- Low Returns

- “Under your mattress”

- High Yield Savings Account

- Treasury or Government Bill/Bond

- Risky Assets

- Cryptocurrency

- High Capital Investments

- Real Estate

- Alternative Assets

- Private Equity

- Alternative Options ~ A Potential Better Route:

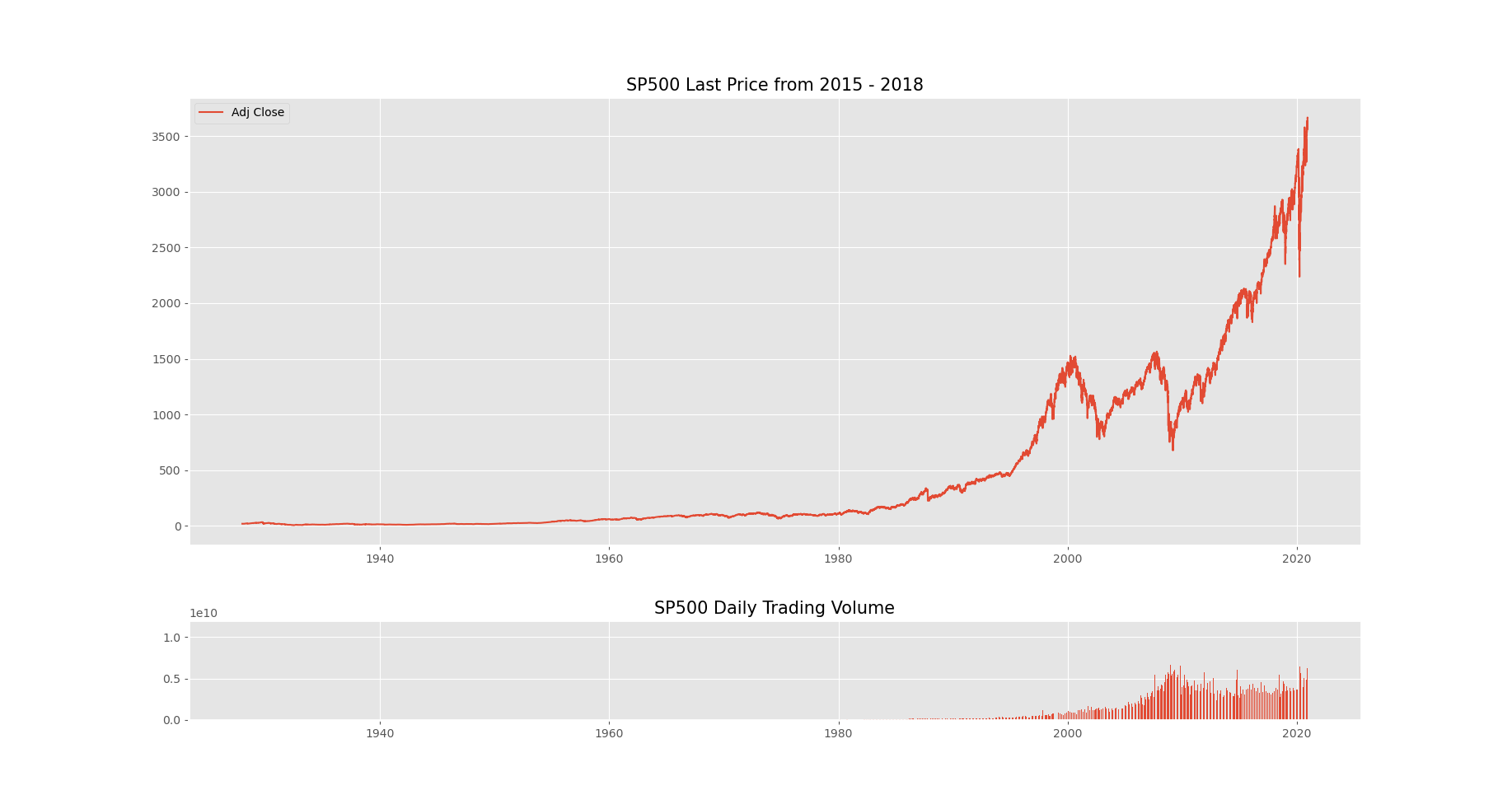

- Stock Market (S&P 500 Index) - measures performance of 505 publicly listed companies

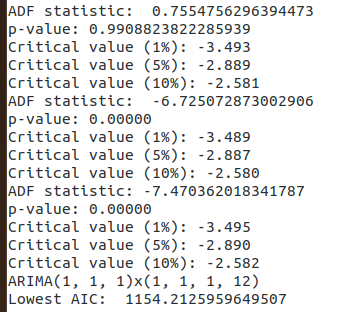

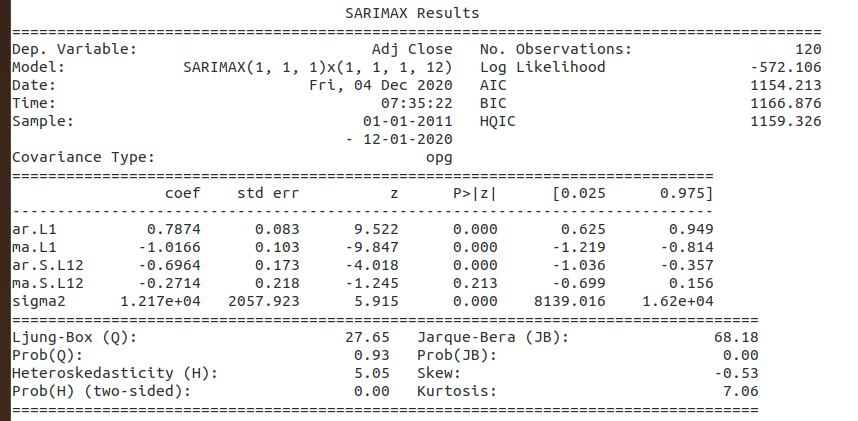

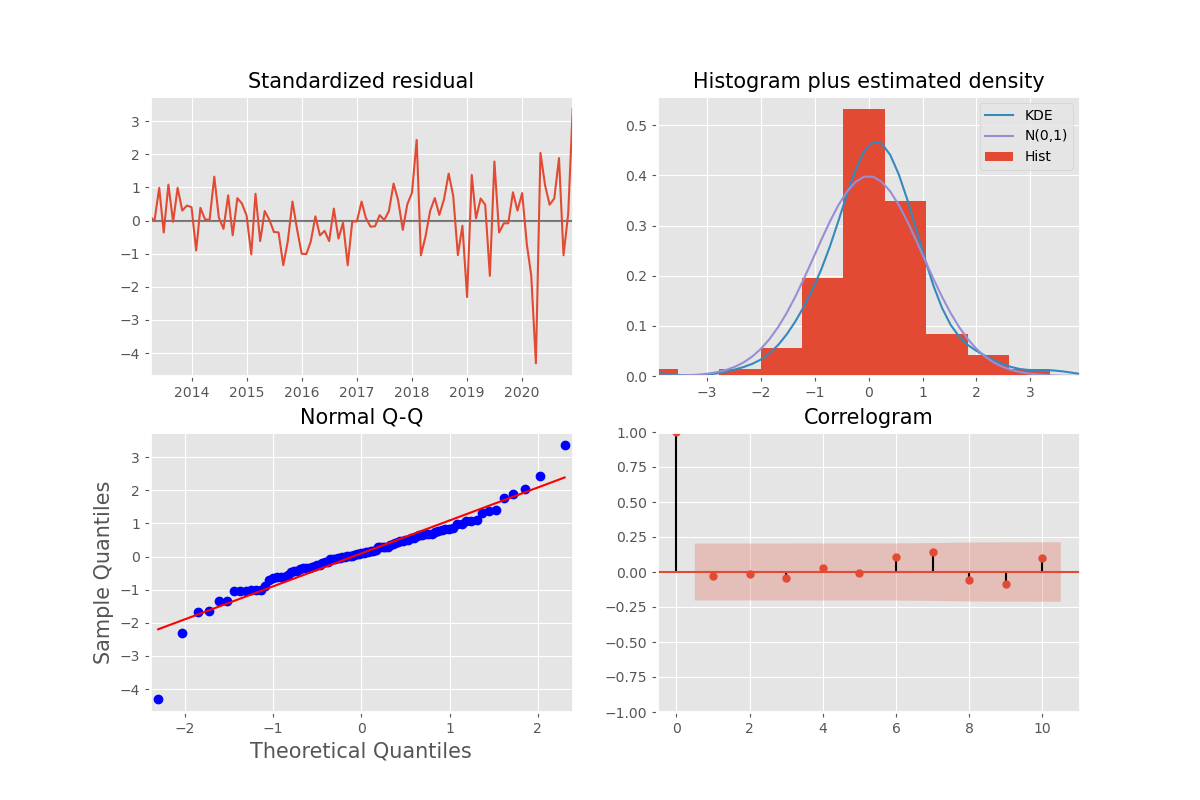

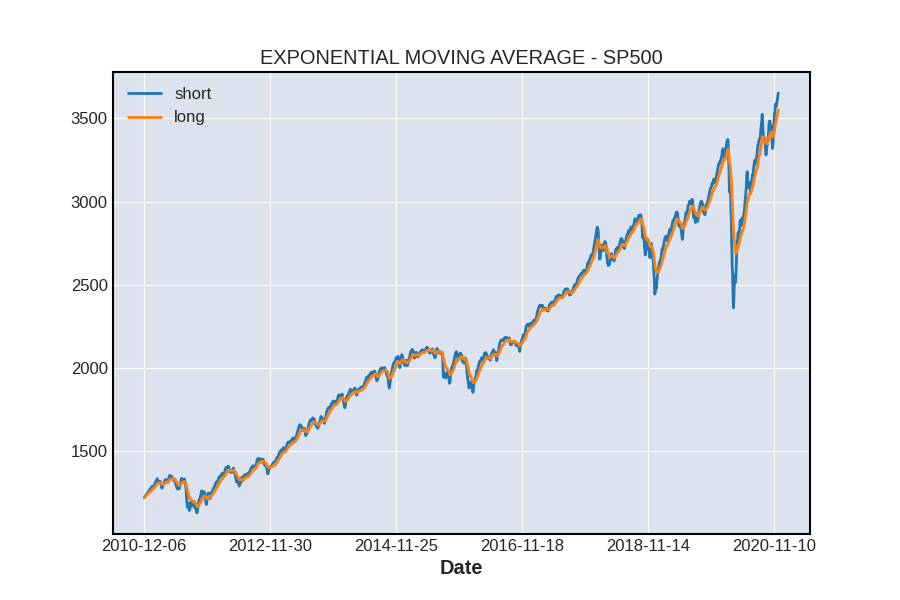

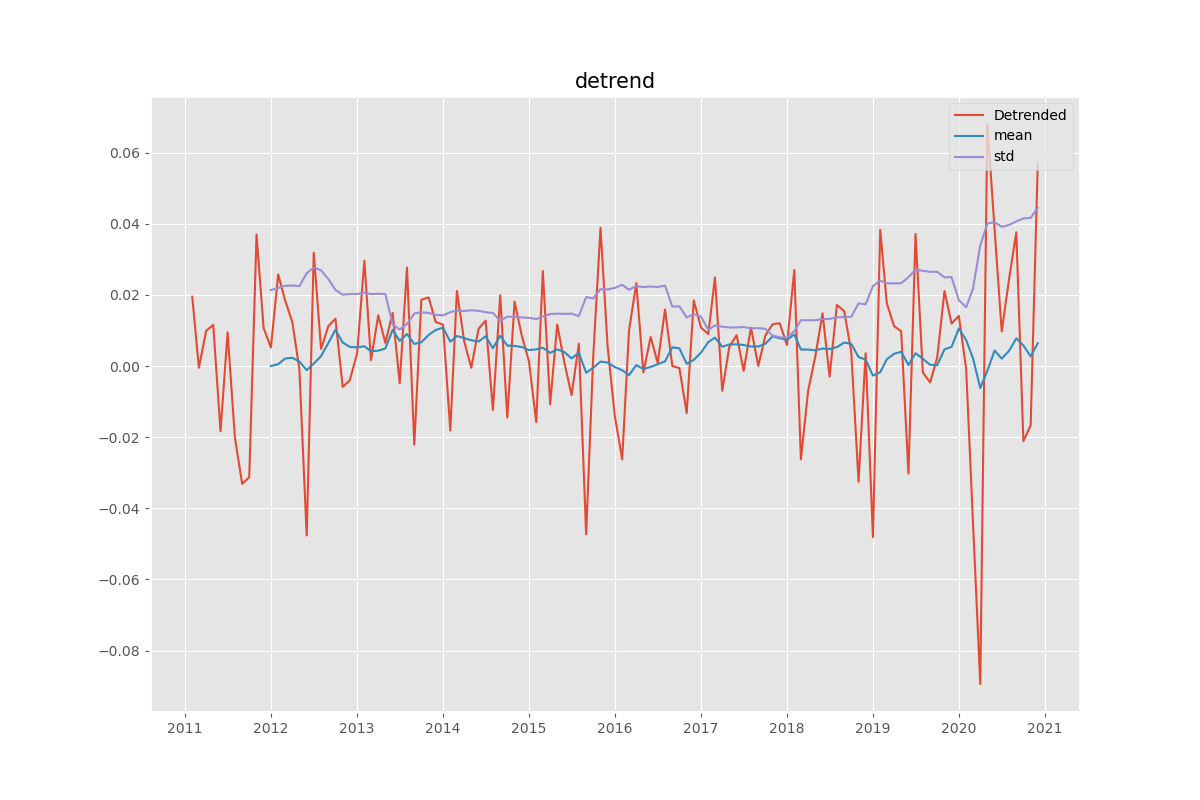

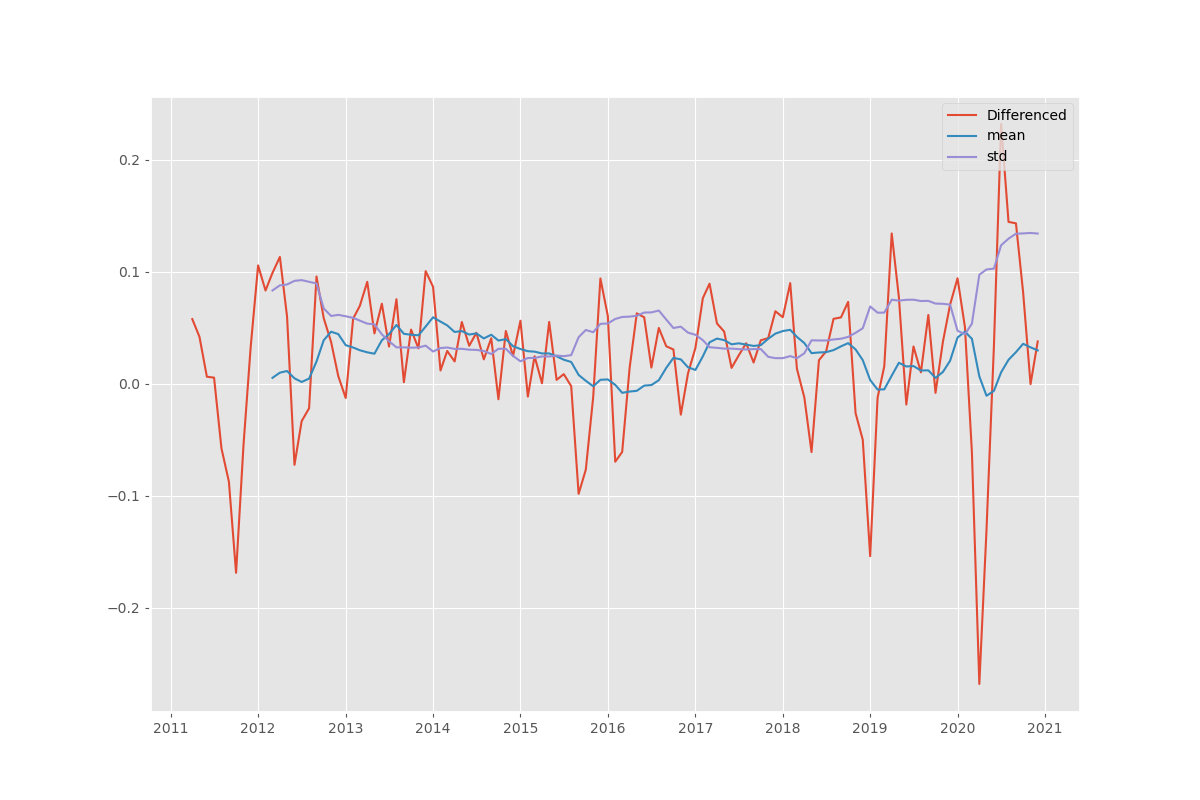

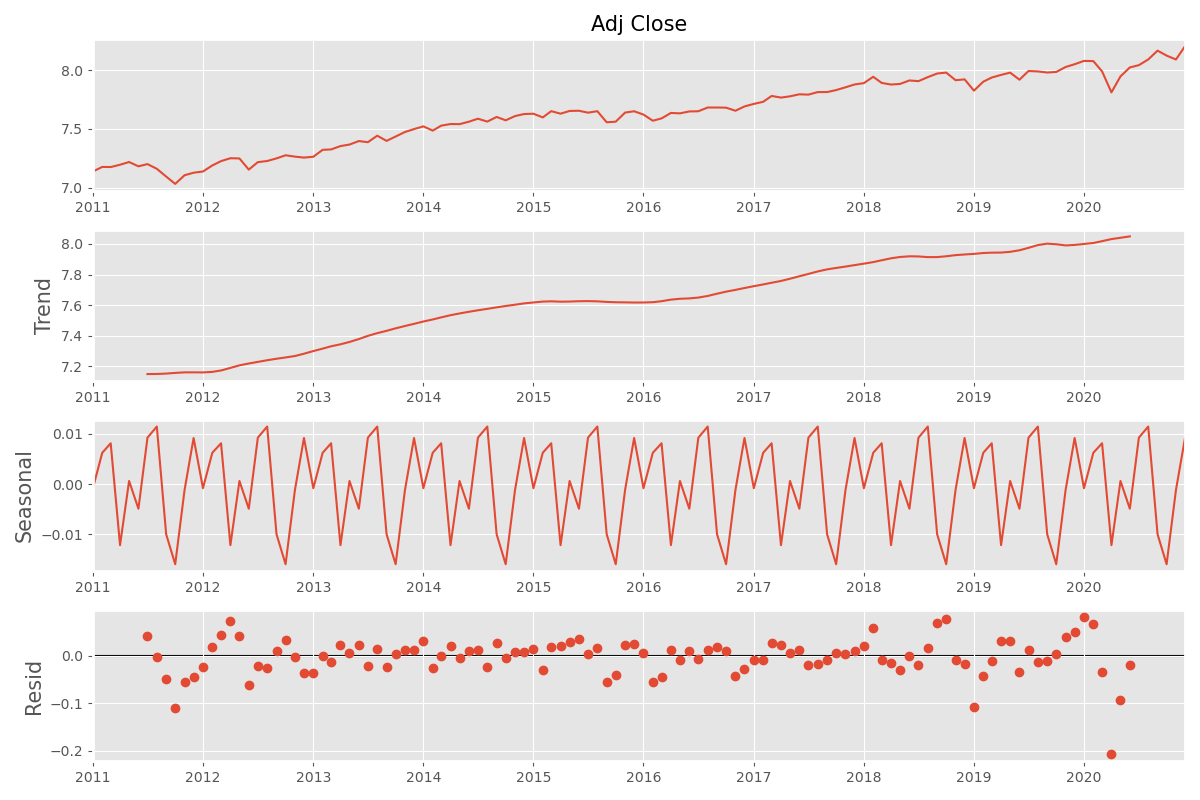

- Price movements tend to drift towards some long term mean either upwards or downwards.

- Stationary TS has constant mean/variance/autocorrelation over time

- p-value > 0.05 = reject null (nonstationary)

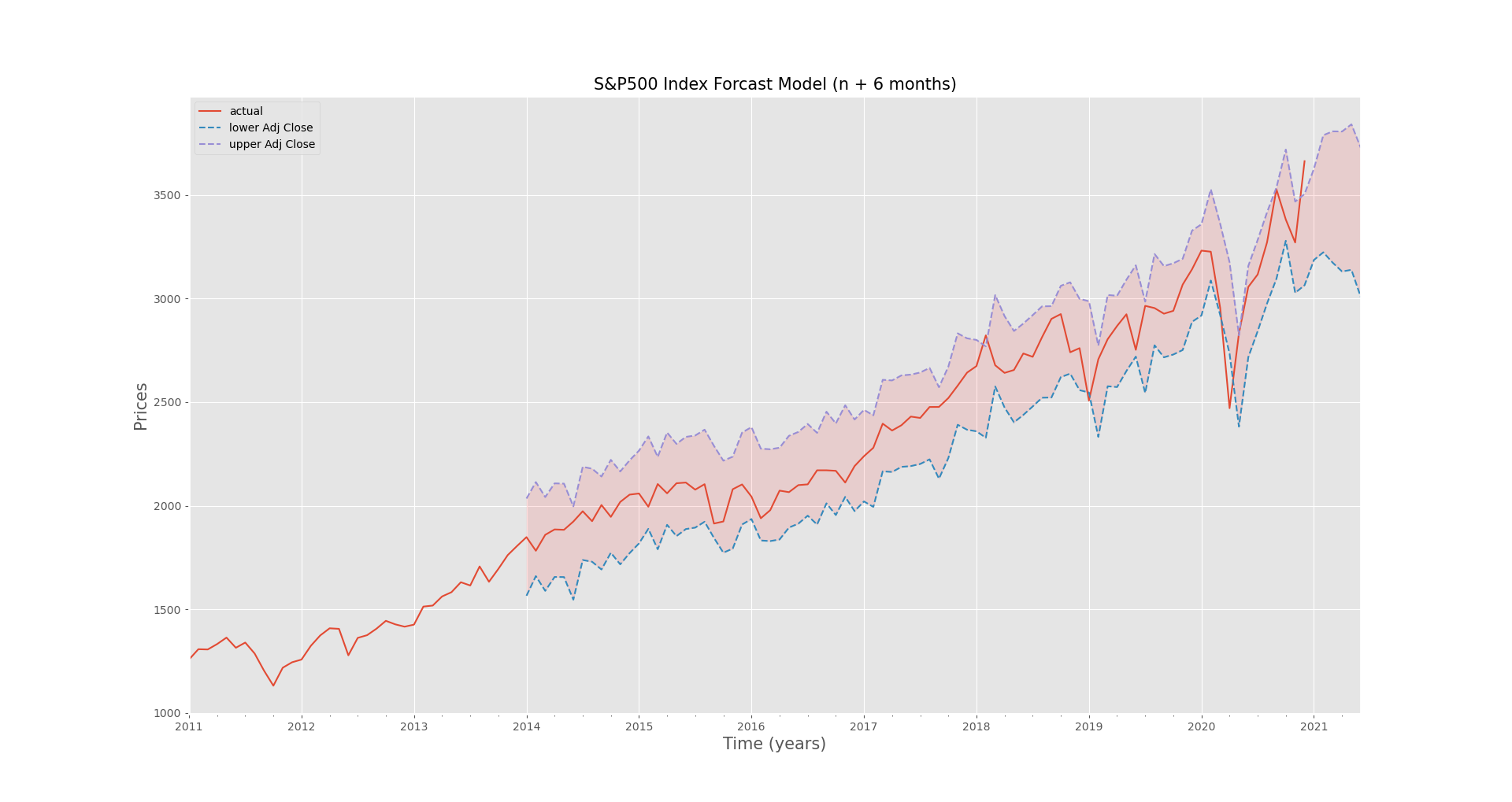

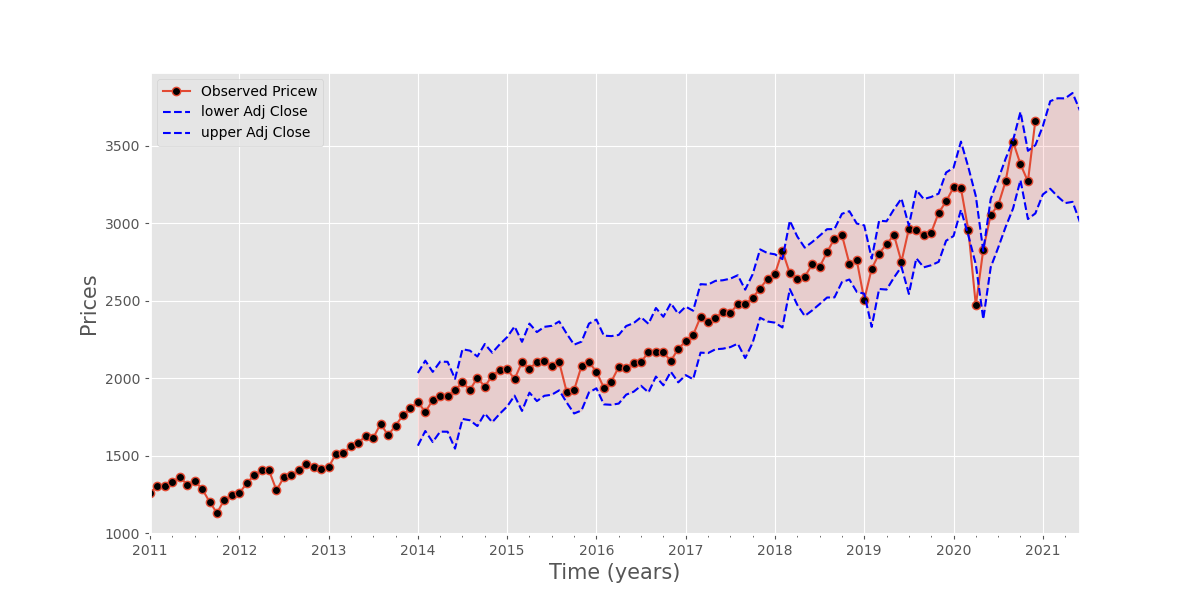

- Upper & Lower Bounds of Fitted Parameters (7 year Rolling Perdictions - Trailing)

- 95% Confidence Interval (shaded Section)

- Forcast 6 months into future

- perdiction widens to reflect loss of certainty in the market outlook

- Over time the market outperforms other assets

- Every year your money in your savings account is losing money due to inflation

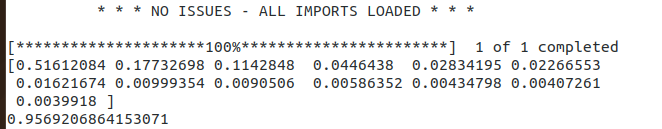

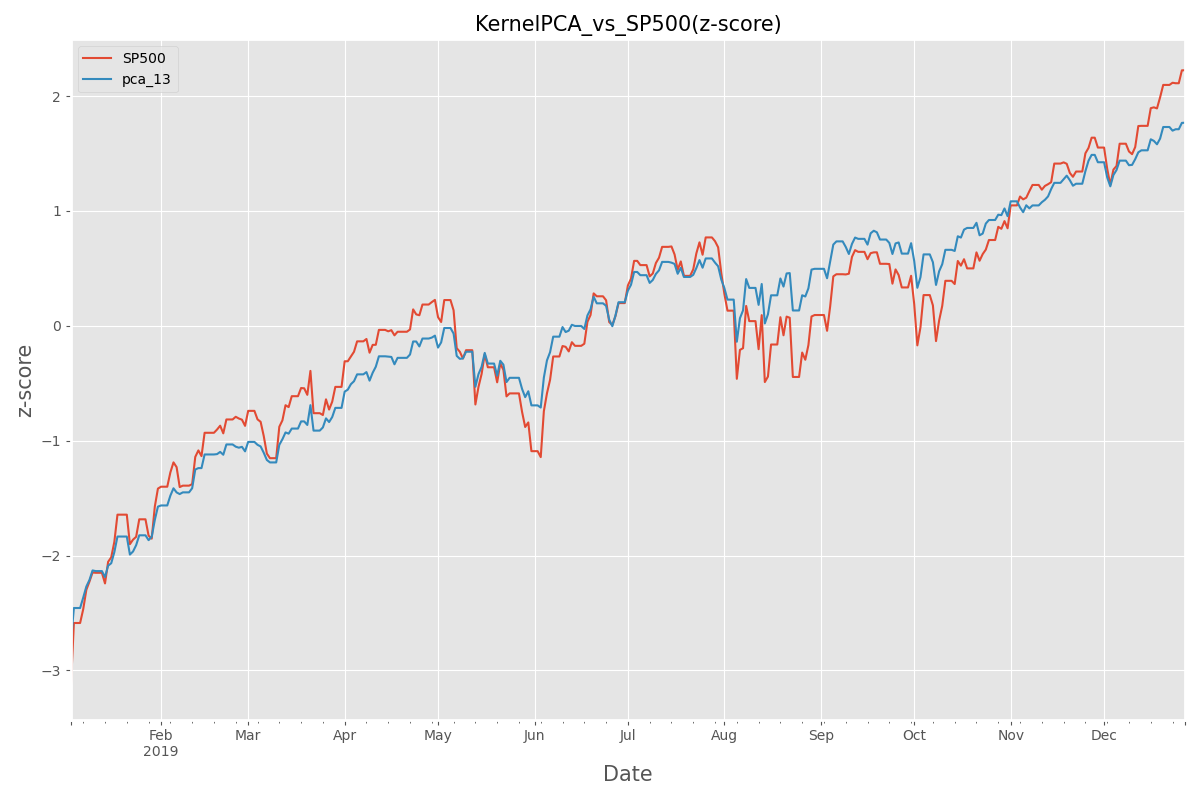

- Generate portfolio from components of SP500

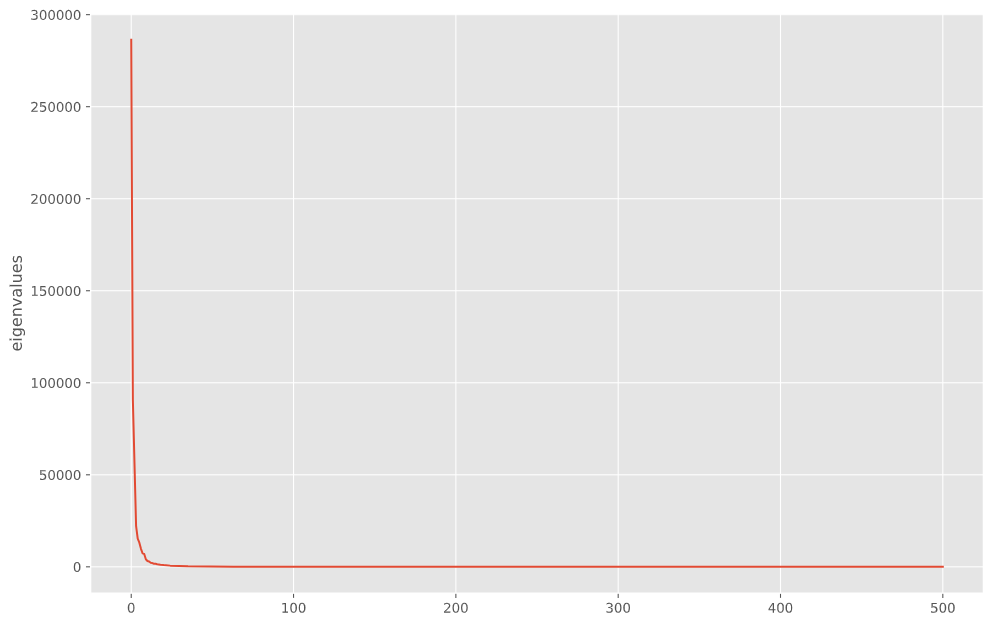

- Use z-score to normalize data

- Perform Kernel-PCA on the 505 component stocks within the S&P 500 Index

- Generate Outputs: