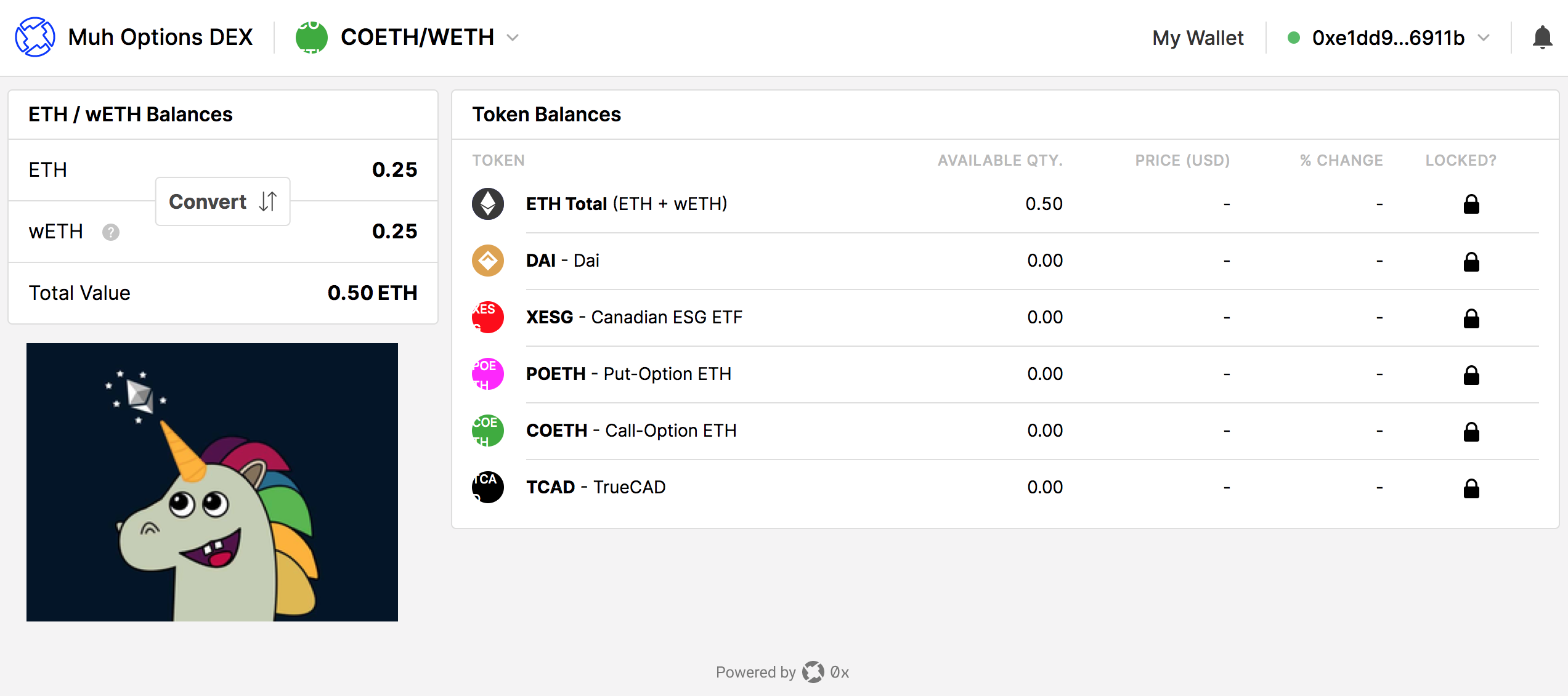

ETHWaterloo Hackathon 2019 submission: https://devpost.com/software/muh-options

Note on tickers: poETH = put-option-ETH for example.

A peer-to-peer call and put options on Ethereum powered by UMA and 0x. Generally the user interacts with an issuance and/or and exchange interface. In Issuance page, the user can create a "put" or "call" option on any finance asset that can have a price feed. For example, Alice can create an option that says "I would like to have the option to buy ETH at $200 6 months from now". That option is a tokenized derivative (ERC20) that automatically gets listed on the DEX: the exchange interface (DEX = decentralized exchange). A counterparty can see that "option" and satify it, for a fee of course. So the counterparty "buys" that option, effectively earning a fee while pledging to deliver the ETH to Alice 6 months from now.

A "put" option is the reverse: Alice buys the option to sell an asset at some point in the future.

git clone https://github.com/0xProject/0x-launch-kit-backend

cd 0x-launch-kit-backend

vim .env # edit this: RPC_URL="https://kovan.infura.io/v3/[PUT YOUR INFURA KEY HERE]

yarn start:js

(in another terminal tab):

git clone https://github.com/aliatiia/OptionsDEX

cd OptionsDEX

REACT_APP_RELAYER_URL="http://localhost:3000/v2" yarn start

(note: it may take up to ~2 minutes)

Visit the DEX at http://localhost:3001/ in your borwser.

TODO: a frontend to mint new put/call options (UMA's modified factory contract) and auto-listing them on OptionsDEX