C++ in Quantitative Finance part #1

Submitted by: Zimin Luo 417124

The project requirement can be found here.

Objective

The objective of this project is to use Monte Carlo simulations to approximate the price of the up-and-out put option with barrier. The effect of different barrier levels and number of path generated are also briefly analyzed.

Characteristics of the Option

Up-and-out option is the option that starts at a price that's lower than the barrier price and terminates whenever the option price reaches the barrier price or maturity. Due to the inclusion of the barrier, the European option becomes path-dependent, hence the entire path needs to be generated.

The payoff of a PUT UP-AND-OUT barrier option is:

where:

-

$\Phi_t$ is the payoff at time$t$ -

$X$ is the strike price -

$S_T$ is the price at maturity -

$T$ is time to maturity -

$L$ is the barrier

The following assumptions are made:

- prices of the underlying instrument follow the log-normal distribution

- distribution parameters

$\mu$ and$\sigma$ are constant, - no transaction costs and no taxes,

- it is possible to purchase or sell any amount of stock or options or their fractions at any given time

- underlying instrument does not pay dividend

- risk-free arbitrage is not possible

- trading is continuous

- traders can borrow and invest their capital at the risk-free interest rate

- risk-free interest rate

$r$ is constant

Code

Parameters

The following notation and default values are used for the purpose of this report:

-

spot: price of the underlying at the moment of option pricing:$S_0 = 145$ -

strike: strike price:$K = 150$ -

vol: annualized voltality rate:$\sigma = 25%$ -

r: annualized risk-free rate:$r = 5%$ -

expiry: time to maturity:$t = 1$ (one year)

Barrier level and the number of path to be generated are defined by the user.

File Structure

There are total five cpp files in the directory:

myMonteCarloProject.cpp: contains the main functionmyEuroOptionBarrier.cpp: contains the class and methods ofEuroOptionBarriermyEuroOptionBarrier.h: the header file formyEuroOptionBarrier.cppRandom1.cpp: draws a random value from the normal distribution via Box-Muller transformRandom1.h: the header file forRandom1.h

The Algorithm

First, draw a random value

// Random1.cpp

double getOneGaussianByBoxMueller(){

double result;

double x;

double y;

double sizeSquared;

do {

x = 2.0*rand()/static_cast<double>(RAND_MAX)-1;

y = 2.0*rand()/static_cast<double>(RAND_MAX)-1;

sizeSquared = x*x + y*y;

}

while

( sizeSquared >= 1.0);

result = x*sqrt(-2*log(sizeSquared)/sizeSquared);

return result;

}Second, generate the entire path based on the following formula, where

where:

-

thisDriftis$(r - \frac{1}{2}\sigma^2){T/n}$ -

cumShocksis the cumulative sum of${(r - \frac{1}{2}\sigma^2){T/n} + \sigma\sqrt{T/n} N(0,1)}$ -

thisPathappends every$S_0e^{\textsf{cumShocks}}$ to the end

// EuroBarrierOption.cpp

void EuroBarrierOption::generatePath(){

// declaration of variables

double thisDrift = (r * expiry - 0.5 * vol * vol * expiry) / double(nInt);

double cumShocks = 0;

// clear the possible `thisPath` stored in memory

thisPath.clear();

for (int i = 0; i < nInt; i++) {

cumShocks += (thisDrift + vol * sqrt(expiry / double(nInt)) *

getOneGaussianByBoxMueller());

// add to the end of the path

thisPath.push_back(spot * exp(cumShocks));

}

};The European UP-AND-OUT PUT option is computed in the following

// EuroBarrierOption.cpp

double EuroBarrierOption::getEuroBarrierUNOPutPrice(int nReps){

// declaration of variables

double rollingSum = 0.0;

double thisLast = 0.0;

// creates a loop that repeats for `nRep` times

for (int i=0; i<nReps; i++) {

// generates a path

generatePath();

// get the maximum value in the path

double thisMax = *max_element(thisPath.begin(), thisPath.end());

// get the last value in the path

thisLast = thisPath[thisPath.size() - 1];

// if the last price < strike price, and

// the maximum value in the path is < the barrier price

// the payoff is strike price - last price

// otherwise the payoff is 0

rollingSum += (( thisLast < strike ) && ( thisMax < barrier )) ?

( strike - thisLast ) : 0;

}

// calculates the average price

// and multiplies it by $e^{-rT}$

return exp(-r * expiry) * rollingSum / double(nReps);

}In the main file myMonteCarloProject.cpp, a new instance of the class EuroBarrierOption is created and the method getEuroBarrierUNOPutPrice is called to calculate the option price.

// myMonteCarloProject.cpp

int main(){

int nInt = 252; // number of intervals: assume 252 trading days in a year

double Strike = 150.0; // strike price

double Spot = 145.0; // price of the underlying instrument

double Vol = 0.25; // volatility

double Rfr = 0.05; // risk-free rate

double Expiry = 1.0; // time to maturity (1 = one year)

double Barrier; // barrier level -> to be defined by user

int nReps; // number of paths generated -> to be defined by user

// set the seed for reproducible results

srand( time(NULL) );

// ask user to set the barrier level and nReps

cout << "Enter the barrier level: ";

cin >> Barrier;

cout << "Enter the number of paths to be generated: ";

cin >> nReps;

// create a new instance of the EuroBarrierOption class named myEuro

EuroBarrierOption myEuro(nInt, Strike, Spot, Vol, Rfr, Expiry, Barrier);

// call the up-and-out Put method to get option price

double uno = myEuro.getEuroBarrierUNOPutPrice(nReps);

// display the result

cout << "The up-and-out put option price is: "<< uno << endl;

return 0;

}Results

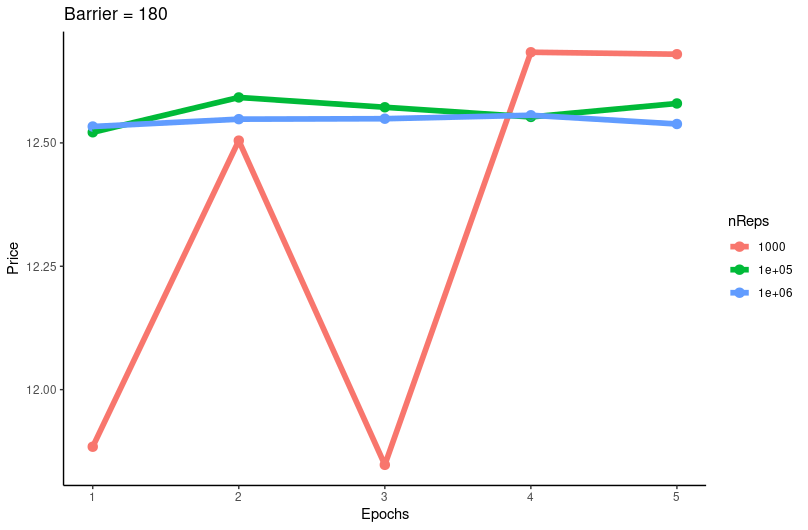

Constant barrier and increasing nReps

- When the

nReps = 1000andbarrier=180the results: 11.8843, 12.5046, 11.8476, 12.6837, 12.6797 - When the

nReps = 100000andbarrier=180the results: 12.5215, 12.5921, 12.5722, 12.5526, 12.5799 - When the

nReps = 1000000andbarrier=180the results: 12.5332, 12.5481, 12.549, 12.556, 12.5383

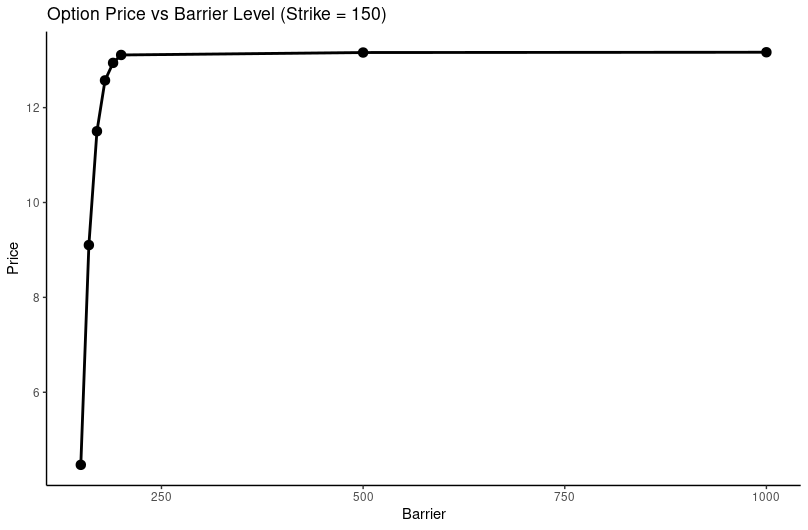

Constant nReps and varying barrier

Let nReps = 1000000:

barrier = 150: 4.47014barrier = 160: 9.10273barrier = 170: 11.5022barrier = 180: 12.5739barrier = 190: 12.943barrier = 200: 13.1098barrier = 500: 13.1614barrier = 1000: 13.1674

From the above result, I have the following observations:

- As the number of paths generated increases, the results become less volatile. Comparing the three results in the line plot, it is clear to see that when

nRepsis only 1000 (red line), the approximation varies between 11 and 13; the blue and green lines are much smoother, meaning that their values fluctuate within a much smaller interval. This is inline with my expectations because of the law of large numbers. - As the barrier level increases, the price of the option also increases. However, when the barrier level reaches a certain value, its impact on the option price diminishes and the option price converges. This is also inline with my expectation as the higher the barrier level is, the less chance the path will reach it.

Checklist

- a zip file with

*.cppand*.hfiles only - a pdf file with a short report (2 - 6 pages)

- objective of the project

- assumptions

- description of the option to be priced and its characteristics

- description and explanation of code elements

- information about the results of the simulation, i.e. approximation of the theorectial price of your option

-

your_surname.zipandyour_surname.pdf - Honor code

TODO

-

myMonteCarloProject.cpp: contains the main file -

myEuroOptionBarrier.cpp: contains the -

myEuroOptionBarrier.h: header file formyEuroOptionBarrier.cpp -

Random1.cpp: generates a random value from normal distribution via Box Muller approach -

Random1.h: the header file forRandom1.h - add comments