Correlation_Analysis

Protecting Portfolios Using Correlation Diversification

Project Description/ Outline:

We all want rewards without risk. A balanced investment portfolio offers increased growth while minimizing the potential for loss.One of the best way to do this by examining the correlation between various assets and allocating your portfolio accordingly, incorporating uncorrelated and even negatively correlated assets.

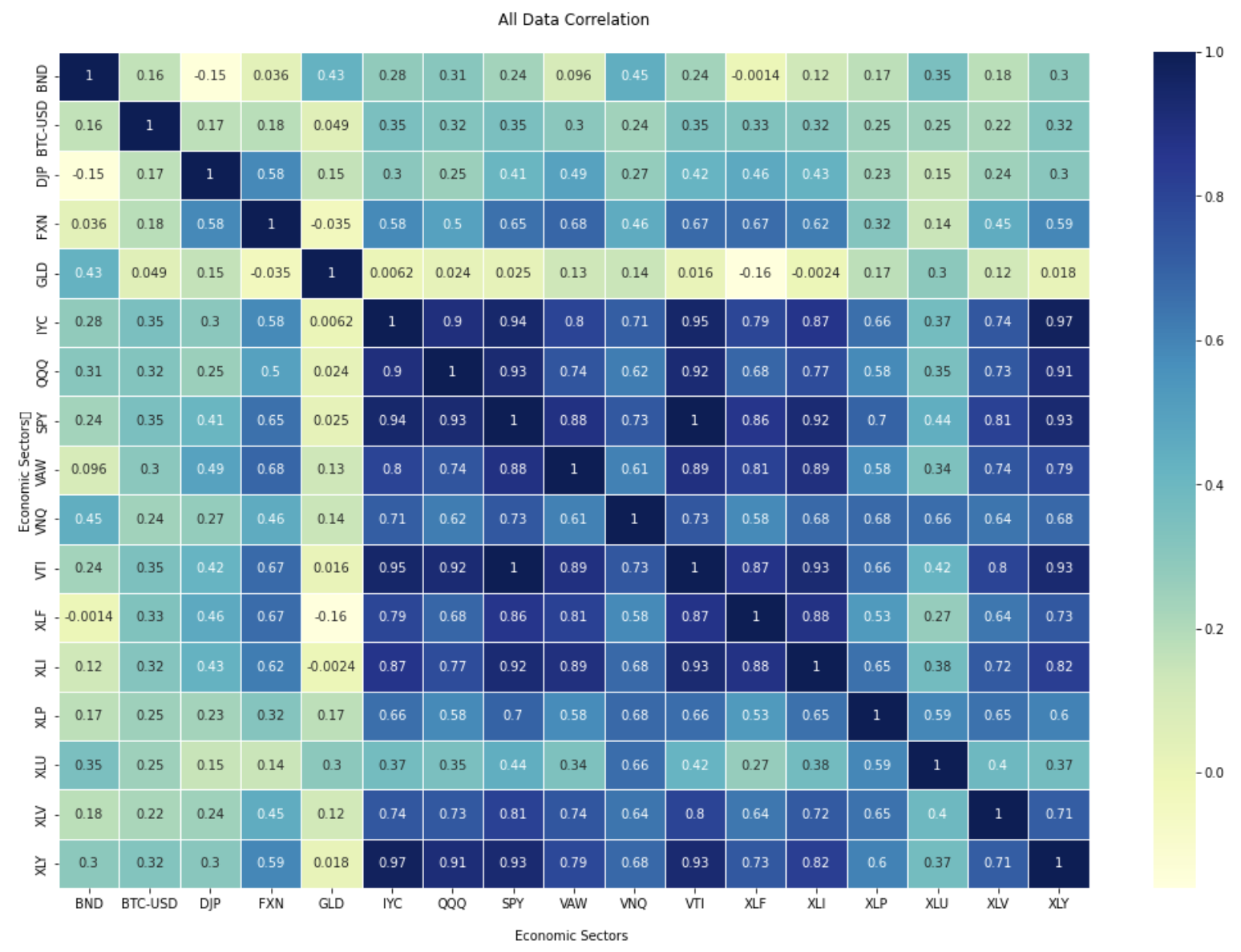

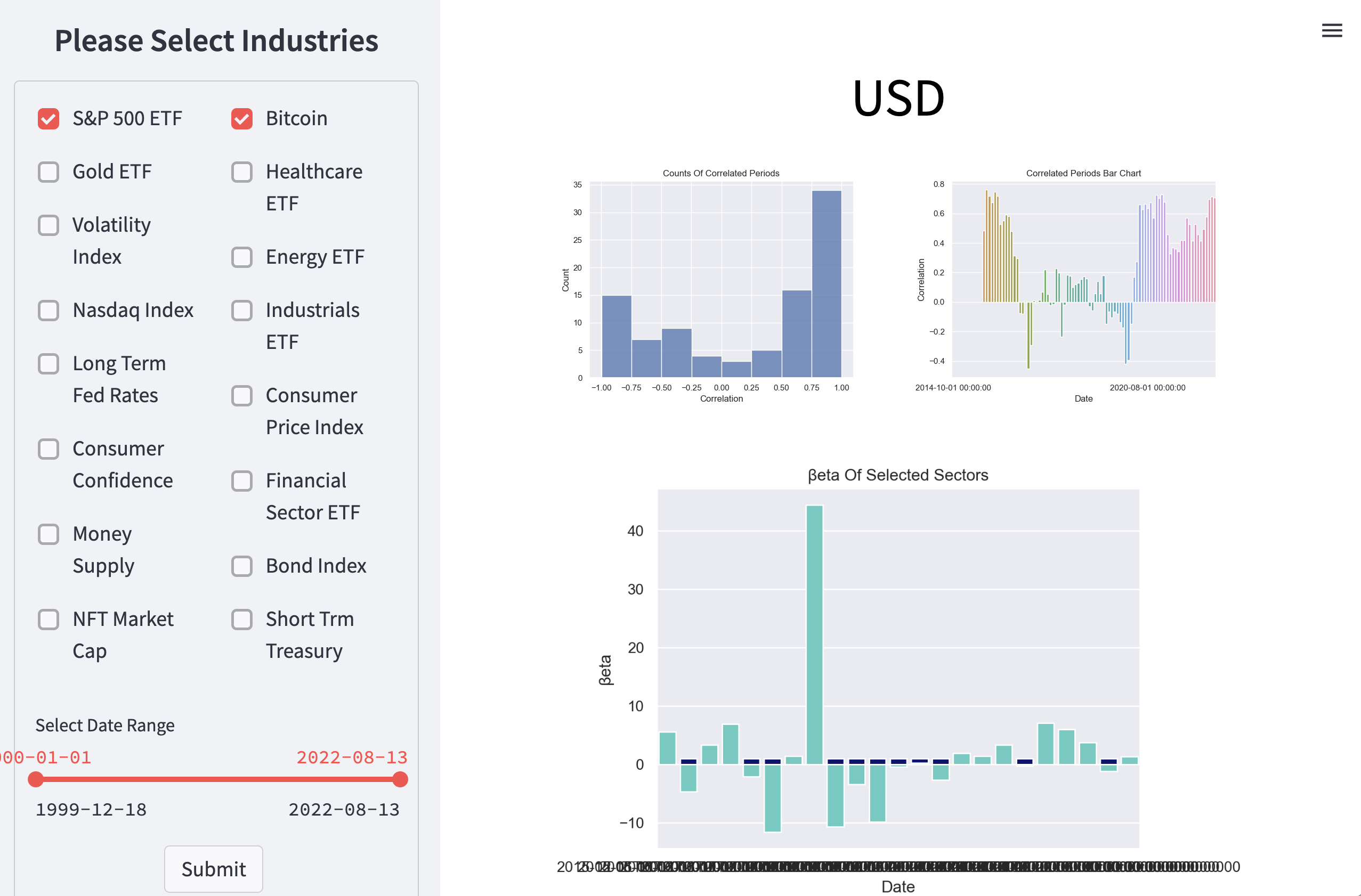

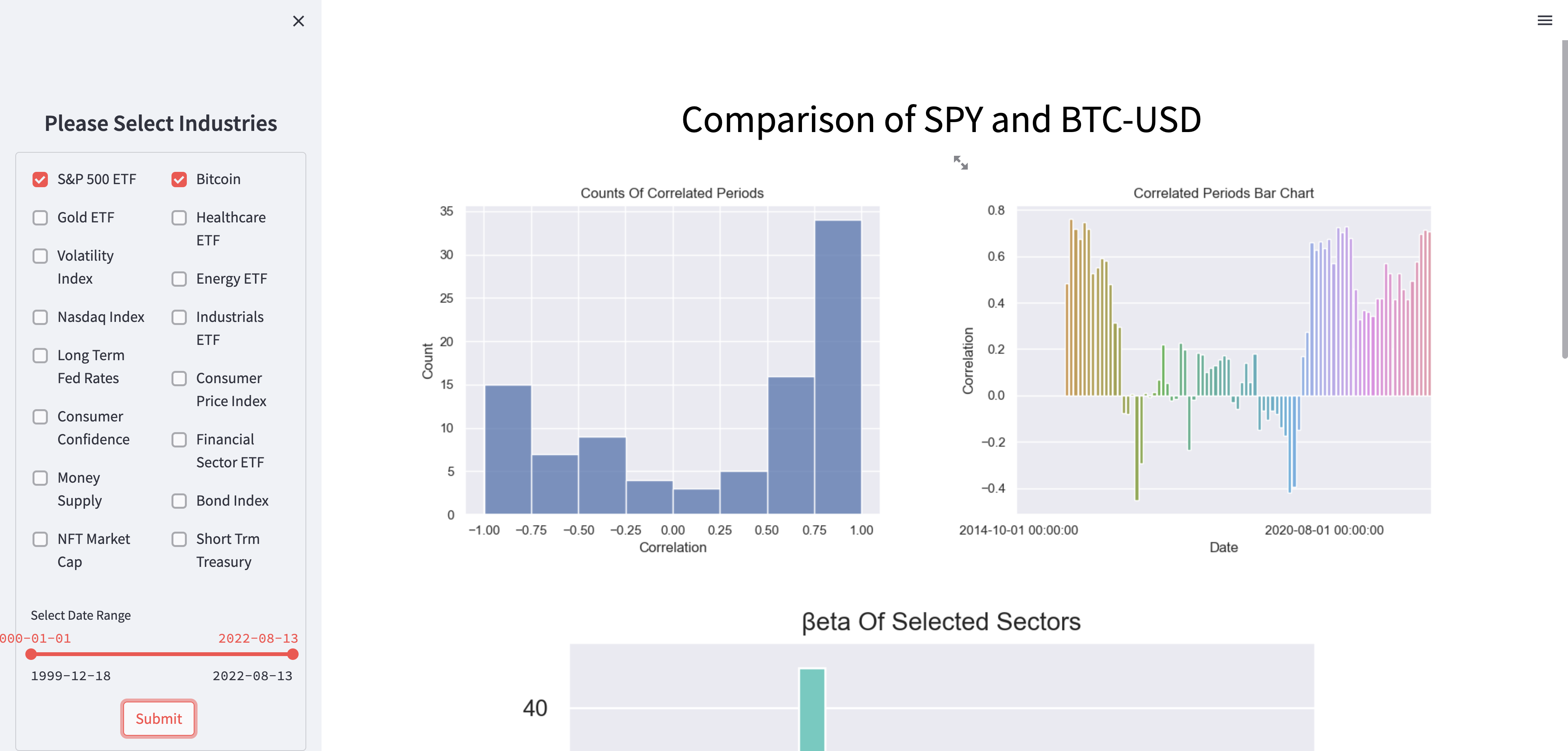

In this study, we chose 17 popular alternative assets and the stock market, as measured by the S&P 500 to determine how they were correlated historically. We outlined the assets with a strong correlation and moderate correlation as well as those that are uncorrelated and negatively correlated.

Since correlation is only one of several important factors in constructing a strong and diversified portfolio, and so should not be the only influence in deciding which stocks to buy. To determine the sectors with the most investment potential we did the further analysis. Tools we used to determine the sectors with the most investment potential :

- Standard deviations,

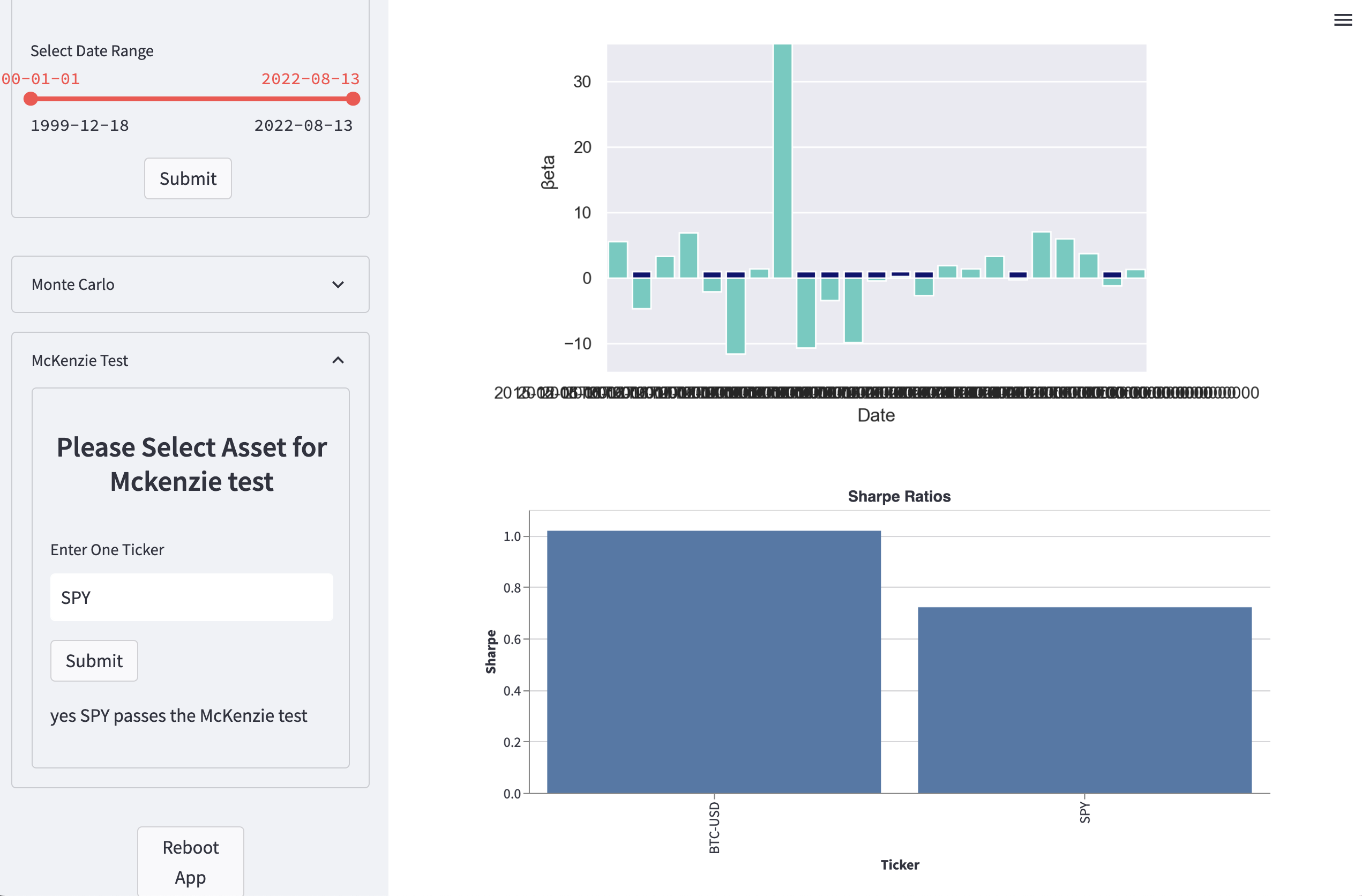

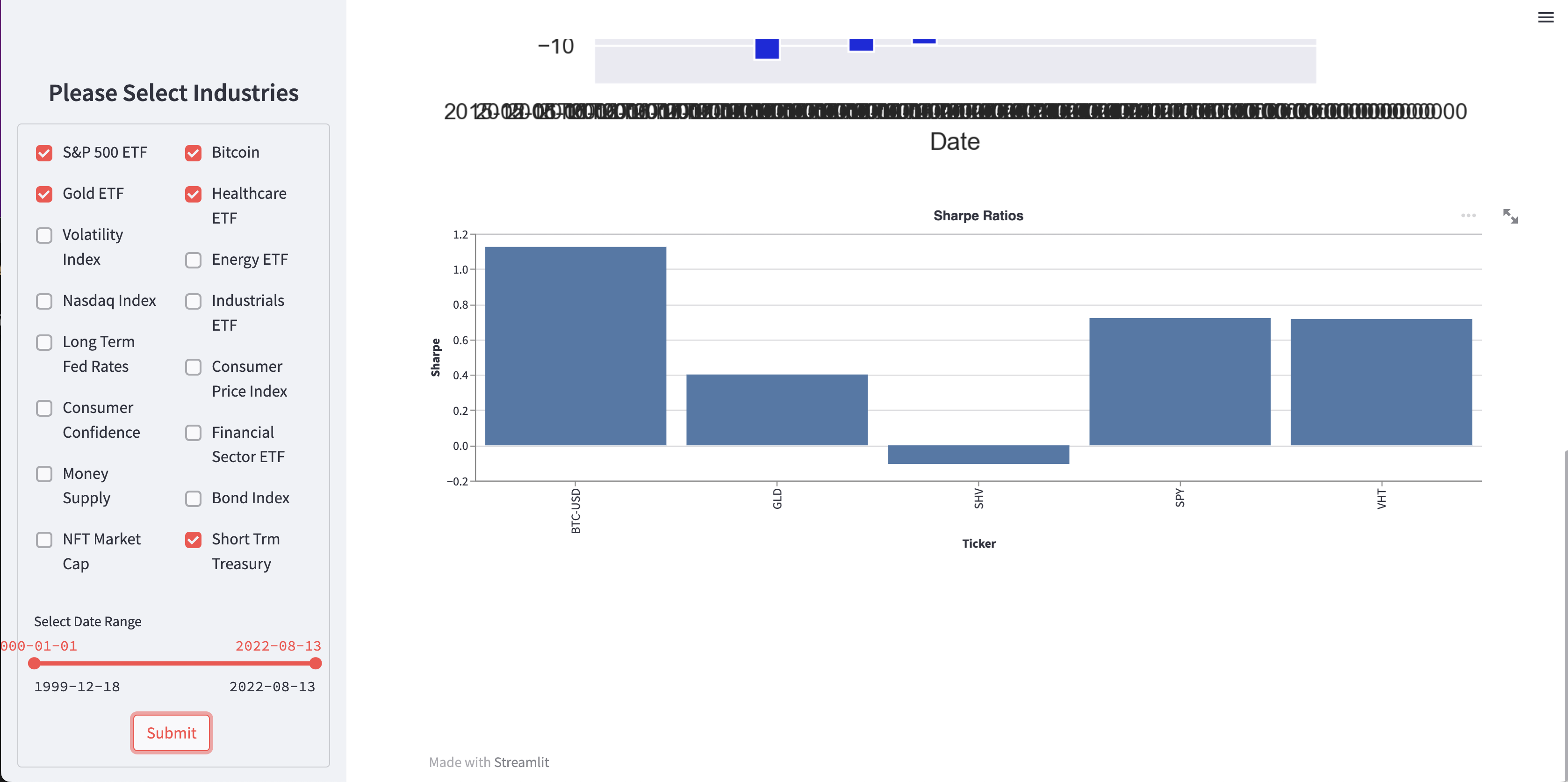

- Sharpe ratios,

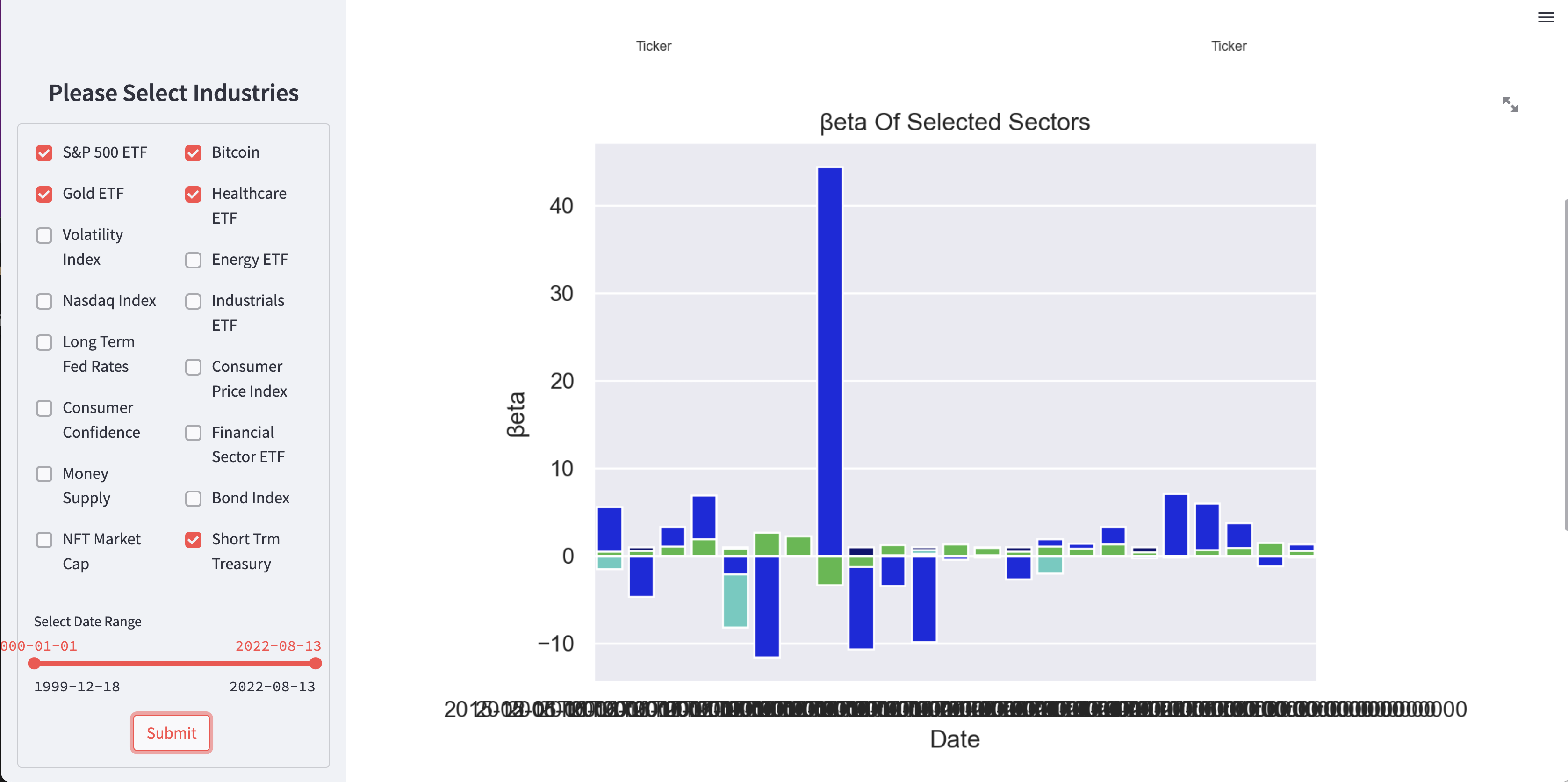

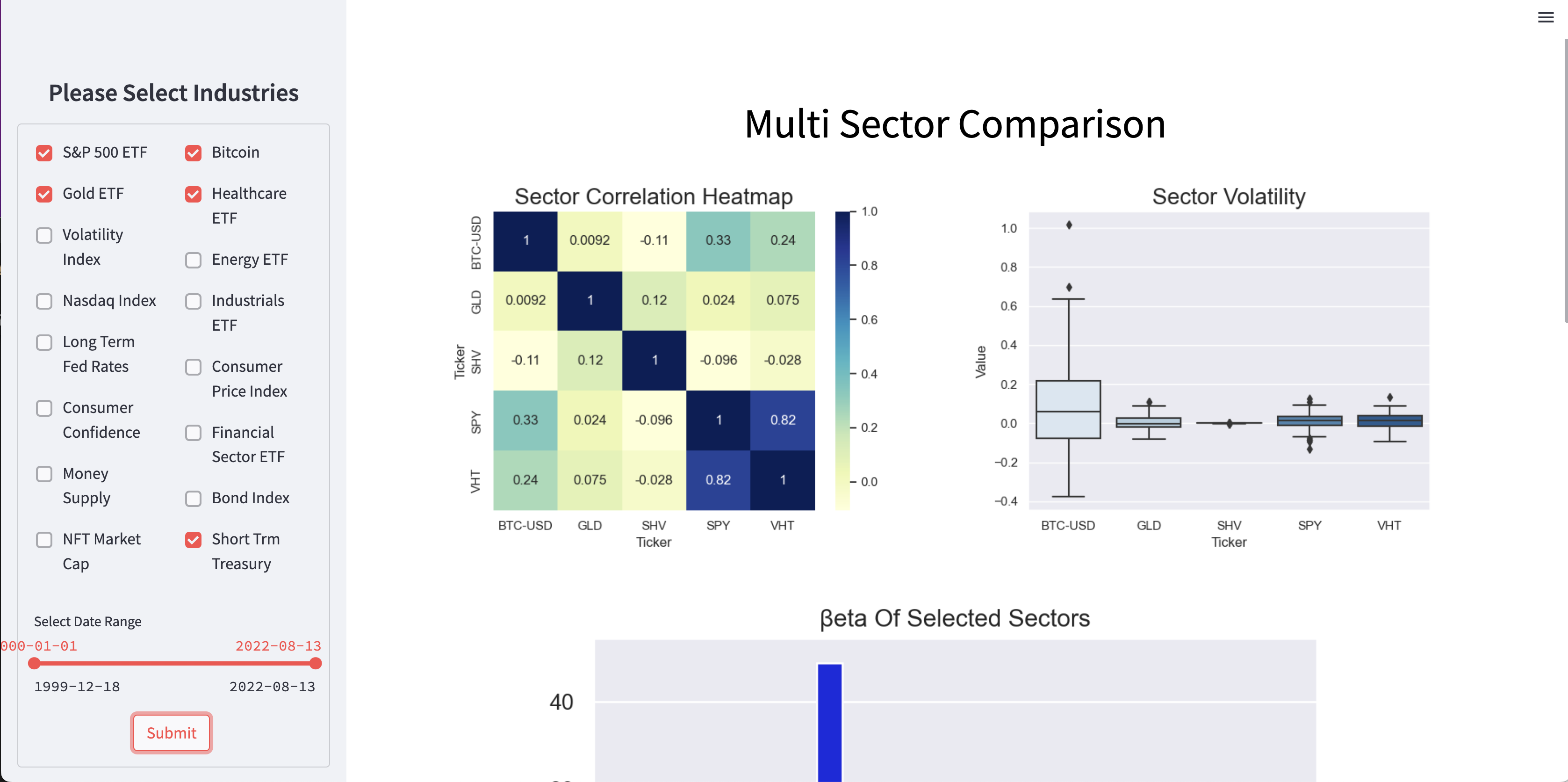

- Betas,

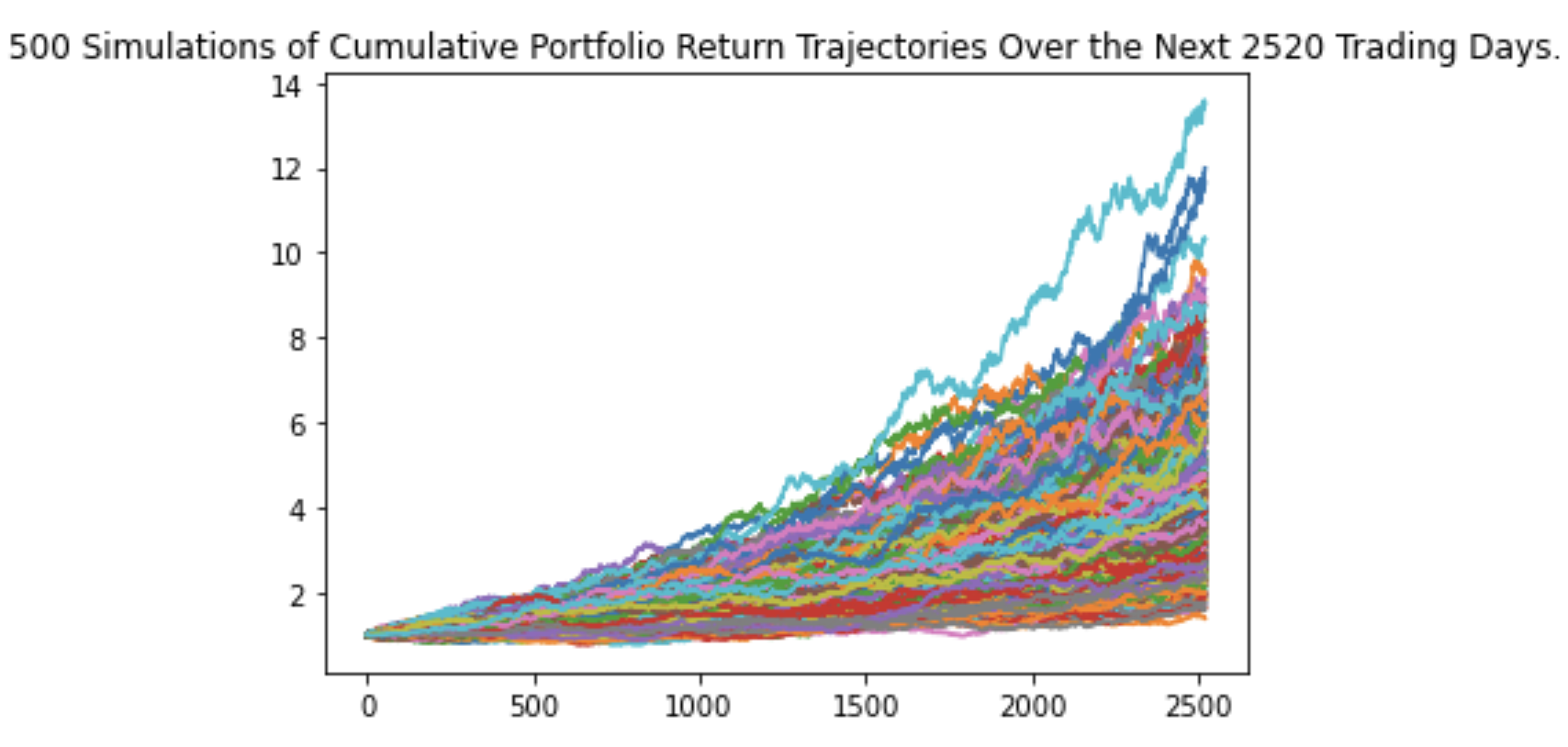

- Monte Carlo Simulations,

- Pearson Correlation Coefficient and

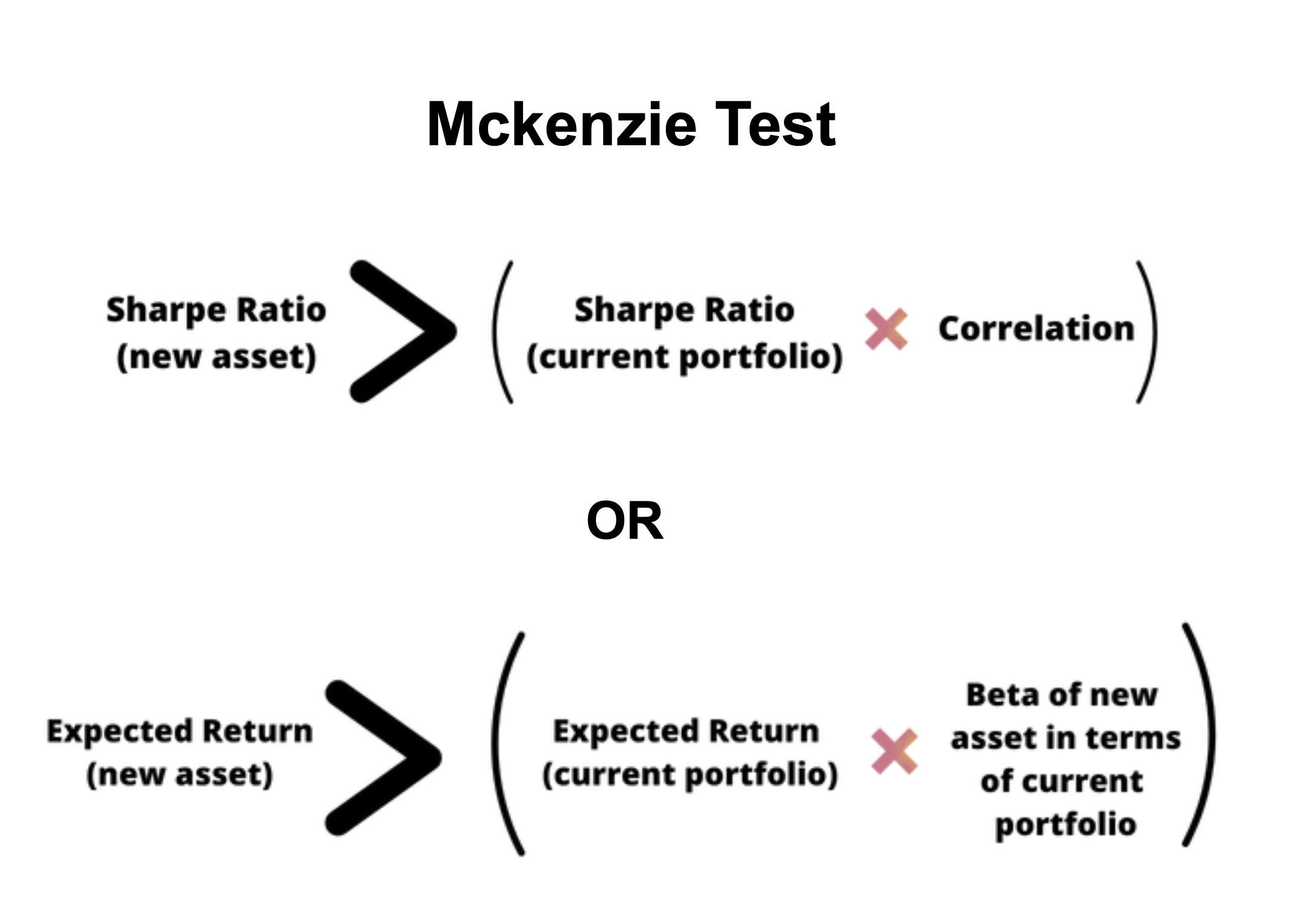

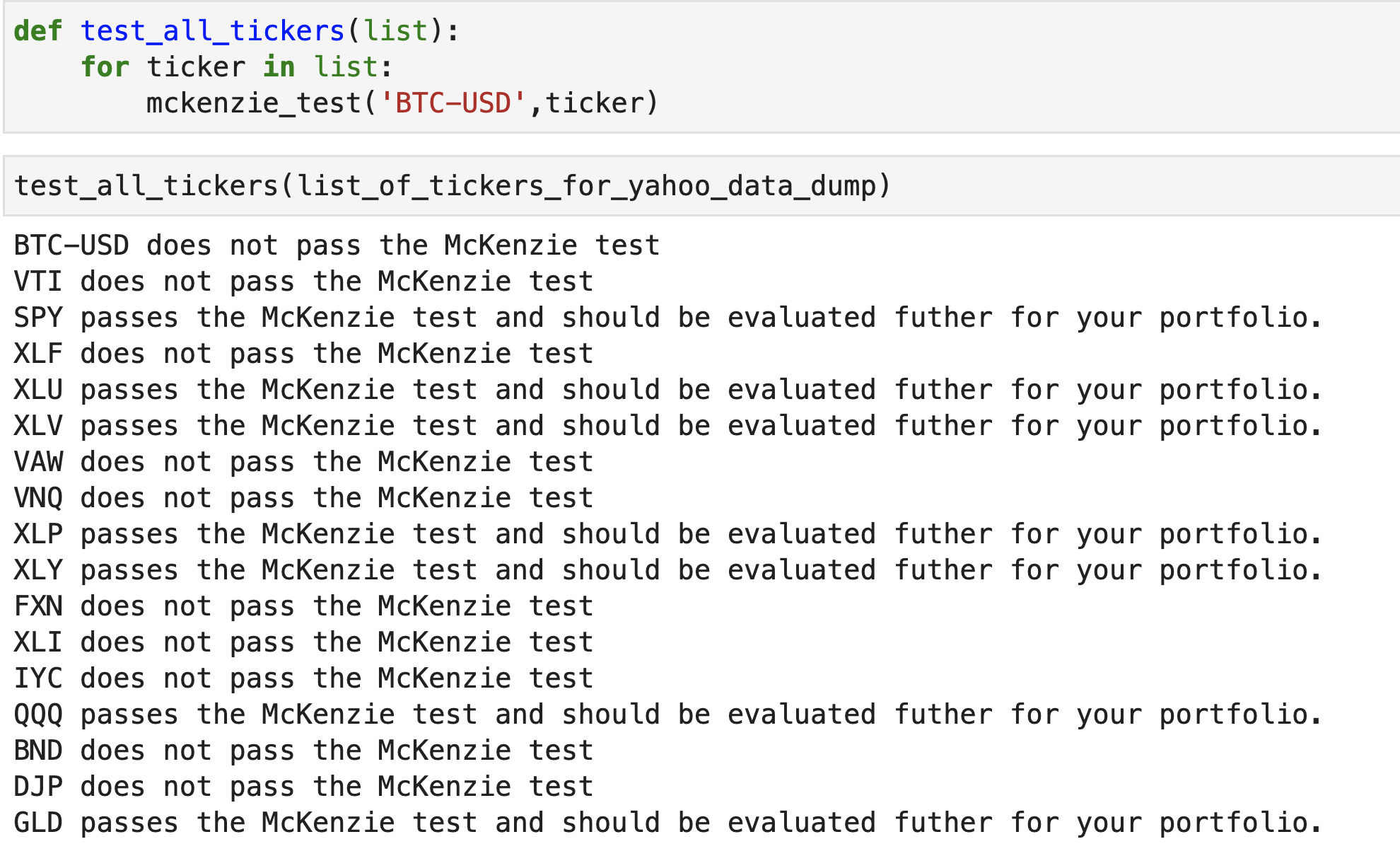

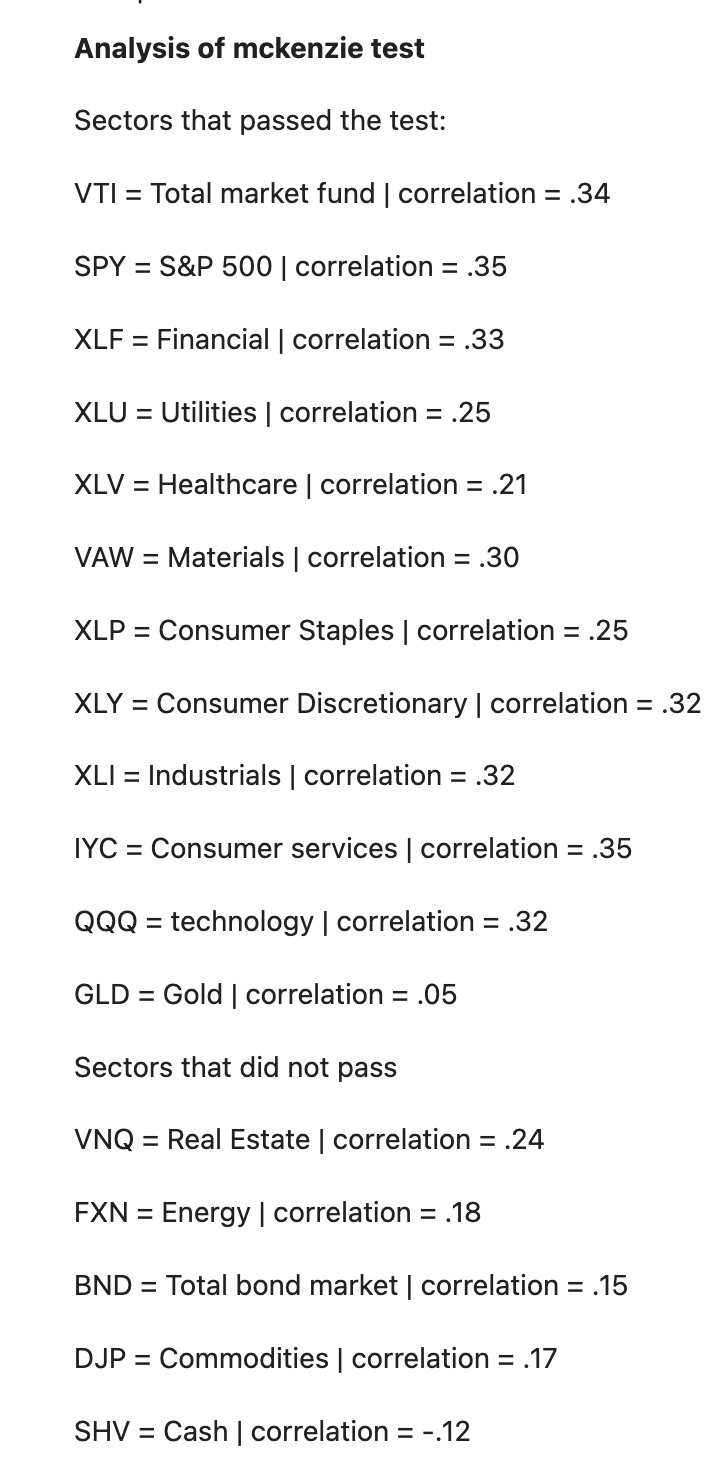

- McKenzie Test

- Data Visualization

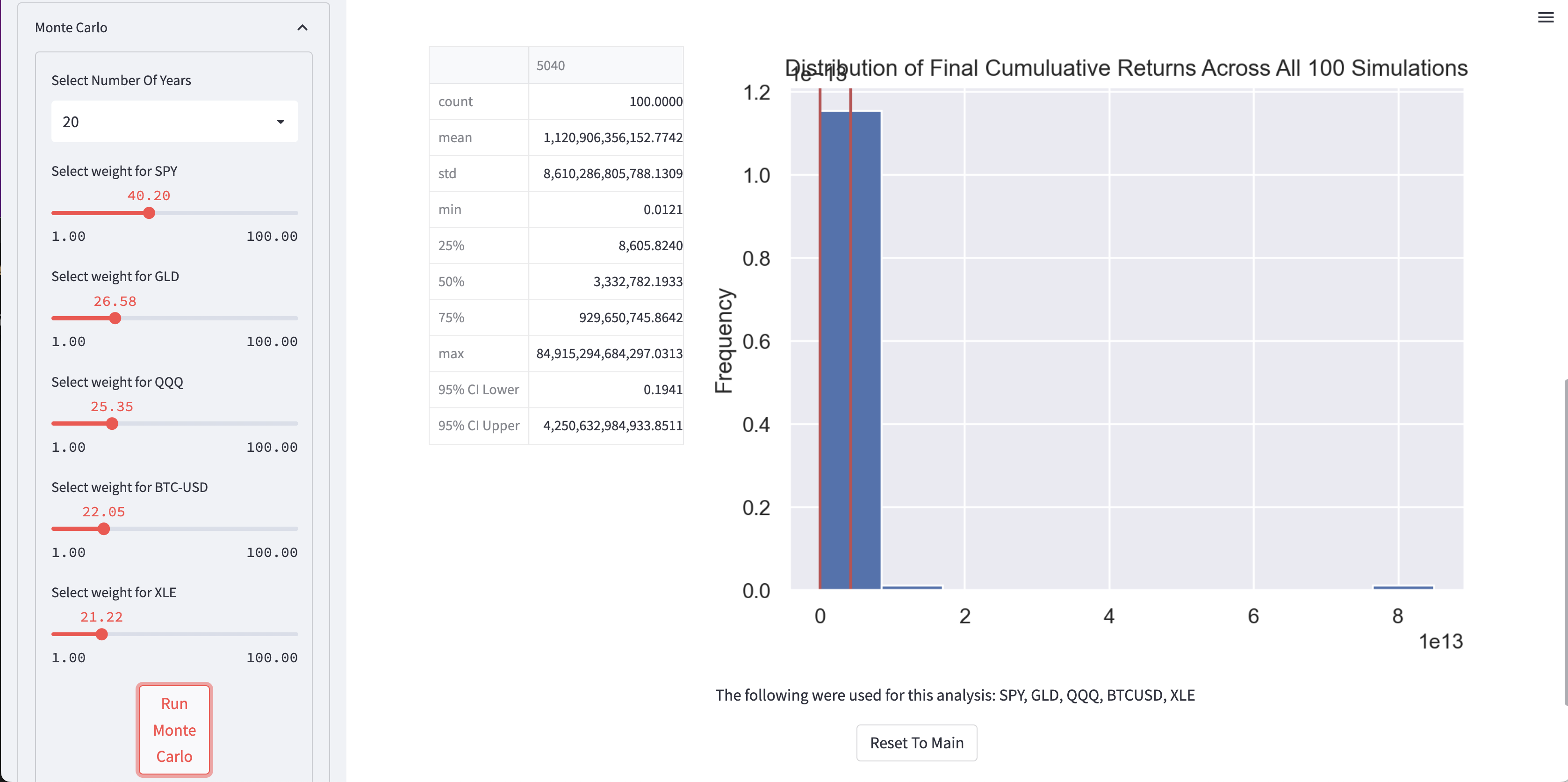

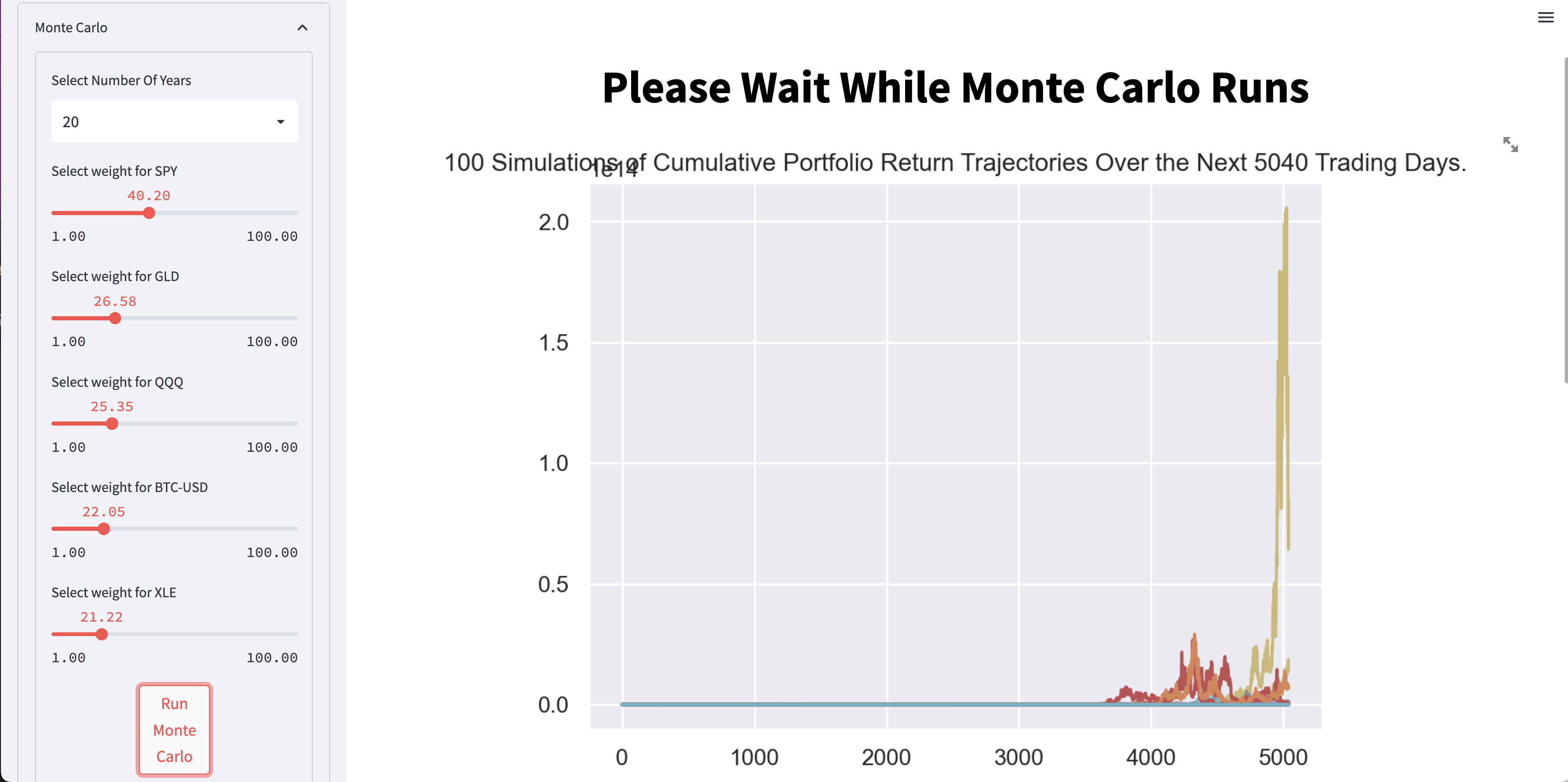

After identifying the attractive assets , we constructed a financial application that provides the user the ability to search for available assets that will measure their performance, volatility, risk and risk-return profile by making some adjustments relating to timeframe , weight composition and number of samples in order to make a better investment decisions.

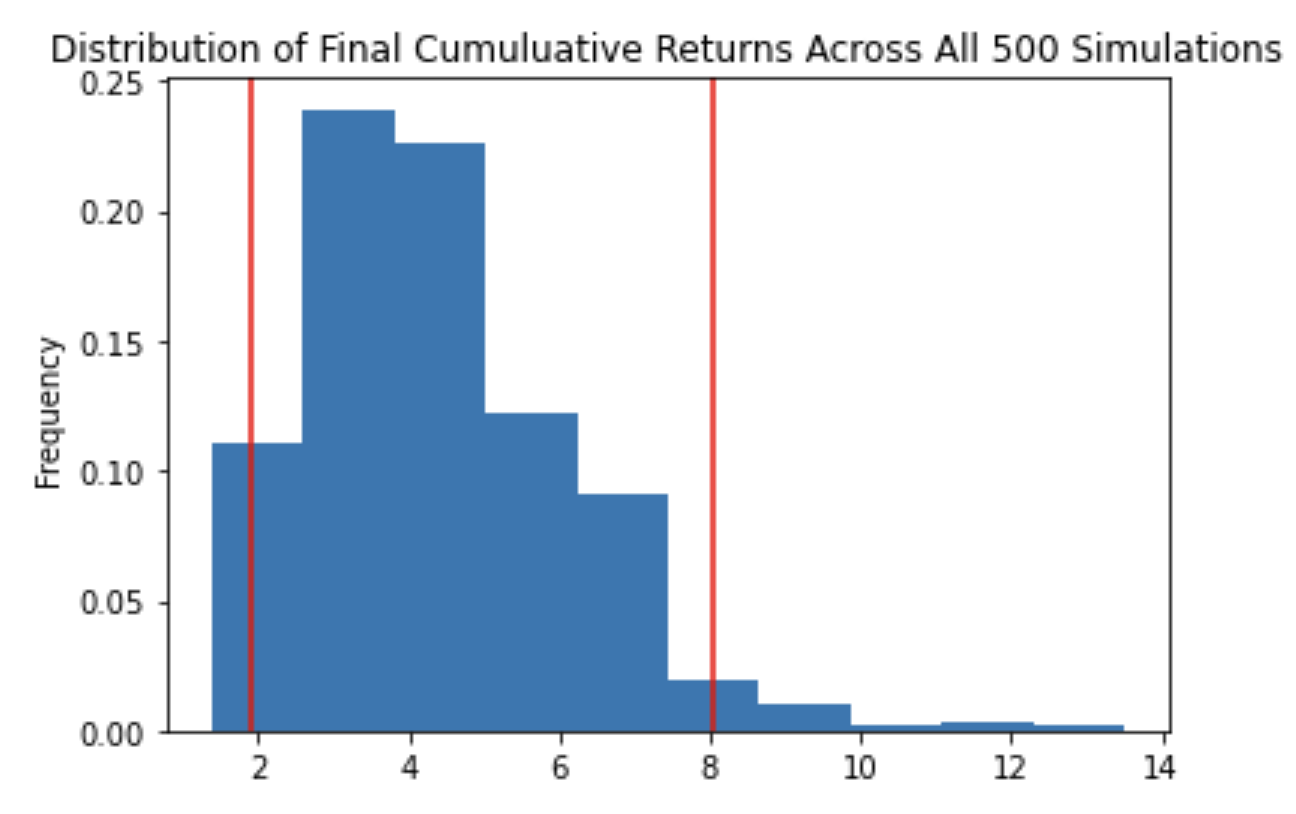

This app will also run the Monte Carlo Simulation to forecast the performance of the selected assets that will help the user to analyze the most probable outcomes of real world scenarios in an environment that’s safe and efficient.

Our objective is to search through various market sectors and find those that are least correlated to each other historically. We will analyze different economic sectors plus equities, bonds, cryptocurrency, commodities and currencies. By using a diverse set of tools such as MC Simulations, Numpy, and Pandas we will then attempt to predict which market sectors will stay uncorrelated in the future by performing quantitative analysis.

Ultimately, we want to know how each sector correlates with the rest of the market. Uncorrelated strategies diversify risk and may protect against catastrophic losses across a portfolio. This application seeks to identify opportunities to invest in non-correlated assets to diversify portfolio.

Technologies

This project runs on python 3.7 and includes the following libraries and dependencies:

- Numpy

- Pandas

- Matplotlib inline

- hvPlot

- Jupyter Notebook

- MCSimulations from MCForecastTools

- os

- requests

- json

- Alpaca_trade_api

- Yahoo finance api

- Seaborn

- plost

- sklearn

- datasets

- dotenv

Installation Guide

To use the application you need to install the following dependencies.

pip install matplotlib

pip install pathlib

conda install -c anaconda requests

conda install -c pyviz hvplot

pip install python-dotenv

pip install alpaca-trade-api

pip install altair

pip install seaborn

pip install streamlit

pip install pyautogui

pip install plost

- Make sure to use hvPlot version 0.7.0 or later.

Methodology

Data Sources:

- Y!Finance

- Alpaca API

- econDB

Data Cleaning:

- Finding and determining the missing values

- Finding and removing the duplicates

- Normalizing data

Data Exploration:

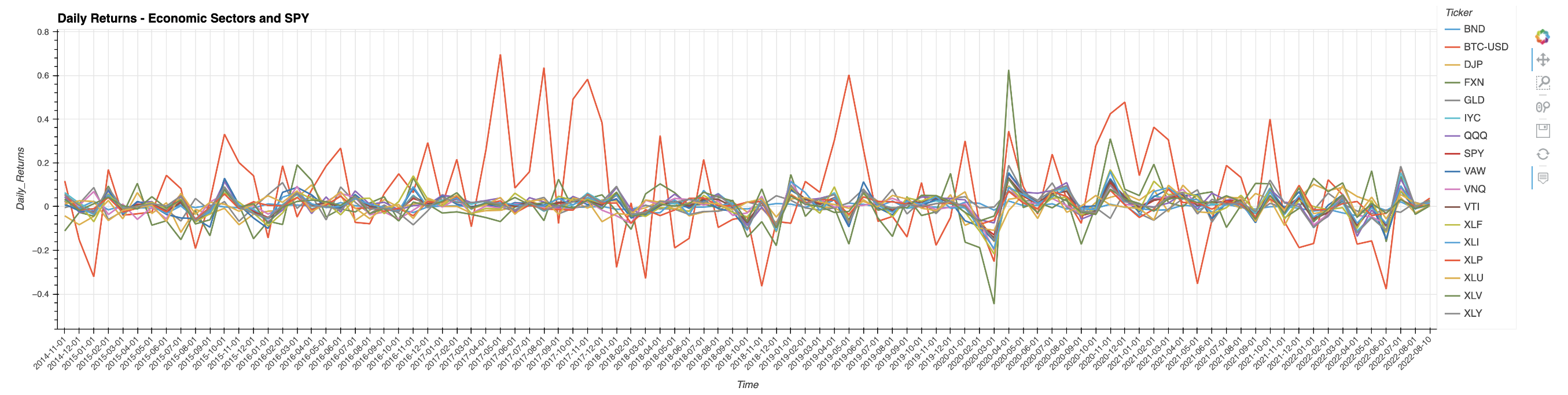

- Daily returns

- Cumulative returns

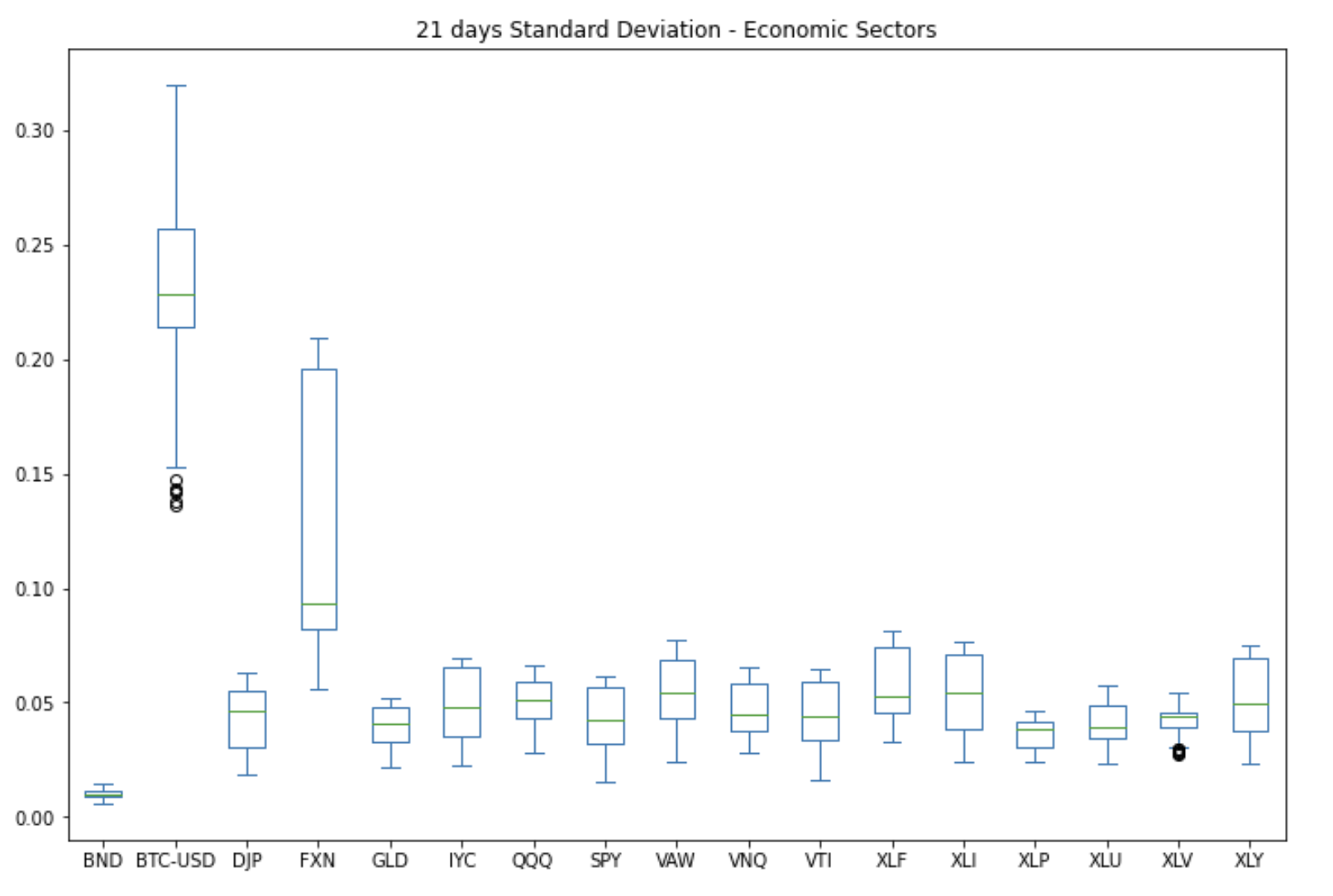

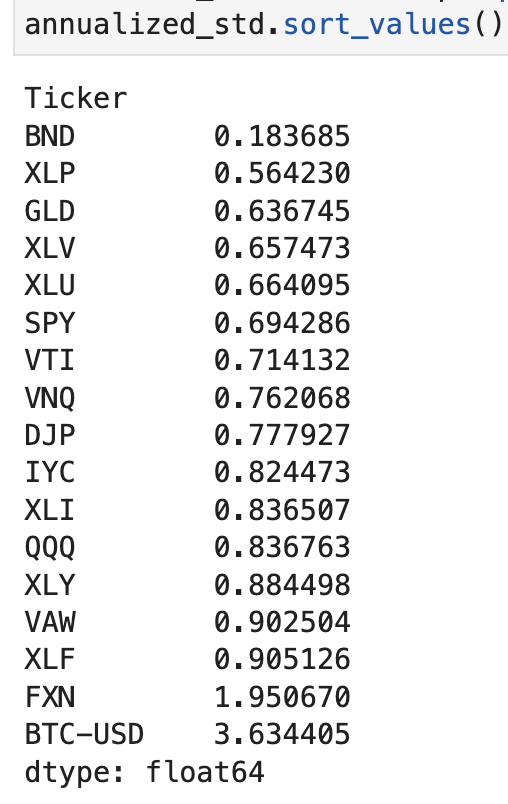

- Standard deviations

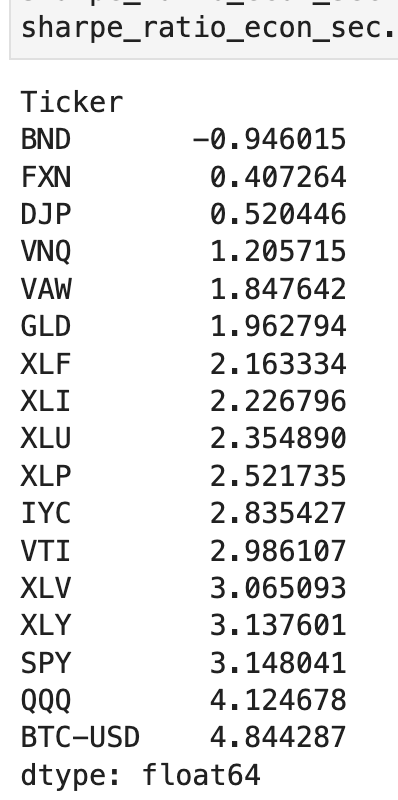

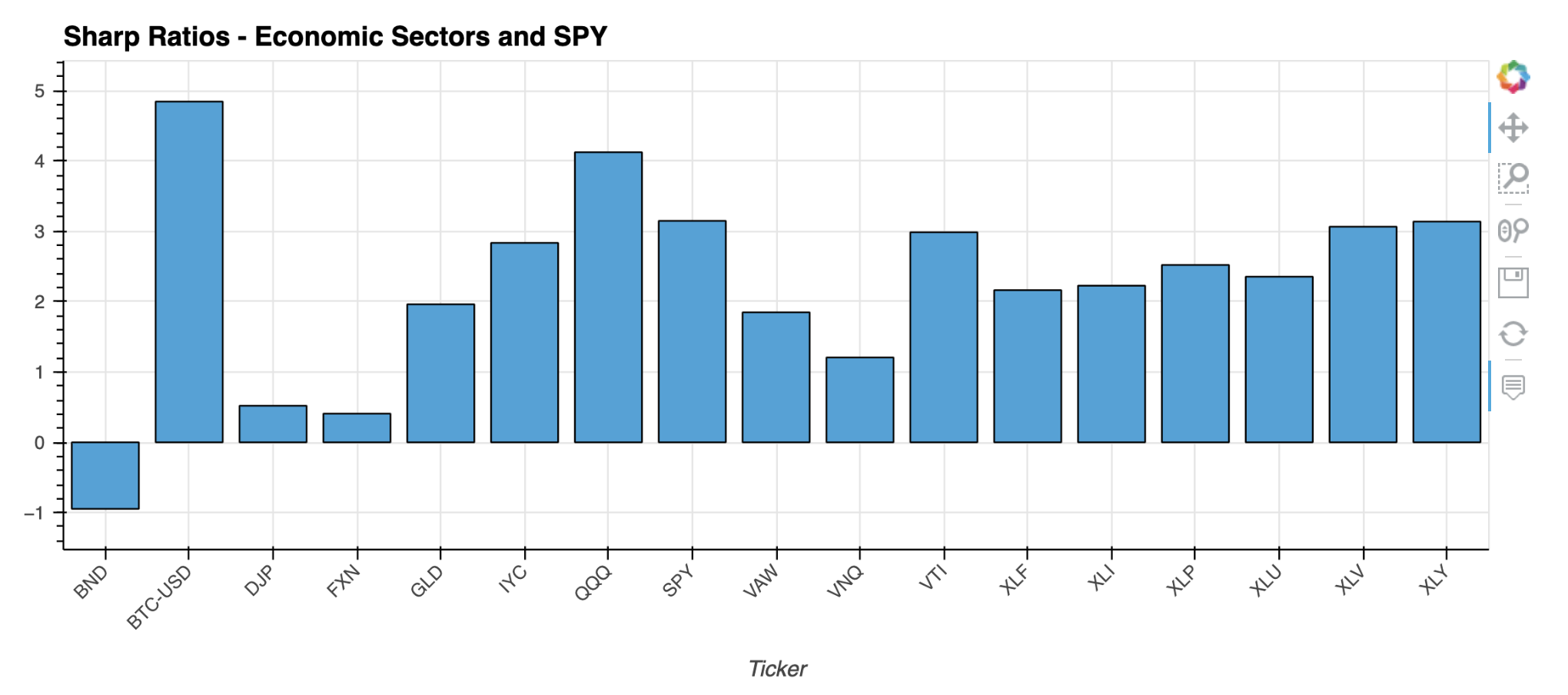

- Sharp ratio

- Beta

- Mckenzie test

- Monte Carlo Simulation

Data Visualization:

- Seaborn

- Matplotlib

- Altair

- hvPlot

Analysis Outcomes:

Performance Analysis

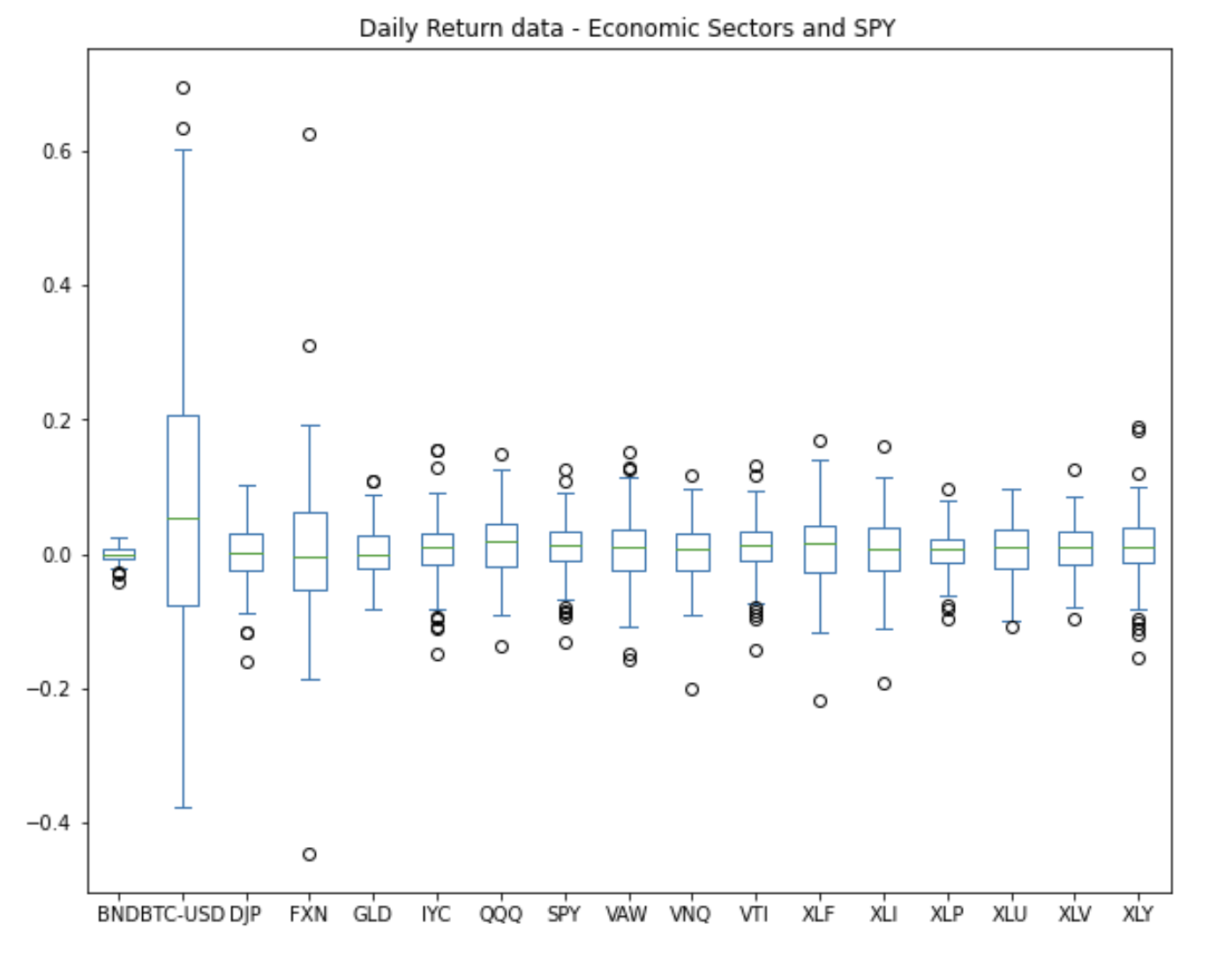

Bitcoin (cryptocurrency)and XLV(Healthcare) are the two most volatile sectors with high average returns are out perfoming the market.

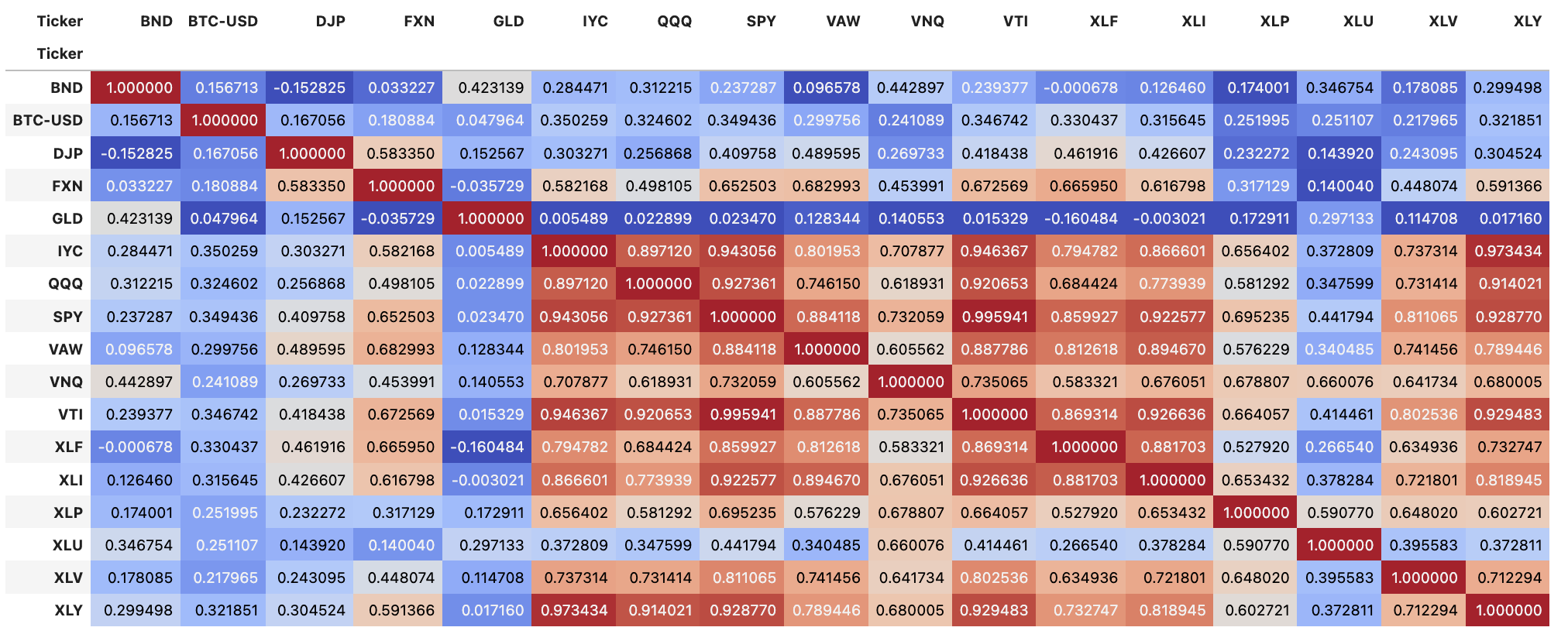

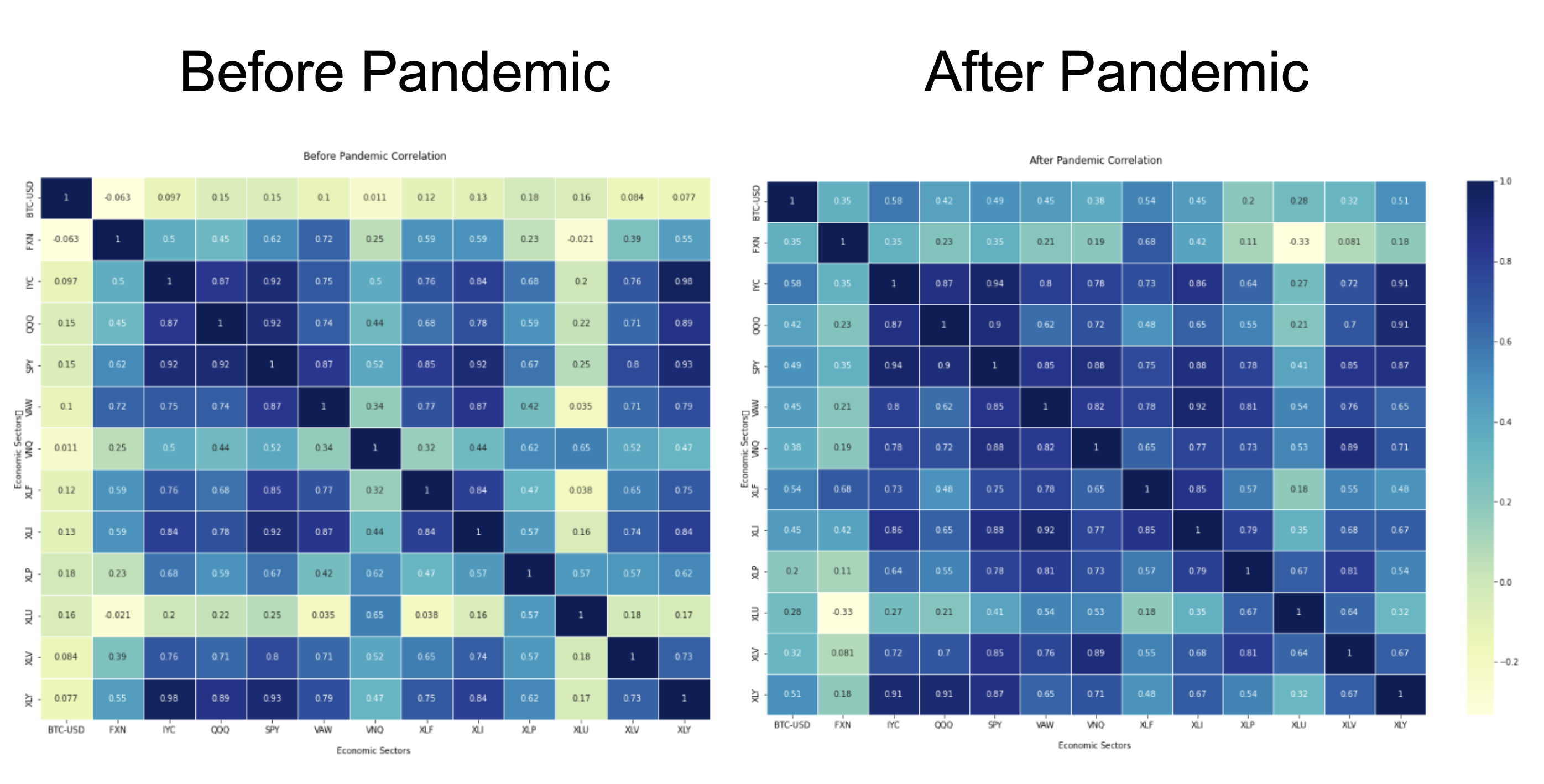

Correlation Analysis

- GLD (commodity) is the least correlated with all the other sectors.

- Bitcoin(cryptocurrency) ,DJP(commodity)and FXN(Energy) are also very uncorrelated.

- These sectors could be a good choice to provide cushion in the portfolio against the risk.

Risk Analysis

Bitcoin is the highest risk asset with the maximum number of the outliers and longer whiskers followed by FXN(Energy Fund). This makes sense because Bitcoin has the highest standard deviation among all other sectors.

RISK-RETURN ANALYSIS

Bitcoin is having the best risk-return profile with the highest sharp ratio of 4.844 followed by QQQwhich means that from a risk-return perspective they offer a considerably better investment opportunity.

DIVERSIFY THE PORTFOLIO WITH MCKENZIE TEST

Montecarlo simulations

Interesting Findings

After Covid-19 market became more correlated than it was before the pendemic.

CONCLUSION:

- Crypto currency use to be uncorrelated with the market but now its very correlated with the market.

- Commodity and gold sector have remained uncorrelated and may be able to contribute a good cushion in the portfolio against risk.

- Energy sector is very promising as well in terms of correlation, volatility with low risk high return profile.

Usage

To use this application navigate to the application folder and type "streamlit run streamlit_app.py". The application will open a new window in your default web browser AT http://localhost:8501/.

Dashboard

Usage Example##

What can be improved

-

Add more functionality that will allow users to select custom sectors.

-

Add more analytics tools.

-

Improve interactivity with the graph.

Contributers

Sterling Davis

David Lampach

Patrick Ball

Derick DeCesare

Manisha Lal

(08/13/2022)

License

copyright 2022