = 'BTC' # <-- edit, coin you want to trade

pair = 'USDT' # <-- edit, coin you want to trade with

side = 'BUY' # <-- edit, side you want to trade, either 'BUY' or 'SELL'

# Choose only one: [Part: None|1-100, Amount: None|int]

part = None # <-- edit, percentage of your pair coin in portfolio you want to trade with

amount = 1000 # <-- edit, either None or specific value

start = 52000 # <-- edit, value you want to start your orders

end = 54000 # <-- edit, value you want to end your orders

steps = 30 # <-- edit, number of orders you want to place

# True = normal distribution, False = linear distribution, [default: False]

norm_dist = False # <-- edit, type of orders distribution

run = check_params(coin, pair)

if run:

order_manager(client, portfolio, side, coin, pair, start, end, steps, part, amount, norm_dist)2.1 order of posting orders

- If you choose to set BUY, program will post orders by price descending

- If you choose to set SELL, program will post orders by price ascending

2.2 check_params

If you execute run = check_params('ABC', 'XYZ'), you'll get result:

Missing coin ABC in params.Coins

Missing coin XYZ in params.Coins

Also variable run will be False, and code won't run any further. Before moving further, you have to add missing coins to

params.Coins. For example BTC has below parameters:

'BTC': {'lot': 6, 'price': 2}

If you want to trade BTC, you can open order only with:

- price value with precision = 2

- lot value with precision = 6

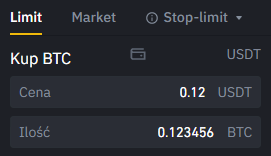

You can check precision manually in Binance BUY/SELL window by checking how many decimals are accepted, like below:

2.3 part vs. amount

Difference between part and amount:

partis used to take a percentage of your free asset based on your portfolio. For example if you wish to trade 100% of your coin you should setpart = 100, andamount = None.amountis used to trade specific amount of your asset. For example if you wish to trade exactly 1000 USDT, you should setamout = 1000andpart = None.

Code will check for errors:

- if you gave both variables with a value (

if (part is not None) & (amount is not None)) - if you have provided amount above your free assets (

if amount > balance)

2.4 steps

Once your parameters are ready, you can open your first order. Program will ask some questions on the run.

In Binance the minimum value of an order has to be 10 USD or 0.0001 BTC. If you wish to trade with other pair,

please edit def order_adjustment() in functions/orders.py.

Questions to answer:

- do you want to open more orders then specified in

stepsif there is a possibility? Code will look for the maximum number of steps to split your orders while staying abovemin_val. - do you want to open less orders then specified in

stepsif at least 1 is belowmin_val? - abort?

2.5 norm_dist

# True = normal distribution, False = linear distribution, [default: False]

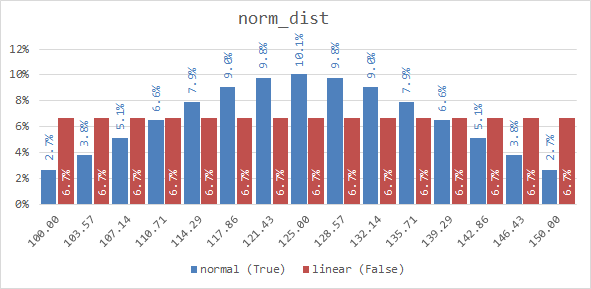

norm_dist = False # <-- edit, type of orders distributionIf norm_dist = False then all orders will be divided linearly (equally), (red bars in chart below).

If you change that variable to True, code will divide your orders based on normal distribution (blue bars in chart below).

Stats for 15 orders in price range 100-150 are as below:

normal (True) linear (False)

count 15.00 15.00

min_price 100.00 100.00

max_price 150.00 150.00

average_price 125.00 125.00

min_coins 17.59 43.33

max_coins 65.37 43.33

average_coins 43.33 43.33

sum 650.00 650.00

std_dev 16.56 0.00

2.6 5x limit

Binance isn't letting for orders with price 5 and above times higher then the current price. To handle issues when user

sets end value above that limit, function check_current_price has been introduced to check and decide on the next

steps. It reads the current price of paired coin and if end is above 5x limit, user has to decide, what to do next:

- (1) - edit end value manually - it will stop the program.

- (2) - limit number of orders (open less then orders, but all within 5x) - the amount of traded coins will be reduced to cover only orders within 5x limitation. Orders above 5x will be ignored.

- (3) - apply 5x as new end for 100% of amount - the amount of traded coins will remain the same, but price range will be updated to fit within 5x limitation

3. Trailing Bot

File trailingOrder.py contains trailing bot which mimics 3Commas' Trailing TP.

source: 3Commas

from exchange.basics import connect

from functions.trailOrder import trailing_bot

if __name__ == '__main__':

client = connect()

params = {

'coin': 'BTC', # <-- edit, coin you want to trade

'pair': 'USDT', # <-- edit, coin you want to trade with

'side': 'SELL', # <-- edit, side you want to trade, either 'BUY' or 'SELL'

'price': 54500, # <-- edit, value when trailing has to start

'val': 1000, # <-- edit, value of pair asset you want to trade

'deviation': ('V', 250) # <-- edit, 'P' (percentage) or 'V' (value)

}

trailing_bot(client, params)3.1 price

type: int/double

You set price for which you wish to BUY or SELL an asset. It means once pair reaches that price level it will start trailing. Until then it is just monitoring the market.

3.2 val

type: int/double

You set value of how much of pair you want to give for traded coin. For example 1000 USDT for x BTC.

3.3 deviation

type: touple(str, int/double)

'V'for value, for example250if you wish to set boundaries of 250 below and 250 aboveprice'P'for percentage, for example1.5if you wish to set boundaries of 1.5% below and 1.5% aboveprice

3.4 monitoring and trailing

When program is running it is monitoring exchange to see if the current price of coin get withing initial boundaries.

Once the price is in, program start trailing. It will shift initial boundaries up (if selling) or down (if buying)

respecting initial deviation level. Once the current price goes outside current boundaries it will either:

- fire market order:

- if you are selling and price goes below boundaries

- if you are buying and price goes above boundaries

- shift boundaries to respect new price.

If deviation is 'P' (percentage) new boundaries are calculate based on the current price, not original one.

4. Limitations

Based on API Trading Rules (see: What kind of limits are there?) you can be banned from 5 minutes to 3 days if you spam order creation and cancellation very quickly without executing trades. This program allows you to open hundreds of orders very quickly. Please use trial and error to achieve your ideal trading pattern and do not play with opening tones of orders just to close them right after!

Error -1015 TOO_MANY_ORDERS : API has Hard-Limit of 100 orders per 10 seconds. To keep within this limit, communication between program and Binance has been artificially slowed down to 10 actions/second.

5. Common issues:

binance.exceptions.BinanceAPIException: APIError(code=-1021): Timestamp for this request was 1000ms ahead of the server's time.

This is know issue (link), which I couldn't resolve myself. The only solution for that is restarting your PC and running code again.

6. TO DO:

postOrder.py

- add automatic precision checker

- work on nice GUI

trailingOrder.py

- live price chart with current boundaries