Ethereum-Arbitrage-Web-Platform

Contents

- Description

- Sample Flow

- Other Features

- Installation Guide

- Working Example

- Further Improvements

- License

Description

Levl - Flash Arbitrage is a platform that allows users to take advantage of arbitrage opportunities that may arise between Uniswap and Sushiswap.

The catch is that the operation doesn't involve the user's time or capital. The platform is constantly monitoring the user's chosen pairs and executes transaction by first Flash Loaning from one of the DEXes.

Sample Flow

Landing Page

When the user connects to the platform this is the very first thing they see.

Connecting Your Wallet

To connect your MetaMask wallet, click on the Connect Wallet button in the top-right.

A preview of your address and the network over which you are connected (in this example, Rinkeby) will be shown. To disconnect, simply press the Disconnect button.

Showing the Guide

In order to show the short informational banner, click on the INFO button in the top-left.

Placing an Order

An order represents the user's wish to track the existence of any arbitrage opportunities for the selected pair.

Requirements

- An order requires two valid token addresses.

If not, the field will be marked red, as shown below:

- The two tokens should exist as a pair on both Uniswap and Sushiswap.

- At the moment, it is also required that each of the tokens is paired with

DAI(in order to determine an objective valuation of the two tokens)

Fortunately, the platform does all of these checks, so no worries here.

Placing the Order

Simply enter the addresses of your tokens in the two input fields and hit the CHECK PAIR STATUS button.

If there are errors, there will be a red alert displayed in the bottom-left, explaining the reason behind the failure, like shown:

If everything is alright, though, there will be a green alert displayed in the bottom-left. Afterwards, click the PLACE ORDER button.

Confirming the Order

You will be asked to confirm the transaction for the order creation and pay a fee. The fee is used to cover for the gas expenses involved and nothing more.

Again, a green alert will be shown in the bottom-left if everything goes smoothly.

Sample Order Placement Transaction

Your transaction should look something like this.

Showing Orders

If you have at least one CONFIRMED Order Placement transaction on etherscan, refresh the page and click on the ORDERS button in the top-left.

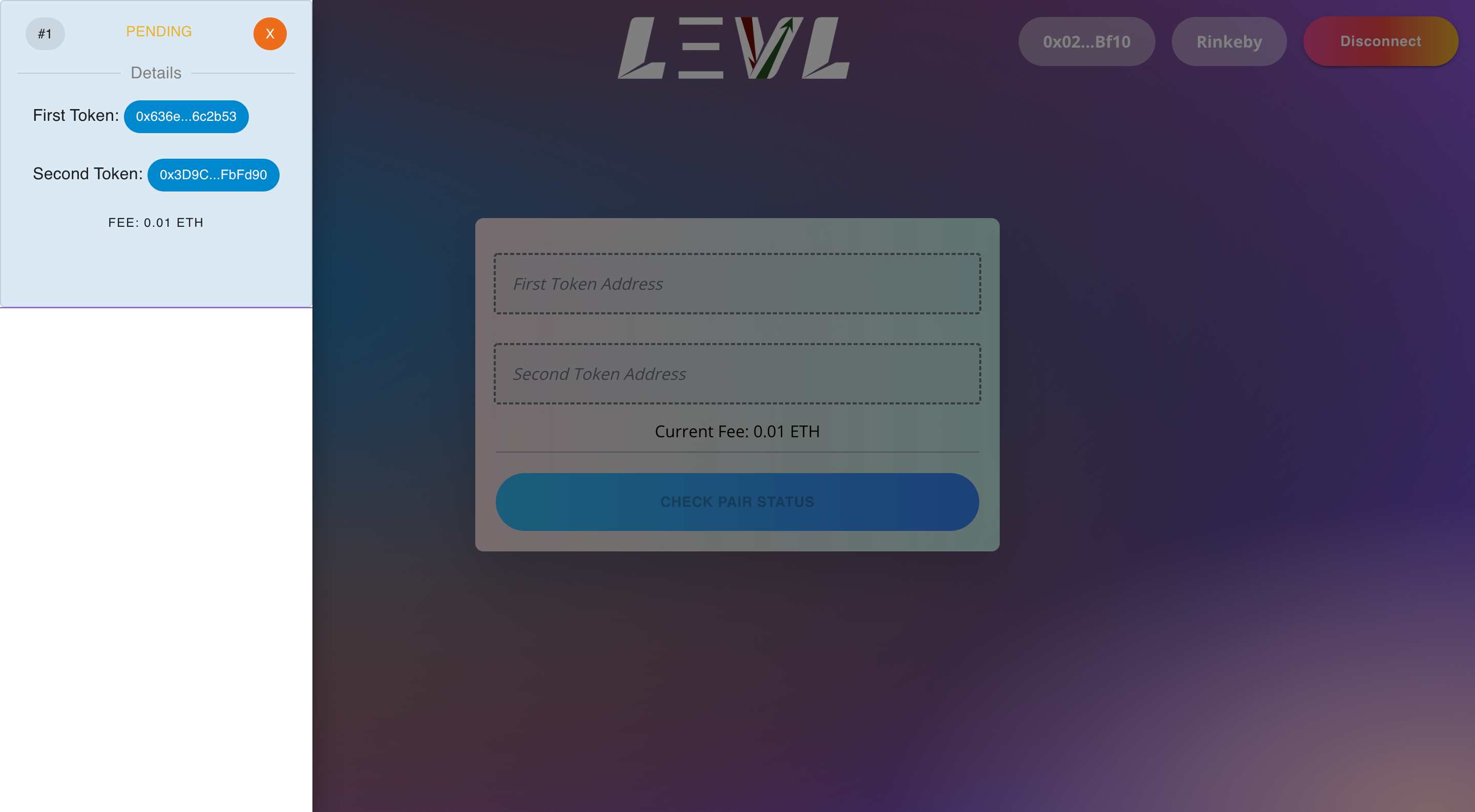

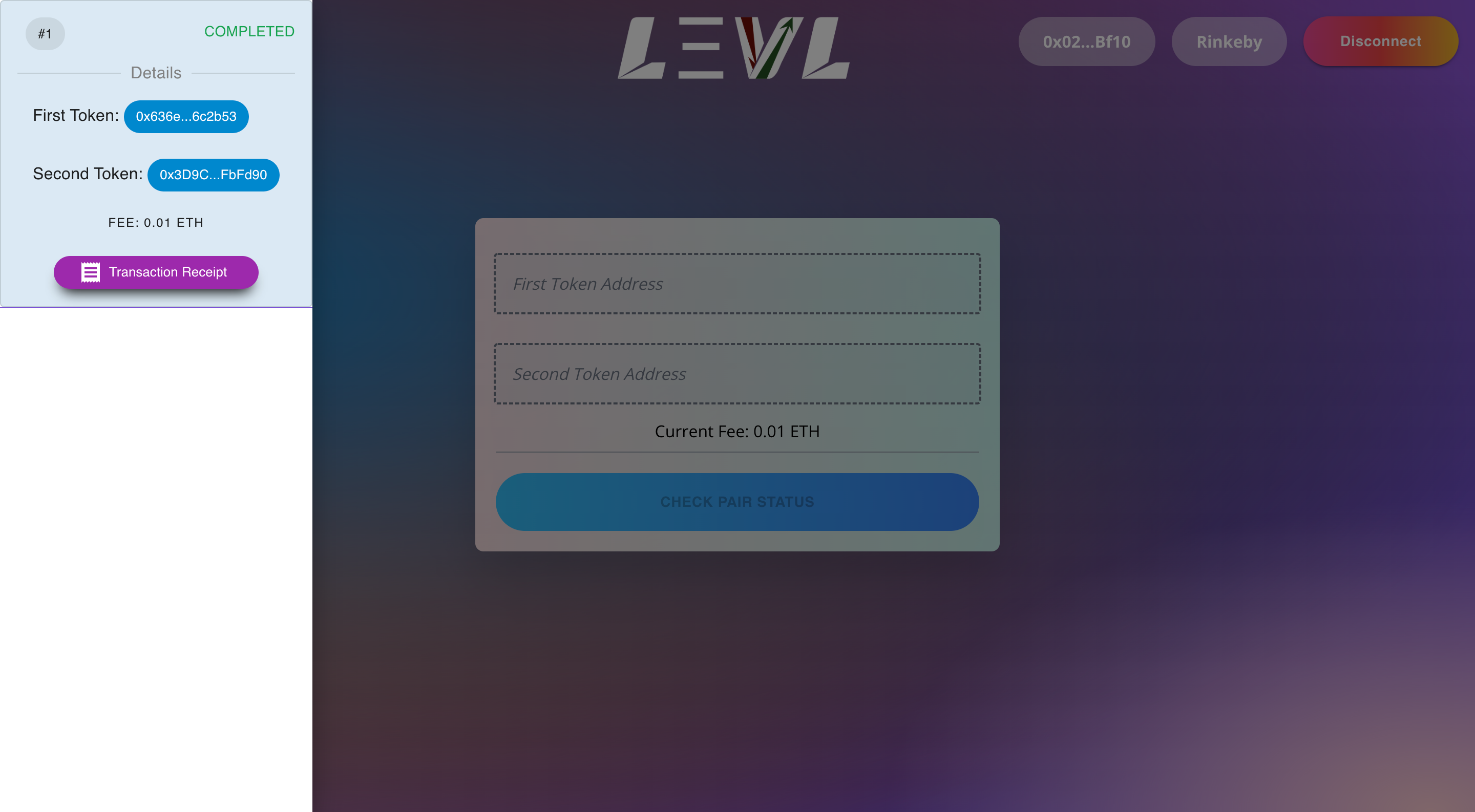

Order Status

An order can have one of the following statuses:

-

PENDING - the order has been picked up, but there has yet to be an opportunity for executing it

-

CONFIRMED - the order has been executed and the proceeds have been sent to the user's wallet

In this particular case, the transaction receipt is also available and clicking the button will redirect to etherscan.

-

REJECTED - if there are problems that interfere with the execution (e.g. lack of liquidity), the order will be rejected and the order will not be tracked anymore

If this is the case, you should cancel the order.

-

DELETED - the order has been cancelled by the user In case of cancelling an order, the fee for covering the gas costs is returned to the user's wallet.

Cancelling an Order

To cancel an order, simply click on the x button placed in the top-right of the order card.

Successful Execution

In case of a successful execution, you will find the funds in your wallet. There is no withdraw transaction required on the user's part.

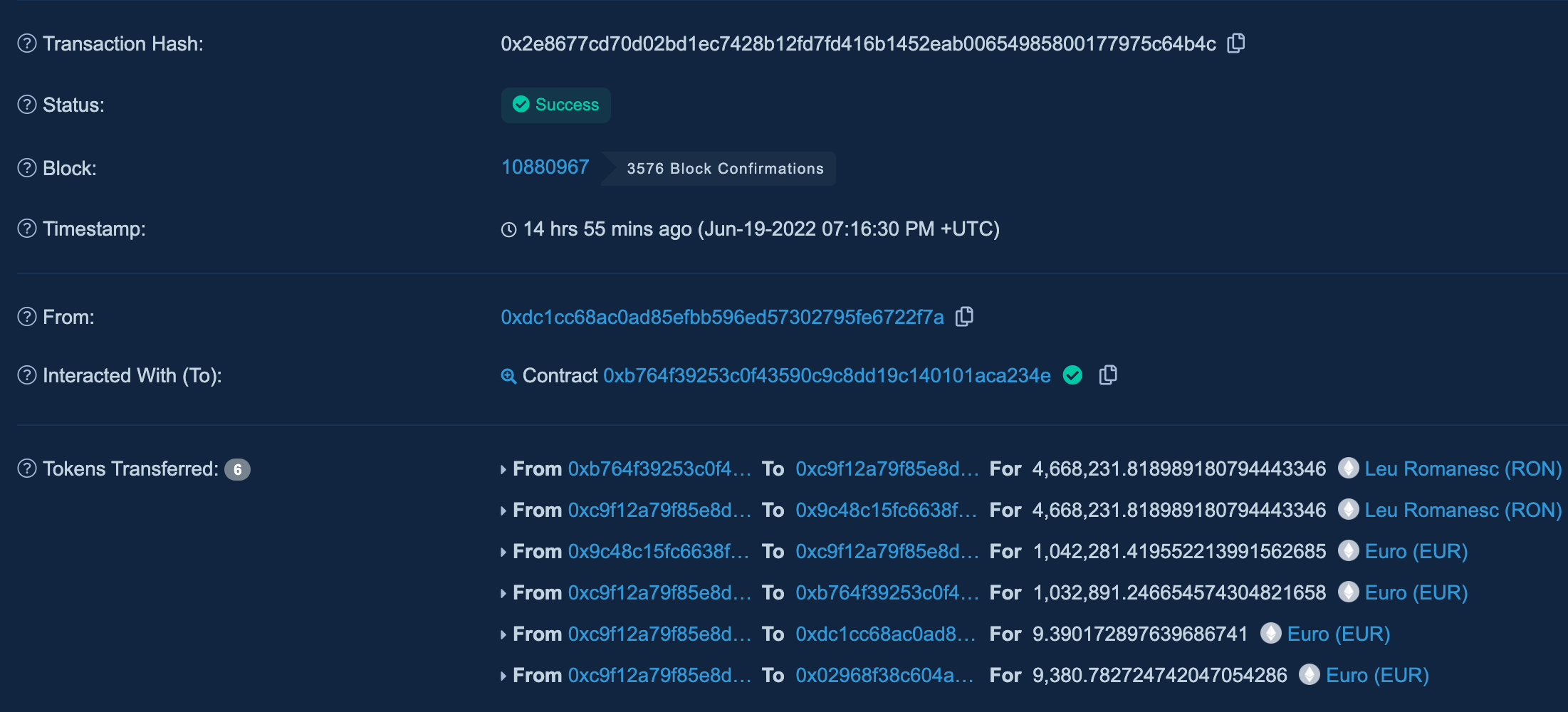

A successfully executed Flash Arbitrage transaction will look something like this:

Other Features

On the configuring side, for the more savvy users, one can modify multiple things, including, but not limited to:

- The Gas Coverage Fee of the Platform

- The Commission Charged on Successful Execution

- Various Execution or Profitability Thresholds

Installation Guide

The guide is written using macOS Monterey 12.4 as the distribution of reference. However, the steps undertaken should be similar on any other distribution.

The first step is cloning the repo. Once that's finished, proceed as described below.

Python

You should have Python (3.9 or later) installed, as well as the pip package manager.

To download Python, follow this link.

To install pip, run the following commands, one by one, in the terminal:

curl https://bootstrap.pypa.io/get-pip.py -o get-pip.py

python3 get-pip.py

rm get-pip.pyTo check your version of Python, run:

python3 --versionTo check your version of pip, run:

pip --versionBrownie

The framework used for the development and deployment of the Solidity Smart Contracts is Brownie. It is installed using the pipx package manager, so we need to install that one first:

python3 -m pip install --user pipx

python3 -m pipx ensurepathAfterwards, restart your terminal, and type the following command:

pipx install eth-brownieTo verify that the installation was indeed successful, type brownie in the terminal. Your output should look something like this:

Brownie v1.18.2 - Python development framework for Ethereum

Usage: brownie <command> [<args>...] [options <args>]

...

etc.React

If you made it this far, everything should work just fine. All of the useful functions are exposed and ready to use as of now.

However, for a better experience, you could use the front-end! It is written in React.js, so we need to install a few things.

For starters, we need to install Node.js (16 or later) and NPM (8 or later).

To download Node.js, follow this link. Once the installation process is done, check your versions of Node.js and NPM by running the following:

node --version

npm --versionIf everything went smoothly, open a new terminal window, go to the client folder, and take care of all the dependencies by running:

npm iTo start the app, simply run:

npm run devDon't panic if there are errors on the screen, it's because the builds are not migrated yet. We will take care of that immediately. For now, if you can see something like the following in the console, it's all that matters.

> levl@0.0.0 dev

> vite

vite v2.9.14 dev server running at:

> Local: http://localhost:3000/

> Network: use `--host` to expose.env

Sensitive information should NOT be stored online, thus, you should create this file by yourself. Its responsibility is to hold the private key and your Infura Node access token.

touch .envThe format is:

export PRIVATE_KEY=<private key goes here>

export WEB3_INFURA_PROJECT_ID=<infura project ID goes here>

export ETHERSCAN_TOKEN=<etherscan access token goes here>

export DEPLOYER_KEY=<private key of the example token deployer wallet>First Run

There are two main components of the app, namely:

- The Contracts

- The Monitor

To compile the contracts, go to the main directory (ethereum-arbitrage-web-platform) and simply run:

brownie compileTo deploy them on a certain network, in this example, Rinkeby, run the following command containing the --network flag:

brownie run scripts/deploy_manager.py --network rinkebyTo start the monitor, run the following command in a separate terminal window:

brownie run scripts/arbitrage_manager.py --network rinkebyNote: Modify the sleep time in accordance to your preferences. It should be zero, but this could quickly lead to overloading the Infura / Alchemy node used for connecting and thus, may cause you to reach your daily request limit.

To spin up the front-end and use it for interacting with the platform, migrate the config and builds by running:

brownie run scripts/migration_manager.py --network rinkebyAnd then, in a separate terminal window:

npm run devNow you are ready to take part in arbitraging. Just follow the steps provided in the Sample Flow section and you are good to go!

Working Example

There are two tokens provided as a working example in the ERC20RON.sol and ERC20EUR.sol files.

By running the demo_manager.py script, you will get a sure-fire arbitrage opportunity.

brownie run scripts/demo_manager.py --network rinkebyUnder the hood, what happens is, in order:

- Liquidity Deployment

- The two token contracts are deployed

- Liquidity is provided asymmetrically on Uniswap and Sushiswap for the two tokens

- DAI pairs are provided on Uniswap for both tokens as an objective value reference

- Contract Deployment

- The Order Manager Contract is deployed

- The Flash Arbitrage Contract is deployed

- The Data Provider Contract is deployed

- Front-End Migration

- The Config data is migrated to the front-end

- The Contract ABIs are migrated to the front-end

Now, everything that's left for you to do is input the two token addresses in the fields, place the order and make sure the monitor is running.

You can find all relevant contract addresses in the map.json file.

Further Improvements

This project would be best described as a Proof-of-Concept and it is by no means production-ready. Some improvements that could be made in this direction would include:

- Using Meta-Transactions instead of the

Gas Coverage Fee - For mass usage, the platform should be hosted and connected to a self-managed node, not through a third party

- Instead of comparing prices with ETH through USD,

WETHpairs could be used. - The only stablecoin used for price reference is

DAI, the list could be extended to include others (e.g.USDC,USDT) - Adding more DEXes to the monitor (e.g. Pancakeswap, Balancer, Curve)

- Using L2s or going cross-chain